What is Recharacterization?

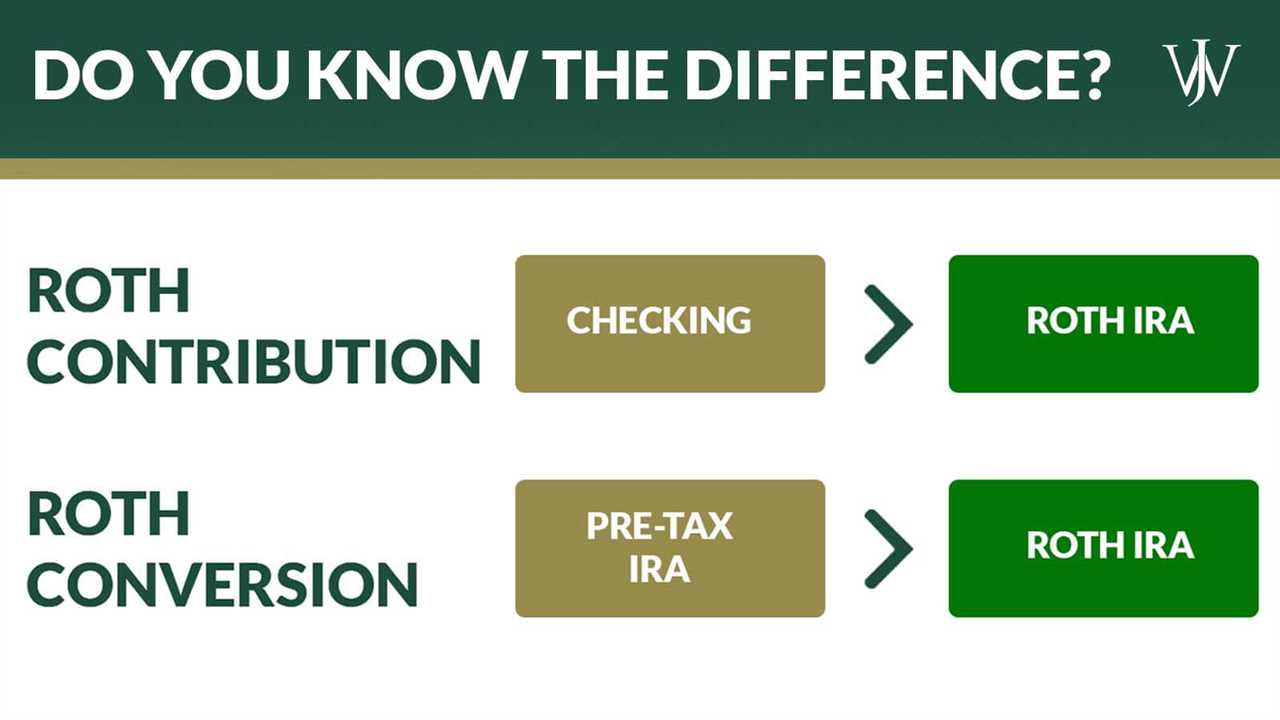

Recharacterization is a term used in the field of retirement planning to describe the process of undoing a contribution or conversion made to an individual retirement account (IRA) or Roth IRA. It allows individuals to correct or reverse certain financial decisions related to their retirement savings.

Definition and Explanation

Recharacterization involves changing the tax treatment of a contribution or conversion made to an IRA or Roth IRA. It allows individuals to move funds from one type of account to another, typically from a Roth IRA to a traditional IRA or vice versa. This can be beneficial in certain situations where individuals want to take advantage of tax benefits or correct a mistake made in their retirement planning.

Why is Recharacterization Important?

Recharacterization is important because it provides individuals with flexibility and the ability to correct financial decisions that may have unintended consequences. It allows individuals to optimize their retirement savings strategy and take advantage of tax benefits that may be more suitable for their current financial situation.

Additionally, recharacterization can help individuals avoid penalties and tax liabilities that may arise from making contributions or conversions that are not allowed under IRS rules. It provides a safety net for individuals who may have made a mistake or miscalculation in their retirement planning.

Benefits and Advantages

There are several benefits and advantages to recharacterization:

- Tax Optimization: Recharacterization allows individuals to optimize their tax strategy by moving funds between different types of retirement accounts.

- Flexibility: It provides individuals with flexibility to correct mistakes or make adjustments to their retirement savings plan.

- Avoiding Penalties: Recharacterization can help individuals avoid penalties and tax liabilities that may arise from non-compliant contributions or conversions.

