What is General Collateral Financing Trades (GCF)?

General Collateral Financing Trades (GCF) is a concept and mechanism used in the financial industry to facilitate short-term borrowing and lending of securities. It is a type of repurchase agreement (repo) that allows market participants to obtain funding by pledging high-quality securities as collateral.

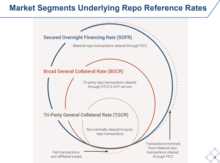

GCF trades are typically executed through a tri-party arrangement involving a clearing bank, a borrower, and a lender. The clearing bank acts as an intermediary, facilitating the transfer of securities and cash between the borrower and lender. It also ensures the collateral is properly managed and provides operational support for the transaction.

The securities eligible for GCF trades are typically highly liquid and low-risk, such as U.S. Treasury securities, agency securities, and mortgage-backed securities. These securities are considered general collateral because they are widely accepted in the market and can be easily traded.

GCF trades are commonly used by financial institutions, such as banks and broker-dealers, to manage their short-term funding needs and optimize their balance sheets. They provide a flexible and efficient way to access liquidity and obtain financing without the need for traditional bank loans.

Overall, GCF trades play a crucial role in the functioning of the financial markets by facilitating the flow of funds and ensuring the smooth operation of the repo market. They provide market participants with a reliable source of short-term funding and help support the liquidity and stability of the financial system.

How does GCF work?

In a GCF trade, a borrower pledges a pool of general collateral securities to a lender in exchange for cash. The borrower retains ownership of the securities and continues to receive any interest or dividends associated with them. The cash received can be used for various purposes, such as funding operational needs, investing in other assets, or managing short-term liquidity requirements.

Key features of GCF:

1. Collateral Pool: The general collateral pool consists of high-quality securities, such as government bonds or highly rated corporate bonds. These securities are easily tradable and have a low risk of default.

2. Triparty Repo: GCF trades are typically executed through a triparty repo arrangement, where a third-party agent acts as an intermediary between the borrower and lender. The agent facilitates the transaction, manages the collateral, and ensures the timely settlement of cash and securities.

3. Short-Term Nature: GCF trades are short-term in nature, usually ranging from overnight to a few weeks. This allows market participants to efficiently manage their liquidity needs and optimize their investment strategies.

4. Market Liquidity: GCF trades contribute to overall market liquidity by providing a mechanism for market participants to access cash quickly and efficiently. This enhances the functioning of financial markets and supports various trading and investment activities.

Benefits of GCF:

1. Liquidity Management: GCF enables market participants to efficiently manage their short-term liquidity needs by providing access to cash against high-quality collateral.

2. Risk Mitigation: The collateralization of GCF trades reduces the credit risk associated with lending and borrowing activities. This provides greater security to both borrowers and lenders.

3. Market Efficiency: GCF trades contribute to the overall efficiency of financial markets by enhancing liquidity and facilitating the smooth functioning of various trading and investment activities.

4. Diversification of Funding Sources: GCF allows market participants to diversify their sources of funding by accessing cash from a wide range of lenders. This reduces reliance on traditional funding channels and enhances financial stability.

| Advantages | Disadvantages |

|---|---|

| Efficient liquidity management | Potential risk of collateral value fluctuation |

| Risk mitigation through collateralization | Possibility of counterparty default |

| Contribution to market efficiency | Complexity of triparty repo arrangements |

| Diversification of funding sources | Regulatory and compliance considerations |

Overall, General Collateral Financing Trades (GCF) play a crucial role in the financial industry by providing market participants with a flexible and efficient mechanism for short-term funding and liquidity management. The collateralization and triparty repo arrangements associated with GCF trades enhance market stability and contribute to the overall efficiency of financial markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.