Depreciated Cost Calculation Formula Example

Depreciation is an important concept in accounting that allows businesses to allocate the cost of an asset over its useful life. By depreciating an asset, businesses can account for the wear and tear, obsolescence, and decrease in value that occurs over time.

Depreciation is the process of allocating the cost of an asset over its useful life. It is a non-cash expense that reduces the value of an asset on the balance sheet. Depreciation is important for businesses because it allows them to accurately reflect the decrease in value of their assets over time.

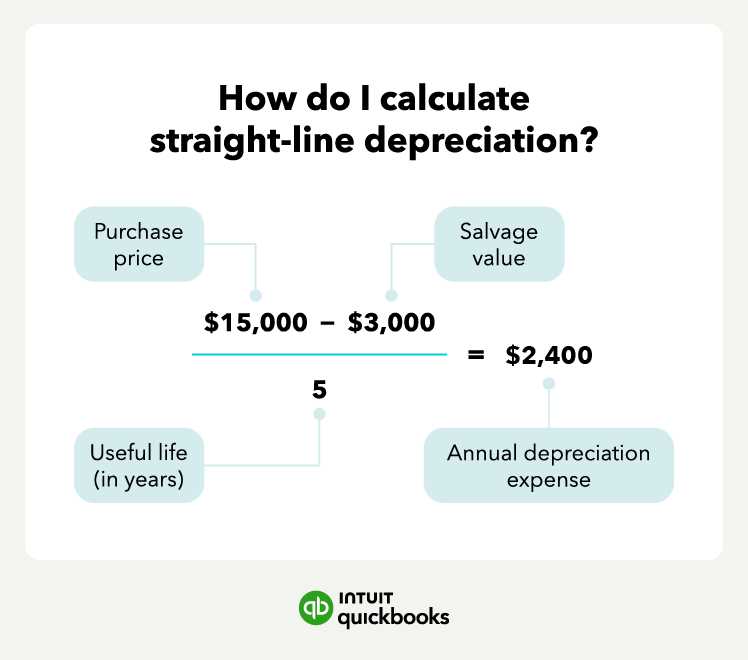

There are several methods and formulas used to calculate depreciation, but one common formula is the straight-line method. The formula for calculating the depreciated cost using the straight-line method is:

The cost of the asset refers to the original purchase price, while the salvage value is the estimated value of the asset at the end of its useful life. The useful life is the estimated number of years that the asset will be in use.

Example Calculation

Let’s say a company purchases a delivery truck for $50,000. The estimated salvage value of the truck is $5,000, and the useful life is estimated to be 5 years. Using the straight-line method, we can calculate the depreciated cost as follows:

Depreciated Cost = $9,000 per year

Therefore, the company can allocate $9,000 as a depreciation expense each year for the truck.

Benefits of Using Depreciation Formulas

Using depreciation formulas in accounting has several benefits:

- Accurate reflection of asset value: Depreciation formulas allow businesses to accurately reflect the decrease in value of their assets over time.

- Consistency in financial reporting: By using depreciation formulas, businesses can ensure consistency in their financial reporting.

- Tax benefits: Depreciation expenses can be deducted from taxable income, reducing the amount of taxes owed by the business.

- Planning and budgeting: Depreciation formulas help businesses plan and budget for asset replacements or upgrades in the future.

Depreciation is a crucial concept in accounting that allows businesses to allocate the cost of an asset over its useful life. It represents the decrease in value of an asset due to wear and tear, obsolescence, or other factors.

Importance of Depreciation

Depreciation is important for several reasons:

- Accurate Financial Reporting: Depreciation helps businesses accurately report their financial statements by reflecting the true value of their assets.

- Tax Deductions: Depreciation allows businesses to claim tax deductions for the decrease in value of their assets over time.

