What is ASCOT?

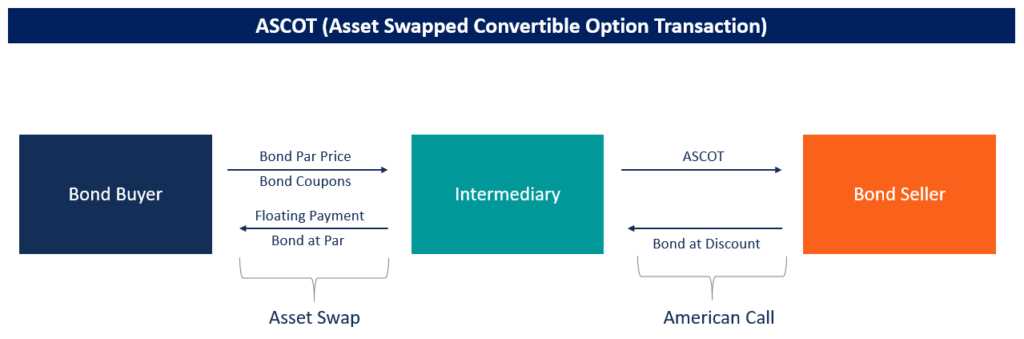

ASCOT, which stands for Asset Swapped Convertible Option Transaction, is an advanced financial concept that combines the features of an asset swap and a convertible option. It is a sophisticated investment strategy that allows investors to gain exposure to a specific asset while also having the option to convert it into another asset at a later date.

ASCOT is designed to provide investors with flexibility and diversification in their investment portfolios. It allows them to benefit from the potential upside of an asset while also managing their risk through the option to convert it into a different asset if market conditions change.

With ASCOT, investors can choose to convert their investment into a different asset, such as stocks, bonds, or commodities, based on their investment objectives and market conditions. This flexibility allows them to adapt their investment strategy to changing market dynamics and potentially maximize their returns.

ASCOT transactions are typically structured as over-the-counter (OTC) derivatives, which means they are privately negotiated between two parties rather than traded on a public exchange. This allows for greater customization and tailoring of the transaction to meet the specific needs of the investor.

In summary, ASCOT is a unique investment strategy that combines the features of an asset swap and a convertible option. It provides investors with flexibility, diversification, and risk management capabilities, allowing them to adapt their investment strategy to changing market conditions and potentially maximize their returns.

Benefits of ASCOT

ASCOT, or Asset Swapped Convertible Option Transaction, offers a range of benefits for investors and issuers alike. Let’s take a closer look at some of the key advantages:

1. Enhanced Yield

ASCOT allows investors to enhance their yield by combining the features of a convertible bond with a swap transaction. This unique structure provides the potential for higher returns compared to traditional fixed-income investments.

2. Diversification

By investing in ASCOT, investors can diversify their portfolio and gain exposure to a broader range of assets. This can help to reduce risk and increase the potential for long-term growth.

3. Flexibility

ASCOT offers flexibility in terms of investment horizons and risk profiles. Investors can choose from a variety of different structures and customize their investment to meet their specific needs and objectives.

4. Risk Management

ASCOT provides investors with various risk management strategies to protect their investment. These strategies can include hedging against market volatility, managing credit risk, and mitigating potential losses.

5. Potential for Capital Appreciation

ASCOT offers the potential for capital appreciation through the conversion feature of the convertible bond. If the underlying asset performs well, investors have the opportunity to convert their bonds into equity and benefit from any increase in the stock price.

6. Income Generation

ASCOT can generate income for investors through the coupon payments associated with the convertible bond. This income stream can provide a steady source of cash flow and enhance overall portfolio returns.

| Benefits | Description |

|---|---|

| Enhanced Yield | Combines features of a convertible bond and swap transaction to provide higher returns. |

| Diversification | Investors can gain exposure to a broader range of assets, reducing risk and increasing potential growth. |

| Flexibility | Investment horizons and risk profiles can be customized to meet specific needs and objectives. |

| Risk Management | Various strategies available to manage market volatility, credit risk, and potential losses. |

| Potential for Capital Appreciation | Convertible bond conversion feature allows investors to benefit from stock price increases. |

| Income Generation | Coupon payments from the convertible bond provide a steady source of cash flow. |

Key Features

ASCOT offers a range of key features that make it an attractive option for investors:

1. Asset Swapping: ASCOT allows for the swapping of assets, providing investors with the opportunity to diversify their portfolio and mitigate risk.

2. Convertible Option: ASCOT includes a convertible option, which gives investors the right to convert their investment into a specified number of shares of the underlying asset.

3. Risk Management: ASCOT offers risk management strategies that help investors protect their investment and minimize potential losses.

4. Advanced Concepts: ASCOT incorporates advanced concepts in its transaction process, providing investors with a sophisticated investment option.

5. Transaction Process: ASCOT follows a well-defined transaction process, ensuring transparency and efficiency in the investment process.

6. Benefits: ASCOT offers a range of benefits, including potential capital appreciation, income generation, and portfolio diversification.

Overall, ASCOT’s key features make it an innovative and attractive investment option for investors looking to maximize their returns while managing risk.

