What is Annualized Total Return?

Annualized total return is a measure used in finance to calculate the average rate of return on an investment over a specific period of time, typically one year. It takes into account both the capital gains or losses and any income generated by the investment, such as dividends or interest.

This metric is useful for investors who want to evaluate the performance of their investments over time and compare them to other investment options. It provides a standardized way to measure the return on investment and helps investors make informed decisions about their portfolio.

To calculate the annualized total return, you need to know the initial investment amount, the ending investment value, and the time period of the investment. The formula for annualized total return takes into account the compounding effect of returns over time, giving a more accurate representation of the investment’s performance.

Investors can use the annualized total return to assess the historical performance of an investment and make projections for future returns. It allows them to determine if their investment is meeting their expectations and if it is performing better or worse than other investment options.

How to Calculate Annualized Total Return

Calculating the annualized total return is a useful tool for investors to evaluate the performance of their investments over a specific period of time. It takes into account both the capital gains or losses and the income generated by the investment.

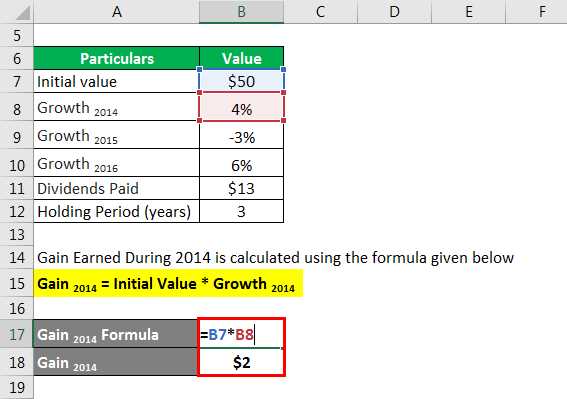

Step 1: Gather the necessary information

Before you can calculate the annualized total return, you need to gather some key information about your investment. This includes the initial investment amount, the ending investment value, and the time period over which the investment was held.

Step 2: Calculate the total return

To calculate the total return, subtract the initial investment amount from the ending investment value. Then, divide the result by the initial investment amount. Multiply the result by 100 to convert it into a percentage.

Step 3: Determine the time period

Next, determine the time period over which the investment was held. This can be measured in months, years, or any other unit of time. For example, if the investment was held for 3 years, the time period would be 3.

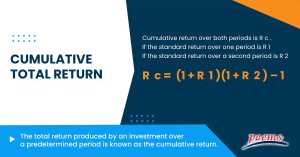

Step 4: Calculate the annualized total return

To calculate the annualized total return, use the following formula:

For example, if the total return is 20% and the time period is 3 years, the annualized total return would be:

Once you have calculated the annualized total return, you can use it to compare the performance of different investments or to evaluate the overall performance of your investment portfolio.

| Initial Investment Amount | Ending Investment Value | Total Return | Time Period | Annualized Total Return |

|---|---|---|---|---|

| $10,000 | $12,000 | 20% | 3 years | 6.42% |

| $5,000 | $6,500 | 30% | 2 years | 14.47% |

By calculating the annualized total return, investors can make more informed decisions about their investments and better understand the performance of their portfolio over time.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.