What is an Angel Investor?

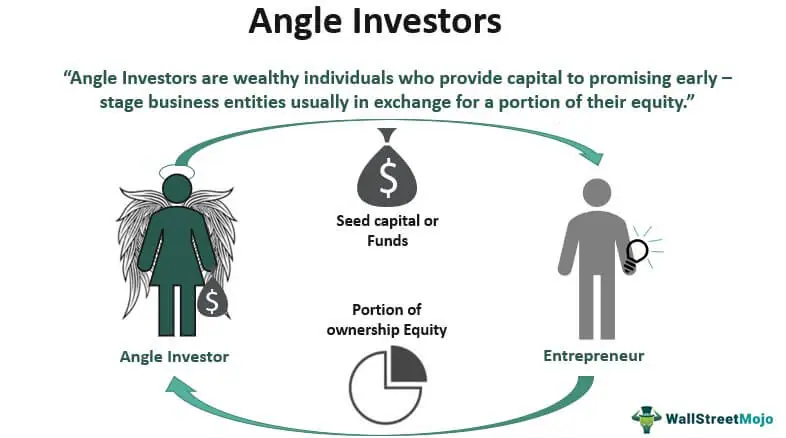

An angel investor is an individual who provides financial support and mentorship to early-stage startups in exchange for equity ownership. These investors are typically high-net-worth individuals who have a keen interest in investing in innovative and promising business ideas.

Angel investors play a crucial role in the startup ecosystem by filling the funding gap between friends and family investments and venture capital funding. They are often the first outside investors to provide capital to startups, helping them to get off the ground and grow.

Unlike venture capitalists who invest other people’s money, angel investors use their own personal funds to invest in startups. They take on a higher level of risk, as many startups fail, but they also have the potential for significant returns if the startup is successful.

In addition to providing financial support, angel investors often bring valuable expertise and industry connections to the table. They can offer guidance and mentorship to entrepreneurs, helping them navigate the challenges of starting and scaling a business.

Angel investors typically invest in industries and sectors they are familiar with, leveraging their own knowledge and experience to make informed investment decisions. They may also invest in startups that align with their personal interests or passions.

Overall, angel investors play a vital role in fostering innovation and entrepreneurship by providing the necessary capital and support to early-stage startups. Their investments can help turn ideas into reality and contribute to economic growth and job creation.

Angel Investor Definition and How It Works

An angel investor is an individual who provides financial support to startup companies or small businesses in exchange for equity or ownership in the company. Angel investors are typically high-net-worth individuals who have a keen interest in investing in early-stage businesses with high growth potential.

Angel investors play a crucial role in the private equity and venture capital ecosystem. They often invest their own personal funds and take on a significant amount of risk by investing in startups that may not have a proven track record or established revenue streams. However, they are attracted to the potential for high returns on their investments if the startup is successful.

In addition to providing financial support, angel investors often bring valuable expertise, industry connections, and mentorship to the startups they invest in. They may have experience in the same industry or have successfully built and sold their own businesses. This guidance can be invaluable to entrepreneurs who are navigating the challenges of starting and growing a company.

Angel investors typically invest smaller amounts compared to venture capital firms, but their investments can still have a significant impact on the success of a startup. They may invest anywhere from a few thousand dollars to several million dollars, depending on the stage of the company and the potential for growth.

Overall, angel investors play a vital role in the startup ecosystem by providing the necessary capital and support for early-stage companies to thrive. Their investments can help fuel innovation, create jobs, and drive economic growth.

The Role of Angel Investors in Private Equity

Private equity refers to investments made in private companies that are not publicly traded on stock exchanges. These investments are typically made by institutional investors, such as private equity firms, pension funds, and endowments. However, angel investors also play a significant role in private equity.

Angel investors are high-net-worth individuals who provide capital to early-stage or startup companies in exchange for equity ownership. They are often experienced entrepreneurs or business professionals who have accumulated wealth and are looking to invest in promising ventures.

