Convertible Bond Definition

How Convertible Bonds Work

If the investor chooses to convert the bond into shares of the issuer’s common stock, they will no longer receive the fixed interest payments. Instead, they become shareholders and will be entitled to any dividends and potential capital gains associated with the stock.

Benefits of Convertible Bonds

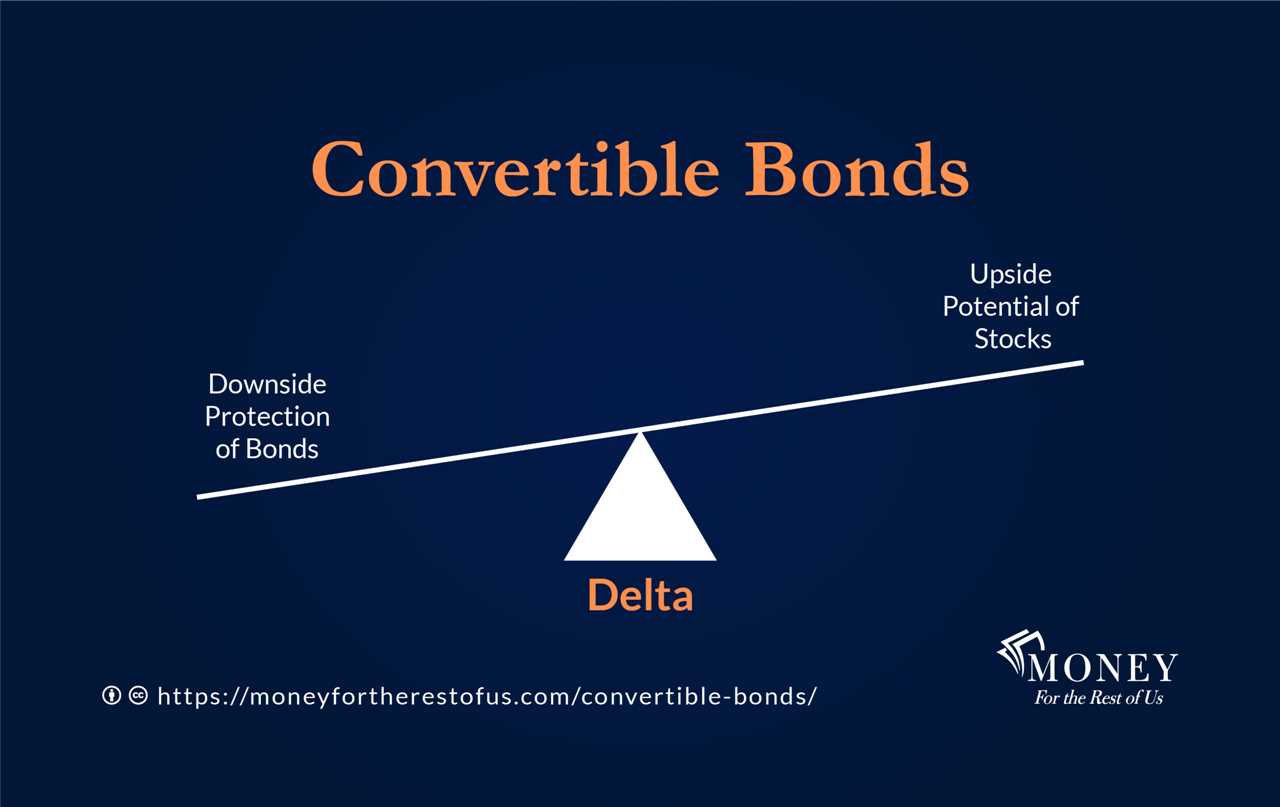

Convertible bonds offer several benefits to both investors and issuers. For investors, they provide the opportunity to participate in the potential upside of the issuer’s stock price while still receiving a fixed income. This can be particularly attractive in a low-interest-rate environment.

