What are Qualifying Annuities?

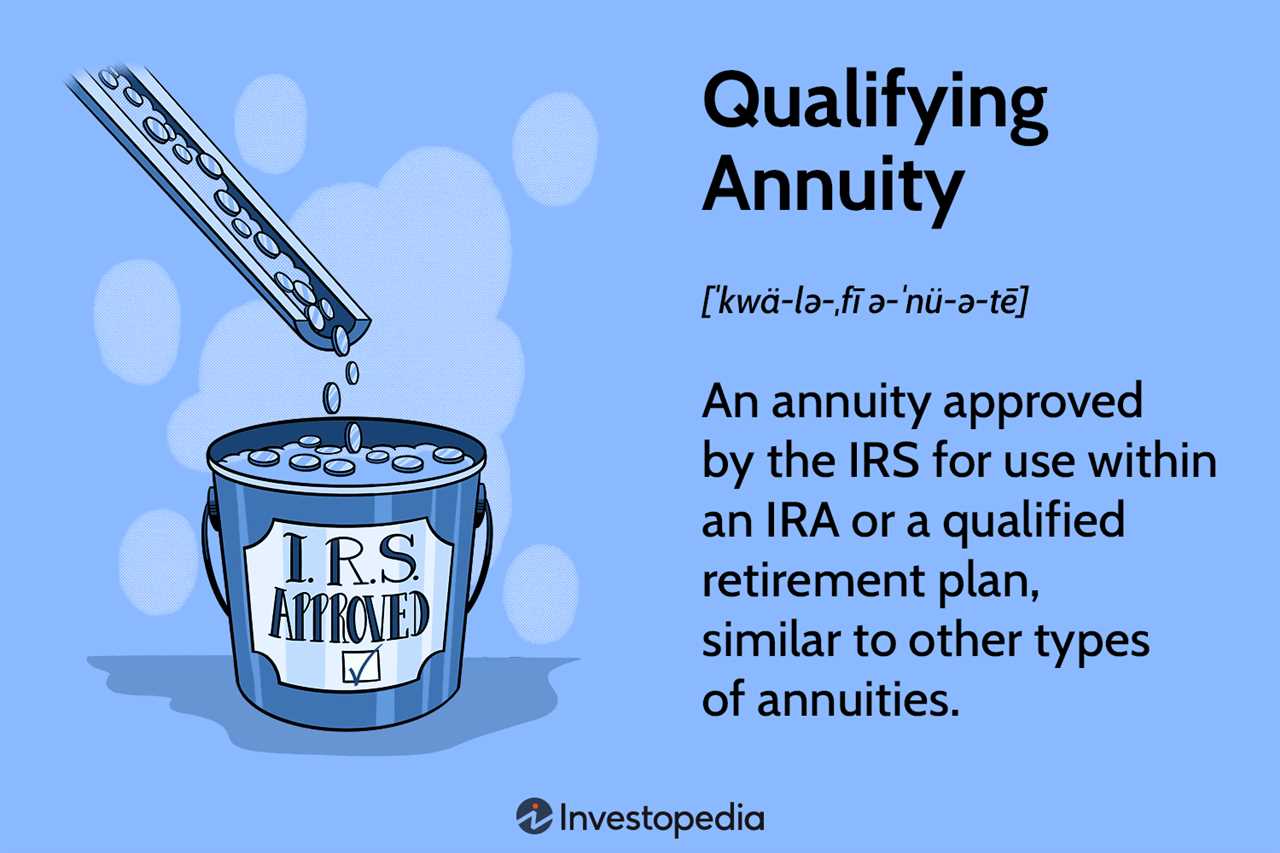

Qualifying annuities are a type of annuity that meets certain requirements set by the Internal Revenue Service (IRS) to receive favorable tax treatment. These annuities are typically used for retirement planning and offer individuals a way to save and grow their money over time.

