Credit Unions: Definition, Membership Requirements, and Comparison with Banks

A credit union is a financial institution that is owned and operated by its members, who are also its customers. Unlike banks, which are for-profit institutions owned by shareholders, credit unions are not-for-profit organizations that exist solely to serve their members’ financial needs.

Membership Requirements

In order to become a member of a credit union, individuals must meet certain eligibility criteria. These criteria can vary depending on the specific credit union, but common requirements include:

- Living or working in a specific geographic area

- Belonging to a certain profession or industry

- Being a member of a particular organization or association

Membership requirements are designed to ensure that credit unions serve a specific community or group of individuals with shared interests or characteristics.

Comparison with Banks

While both credit unions and banks offer similar financial services, there are some key differences between the two:

Ownership:

As mentioned earlier, credit unions are owned by their members, while banks are owned by shareholders. This difference in ownership structure often leads to differences in the way the institutions operate and the services they offer.

Profit Distribution:

Because credit unions are not-for-profit organizations, any profits they generate are typically reinvested into the institution or returned to members in the form of lower fees, higher interest rates on savings accounts, and lower interest rates on loans. Banks, on the other hand, distribute profits to their shareholders.

Many credit union members appreciate the personalized service they receive from their institution. Credit unions often have a smaller customer base than banks, allowing them to provide more individualized attention to their members.

Interest Rates and Fees:

Overall, credit unions can be a great alternative to traditional banks for individuals who meet the membership requirements. They offer personalized service, competitive rates, and a focus on serving their members’ financial needs.

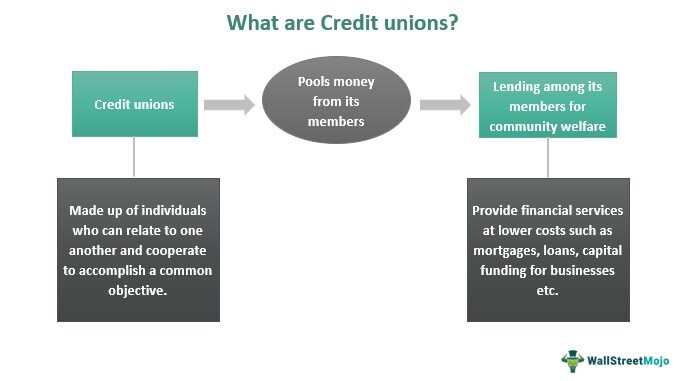

What are Credit Unions?

A credit union is a financial institution that is owned and operated by its members, who are also its customers. Unlike traditional banks, credit unions are not-for-profit organizations that exist to serve their members rather than to generate profits for shareholders. This unique structure allows credit unions to offer a range of benefits and advantages to their members.

Membership

Membership in a credit union is typically based on a common bond, such as employment, geographic location, or membership in a specific organization or community. This common bond ensures that credit unions serve a specific group of individuals who share a common interest or affiliation.

Unlike banks, which are open to anyone who meets their eligibility criteria, credit unions have membership requirements that must be met in order to join. These requirements vary depending on the credit union, but they are generally designed to ensure that the credit union serves its intended community or group of individuals.

Benefits of Credit Unions

One of the main benefits of credit unions is their focus on member service. Because credit unions are owned by their members, they are able to prioritize the needs and interests of their members above all else. This often leads to more personalized and attentive customer service, as well as a greater emphasis on financial education and support.

In addition, credit unions often offer lower fees and interest rates compared to traditional banks. This is because credit unions are not-for-profit organizations, so they can pass on their earnings to their members in the form of lower fees and better interest rates. This can result in significant savings for credit union members.

In summary, credit unions are member-owned financial institutions that offer a range of benefits and advantages to their members. With a focus on personalized service, lower fees and interest rates, and community involvement, credit unions can be a valuable alternative to traditional banks.

Membership Requirements for Credit Unions

Membership in a credit union is typically restricted to individuals who share a common bond, such as belonging to a specific community, profession, or organization. This common bond ensures that credit unions serve a specific group of people with similar interests and needs.

