What is Alternative Minimum Tax (AMT)?

The Alternative Minimum Tax (AMT) is a parallel tax system in the United States that ensures individuals and corporations with high incomes and significant deductions pay a minimum amount of tax. It was introduced in 1969 to prevent high-income taxpayers from using various tax deductions and credits to avoid paying their fair share of taxes.

The AMT operates by calculating taxable income using a different set of rules compared to the regular tax system. It disallows certain deductions and exemptions that are allowed under the regular tax system. The goal of the AMT is to ensure that individuals and corporations with substantial income and deductions still contribute a minimum amount of tax, regardless of their ability to reduce their tax liability through deductions and credits.

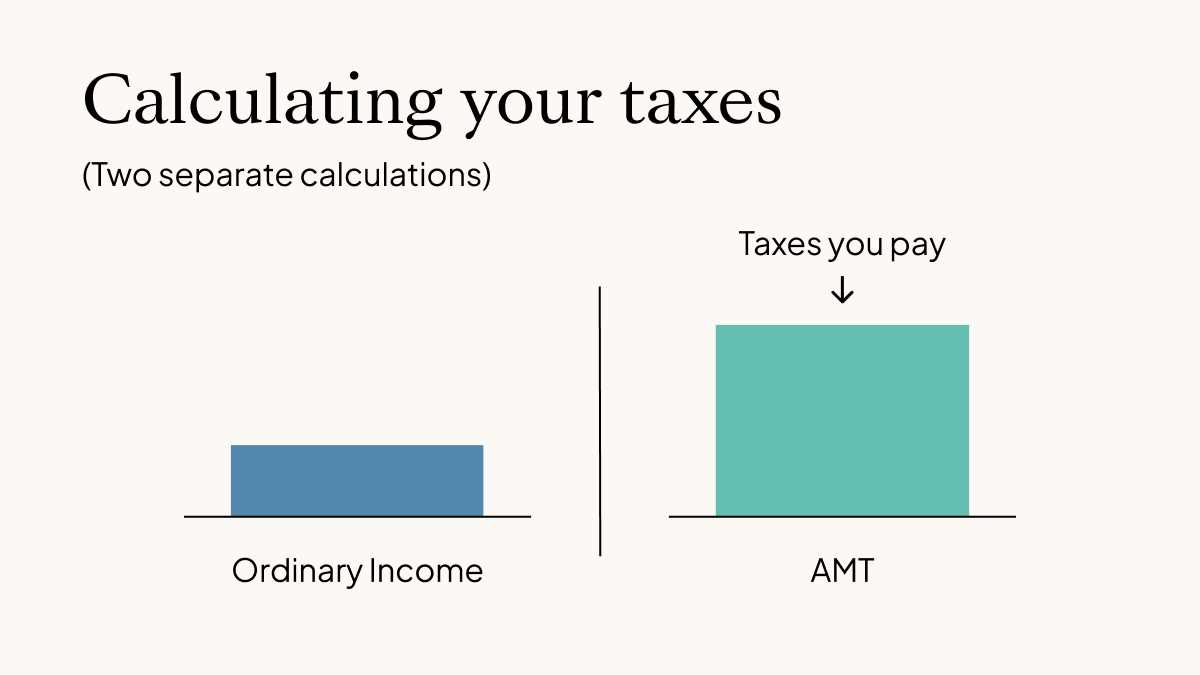

Under the AMT, taxpayers are required to calculate their tax liability using both the regular tax system and the AMT system, and then pay the higher of the two amounts. This means that if a taxpayer’s regular tax liability is lower than their AMT liability, they must pay the higher AMT amount.

The AMT primarily affects high-income individuals and corporations who have a significant amount of deductions and exemptions. It is designed to prevent these taxpayers from using various tax planning strategies to reduce their tax liability to zero or near-zero. By imposing a minimum tax, the government aims to ensure that everyone pays their fair share of taxes, regardless of their ability to take advantage of deductions and credits.

It is important for taxpayers to be aware of the AMT and understand how it may affect their tax liability. Consulting with a tax professional can help individuals and corporations navigate the complexities of the AMT and ensure compliance with the tax laws.

The Alternative Minimum Tax (AMT) is a parallel tax system in the United States that was designed to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of deductions and credits they may be eligible for under the regular tax system. The AMT was introduced in 1969 and has undergone various revisions since then.

Purpose of the AMT

The primary purpose of the AMT is to prevent wealthy taxpayers from using various deductions and loopholes to significantly reduce their tax liability. The regular tax system allows taxpayers to claim deductions for expenses such as mortgage interest, state and local taxes, and certain business expenses. However, these deductions can sometimes result in high-income individuals and corporations paying little to no taxes.

The AMT sets a minimum tax rate and limits the deductions and exemptions that can be claimed. This ensures that individuals and corporations with high incomes still contribute a minimum amount of tax to the government.

Who is Affected by the AMT?

The AMT primarily affects high-income individuals and corporations. Taxpayers with incomes above a certain threshold, which is adjusted annually for inflation, may be subject to the AMT. Additionally, certain types of income, such as capital gains and dividends, can trigger the AMT even for taxpayers with lower incomes.

The AMT also impacts taxpayers who have significant deductions and exemptions, such as those with large families or who live in high-tax states. These deductions and exemptions may be limited or disallowed under the AMT, resulting in a higher tax liability.