- Maximizing Tax Benefits: It allows individuals to take advantage of tax benefits that may be more suitable for their current financial situation.

How Does Recharacterization Work?

The process of recharacterization involves several steps:

- Determine the need for recharacterization: Individuals need to assess whether recharacterization is necessary based on their financial situation and retirement goals.

- Notify the IRA custodian: Individuals need to notify the custodian of their IRA or Roth IRA about their intention to recharacterize a contribution or conversion.

- Complete the necessary paperwork: Individuals need to complete the required paperwork provided by the IRA custodian to initiate the recharacterization process.

- Transfer funds: Once the paperwork is completed, individuals need to transfer the funds from the original account to the new account as specified in the recharacterization request.

- Report the recharacterization: Individuals need to report the recharacterization on their tax return to ensure proper documentation and compliance with IRS regulations.

It is important to consult with a financial advisor or tax professional to ensure that the recharacterization process is done correctly and in accordance with IRS rules and regulations.

Definition and Explanation

Recharacterization is a financial strategy that allows an individual to change the tax treatment of an investment or contribution. It is commonly used in retirement planning to correct mistakes or take advantage of more favorable tax rules.

When an individual recharacterizes an investment or contribution, they are essentially undoing the original transaction and treating it as if it had been made in a different way. This can be beneficial if the original transaction would result in unfavorable tax consequences.

For example, let’s say an individual made a contribution to a traditional IRA but later realized that they would have received a larger tax deduction if they had made the contribution to a Roth IRA instead. By recharacterizing the contribution, they can treat it as if it had been made to a Roth IRA from the beginning, allowing them to take advantage of the more favorable tax treatment.

Recharacterization can also be used to correct mistakes or errors. For instance, if an individual accidentally made an excess contribution to an IRA, they can recharacterize the excess amount as a contribution to a different type of retirement account, such as a 401(k) or a SEP IRA.

| Key Points |

|---|

| Recharacterization is a financial strategy that allows individuals to change the tax treatment of an investment or contribution. |

| It is commonly used in retirement planning to correct mistakes or take advantage of more favorable tax rules. |

| Recharacterization involves undoing the original transaction and treating it as if it had been made in a different way. |

| It can be used to correct mistakes, such as excess contributions, or to take advantage of more favorable tax treatment. |

| Recharacterization is subject to specific rules and limitations set by the IRS. |

Why is Recharacterization Important?

Recharacterization is an important tool in retirement planning that allows individuals to correct and adjust their contributions to various retirement accounts. It provides flexibility and the opportunity to optimize tax benefits and investment strategies.

One of the main reasons recharacterization is important is because it allows individuals to undo or reverse certain contributions made to retirement accounts. This can be beneficial in situations where the individual realizes they made a mistake or wants to take advantage of better investment opportunities.

Recharacterization can also help individuals manage their tax liability. By recharacterizing contributions, individuals can potentially reduce their taxable income for the year, which can result in lower taxes owed. This can be especially advantageous for individuals who may have exceeded contribution limits or made contributions to the wrong type of retirement account.

Furthermore, recharacterization can be used as a strategy to optimize investment returns. By recharacterizing contributions from one type of retirement account to another, individuals can take advantage of different investment options and potentially increase their overall returns. For example, if an individual realizes that their contributions to a traditional IRA would be better suited in a Roth IRA, they can recharacterize those contributions and potentially benefit from tax-free growth and withdrawals in the future.

Overall, recharacterization is important because it provides individuals with the opportunity to correct mistakes, optimize tax benefits, and improve their retirement savings strategies. It is a valuable tool that can help individuals make the most of their retirement accounts and achieve their long-term financial goals.

Benefits and Advantages of Recharacterization

1. Tax Savings

One of the primary advantages of recharacterization is the potential for tax savings. By recharacterizing a contribution from one type of retirement account to another, individuals can effectively change the tax treatment of their contributions. This can result in lower tax liabilities, especially if the recharacterization is done strategically to take advantage of lower tax rates or deductions.

2. Flexibility

Recharacterization provides individuals with flexibility in managing their retirement savings. It allows them to adjust their contributions and investments based on changing financial circumstances or investment strategies. For example, if an individual realizes that they made a contribution to the wrong type of retirement account, recharacterization allows them to correct the mistake and align their contributions with their intended retirement goals.