The specific membership requirements can vary depending on the credit union, but some common criteria include:

| Employment: | Some credit unions may require you to be employed by a specific company or work in a particular industry. |

| Residence: | Many credit unions serve a specific geographic area, so you may need to live or work in a certain location to be eligible for membership. |

| Membership in an organization: | Some credit unions are affiliated with certain organizations, such as labor unions or professional associations. If you are a member of these organizations, you may be eligible for membership in the associated credit union. |

| Family relationship: | Some credit unions allow family members of existing members to join, regardless of their employment or residence status. |

If you meet the membership requirements for a credit union, joining can be a smart financial move. Not only will you gain access to a range of financial products and services, but you’ll also become part of a community that prioritizes your financial well-being.

Advantages of Credit Unions over Banks

1. Lower Fees

2. Higher Interest Rates

One of the biggest advantages of credit unions is that they often offer higher interest rates on savings accounts, certificates of deposit (CDs), and other financial products. This means that your money can grow faster over time, helping you reach your financial goals more quickly.

3. Personalized Service

Credit unions are typically smaller and more community-oriented than banks. This allows them to provide a higher level of personalized service to their members. You can expect to receive individual attention and tailored financial advice from credit union staff.

4. Member Ownership

Unlike banks, credit unions are not-for-profit organizations owned by their members. This means that when you join a credit union, you become a member and have a say in how the credit union is run. You can participate in decision-making processes and have a voice in the direction of the institution.

5. Community Impact

Credit unions are deeply rooted in the communities they serve. They often support local initiatives, charities, and events, helping to strengthen the local economy. By banking with a credit union, you can contribute to the well-being of your community.

Overall, credit unions offer a range of advantages over traditional banks. From lower fees and higher interest rates to personalized service and community impact, credit unions provide a unique and member-focused banking experience.

Differences between Credit Unions and Banks

Ownership: One of the main differences between credit unions and banks is their ownership structure. Credit unions are member-owned, meaning that the individuals who use the credit union’s services are also its owners. Banks, on the other hand, are typically owned by shareholders or investors.

Profit Motive: Because credit unions are not-for-profit organizations, their primary goal is to serve their members rather than generate profits. This often translates into lower fees and better interest rates for credit union members. Banks, on the other hand, are profit-driven institutions that aim to maximize their earnings.

Membership: Another significant difference between credit unions and banks is the membership requirements. Credit unions have specific eligibility criteria that individuals must meet in order to become members. These requirements can include factors such as employment, geographic location, or membership in a certain organization. Banks, on the other hand, are generally open to anyone who meets the basic requirements set by the institution.

Decision-Making: Credit unions operate on a democratic principle, where members have a say in the decision-making process. Each member typically has one vote, regardless of the amount of money they have invested in the credit union. Banks, on the other hand, are typically run by a board of directors who make decisions on behalf of the institution.

Services: While both credit unions and banks offer similar services such as checking accounts, savings accounts, and loans, there may be differences in the specific products and features they offer. Credit unions often focus on providing personalized service and may offer lower interest rates on loans and higher interest rates on savings accounts compared to banks.

Insurance: Both credit unions and banks are insured, but by different entities. Credit unions are typically insured by the National Credit Union Administration (NCUA), while banks are insured by the Federal Deposit Insurance Corporation (FDIC). This insurance protects depositors’ funds in case of a financial institution failure.

Choosing between a Credit Union and a Bank

Membership

One of the main differences between credit unions and banks is membership. Credit unions are typically member-owned and operated, meaning that you need to meet certain eligibility criteria to become a member. This often includes living or working in a specific area or being part of a certain organization. Banks, on the other hand, are open to anyone who meets their account opening requirements.

Customer Service

Interest Rates and Fees

Convenience and Accessibility

While credit unions may offer competitive rates and fees, one potential drawback is their limited branch and ATM network. Banks, on the other hand, often have a larger presence and may offer more convenient access to branches and ATMs. This can be an important factor to consider if you value convenience and accessibility.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.