What is Carve-Out?

Carve-Out is a business strategy that involves separating a specific business unit or division from a larger company to create a standalone entity. This strategy allows the company to focus on its core operations and unlock the value of the separated business unit.

Carve-Outs can occur through various means, such as selling the business unit to a third party, conducting an initial public offering (IPO), or spinning off the business unit as a separate publicly traded company. The separated business unit typically operates independently and has its own management team, financials, and operations.

Benefits of Carve-Out Strategy

The Carve-Out strategy offers several benefits to companies:

- Focus: By separating a business unit, companies can focus on their core operations and allocate resources more efficiently.

- Value creation: Carve-Outs can unlock the value of the separated business unit, as it may be more attractive to investors or potential buyers as a standalone entity.

- Financial transparency: Carve-Outs often require the separated business unit to have its own financial statements, providing greater transparency and accountability.

Overall, Carve-Outs can be a strategic move for companies looking to streamline their operations, unlock value, and create opportunities for growth.

Definition and Meaning

In the context of business strategy, a carve-out refers to the process of separating a specific business unit or division from its parent company to create a standalone entity. This can be achieved through various methods, such as selling the business unit to a third party, conducting an initial public offering (IPO), or spinning off the unit as a separate company.

A carve-out is typically pursued when a company wants to focus on its core operations and believes that a particular business unit would be better off operating independently. By separating the business unit, the parent company can allocate resources more effectively, streamline operations, and potentially unlock additional value for shareholders.