How Does the AMT Work?

The Alternative Minimum Tax (AMT) is a parallel tax system in the United States that was designed to ensure that high-income individuals and corporations pay a minimum amount of tax, regardless of the deductions and credits they may be eligible for under the regular tax system. The AMT operates by limiting certain deductions and exemptions and applying a flat tax rate to a broader income base.

Calculation of the AMT

The calculation of the AMT starts with the taxpayer’s regular taxable income, which is then adjusted by adding back certain deductions and exemptions that are not allowed under the AMT. Some of the most common adjustments include state and local income taxes, property taxes, certain miscellaneous deductions, and personal exemptions.

Once the AMT income is determined, it is subject to a flat tax rate. For individuals, the rate is typically 26% or 28%, depending on the level of income. For corporations, the rate is 20%. The taxpayer then compares the tax liability calculated under the regular tax system with the tax liability calculated under the AMT system. If the AMT liability is higher, the taxpayer must pay the difference as an additional tax.

Exemptions and Thresholds

The AMT includes exemptions and thresholds that determine who is subject to the tax. These exemptions are designed to prevent middle-income taxpayers from being subject to the AMT. The exemption amount is subtracted from the AMT income before applying the tax rate. The exemption amount is phased out for higher-income taxpayers.

The thresholds for the AMT are adjusted annually for inflation. If a taxpayer’s regular tax liability falls below the threshold, they are not subject to the AMT. However, if their regular tax liability exceeds the threshold, they must calculate their AMT liability to determine if they owe any additional tax.

Reporting the AMT

Individuals and corporations that are subject to the AMT must complete Form 6251 when filing their tax return. This form calculates the AMT liability and determines if any additional tax is owed. The AMT liability is reported on line 45 of Form 1040 for individuals, and on line 35 of Form 1120 for corporations.

It is important for taxpayers to carefully review their deductions and exemptions to determine if they may be subject to the AMT. Consulting with a tax professional can help ensure compliance with the complex rules of the AMT and minimize any additional tax liability.

AMT Exemptions and Thresholds

The Alternative Minimum Tax (AMT) is a parallel tax system in the United States that ensures that high-income individuals and corporations pay a minimum amount of tax, regardless of deductions and credits. To determine whether an individual or corporation is subject to the AMT, certain exemptions and thresholds are taken into account.

For individuals, the AMT exemption amount is the amount of income that is exempt from the AMT. This exemption is phased out as income increases, meaning that higher-income individuals will have a lower exemption amount or no exemption at all. The AMT exemption amount for individuals is adjusted annually for inflation.

For the tax year 2021, the AMT exemption amount for individuals is $73,600 for single filers and $114,600 for married couples filing jointly. The exemption amount begins to phase out at $523,600 for single filers and $1,047,200 for married couples filing jointly.

In addition to the exemption amount, the AMT also has a threshold, which is the income level at which the AMT kicks in. If an individual’s income exceeds the threshold, they are subject to the AMT. The threshold for the tax year 2021 is $523,600 for single filers and $1,047,200 for married couples filing jointly.

For corporations, the AMT exemption amount and threshold are different. The exemption amount for corporations is $40,000, and the threshold is $175,000 of alternative minimum taxable income.

It is important to note that the AMT exemptions and thresholds may change from year to year, so it is essential to stay updated on the current tax laws and regulations.

| Year | Individual Exemption Amount (Single Filer) | Individual Exemption Amount (Married Filing Jointly) | Individual Threshold (Single Filer) | Individual Threshold (Married Filing Jointly) | Corporate Exemption Amount | Corporate Threshold |

|---|---|---|---|---|---|---|

| 2021 | $73,600 | $114,600 | $523,600 | $1,047,200 | $40,000 | $175,000 |

AMT Calculation and Reporting

Calculating and reporting the Alternative Minimum Tax (AMT) can be a complex process. It requires careful consideration of various factors and the use of specific forms and instructions provided by the Internal Revenue Service (IRS).

Step 1: Determine AMT Income

The first step in calculating the AMT is to determine your AMT income. This is done by starting with your regular taxable income and making certain adjustments. Some common adjustments include adding back certain deductions and exclusions, such as state and local taxes, miscellaneous itemized deductions, and tax-exempt interest from private activity bonds.

Step 2: Calculate AMT Liability

Once you have determined your AMT income, you can calculate your AMT liability. This is done by applying the AMT tax rates to your AMT income. The AMT tax rates are typically lower than the regular tax rates, but the AMT system eliminates or reduces many of the deductions and exemptions that are allowed under the regular tax system.

Step 3: Compare AMT Liability and Regular Tax Liability

After calculating your AMT liability, you need to compare it to your regular tax liability. If your AMT liability is higher than your regular tax liability, you may owe additional taxes under the AMT system.

If your regular tax liability is higher than your AMT liability, you do not owe any additional taxes under the AMT system. However, you may still need to complete Form 6251 to report your AMT liability and determine if you are subject to the AMT in future years.

Step 4: Complete AMT Forms and Attach to Your Tax Return

Finally, you will need to complete the necessary AMT forms and attach them to your tax return. In addition to Form 6251, you may also need to complete other forms and schedules, depending on your specific situation.

By accurately calculating and reporting the AMT, you can ensure compliance with the tax laws and regulations. Consulting with a tax professional or using tax software can help simplify the process and ensure accuracy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.