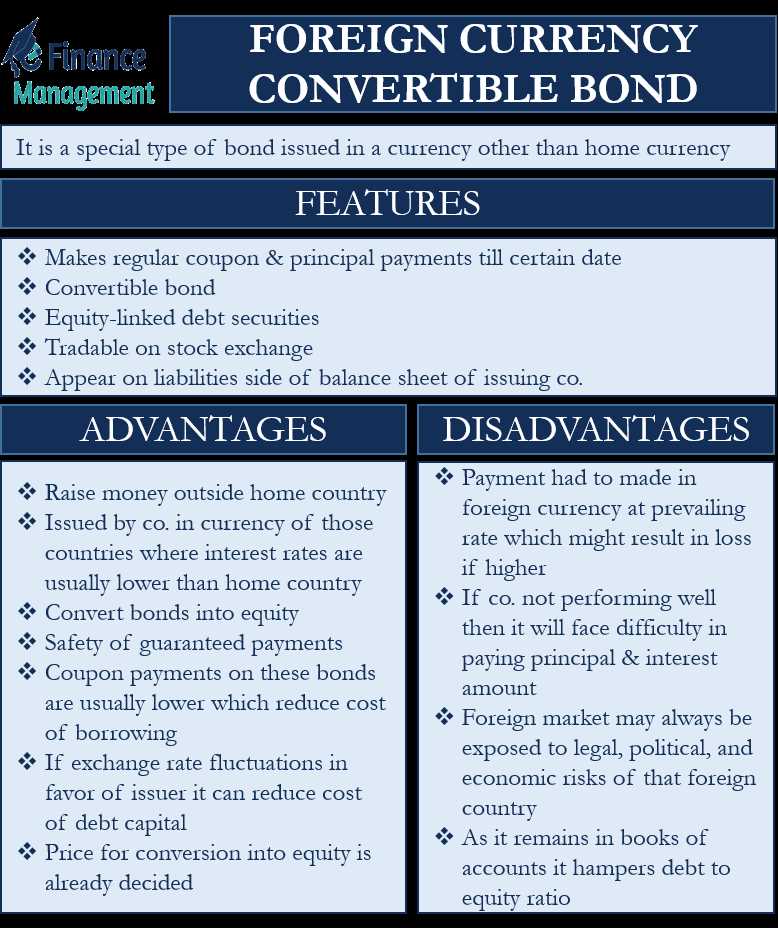

For issuers, convertible bonds offer a way to raise capital at a lower cost compared to issuing non-convertible bonds or equity. They also provide flexibility in managing their capital structure and can be used to attract a broader range of investors.

What is a Convertible Bond?

A convertible bond is a type of bond that can be converted into a predetermined number of shares of the issuer’s common stock. It combines features of both debt and equity securities, offering investors the potential for fixed income payments and the opportunity to participate in the appreciation of the issuer’s stock.

Convertible bonds typically have a fixed interest rate and a maturity date, like traditional bonds. However, what sets them apart is their conversion feature, which allows bondholders to convert their bonds into shares of the issuer’s stock at a predetermined conversion price.

This conversion feature gives convertible bondholders the flexibility to benefit from any increase in the issuer’s stock price. If the stock price rises above the conversion price, bondholders can convert their bonds and participate in the potential upside. On the other hand, if the stock price remains below the conversion price, bondholders can choose to hold the bonds and receive fixed interest payments until maturity.

Convertible bonds are often issued by companies that have the potential for significant growth in their stock price. They are attractive to investors who want to benefit from the potential upside of the issuer’s stock while still having the security of fixed income payments. Additionally, convertible bonds can provide issuers with a lower cost of capital compared to issuing traditional equity.

Overall, convertible bonds offer a unique investment opportunity that combines the benefits of fixed income and equity investments. They provide investors with the potential for both income and capital appreciation, making them a popular choice for those seeking a balanced investment strategy.

Example and Benefits of Convertible Bonds

Convertible bonds offer investors the opportunity to benefit from both the fixed income and equity markets. Here is an example to illustrate how convertible bonds work and the potential benefits they can provide:

- Company XYZ issues a convertible bond with a face value of $1,000 and a coupon rate of 5%.

- Investors who purchase this bond will receive regular interest payments of $50 per year ($1,000 * 5%) until the bond matures.

- However, what makes convertible bonds unique is that they can be converted into a predetermined number of the company’s common shares.

- Let’s say the conversion ratio is 10:1, meaning that for every $1,000 bond, the investor can convert it into 10 shares of the company’s stock.

- If the company’s stock price increases significantly, let’s say from $50 to $100 per share, the investor can choose to convert their bond into shares.

- By converting the bond, the investor would receive 10 shares worth $1,000 ($100 * 10), which is equal to the face value of the bond.

- This allows the investor to benefit from the appreciation of the company’s stock while still receiving the regular interest payments.

- On the other hand, if the company’s stock price does not increase, the investor can simply hold onto the bond and continue to receive the fixed income payments.

Overall, convertible bonds provide investors with the potential for capital appreciation if the underlying stock price rises, while still providing the stability of regular interest payments. This makes them an attractive investment option for those looking to diversify their portfolio and take advantage of both the fixed income and equity markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.