Key Considerations for Carve-Outs

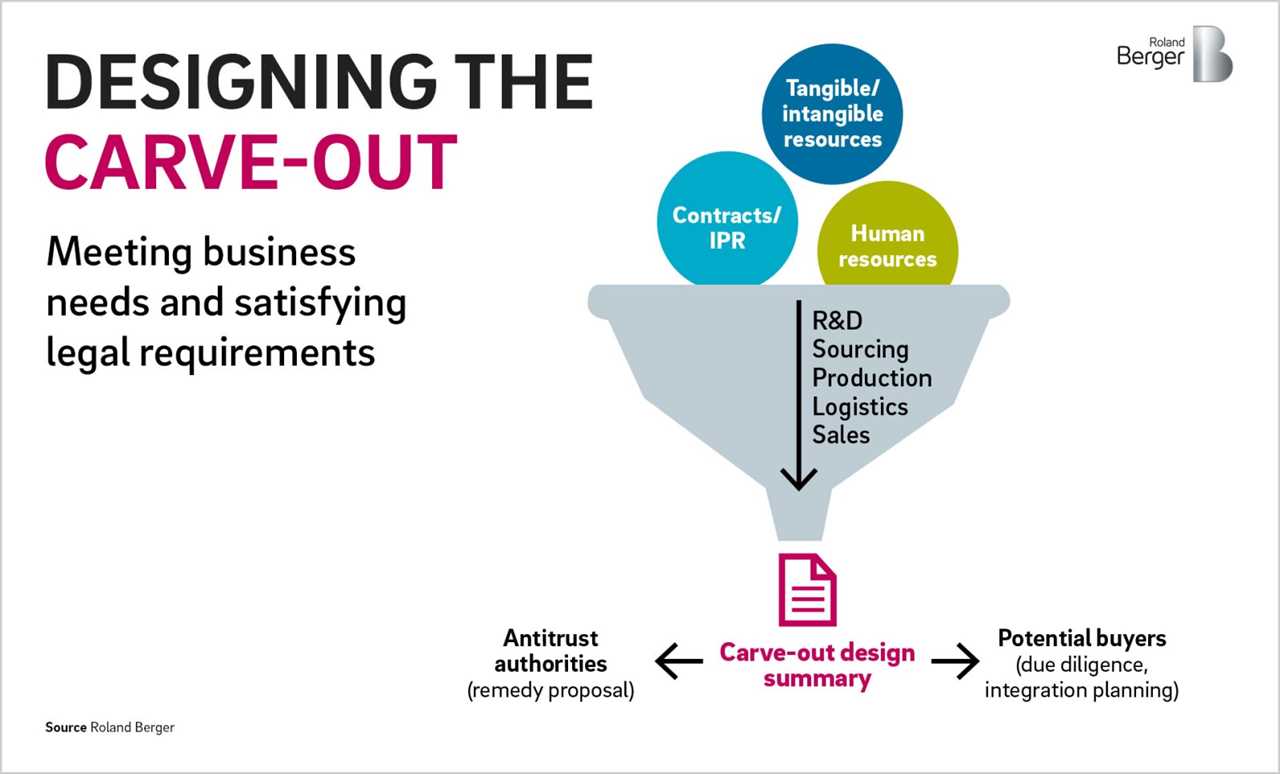

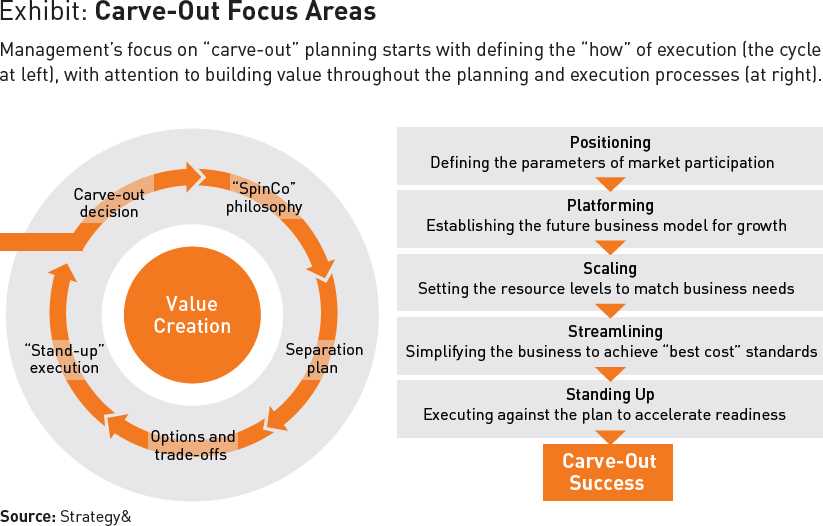

Carve-outs can be complex and require careful planning and execution. Here are some key considerations:

- Legal and Regulatory Compliance: Companies need to ensure that the carve-out process complies with all applicable laws and regulations. This may involve obtaining approvals from regulatory bodies, addressing employee and customer concerns, and managing any potential legal issues.

- Financial Analysis: Before proceeding with a carve-out, companies should conduct a thorough financial analysis to assess the potential impact on their financial statements, including any tax implications, potential costs, and expected benefits.

- Operational Transition: Separating a business unit requires careful planning to ensure a smooth transition. This may involve establishing new systems and processes, transferring employees, and addressing any operational challenges that may arise.

- Communication and Stakeholder Management: Clear and effective communication is crucial during a carve-out to manage expectations and address concerns from employees, customers, investors, and other stakeholders. Companies should develop a comprehensive communication plan to keep all parties informed throughout the process.

- Post-Carve-Out Strategy: Once the carve-out is complete, the newly formed entity will need to develop its own strategic plan and operational framework. This may involve identifying growth opportunities, establishing a new leadership team, and setting goals and targets for the standalone business.

Overall, a carve-out can be a strategic move for companies looking to optimize their operations and create value. However, it requires careful planning, execution, and ongoing management to ensure a successful transition and maximize the benefits for all stakeholders involved.

Benefits of Carve-Out Strategy

A carve-out strategy can offer several benefits to businesses looking to streamline their operations or unlock the value of specific business units. Here are some key advantages:

1. Focus on Core Competencies:

By carving out non-core business units, companies can focus their resources and attention on their core competencies. This allows them to allocate their time, energy, and capital to areas where they have a competitive advantage, leading to improved performance and profitability.

2. Increased Flexibility:

Carve-outs provide companies with increased flexibility in managing their business units. They can sell or spin off non-core units, allowing them to adapt to changing market conditions and pursue new growth opportunities. This flexibility can help companies stay agile and responsive in a rapidly evolving business landscape.