Asset Swapped Convertible Option

The Asset Swapped Convertible Option (ASCOT) is a financial instrument that combines the features of a convertible bond and an option. It allows investors to participate in the potential upside of an underlying asset while providing downside protection.

ASCOT works by allowing the investor to convert their bond into shares of the underlying asset at a predetermined conversion price. This conversion option provides the investor with the opportunity to benefit from any increase in the price of the underlying asset.

However, unlike a traditional convertible bond, ASCOT also includes an option component. This option allows the investor to swap the underlying asset for a different asset at a predetermined swap ratio. This feature provides additional flexibility and risk management capabilities.

By combining the features of a convertible bond and an option, ASCOT offers investors a unique investment opportunity. It allows them to participate in the potential upside of an underlying asset while also providing downside protection and the ability to manage risk through asset swapping.

| Benefits of ASCOT | Key Features |

|---|---|

| 1. Potential upside of underlying asset | 1. Convertible bond feature |

| 2. Downside protection | 2. Option component |

| 3. Risk management capabilities | 3. Asset swapping feature |

Transaction Process

The transaction process for an Asset Swapped Convertible Option (ASCOT) involves several steps to ensure a smooth and efficient execution:

1. Initial Consultation

The process begins with an initial consultation between the investor and the financial institution offering ASCOT. During this consultation, the investor’s financial goals and risk tolerance are assessed, and the benefits and features of ASCOT are explained in detail.

2. Customization

Once the investor decides to proceed with ASCOT, the financial institution works closely with them to customize the transaction according to their specific needs and preferences. This includes determining the underlying asset, the conversion ratio, the strike price, and the maturity date.

3. Documentation

Once the customization is complete, the necessary documentation is prepared. This includes a contract outlining the terms and conditions of the ASCOT, as well as any additional legal agreements required for the transaction.

4. Execution

After the documentation is finalized and signed by both parties, the ASCOT transaction is executed. This involves the investor providing the necessary funds to the financial institution, who then carries out the necessary steps to initiate the ASCOT.

5. Monitoring

Throughout the duration of the ASCOT, the financial institution closely monitors the performance of the underlying asset and provides regular updates to the investor. This ensures that the investor remains informed about the progress of their investment.

6. Maturity and Settlement

Overall, the transaction process for ASCOT is designed to provide investors with a seamless and transparent experience, allowing them to take advantage of the benefits and features offered by this innovative financial instrument.

Advanced Concepts

ASCOT introduces several advanced concepts in the world of finance and investment. Here are some key concepts to understand:

- Asset Swapped Convertible Option: ASCOT is a financial instrument that combines the features of a convertible bond and an asset swap. It allows investors to benefit from the potential upside of the underlying asset while also providing downside protection.

- Convertible Bond: A type of bond that can be converted into a predetermined number of shares of the issuer’s common stock. Convertible bonds offer investors the potential for capital appreciation if the stock price rises.

- Asset Swap: An arrangement where one party exchanges the cash flows of a fixed income instrument for the cash flows of another asset, such as a different bond or a stock. Asset swaps are often used to manage risk or enhance returns.

- Option: A financial derivative that gives the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period of time. Options can be used to hedge risk or speculate on price movements.

- Transaction Process: ASCOT transactions involve multiple steps, including the negotiation of terms, the execution of legal agreements, the exchange of cash flows, and the settlement of the transaction.

- Risk Management Strategies: ASCOT provides investors with various risk management strategies, such as hedging against market volatility, diversifying investment portfolios, and protecting against downside risk.

Risk Management Strategies

When engaging in an Asset Swapped Convertible Option Transaction (ASCOT), it is crucial to have effective risk management strategies in place. These strategies help mitigate potential risks and ensure the success of the transaction. Here are some key risk management strategies to consider:

1. Diversification:

Diversifying your investment portfolio is a fundamental risk management strategy. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the impact of any single investment on your overall portfolio. This helps to mitigate the risk associated with ASCOT transactions.

2. Hedging:

Hedging is another important risk management strategy. It involves taking a position in a financial instrument that is negatively correlated with the ASCOT transaction. This helps to offset potential losses in the event that the ASCOT transaction does not perform as expected. Hedging can be done through options, futures, or other derivative instruments.

3. Due Diligence:

Thorough due diligence is essential when considering an ASCOT transaction. This involves conducting a comprehensive analysis of the underlying assets, the counterparty involved, and the terms of the transaction. By conducting due diligence, you can identify and assess potential risks, allowing you to make informed decisions and mitigate any potential pitfalls.

4. Risk Assessment:

Regularly assessing and monitoring the risks associated with the ASCOT transaction is crucial. This involves evaluating the market conditions, the performance of the underlying assets, and any changes in the counterparty’s financial position. By staying vigilant and proactive in risk assessment, you can identify and address any potential risks before they become major issues.

5. Contingency Planning:

Having a contingency plan in place is essential for effective risk management. This involves developing alternative strategies or exit plans in case the ASCOT transaction does not go as expected. By having a backup plan, you can minimize potential losses and protect your investment.

By implementing these risk management strategies, you can navigate the complexities of ASCOT transactions with confidence and minimize potential risks. Remember, it is always important to consult with a financial advisor or risk management expert to tailor these strategies to your specific needs and circumstances.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.