Angel investors provide more than just financial capital. They also bring valuable expertise, industry knowledge, and networks to the table. Their experience and insights can help guide the strategic direction of the company and contribute to its success.

Furthermore, angel investors often invest in industries or sectors that they are familiar with or have experience in. This specialization allows them to identify promising investment opportunities and provide targeted support to the companies they invest in.

Angel investors typically invest smaller amounts compared to private equity firms, but their investments can have a significant impact on the growth and development of a company. They often invest at an early stage when the company is still in its infancy and may not have access to traditional sources of funding.

In addition to providing capital, angel investors also help companies attract further investment from venture capital firms or other institutional investors. Their endorsement and involvement can increase the credibility and attractiveness of a company to potential investors.

The Benefits of Angel Investing

For angel investors, private equity investments offer several benefits. Firstly, they have the potential to earn high returns on their investments if the companies they back are successful. This can outweigh the risks associated with investing in early-stage ventures.

Secondly, angel investors have the opportunity to support and mentor entrepreneurs, sharing their knowledge and experience to help them navigate the challenges of starting and growing a business. This can be personally fulfilling for angel investors and allow them to contribute to the development of innovative ideas and technologies.

Lastly, angel investing can provide diversification to an investor’s portfolio. By investing in a range of companies across different industries, angel investors can spread their risk and increase their chances of finding successful investments.

Why Entrepreneurs Seek Angel Investors

For entrepreneurs, angel investors offer a vital source of funding and support. Many startups and early-stage companies struggle to secure traditional bank loans or attract larger institutional investors due to their high-risk nature or lack of track record.

Angel investors are often more willing to take on these risks and provide the necessary capital to help companies get off the ground. They can provide the initial funding needed to develop a prototype, hire key personnel, or launch a marketing campaign.

In addition to financial support, angel investors can also provide valuable mentorship and guidance. Their experience and networks can open doors to new opportunities, partnerships, and customers. This can be particularly valuable for entrepreneurs who are new to the business world and may lack the necessary connections.

Overall, angel investors play a crucial role in private equity by providing early-stage funding, expertise, and support to startups and early-stage companies. Their contributions can significantly impact the success and growth of these companies, making them an essential part of the entrepreneurial ecosystem.

