What is Variable Survivorship Life Insurance?

Variable Survivorship Life Insurance is a type of life insurance policy that covers two individuals, usually spouses, under one policy. Unlike traditional life insurance policies that pay out upon the death of one individual, variable survivorship life insurance pays out a death benefit after both individuals have passed away.

How does Variable Survivorship Life Insurance work?

Variable Survivorship Life Insurance works by combining the benefits of a traditional life insurance policy with the investment options of a variable life insurance policy. The policyholders pay premiums, which are then invested in a variety of investment options such as stocks, bonds, and mutual funds. The cash value of the policy can grow over time based on the performance of these investments.

Unlike traditional life insurance policies, variable survivorship life insurance policies do not have a cash value that can be accessed during the insured individuals’ lifetimes. The cash value is only available upon the death of both insured individuals.

Benefits of Variable Survivorship Life Insurance

There are several benefits to choosing variable survivorship life insurance:

- Estate planning: Variable survivorship life insurance can help to ensure that there are funds available to pay estate taxes, which can be a significant burden on high net worth individuals and families.

- Flexibility: The investment options available with variable survivorship life insurance allow policyholders to potentially grow the cash value of the policy over time.

- Protection for future generations: By providing a death benefit that is paid out after both insured individuals have passed away, variable survivorship life insurance can help to provide for future generations and leave a lasting legacy.

Variable Survivorship Life Insurance (VSLI) is a type of life insurance policy that covers two individuals, typically spouses, under a single policy. Unlike traditional life insurance policies that pay out a death benefit upon the death of the insured individual, VSLI policies pay out a death benefit after both insured individuals have passed away.

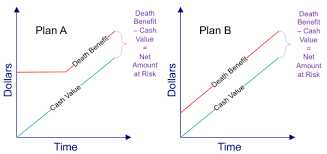

One of the key features of VSLI policies is the ability to accumulate cash value over time. This cash value is invested in a variety of investment options, such as stocks, bonds, and mutual funds. The policyholders have the flexibility to choose how their cash value is invested, allowing them to potentially grow their investment and increase the death benefit.

Another important aspect of VSLI policies is the survivorship clause. This clause states that the death benefit will only be paid out after both insured individuals have died. This can be beneficial for estate planning purposes, as it allows the policyholders to ensure that their heirs receive a financial benefit after their passing.

Types of Variable Survivorship Life Insurance

1. Variable Universal Life Insurance

Variable Universal Life Insurance (VUL) is a type of variable survivorship life insurance policy that offers both a death benefit and a cash value component. The cash value component of the policy is invested in a variety of investment options, such as stocks, bonds, and mutual funds, allowing the policyholder to potentially grow their cash value over time. The death benefit is paid out to the beneficiaries upon the death of the second insured individual.

2. Variable Whole Life Insurance

Variable Whole Life Insurance is another type of variable survivorship life insurance policy that provides a death benefit and a cash value component. However, unlike VUL, the cash value component of variable whole life insurance is invested in a fixed account, rather than a variety of investment options. This can provide a more stable and predictable cash value growth, but may not offer the same potential for high returns as VUL.

3. Survivorship Indexed Universal Life Insurance

SIUL policies often come with a cap or limit on the amount of growth that can be credited to the cash value component, as well as a floor or minimum guaranteed interest rate. This can help protect the policyholder from excessive market volatility while still offering potential for growth.

Benefits of Variable Survivorship Life Insurance

Variable Survivorship Life Insurance offers several benefits that make it an attractive option for many individuals and families. Here are some of the key advantages of this type of insurance:

1. Estate Planning

Variable Survivorship Life Insurance is often used as a tool for estate planning. It allows individuals to leave a substantial amount of money to their heirs, ensuring financial security for future generations. This type of insurance can help cover estate taxes and other expenses, ensuring that the family’s assets are preserved.

2. Flexibility

One of the main benefits of Variable Survivorship Life Insurance is its flexibility. Policyholders have the ability to adjust their premium payments and death benefit amounts as needed. This flexibility allows individuals to adapt their insurance coverage to their changing financial circumstances and goals.

3. Cash Value Accumulation

Variable Survivorship Life Insurance policies often come with a cash value component. This means that a portion of the premium payments goes into an investment account, which can grow over time. Policyholders can access this cash value through loans or withdrawals, providing them with a source of funds for various purposes, such as education expenses or retirement income.

4. Investment Options

Another advantage of Variable Survivorship Life Insurance is the opportunity for policyholders to choose from a range of investment options. These options typically include stocks, bonds, and mutual funds. By selecting the right investments, policyholders have the potential to earn higher returns and grow their cash value more quickly.

5. Survivorship Benefit

Variable Survivorship Life Insurance provides a survivorship benefit, which means that the death benefit is paid out after the death of both insured individuals. This can be beneficial for couples who want to ensure that their surviving spouse or children are financially protected. The death benefit can be used to cover living expenses, pay off debts, or provide an inheritance to loved ones.

Overall, Variable Survivorship Life Insurance offers a combination of financial protection and investment opportunities. It can be a valuable tool for individuals and families who want to secure their financial future while also having the potential for growth and flexibility.

Factors to Consider when Choosing Variable Survivorship Life Insurance

Choosing the right variable survivorship life insurance policy is an important decision that requires careful consideration. Here are some factors to keep in mind when making your choice:

1. Financial Stability of the Insurance Company

It is crucial to choose an insurance company with a strong financial stability rating. This ensures that the company will be able to fulfill its obligations and pay out the death benefit when the time comes. Look for companies that have high ratings from reputable rating agencies.

2. Premiums and Costs

Consider the premiums and costs associated with the policy. Variable survivorship life insurance policies typically have higher premiums compared to other types of life insurance. Make sure you can comfortably afford the premiums throughout the life of the policy.

3. Investment Options

Variable survivorship life insurance policies allow policyholders to invest their cash value in various investment options such as stocks, bonds, and mutual funds. Consider the investment options available and determine if they align with your investment goals and risk tolerance.

4. Policy Flexibility

Look for a policy that offers flexibility in terms of adjusting the death benefit, premium payments, and investment options. Life circumstances can change, so having the ability to make changes to your policy can be beneficial in the long run.

5. Policy Riders

Check if the policy offers any additional riders that can enhance the coverage or provide additional benefits. Common riders include accelerated death benefit riders, long-term care riders, and disability income riders. Evaluate if these riders align with your needs and objectives.

6. Policy Performance

Research the historical performance of the policy and the underlying investment options. Look for policies that have a track record of consistent returns and consider the potential risks associated with the investment options.

7. Professional Advice

Consider seeking advice from a financial advisor or insurance professional who specializes in variable survivorship life insurance. They can provide guidance and help you navigate through the complexities of the policy, ensuring that you make an informed decision.

By considering these factors, you can make a well-informed decision when choosing a variable survivorship life insurance policy that aligns with your financial goals and objectives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.