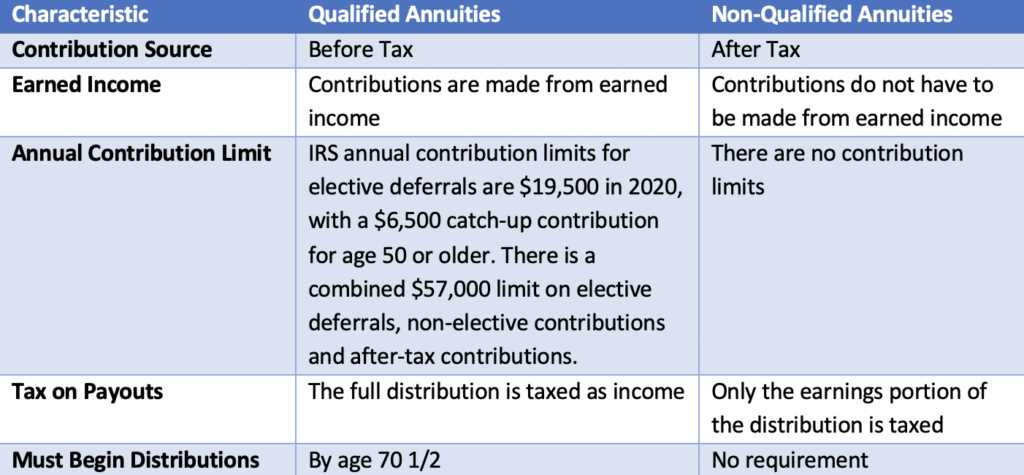

Qualifying annuities are funded with pre-tax dollars, meaning that the money used to purchase the annuity is not subject to income tax at the time of contribution. Instead, taxes are deferred until the individual begins to receive payments from the annuity.

These annuities can be either fixed or variable. Fixed qualifying annuities provide a guaranteed interest rate for a specified period of time, while variable qualifying annuities allow individuals to invest their money in various investment options, such as stocks and bonds.

Benefits and Features

One of the main benefits of qualifying annuities is the tax advantage they offer. By deferring taxes until retirement, individuals may be able to lower their overall tax liability and potentially save more money for the future.

Additionally, qualifying annuities provide a steady stream of income during retirement. Individuals can choose to receive payments for a specific period of time or for the rest of their lives, providing financial security and peace of mind.

Another feature of qualifying annuities is the ability to customize the annuity to fit individual needs. Individuals can choose from various payout options, such as lump sum payments or regular monthly payments, and can also add optional riders for additional benefits, such as a death benefit or long-term care coverage.

How Qualifying Annuities Work

When an individual purchases a qualifying annuity, they make regular contributions to the annuity contract. These contributions grow tax-deferred over time, allowing the money to compound and potentially earn interest.

Once the individual reaches retirement age, they can begin to receive payments from the annuity. These payments can be received in a lump sum or as regular income, depending on the individual’s preference and the terms of the annuity contract.