How Angel Investors Contribute to Venture Capital

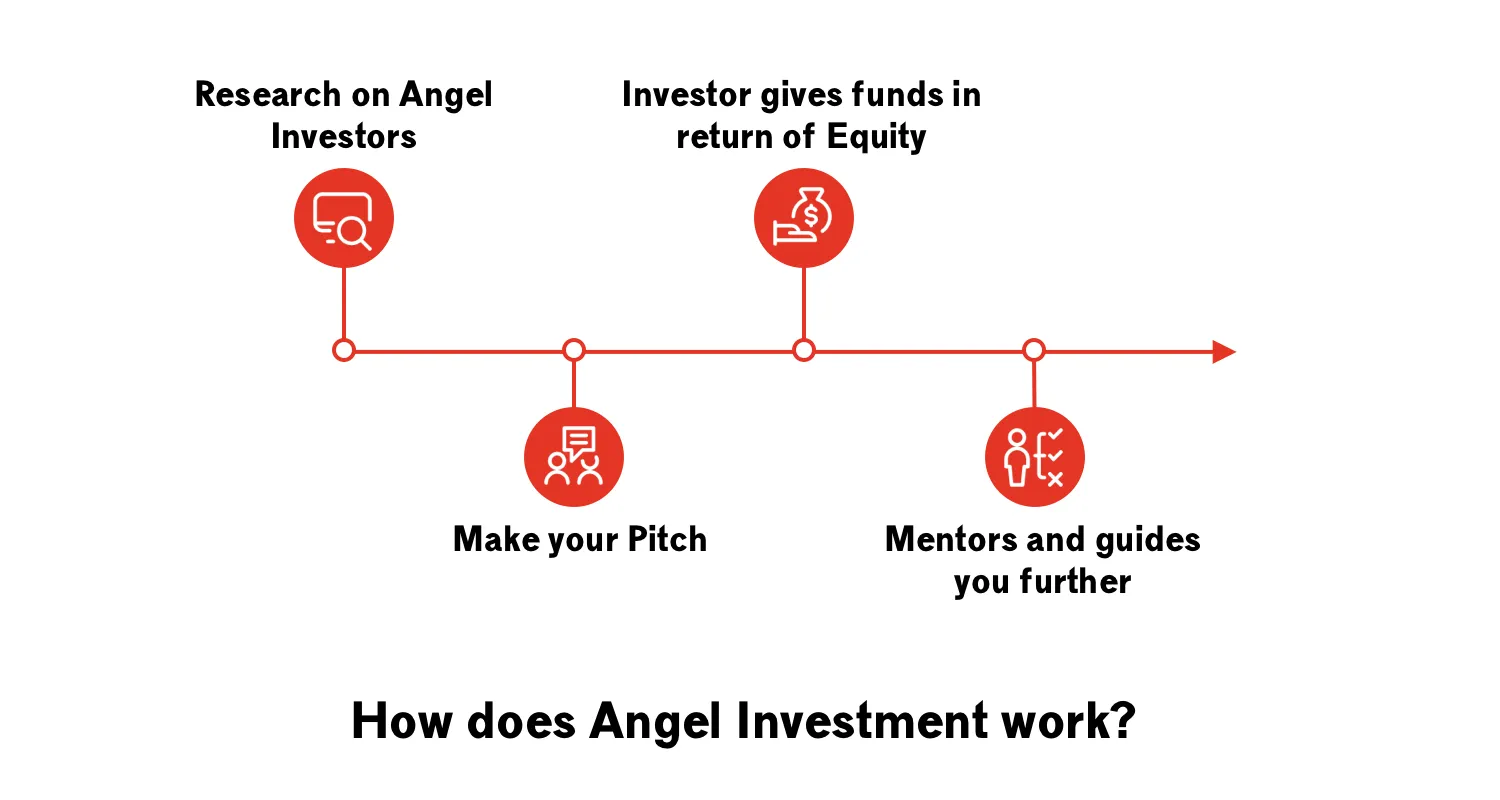

Angel investors play a crucial role in the world of venture capital. They provide the initial funding that startups need to get off the ground and grow. While venture capital firms typically invest larger amounts of money, angel investors are often the first to recognize the potential of a new business idea and are willing to take on the risk.

One of the main ways angel investors contribute to venture capital is by providing seed funding. This is the initial capital that startups need to develop their products, conduct market research, and hire key team members. Without this initial funding, many startups would struggle to get started.

Angel investors also bring more than just money to the table. They often have valuable industry experience and connections that can help startups navigate the challenges of building a business. They can provide mentorship and guidance, helping entrepreneurs avoid common pitfalls and make strategic decisions.

In addition to financial and strategic support, angel investors can also help startups attract additional funding from venture capital firms. When a startup has already secured funding from an angel investor, it signals to other investors that the business has potential and is worth considering. This can make it easier for startups to raise larger amounts of capital in the future.

The Benefits of Angel Investing

Angel investing is not only beneficial for startups, but also for the angel investors themselves. By investing in early-stage companies, angel investors have the opportunity to earn significant returns on their investment if the startup is successful. This can be much higher than the returns they would receive from more traditional investments.

Angel investing also allows individuals to support and be a part of the entrepreneurial ecosystem. It gives them the chance to help bring innovative ideas to life and contribute to job creation and economic growth. Many angel investors find the experience of working with startups to be rewarding and fulfilling.

Why Entrepreneurs Seek Angel Investors

For entrepreneurs, seeking angel investors can be a smart move. Angel investors provide not only the necessary funding, but also valuable expertise and connections. They can help entrepreneurs refine their business plans, connect them with potential customers and partners, and open doors to new opportunities.

