What are Closed-End Funds?

Closed-end funds are a type of investment fund that raises a fixed amount of capital through an initial public offering (IPO) and then issues a fixed number of shares. Unlike open-end funds, which continuously issue and redeem shares at their net asset value (NAV), closed-end funds have a fixed number of shares outstanding and trade on stock exchanges like individual stocks.

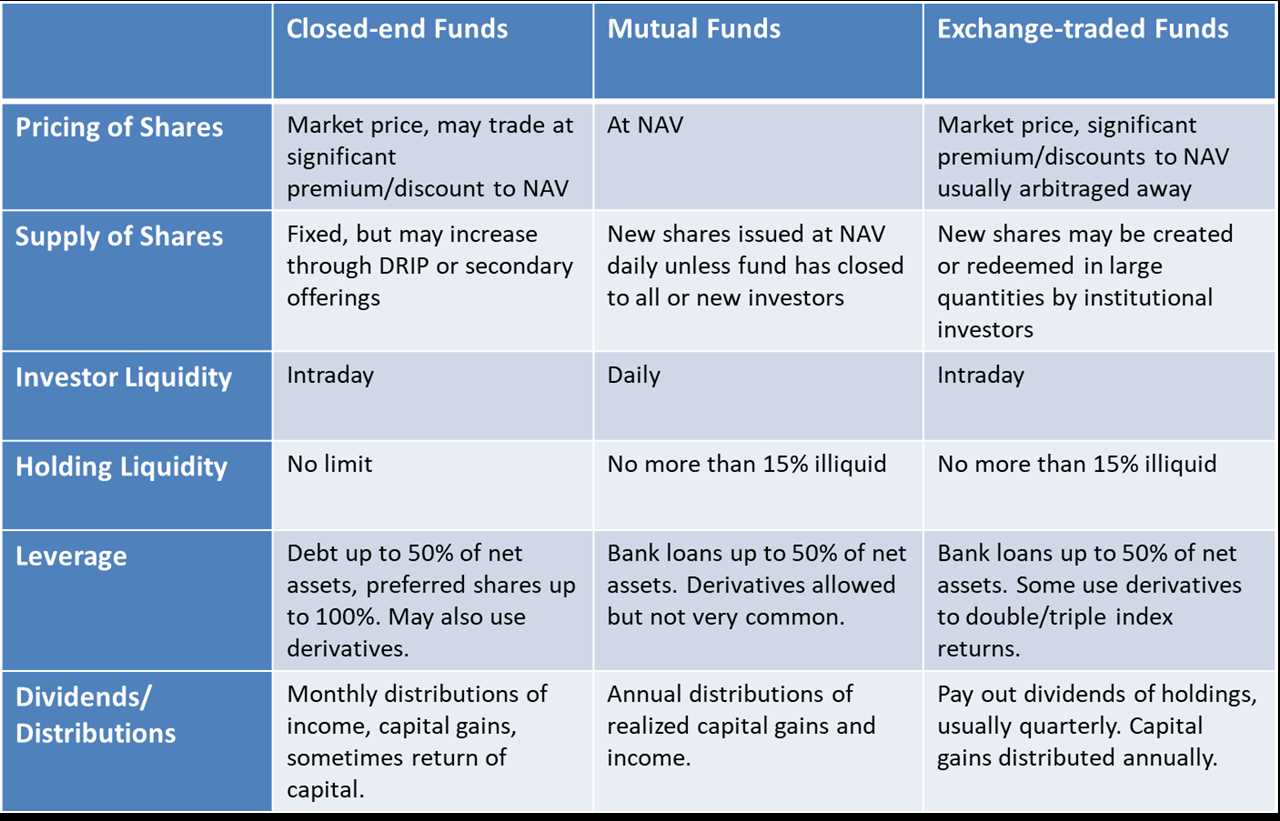

One of the key characteristics of closed-end funds is that their share prices can trade at a premium or discount to their net asset value. This is because the market price of closed-end fund shares is determined by supply and demand factors, rather than the underlying value of the fund’s assets. As a result, investors may be able to purchase shares of a closed-end fund at a discount to their net asset value, providing an opportunity for potential capital appreciation.

Key Features of Closed-End Funds:

- Fixed number of shares

- Trade on stock exchanges

- Share prices can trade at a premium or discount to net asset value

- Opportunity for potential capital appreciation

Closed-end funds typically have a specific investment objective, such as investing in a particular sector, geographic region, or asset class. They are managed by professional investment managers who make investment decisions on behalf of the fund’s shareholders. Closed-end funds may also employ leverage, using borrowed money to potentially enhance returns, although this can also increase risk.

What are Open-End Funds?

Open-end funds are designed to provide investors with a convenient and affordable way to diversify their investments and access professional investment management. They are regulated by the Securities and Exchange Commission (SEC) and must adhere to certain rules and regulations to protect investors’ interests.

One key feature of open-end funds is their ability to issue an unlimited number of shares. This means that as more investors buy shares, the fund will issue new shares to meet the demand. Similarly, if investors sell their shares, the fund will redeem them and reduce the number of outstanding shares.

Open-end funds are priced based on their net asset value (NAV), which is calculated by dividing the total value of the fund’s assets by the number of shares outstanding. The NAV is typically calculated at the end of each trading day and is used to determine the price at which investors can buy or sell shares.

Investors in open-end funds can choose between different share classes, each with its own fee structure and minimum investment requirements. Common share classes include Class A, Class B, and Class C shares, each offering different levels of fees and expenses.

Overall, open-end funds provide individual investors with a convenient and accessible way to invest in a diversified portfolio of securities. They offer professional management, liquidity, and flexibility, making them a popular choice for many investors.

The Differences Between Closed-End Funds and Open-End Funds

Structure and Trading

One of the key differences between closed-end funds and open-end funds lies in their structure and how they are traded.

Closed-End Funds: Closed-end funds have a fixed number of shares that are issued through an initial public offering (IPO). These shares are then traded on a stock exchange, just like individual stocks. The price of the shares is determined by supply and demand in the market, and it may trade at a premium or discount to its net asset value (NAV). Investors can buy or sell shares of closed-end funds throughout the trading day.

Investment Strategy and Portfolio Composition

Another important difference between closed-end funds and open-end funds is their investment strategy and portfolio composition.

Closed-End Funds: Closed-end funds often have a specific investment strategy or focus, such as investing in a particular sector, geographic region, or asset class. These funds typically have a fixed portfolio composition, and the fund manager has limited flexibility to make changes to the portfolio. Closed-end funds may also use leverage to enhance returns, which can increase the level of risk for investors.

Liquidity and Pricing

The liquidity and pricing of closed-end funds and open-end funds also differ.

Closed-End Funds: Due to their structure, closed-end funds may trade at a premium or discount to their net asset value (NAV). The price of closed-end funds is determined by supply and demand in the market, and it can be influenced by factors such as investor sentiment and market conditions. The trading volume of closed-end funds may be lower compared to open-end funds, which can result in wider bid-ask spreads.

Open-End Funds: Open-end funds are priced at their net asset value (NAV) at the end of each trading day. The price of open-end funds is based on the value of the underlying securities in the portfolio. Since open-end funds continuously issue and redeem shares, they are generally more liquid compared to closed-end funds. The bid-ask spreads for open-end funds are typically narrower.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.