Considerations and Risks

Choosing the Right Qualifying Annuity

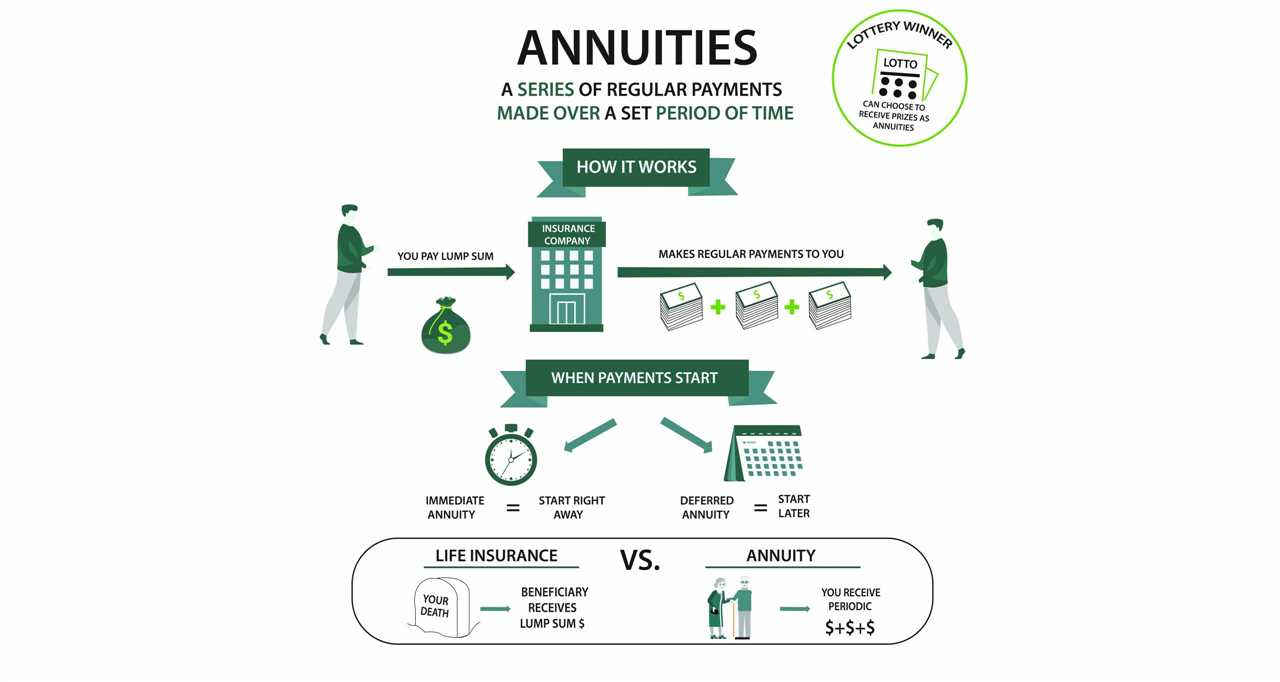

Before delving into the details of qualifying annuities, it is essential to understand the basics of annuities themselves. An annuity is a financial product that provides a steady stream of income over a specific period or for the rest of your life. It is typically used as a retirement savings tool to ensure a stable income during your golden years.

Qualifying annuities offer several advantages, including tax deferral. This means that you won’t have to pay taxes on the earnings until you start withdrawing the funds. This can be beneficial if you expect to be in a lower tax bracket during retirement. Additionally, qualifying annuities provide a guaranteed income stream, which can help alleviate concerns about outliving your savings.

One of the key features of qualifying annuities is the ability to choose between fixed and variable annuities. Fixed annuities offer a guaranteed interest rate for a specific period, providing stability and security. Variable annuities, on the other hand, allow you to invest in a variety of underlying investment options, such as stocks and bonds, potentially offering higher returns but also higher risks.

It is important to note that qualifying annuities come with certain restrictions and limitations. For example, there are contribution limits and withdrawal penalties if you withdraw funds before a certain age. Additionally, the income generated from qualifying annuities is subject to ordinary income tax rates.

Benefits and Features of Qualifying Annuities

Qualifying annuities offer a range of benefits and features that make them an attractive investment option for many individuals. Here are some of the key benefits and features to consider:

Tax-Deferred Growth: One of the main advantages of qualifying annuities is that they offer tax-deferred growth. This means that any earnings on your investment are not subject to income taxes until you withdraw them. This can be particularly beneficial for individuals who are looking to save for retirement, as it allows their investment to grow without being eroded by taxes.

Guaranteed Income: Another key feature of qualifying annuities is the option to receive a guaranteed income stream. This can provide individuals with a stable and predictable source of income during retirement. Depending on the terms of the annuity contract, you may have the option to receive payments for a set period of time or for the rest of your life.

Death Benefit: Many qualifying annuities also offer a death benefit, which can provide financial security for your loved ones. If you pass away before annuity payments have started, your beneficiaries will receive a lump sum payment or a series of payments, depending on the terms of the contract.

Flexibility: Qualifying annuities offer a certain degree of flexibility in terms of how you can access your funds. While there may be penalties for early withdrawals, you generally have the option to make partial withdrawals or access your funds in case of emergencies.

Protection from Market Volatility: Qualifying annuities can provide a level of protection from market volatility. Unlike other investment options, annuities offer a guaranteed rate of return, which can provide peace of mind during periods of market uncertainty.

Long-Term Care Benefits: Some qualifying annuities also offer long-term care benefits, which can help cover the costs of nursing home care or other medical expenses. This can be particularly valuable for individuals who are concerned about the potential costs of long-term care in the future.

How Qualifying Annuities Work

Qualifying annuities are financial products that provide individuals with a steady stream of income during retirement. They work by allowing individuals to invest a lump sum of money with an insurance company, which then guarantees regular payments to the individual for a specified period of time or for the rest of their life.

1. Accumulation Phase

The first phase of a qualifying annuity is the accumulation phase. During this phase, individuals contribute money to the annuity, either as a lump sum or through regular payments. The insurance company then invests these funds, typically in a variety of assets such as stocks, bonds, and real estate, with the goal of generating returns and growing the value of the annuity over time.