Angel investors are often more willing to take risks and invest in early-stage startups compared to traditional lenders or venture capital firms. This makes them an attractive option for entrepreneurs who may not have a proven track record or significant assets to secure traditional financing.

Benefits of Angel Investing

Angel investing offers a range of benefits for both the investors and the entrepreneurs seeking funding. Here are some key advantages of angel investing:

| 1. Financial Support: | Angel investors provide crucial financial support to early-stage startups that may struggle to secure funding from traditional sources such as banks or venture capital firms. This financial support can help entrepreneurs bring their innovative ideas to life and fuel their growth. |

| 2. Expertise and Guidance: | Angel investors often have extensive experience and knowledge in specific industries. They can provide valuable guidance and mentorship to entrepreneurs, helping them navigate challenges, make strategic decisions, and avoid common pitfalls. This expertise can significantly increase the chances of success for startups. |

| 3. Network and Connections: | Angel investors typically have a wide network of contacts in various industries. They can introduce entrepreneurs to potential customers, partners, suppliers, and other investors. These connections can open doors to new opportunities, collaborations, and partnerships, which can be crucial for the growth and success of startups. |

| 4. Validation and Credibility: | Securing investment from reputable angel investors can provide startups with validation and credibility. It signals to other investors, customers, and stakeholders that the business has potential and is worth considering. This validation can help startups attract additional funding, customers, and strategic partnerships. |

| 5. Flexibility and Agility: | Unlike traditional funding sources, angel investors are often more flexible and agile in their investment decisions. They can quickly evaluate opportunities, make investment decisions, and provide funding. This flexibility can be crucial for startups that need rapid access to capital to seize time-sensitive opportunities or address urgent needs. |

| 6. Long-Term Partnership: |

Overall, angel investing offers a win-win situation for both investors and entrepreneurs. It provides financial support, expertise, network, validation, flexibility, and long-term partnership, which can significantly enhance the growth prospects of startups and generate attractive returns for angel investors.

Why Entrepreneurs Seek Angel Investors

Entrepreneurs often seek angel investors to help fund their startups and early-stage businesses. Angel investors play a crucial role in the success of these ventures by providing not only financial support but also valuable expertise, industry connections, and mentorship.

1. Access to Capital

One of the primary reasons entrepreneurs seek angel investors is to gain access to capital. Starting a business requires significant financial resources, and angel investors can provide the necessary funding to get a venture off the ground. These investors are typically high-net-worth individuals who are willing to take on higher risks in exchange for potential high returns.

2. Expertise and Experience

Angel investors often have extensive experience in the industry in which they invest. They bring valuable expertise and insights to the table, which can help entrepreneurs navigate challenges and make informed decisions. Their experience can also help entrepreneurs avoid common pitfalls and accelerate the growth of their businesses.

3. Industry Connections

Angel investors typically have a vast network of industry connections, including other investors, entrepreneurs, and professionals. By partnering with an angel investor, entrepreneurs gain access to these valuable connections, which can open doors to new opportunities, partnerships, and potential customers. These connections can significantly enhance the growth and success of a startup.

4. Mentorship and Guidance

Angel investors often take an active role in the businesses they invest in, providing mentorship and guidance to entrepreneurs. They can offer valuable advice based on their own experiences and help entrepreneurs navigate the challenges of building and scaling a business. This mentorship can be invaluable, especially for first-time entrepreneurs who may lack the necessary experience and knowledge.

5. Validation and Credibility

Securing funding from an angel investor can provide validation and credibility to a startup. It demonstrates that an experienced investor believes in the potential of the business and its founders. This validation can be crucial when seeking additional funding from other sources, such as venture capital firms or banks. It can also attract other investors who may be more willing to invest in a startup that has already gained the trust and support of an angel investor.

6. Long-Term Partnership

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.