3. Enhanced Value Creation:

4. Improved Financial Performance:

Carve-outs can lead to improved financial performance for both the parent company and the carved-out unit. By focusing on core competencies and optimizing operations, companies can enhance their profitability and efficiency. Additionally, the carved-out unit can benefit from increased autonomy and a sharper strategic focus, enabling it to achieve better financial results.

5. Strategic Realignment:

Carve-outs can help companies strategically realign their business portfolio. By divesting non-core units, companies can reshape their operations and concentrate on areas that align with their long-term goals and objectives. This can result in a more streamlined and focused business, better positioned for sustainable growth and success.

Examples of Carve-Outs

Carve-outs can take many forms and occur in various industries. Here are some examples of successful carve-outs:

1. Hewlett-Packard (HP) and Hewlett Packard Enterprise (HPE)

In 2015, Hewlett-Packard split into two separate companies: HP Inc. and Hewlett Packard Enterprise. HP Inc. focuses on personal computers and printers, while Hewlett Packard Enterprise specializes in enterprise technology solutions. This carve-out allowed each company to focus on its core competencies and pursue independent growth strategies.

2. PayPal and eBay

In 2015, PayPal was spun off from its parent company eBay to become an independent publicly traded company. This carve-out allowed PayPal to focus on its online payment services without being tied to eBay’s marketplace business. As a result, PayPal has been able to innovate and expand its services, becoming a global leader in digital payments.

3. Kraft Foods and Mondelez International

In 2012, Kraft Foods split into two separate companies: Kraft Foods Group and Mondelez International. Kraft Foods Group focused on North American grocery brands, while Mondelez International focused on global snacks and confectionery brands. This carve-out allowed each company to pursue its own growth strategies and cater to different markets.

4. Alcon and Novartis

In 2019, Novartis completed the spin-off of its eye care division, Alcon, into a standalone company. This carve-out allowed Alcon to focus on its core business of developing and manufacturing eye care products, while Novartis could concentrate on its pharmaceuticals and other healthcare businesses. The carve-out also provided Alcon with more flexibility to pursue strategic partnerships and acquisitions in the eye care industry.

These examples demonstrate how carve-outs can create value by allowing companies to focus on their core competencies, pursue independent growth strategies, and unlock hidden potential. Carve-outs can be a strategic tool for companies looking to optimize their business portfolios and drive long-term success.

Key Considerations for Carve-Outs

| 1. Strategic Alignment: | It is important to ensure that the carve-out aligns with the overall strategic goals and objectives of the business. This includes evaluating how the carve-out will impact the remaining business units and whether it will create any conflicts of interest. |

| 2. Financial Analysis: | Conducting a thorough financial analysis is crucial to determine the financial viability of the carve-out. This includes assessing the financial health of the business unit being carved out, as well as estimating the potential costs and benefits of the carve-out. |

| 3. Legal and Regulatory Considerations: | Carve-outs often involve complex legal and regulatory issues. It is important to carefully review and comply with all applicable laws and regulations, including those related to intellectual property rights, employee rights, and tax implications. |

| 4. Operational Challenges: | Carving out a business unit can present various operational challenges, such as separating shared resources, establishing new systems and processes, and ensuring a smooth transition for employees and customers. These challenges should be carefully assessed and addressed. |

| 5. Communication and Stakeholder Management: | Effective communication is essential throughout the carve-out process. It is important to keep all stakeholders, including employees, customers, suppliers, and investors, informed and engaged. Managing expectations and addressing concerns can help minimize disruptions and maintain trust. |

| 6. Transition and Integration Planning: | A comprehensive transition and integration plan should be developed to ensure a seamless separation and integration of the carved-out business unit. This includes identifying and addressing potential risks and challenges, as well as establishing clear timelines and milestones. |

By carefully considering these key factors, businesses can increase the likelihood of a successful carve-out strategy and maximize the value of the carved-out business unit.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.