Methods of Depreciation

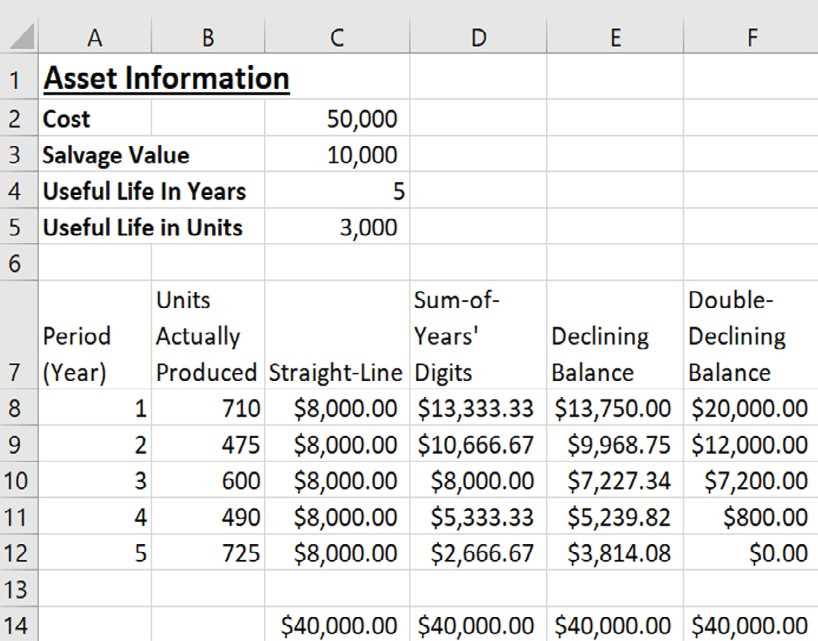

There are various methods of calculating depreciation, including:

| Method | Description |

|---|---|

| Straight-Line Method | Allocates an equal amount of depreciation expense each year over the useful life of the asset. |

| Declining Balance Method | Allocates higher depreciation expense in the early years and lower expense in the later years of the asset’s life. |

| Units of Production Method | Allocates depreciation based on the actual usage or production of the asset. |

Depreciation Formula

The formula for calculating depreciation depends on the method used. However, the general formula is:

Where:

- Cost of Asset is the original cost of the asset.

- Salvage Value is the estimated value of the asset at the end of its useful life.

- Useful Life is the estimated number of years the asset will be used.

By applying the appropriate depreciation method and using the formula, businesses can accurately calculate the depreciation expense for each accounting period.

Depreciation Methods and Formulas

Straight-Line Method

The straight-line method is the most common and simplest depreciation method. It calculates depreciation by dividing the cost of an asset by its useful life. The formula for straight-line depreciation is:

The straight-line method evenly distributes the cost of an asset over its useful life, resulting in a constant depreciation expense each year. This method is easy to understand and calculate, making it popular for financial reporting purposes.

Declining Balance Method

The declining balance method is an accelerated depreciation method that allows for higher depreciation expenses in the earlier years of an asset’s life. This method assumes that an asset will generate more revenue in its early years and less revenue in its later years. The formula for declining balance depreciation is:

Depreciation Expense = (Book Value at Beginning of Year x Depreciation Rate)

Units of Production Method

The units of production method calculates depreciation based on the actual usage of an asset. This method is commonly used for assets that are directly related to production, such as machinery or vehicles. The formula for units of production depreciation is:

This method allows for more accurate depreciation calculations as it considers the actual usage of the asset. The depreciation expense will vary each year based on the level of production. It is important to track and record the units of production accurately for this method to be effective.

Calculation Example for Depreciated Cost

Calculating the depreciated cost of an asset is an essential task in accounting. It helps businesses determine the value of an asset over time and allocate the appropriate expenses. Let’s take a look at an example to understand how to calculate the depreciated cost.

Example:

Company XYZ purchased a delivery truck for $50,000. The estimated useful life of the truck is 5 years, and the salvage value at the end of its useful life is $5,000. The company decides to use the straight-line depreciation method for this asset.

To calculate the annual depreciation expense, we first need to determine the depreciable cost, which is the original cost minus the salvage value:

Depreciable Cost = $45,000

Next, we divide the depreciable cost by the useful life of the asset to find the annual depreciation expense:

Annual Depreciation Expense = Depreciable Cost / Useful Life

Annual Depreciation Expense = $45,000 / 5

Annual Depreciation Expense = $9,000

Therefore, the annual depreciation expense for the delivery truck is $9,000. This means that the value of the truck will decrease by $9,000 each year over its useful life.

By calculating the depreciated cost, businesses can accurately reflect the decrease in value of their assets over time. This information is crucial for financial reporting and decision-making processes.

Benefits of Using Depreciation Formulas

Here are some key benefits of using depreciation formulas:

1. Accurate Financial Reporting:

Depreciation formulas ensure that the financial statements reflect the true value of assets. By calculating and recording depreciation expenses, businesses can provide a more accurate representation of their financial position and performance.

2. Compliance with Accounting Standards:

Depreciation formulas help businesses comply with accounting standards and regulations. These standards require businesses to account for the decrease in value of their assets over time, and depreciation formulas provide a standardized method to do so.

3. Tax Benefits:

Depreciation formulas can also provide tax benefits for businesses. In many countries, businesses are allowed to deduct depreciation expenses from their taxable income, reducing their tax liability. By using depreciation formulas, businesses can maximize their tax savings.

4. Asset Replacement Planning:

Depreciation formulas can assist businesses in planning for asset replacement. By tracking the decrease in value of their assets over time, businesses can estimate when an asset will need to be replaced and budget accordingly. This helps prevent unexpected expenses and ensures that assets are replaced in a timely manner.

5. Improved Decision Making:

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.