3. Risk Management

Another advantage of recharacterization is its ability to manage investment risks. By recharacterizing contributions, individuals can reallocate their retirement savings to different types of investments or accounts that offer better growth potential or lower risk. This flexibility can help individuals adapt to changing market conditions and optimize their investment returns.

4. Maximizing Retirement Savings

Recharacterization can also help individuals maximize their retirement savings. By taking advantage of the ability to recharacterize contributions, individuals can optimize their retirement account balances by moving funds to accounts that offer higher contribution limits or better tax advantages. This can result in higher overall retirement savings and a more secure financial future.

5. Correcting Mistakes

Finally, recharacterization allows individuals to correct mistakes or oversights in their retirement planning. Whether it’s a contribution made to the wrong type of account or an excess contribution that needs to be corrected, recharacterization provides a mechanism to rectify these errors and ensure compliance with retirement account rules and regulations.

How Does Recharacterization Work?

Recharacterization is a process that allows individuals to undo or reverse certain types of transactions involving retirement accounts, such as Individual Retirement Accounts (IRAs) and Roth IRAs. It is a useful tool for individuals who have made contributions or conversions to their retirement accounts but later realize that they would have been better off with a different type of account.

The process of recharacterization involves several steps:

Step 1: Determine Eligibility

Before initiating a recharacterization, it is important to ensure that the individual is eligible. Generally, recharacterization is allowed for contributions or conversions made during the tax year, up until the tax filing deadline (typically April 15th of the following year). However, there are certain restrictions and limitations depending on the type of account and the individual’s income level.

Step 2: Notify the Custodian

Once eligibility is confirmed, the individual must notify the custodian of their intention to recharacterize the transaction. The custodian is the financial institution that holds the retirement account, such as a bank or brokerage firm. The notification can usually be done through a written request or an online form provided by the custodian.

Step 3: Provide Necessary Information

When notifying the custodian, the individual will need to provide specific details about the transaction they wish to recharacterize. This includes the amount of the contribution or conversion, the date it was made, and the type of account involved (e.g., traditional IRA, Roth IRA).

Step 4: Complete the Recharacterization

Once the custodian receives the request and necessary information, they will initiate the recharacterization process. This typically involves transferring the funds from the original account to a new account of the same type (e.g., from a Roth IRA back to a traditional IRA). The custodian will handle the logistics of the transfer, ensuring that it is done correctly and in compliance with IRS rules.

It is important to note that the recharacterization must be completed by the tax filing deadline for the year in which the original transaction took place. Failure to meet this deadline may result in penalties or additional taxes.

Overall, recharacterization provides individuals with flexibility and the ability to correct financial decisions made regarding their retirement accounts. It is a valuable tool that can help optimize tax strategies and ensure that individuals are making the most of their retirement savings.

Step-by-Step Process

1. Determine Eligibility

The first step in the recharacterization process is to determine if you are eligible to make a recharacterization. Generally, recharacterization is available for traditional IRA contributions, Roth IRA conversions, and certain other retirement plan contributions. It is important to review the specific rules and regulations governing your retirement account to determine if recharacterization is an option for you.

2. Gather Information

Once you have determined your eligibility, the next step is to gather all the necessary information related to the transaction you wish to recharacterize. This includes documentation of the original contribution or conversion, as well as any relevant tax forms or statements.

3. Calculate the Recharacterization Amount

After gathering the necessary information, you will need to calculate the amount that you want to recharacterize. This may involve determining the portion of a contribution that you want to move from a traditional IRA to a Roth IRA, or vice versa. It is important to carefully consider the tax implications and potential benefits of the recharacterization before making any decisions.

4. Complete the Recharacterization Form

5. Submit the Recharacterization Form

After completing the recharacterization form, you will need to submit it to your retirement account custodian or administrator. It is important to follow their specific instructions for submitting the form, as well as any deadlines or requirements they may have.

6. Update Your Records

Once the recharacterization has been processed, it is important to update your records to reflect the change. This may involve updating your tax forms, account statements, or other relevant documentation. Keeping accurate records will help ensure that you are in compliance with tax laws and regulations.

7. Review and Monitor

Finally, it is important to review and monitor the results of the recharacterization. This includes reviewing any changes in tax liability, investment performance, or other factors that may be affected by the recharacterization. Regularly reviewing and monitoring your retirement accounts will help you make informed decisions and adjust your strategy as needed.

By following this step-by-step process, individuals can effectively utilize recharacterization as a tool to optimize their retirement planning. It is important to consult with a financial advisor or tax professional to ensure that you fully understand the implications and benefits of recharacterization in your specific situation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.