2. Distribution Phase

Once the individual reaches the distribution phase, they can begin receiving payments from the annuity. The distribution phase can be structured in different ways, depending on the individual’s needs and preferences. Some common options include:

- Immediate Annuity: This option allows individuals to start receiving payments immediately after purchasing the annuity.

- Deferred Annuity: With a deferred annuity, individuals can choose to delay the start of payments until a later date, such as when they reach a certain age or retire.

- Fixed Annuity: A fixed annuity provides individuals with a set payment amount that remains the same throughout the distribution phase.

- Variable Annuity: Unlike a fixed annuity, a variable annuity allows individuals to invest their funds in a variety of investment options, such as mutual funds, and the payment amount can fluctuate based on the performance of these investments.

3. Tax Advantages

One of the key benefits of qualifying annuities is their tax advantages. During the accumulation phase, individuals can contribute money to the annuity on a tax-deferred basis, meaning they do not have to pay taxes on the earnings or growth of the annuity until they start receiving payments. This can help individuals save on taxes and potentially grow their annuity more quickly.

Additionally, if the annuity is held within a qualified retirement account, such as an IRA or 401(k), individuals may be able to deduct their contributions from their taxable income, further reducing their tax liability.

4. Death Benefit

In the event of the annuity holder’s death, qualifying annuities often provide a death benefit. This means that any remaining funds in the annuity can be passed on to the annuity holder’s beneficiaries, typically tax-free or with reduced tax implications. The specific details of the death benefit can vary depending on the terms of the annuity contract.

Considerations and Risks

When considering qualifying annuities, it is important to understand the potential risks and factors that may affect your investment. Here are some key considerations to keep in mind:

1. Market Volatility

Qualifying annuities are subject to market fluctuations, which means that the value of your investment can go up or down depending on the performance of the underlying investments. It is essential to carefully assess your risk tolerance and investment goals before committing to a qualifying annuity.

2. Surrender Charges

Some qualifying annuities may have surrender charges if you decide to withdraw your funds before a specified period. These charges can be substantial and can eat into your investment returns. Make sure to review the surrender charge schedule and understand the potential financial implications before making any early withdrawals.

3. Fees and Expenses

Qualifying annuities often come with various fees and expenses, including administrative fees, mortality and expense charges, and investment management fees. These fees can reduce the overall return on your investment. It is crucial to carefully review the fee structure and compare different annuity options to ensure you are getting the best value for your money.

4. Tax Implications

While qualifying annuities offer tax-deferred growth, withdrawals are typically subject to ordinary income tax. If you withdraw funds before the age of 59 ½, you may also incur a 10% early withdrawal penalty. It is essential to consult with a tax professional to understand the tax implications of investing in qualifying annuities and how they may affect your overall financial plan.

5. Long-Term Commitment

Qualifying annuities are designed as long-term investments, and they often come with surrender periods that can last for several years. It is crucial to consider your liquidity needs and financial goals before committing to a qualifying annuity. Once you purchase an annuity, it can be challenging to access your funds without incurring penalties or surrender charges.

Overall, qualifying annuities can provide a reliable source of income during retirement, but they come with certain risks and considerations. It is essential to carefully evaluate your financial situation, risk tolerance, and investment objectives before deciding to invest in a qualifying annuity. Consulting with a financial advisor can also help you make an informed decision and ensure that an annuity aligns with your overall financial plan.

Choosing the Right Qualifying Annuity

1. Determine Your Financial Goals

2. Assess Your Risk Tolerance

Consider your risk tolerance when choosing a qualifying annuity. Some annuities offer guaranteed returns, while others are tied to market performance. If you’re risk-averse, a fixed annuity might be a better option. If you’re comfortable with market fluctuations, a variable annuity might be suitable.

3. Compare Different Annuity Providers

Research and compare different annuity providers to find the best one for your needs. Look for reputable companies with a strong track record and positive customer reviews. Consider factors such as fees, surrender charges, and customer service when evaluating providers.

4. Understand the Terms and Conditions

Read and understand the terms and conditions of the annuity contract before making a decision. Pay attention to details such as withdrawal restrictions, surrender charges, and any potential penalties. Make sure you fully understand how the annuity works and what you can expect in terms of returns.

5. Seek Professional Advice

Consider consulting with a financial advisor who specializes in annuities. They can provide personalized advice based on your specific financial situation and goals. A professional can help you navigate the complexities of annuities and guide you towards the best option for your needs.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.