Deductible Definition

Simply put, a deductible is an expense that is considered necessary for the operation of a business. It can include costs such as salaries, rent, utilities, office supplies, advertising, and more. These expenses are subtracted from the business’s total revenue, resulting in the taxable income.

By taking advantage of deductible expenses, businesses can lower their taxable income and ultimately pay less in taxes. It is important for businesses to keep accurate records of their expenses and consult with a tax professional to ensure they are maximizing their deductions within the boundaries of the law.

Why are tax deductions important?

Tax deductions are important for several reasons. First, they help to lower your taxable income, which means you’ll owe less in taxes. This can be especially beneficial for small businesses that are just starting out or experiencing financial difficulties. Second, tax deductions can help to offset the costs of running your business. From office supplies to employee salaries, many business expenses can be deducted, allowing you to save money and reinvest it back into your company.

What can be deducted?

There are a wide variety of expenses that can be deducted for business purposes. Some common examples include:

- Office rent or mortgage payments

- Utilities

- Business insurance premiums

- Advertising and marketing expenses

- Business travel and meals

- Employee wages and benefits

- Professional services (such as legal or accounting fees)

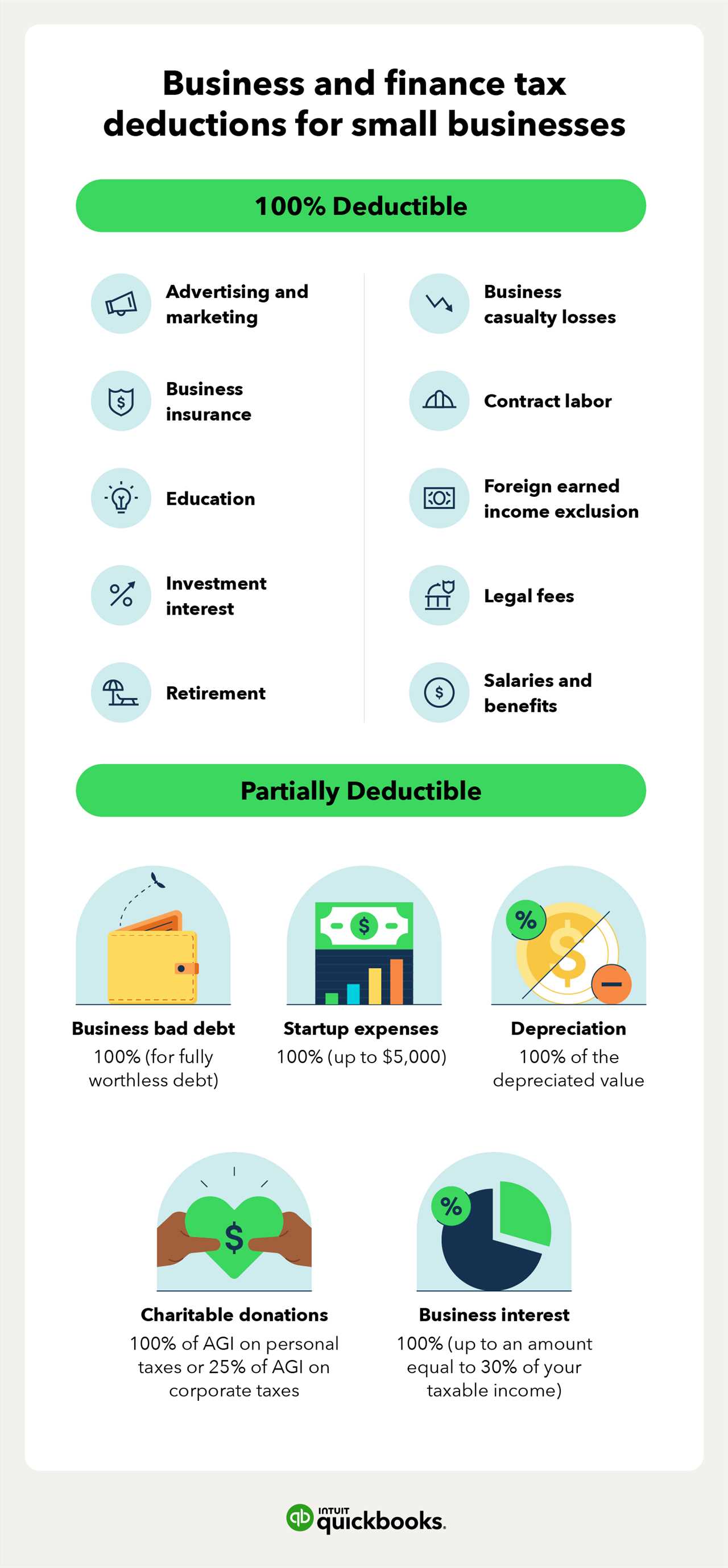

Types of Business Deductions

There are several different types of business deductions that you may be eligible to claim:

- Employee Expenses: If you have employees, you can deduct their wages, salaries, and benefits. You can also deduct expenses related to hiring and training employees.

- Business Travel: If you travel for business purposes, you can deduct your transportation, lodging, and meal expenses. However, you must be able to prove that the travel was directly related to your business.

- Advertising and Marketing: You can deduct the costs of advertising and marketing your business, including website development, print ads, and social media campaigns.

- Professional Services: If you hire professionals such as accountants or lawyers to help with your business, you can deduct their fees.

- Depreciation: You can deduct the cost of certain assets over time, such as vehicles and equipment, through depreciation.

Tax Deductions for Businesses

For businesses, there are a wide range of tax deductions available. These deductions can vary depending on the type of business you have, but some common deductions include:

- Business expenses: This includes things like office supplies, advertising costs, and travel expenses.

- Employee wages: You can deduct the wages you pay to your employees, as well as any benefits you provide.

- Rent and utilities: If you rent office space or pay for utilities, you can deduct these expenses.

- Insurance premiums: If you have insurance for your business, you can deduct the premiums you pay.

- Depreciation: If you have assets that lose value over time, you can deduct a portion of their value each year.

By maximizing your deductions, you can reduce your tax liability and keep more money in your business. So make sure to take the time to understand the tax deductions that are available to you and take advantage of them.

Maximizing Deductions for Your Business

Keep Accurate Records

The first step to maximizing your deductions is to keep accurate and detailed records of all your business expenses. This includes receipts, invoices, bank statements, and any other documentation that shows the money you’ve spent on business-related items.

Identify All Deductible Expenses

Be sure to consult with a tax professional or refer to the IRS guidelines to ensure that you’re taking advantage of all the deductions that are available to you. They will be able to help you navigate the complex tax code and identify any deductions that you may have overlooked.

Remember, every business is unique, and what may be deductible for one business may not be for another. Take the time to understand the specific deductions that apply to your industry and make sure you’re claiming them correctly.

Plan Ahead

Maximizing your deductions requires careful planning and foresight. By keeping track of your expenses throughout the year and staying up to date with changes in the tax laws, you can ensure that you’re taking full advantage of all the deductions available to you.

Consider working with a tax professional or accountant who can help you develop a tax strategy that minimizes your tax liability and maximizes your deductions. They can provide valuable advice and guidance on how to structure your business expenses to optimize your tax savings.

Remember, the goal is to legally reduce your taxable income, not to evade taxes. Make sure you’re following all the rules and regulations set forth by the IRS to avoid any potential penalties or audits.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.