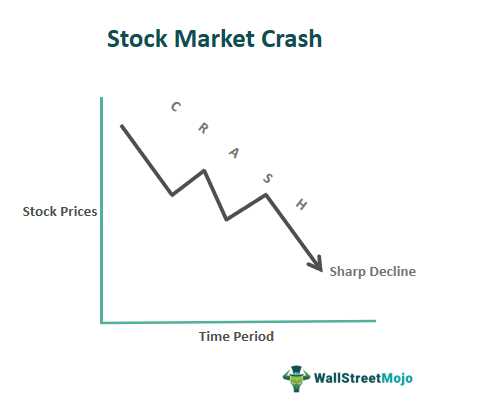

What Causes Stock Market Crashes?

A stock market crash is a sudden and significant decline in the value of stocks traded on the stock market. These crashes can have a profound impact on the economy, investor confidence, and individual investors’ financial well-being. While stock market crashes can be caused by a variety of factors, they are often the result of a combination of economic, behavioral, governmental, and global events.

Economic Factors

Economic factors play a crucial role in causing stock market crashes. These factors can include economic recessions, inflation, interest rates, and corporate earnings. When the economy is in a downturn, investors may become concerned about the future profitability of companies, leading to a sell-off of stocks and a decline in market prices.

Investor Behavior

Investor behavior can also contribute to stock market crashes. Fear and panic can spread quickly among investors, leading to a rush to sell stocks. This can create a domino effect, with falling prices triggering more selling, causing further declines in the market. Additionally, investor speculation and excessive risk-taking can contribute to market volatility and increase the likelihood of a crash.

Government Policies

Government policies can have a significant impact on stock market crashes. Changes in regulations, tax policies, or monetary policies can create uncertainty and volatility in the market. For example, if the government introduces new regulations that restrict certain industries or increase taxes on businesses, investors may react by selling their stocks, causing prices to plummet.

Global Events

Global events, such as geopolitical tensions, natural disasters, or economic crises in other countries, can also trigger stock market crashes. The interconnectedness of the global economy means that events happening in one part of the world can have ripple effects on financial markets worldwide. Uncertainty and fear stemming from these events can lead to a sell-off of stocks and a decline in market values.

Technological Advances

Economic Factors

Stock market crashes can be triggered by various economic factors. These factors can include changes in interest rates, inflation, unemployment rates, and overall economic growth. When these factors are unfavorable, investors may become concerned about the future prospects of companies and the economy as a whole, leading to a sell-off in the stock market.

Interest rates play a crucial role in the stock market. When interest rates rise, borrowing becomes more expensive, which can lead to decreased consumer spending and business investment. This can negatively impact corporate profits and stock prices. Similarly, high inflation can erode the purchasing power of consumers, leading to reduced demand for goods and services, which can also have a negative impact on stock prices.

Unemployment rates are another important economic factor that can influence the stock market. High unemployment rates can indicate a weak economy, as it suggests that businesses are not hiring and consumers are not spending. This can lead to lower corporate profits and lower stock prices.

Overall economic growth is a key driver of stock market performance. When the economy is growing, businesses are generally more profitable, which can lead to higher stock prices. However, if the economy is contracting or experiencing slow growth, investors may become concerned about the future prospects of companies and the stock market, leading to a sell-off.

| Economic Factors | Impact on Stock Market |

|---|---|

| Interest rates | Rising rates can lead to decreased consumer spending and business investment, negatively impacting stock prices. |

| Inflation | High inflation can erode consumer purchasing power, leading to reduced demand for goods and services and lower stock prices. |

| Unemployment rates | High unemployment rates indicate a weak economy, leading to lower corporate profits and lower stock prices. |

| Overall economic growth | Growing economy generally leads to higher corporate profits and higher stock prices. |

Investor Behavior

Investor behavior plays a crucial role in stock market crashes. The psychology of investors can greatly influence the direction of the market. When investors panic or become overly optimistic, it can lead to irrational decision-making and a rapid decline or increase in stock prices.

One common behavior that contributes to stock market crashes is herd mentality. Investors tend to follow the crowd and make decisions based on the actions of others. This can create a domino effect, where a large number of investors start selling their stocks, causing prices to plummet.

Another factor that affects investor behavior is fear and greed. When investors are driven by fear, they tend to sell their stocks in a panic, which can trigger a market crash. On the other hand, when investors are driven by greed, they may engage in speculative buying, driving up prices to unsustainable levels before a crash occurs.

Emotional biases also play a role in investor behavior. Cognitive biases, such as confirmation bias and overconfidence, can lead investors to make irrational decisions based on their preconceived notions or beliefs. This can contribute to market volatility and increase the likelihood of a crash.

