Definition and Importance

Incremental cash flow refers to the net increase or decrease in cash flow that is directly attributable to a specific business decision or project. It is a crucial concept in financial analysis and decision-making, as it helps assess the financial viability of potential investments or projects.

When evaluating a new project or investment opportunity, it is important to consider the incremental cash flow it will generate. This is because incremental cash flow takes into account only the additional cash flows that result from the project, excluding any cash flows that would have occurred regardless of the project.

Furthermore, incremental cash flow analysis allows for better comparison between different investment options. By comparing the incremental cash flows of different projects, decision-makers can determine which option is the most financially beneficial and make informed decisions.

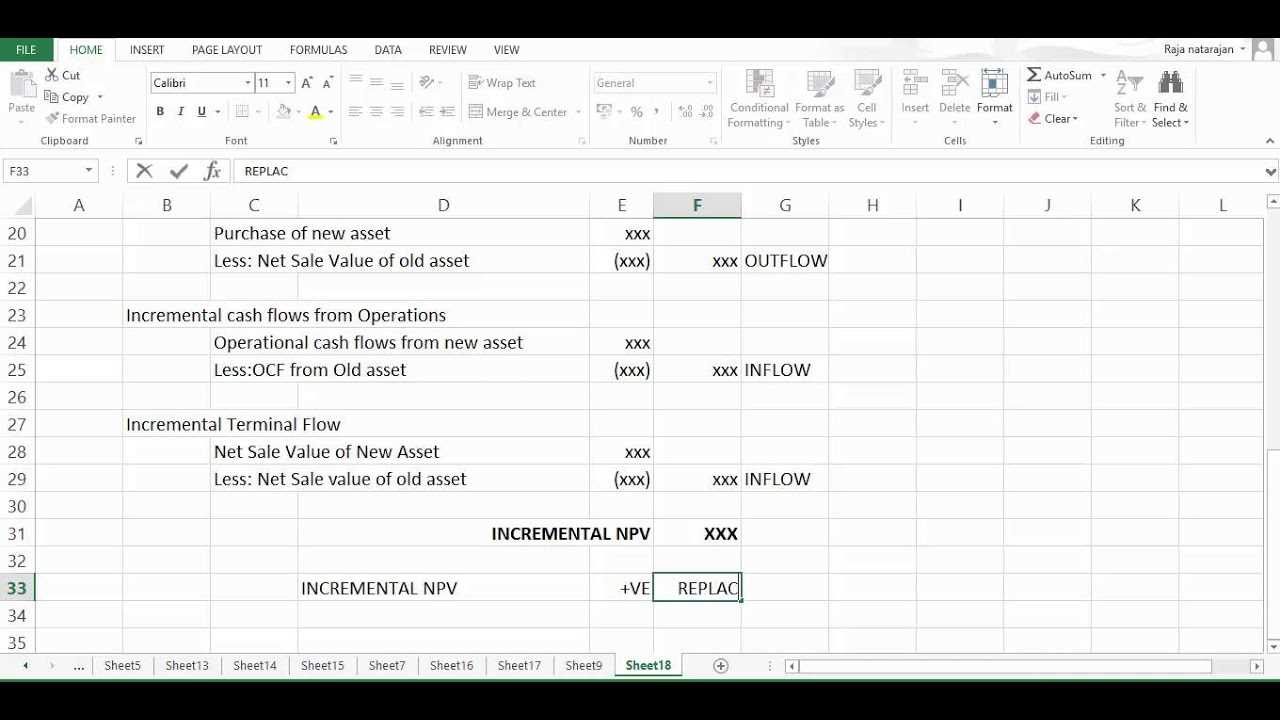

Calculation Methods for Incremental Cash Flow

Calculating incremental cash flow is an essential step in financial analysis and decision-making. It helps businesses evaluate the potential profitability of an investment or project by considering the additional cash flows it generates compared to the existing situation.

1. Net Cash Flow Method

The net cash flow method is one of the simplest and most commonly used approaches to calculate incremental cash flow. It involves subtracting the cash outflows from the cash inflows to determine the net cash flow. This method takes into account all relevant cash flows, including initial investments, operating revenues, operating expenses, taxes, and salvage value.

2. Cash Flow Differential Method

The cash flow differential method compares the cash flows between two alternative scenarios: one with the investment or project and one without it. The difference between the two scenarios represents the incremental cash flow. This method allows businesses to assess whether the investment or project generates additional cash flows that outweigh the costs.

3. Equivalent Annual Cost Method

The equivalent annual cost method converts the total cash flows over the life of an investment or project into an equivalent annual cost. It considers the time value of money by discounting future cash flows to their present value. This method helps businesses compare different investment options by standardizing the cash flows on an annual basis.

4. Payback Period Method

The payback period method calculates the time it takes for an investment or project to recover its initial cash outlay. It focuses on the cash inflows and does not consider the time value of money. The payback period represents the length of time required to reach the breakeven point and start generating positive incremental cash flows.

It is important to note that these calculation methods are not mutually exclusive, and businesses may use a combination of them depending on the specific circumstances and requirements of the analysis. The choice of method should be based on the nature of the investment or project and the desired level of accuracy in evaluating its incremental cash flow.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.