Section 3: Benefits and Risks of Non-Qualified Stock Options (NSOs)

| Benefits | Risks |

|---|---|

|

|

Tax Implications of Non-Qualified Stock Options (NSOs)

Grant

At the time of grant, NSOs do not trigger any tax consequences for the employee. The options are considered a form of compensation, but no taxes are due until the options are exercised.

Exercise

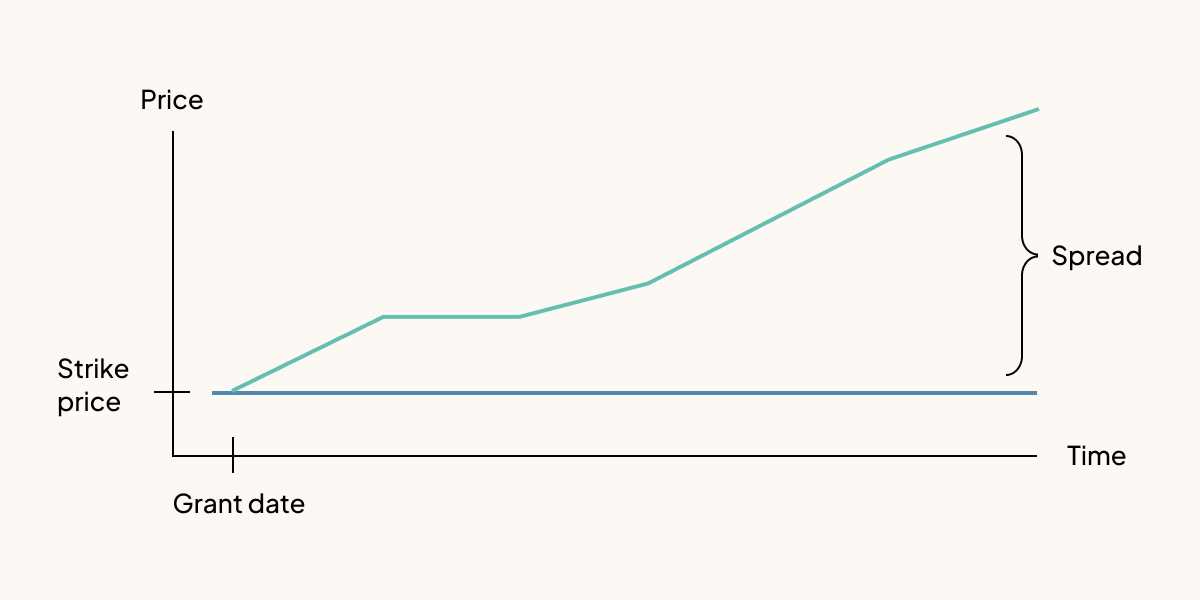

When NSOs are exercised, the difference between the exercise price and the fair market value of the stock is considered taxable income. This amount is subject to ordinary income tax rates and is reported on the employee’s W-2 form.

For example, if an employee exercises NSOs with a strike price of $10 per share and the fair market value of the stock is $20 per share, the employee would be taxed on the $10 per share difference.

Sale

When the stock acquired through NSOs is sold, any gain or loss is subject to capital gains tax. The tax rate depends on how long the stock was held before the sale.

If the stock is held for less than one year, it is considered a short-term capital gain or loss and is taxed at the employee’s ordinary income tax rate. If the stock is held for more than one year, it is considered a long-term capital gain or loss and is taxed at the applicable long-term capital gains tax rate.

Withholding and Reporting

Employers are required to withhold taxes on the income from NSOs at the time of exercise. The amount withheld is typically based on the employee’s tax bracket and is reported on their W-2 form.

Employees should also be aware of the potential for alternative minimum tax (AMT) liability when exercising NSOs. The AMT is a separate tax system that ensures individuals with high deductions and other tax benefits still pay a minimum amount of tax.

| Tax Stage | Tax Implications |

|---|---|

| Grant | No immediate tax consequences |

| Exercise | Difference between exercise price and fair market value is taxable income |

| Sale | Gains or losses subject to capital gains tax |

| Withholding and Reporting | Employer withholds taxes at exercise and reports on employee’s W-2 form |

Strategies for Maximizing the Value of Non-Qualified Stock Options (NSOs)

1. Exercise and Hold

2. Exercise and Sell

Another strategy is to exercise your NSOs and immediately sell the shares. This allows you to lock in any potential gains and avoid the risk of a future decline in the stock price. However, keep in mind that you will still be subject to ordinary income tax on the difference between the exercise price and the fair market value of the stock at the time of exercise.

3. Exercise and Hold, then Sell

This strategy involves exercising your NSOs and holding onto the shares for a certain period of time before selling them. By holding onto the shares for at least one year from the date of exercise and two years from the date of grant, you may qualify for long-term capital gains tax rates, which are typically lower than ordinary income tax rates. However, this strategy also carries the risk of a decline in the stock price during the holding period.

4. Exercise and Sell in Installments

If you have a large number of NSOs, you may consider exercising and selling the shares in installments. This allows you to spread out the potential tax liability over time and potentially take advantage of different stock prices. However, keep in mind that this strategy may require careful planning and monitoring of the stock price.

5. Use NSOs as Collateral

If you need financing for a major purchase or investment, you may consider using your NSOs as collateral for a loan. This allows you to access the value of your NSOs without having to exercise and sell the shares. However, keep in mind that using NSOs as collateral carries its own risks, as you may be required to repay the loan even if the value of the NSOs declines.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.