Furthermore, the use of leverage and margin trading can amplify the impact of investor behavior on stock market crashes. When investors borrow money to invest in stocks, they increase their potential gains but also their potential losses. If a large number of investors who have borrowed money start selling their stocks, it can lead to a sharp decline in prices.

To mitigate the impact of investor behavior on stock market crashes, it is important for investors to practice disciplined and rational decision-making. This includes conducting thorough research, diversifying their portfolios, and not letting emotions dictate their investment decisions.

Government Policies

Government policies play a crucial role in the occurrence and severity of stock market crashes. These policies can either stabilize or destabilize the market, depending on their effectiveness and implementation. Here are some key factors related to government policies that can contribute to stock market crashes:

Regulatory Changes

Changes in regulations can have a significant impact on the stock market. For example, if the government introduces new regulations that restrict certain trading practices or increase transparency requirements, it can create uncertainty and volatility in the market. Investors may become hesitant to trade, leading to a decline in market activity and potentially triggering a crash.

Monetary Policies

Monetary policies, such as interest rate changes and quantitative easing measures, can also influence stock market crashes. When central banks increase interest rates to combat inflation, it can lead to higher borrowing costs for businesses and consumers. This can negatively affect corporate profits and consumer spending, ultimately impacting stock prices and potentially causing a market crash.

Fiscal Policies

Fiscal policies, including taxation and government spending, can also impact the stock market. For instance, if the government implements policies that increase taxes on corporations or high-income individuals, it can reduce corporate profits and investor confidence. This can lead to a sell-off in stocks and contribute to a market crash.

Market Interventions

In some cases, governments may intervene directly in the stock market to stabilize prices during times of crisis. This can involve measures such as providing liquidity support to financial institutions, implementing short-selling bans, or imposing trading halts. While these interventions can prevent immediate market crashes, they may also create artificial stability and delay necessary market corrections, potentially leading to larger crashes in the future.

Political Uncertainty

Political events and uncertainties can also impact stock markets. Elections, changes in government leadership, or geopolitical tensions can create instability and uncertainty, which can lead to market crashes. Investors may become cautious and sell their holdings, causing a decline in stock prices.

Global Events

Global events can have a significant impact on stock market crashes. These events can include geopolitical tensions, natural disasters, and global economic crises. When such events occur, investors often react with panic and uncertainty, leading to a sell-off of stocks and a decline in market prices.

Geopolitical Tensions

Geopolitical tensions, such as conflicts between countries or political instability within a country, can create uncertainty in the global markets. For example, the threat of war or terrorist attacks can cause investors to fear for the safety of their investments and sell off stocks. This can lead to a sharp decline in stock prices and trigger a market crash.

Natural Disasters

Natural disasters, such as hurricanes, earthquakes, or pandemics, can also have a significant impact on the stock market. These events can disrupt supply chains, damage infrastructure, and cause economic uncertainty. When such disasters occur, investors may become wary of the potential economic consequences and choose to sell their stocks, causing a market crash.

Global Economic Crises

Global economic crises, such as recessions or financial meltdowns, can have a profound impact on stock markets worldwide. These crises often result from factors such as excessive debt, speculative bubbles, or banking failures. When a global economic crisis occurs, investors may lose confidence in the market and rush to sell their stocks, leading to a crash.

Technological Advances

Technological advances have played a significant role in stock market crashes throughout history. The introduction of new technologies can disrupt existing industries, leading to market volatility and crashes.

One example of technological advances causing a stock market crash is the dot-com bubble in the late 1990s. The rapid growth of internet companies led to a speculative frenzy, with investors pouring money into companies with little or no profits. When the bubble burst in 2000, many dot-com companies went bankrupt, causing stock prices to plummet and leading to a market crash.

Another example is the 2010 Flash Crash, which was triggered by high-frequency trading algorithms. These algorithms use complex mathematical models to execute trades at incredibly fast speeds. However, on May 6, 2010, a glitch in one of these algorithms caused a massive sell-off, leading to a temporary market crash. This event highlighted the risks associated with relying too heavily on technology in the stock market.

Technological advances can also lead to increased market volatility. The rise of social media platforms and online trading apps has made it easier for individual investors to access the stock market. While this has democratized investing, it has also led to increased speculation and herd behavior. Social media platforms can amplify market movements, causing prices to swing wildly and potentially triggering a crash.

Furthermore, advancements in trading technology have made it possible for large institutional investors to execute trades at lightning-fast speeds. This can create a situation where markets become highly interconnected and susceptible to rapid contagion. A small event in one market can quickly spread to others, leading to a domino effect and a market crash.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.