Mutually Exclusive Examples

In financial analysis, the concept of mutually exclusive examples refers to a situation where two or more investment opportunities or projects cannot be undertaken simultaneously. This means that if one project is chosen, the others must be excluded.

Example 1: Project A vs. Project B

Let’s consider a simplified example to illustrate the concept of mutually exclusive examples. Imagine a company is considering two investment projects: Project A and Project B. Both projects require a significant amount of capital and have the potential for high returns.

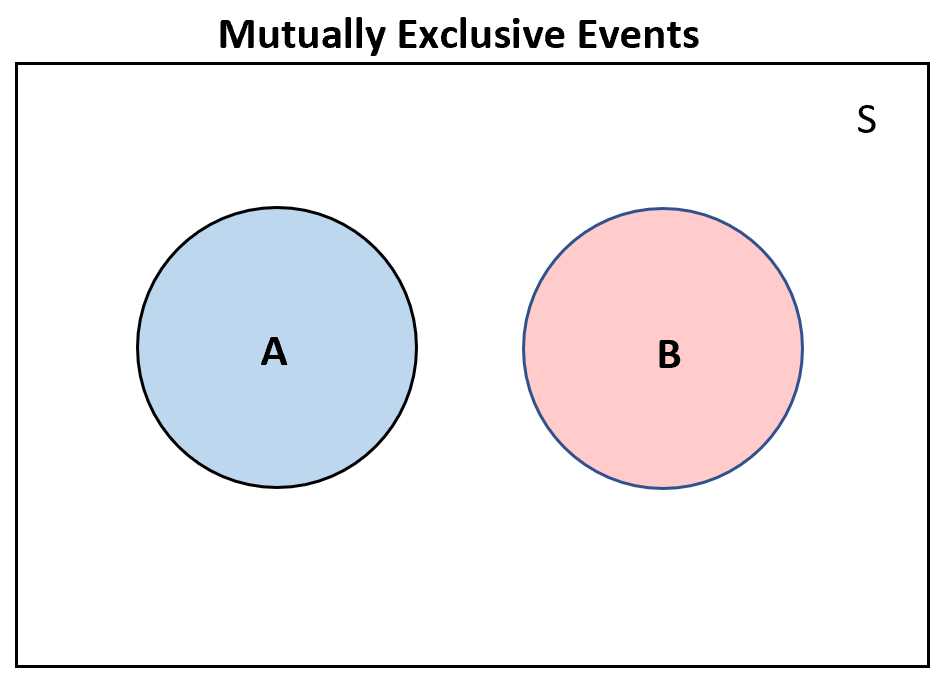

However, after conducting a thorough analysis, the company realizes that Project A and Project B are mutually exclusive. This means that if they choose to invest in Project A, they will not be able to invest in Project B, and vice versa.

Example 2: Expansion vs. Acquisition

Another common example of mutually exclusive options in financial analysis is the choice between expansion and acquisition. A company may have the opportunity to expand its existing operations or acquire another company to achieve growth.

However, due to limited resources and strategic considerations, the company may need to choose between these two options. If they decide to pursue expansion, they will not be able to pursue acquisition, and vice versa.

Financial Analysis

Financial analysis is a process of evaluating the financial health and performance of a company. It involves the assessment of various financial statements, such as balance sheets, income statements, and cash flow statements, to determine the company’s profitability, liquidity, solvency, and overall financial stability.

There are several methods and techniques used in financial analysis, including ratio analysis, trend analysis, and comparative analysis. These methods help analysts and investors to gain insights into the company’s financial position and make informed decisions.

Ratio analysis is one of the most commonly used techniques in financial analysis. It involves the calculation and interpretation of various financial ratios, such as liquidity ratios, profitability ratios, and solvency ratios. These ratios provide valuable information about the company’s ability to meet its short-term and long-term obligations, generate profits, and manage its resources efficiently.

Trend analysis, on the other hand, involves the examination of financial data over a period of time to identify patterns and trends. It helps analysts to understand the company’s historical performance and forecast its future financial performance. By analyzing trends in revenue, expenses, and other financial metrics, analysts can assess the company’s growth potential and identify potential risks and opportunities.

Comparative analysis involves the comparison of a company’s financial performance with that of its competitors or industry peers. It helps analysts to benchmark the company’s performance and identify areas where it is outperforming or underperforming its peers. This analysis can provide valuable insights into the company’s competitive position and help identify strategies for improvement.

Overall, financial analysis plays a crucial role in decision-making processes for investors, lenders, and other stakeholders. It helps them to evaluate the financial viability and potential risks of investing in a company. By analyzing various financial indicators and trends, analysts can make informed decisions and mitigate potential risks.

Catname

Catname is a term used in financial analysis to refer to a category or classification of items or transactions. It is often used to group similar items together for the purpose of analysis and reporting. Catname can be used in various contexts, such as in financial statements, budgeting, and forecasting.

Examples of Catname

Here are some examples of catname in financial analysis:

| Category | Description |

|---|---|

| Revenue | Income generated from the sale of goods or services |

| Expenses | Costs incurred in the operation of a business |

| Assets | Resources owned by a company that have future economic value |

| Liabilities | Debts or obligations owed by a company |

| Equity | Net assets or ownership interest in a company |

Importance of Catname in Financial Analysis

Catname plays a crucial role in financial analysis as it allows analysts and stakeholders to easily understand and interpret financial information. By categorizing items into different catnames, it becomes easier to analyze trends, identify patterns, and make informed decisions.

Furthermore, catname helps in the preparation of financial statements, as it provides a structured framework for organizing financial data. It also facilitates the comparison of financial information across different time periods and companies.

Mutually Exclusive Examples and Meanings

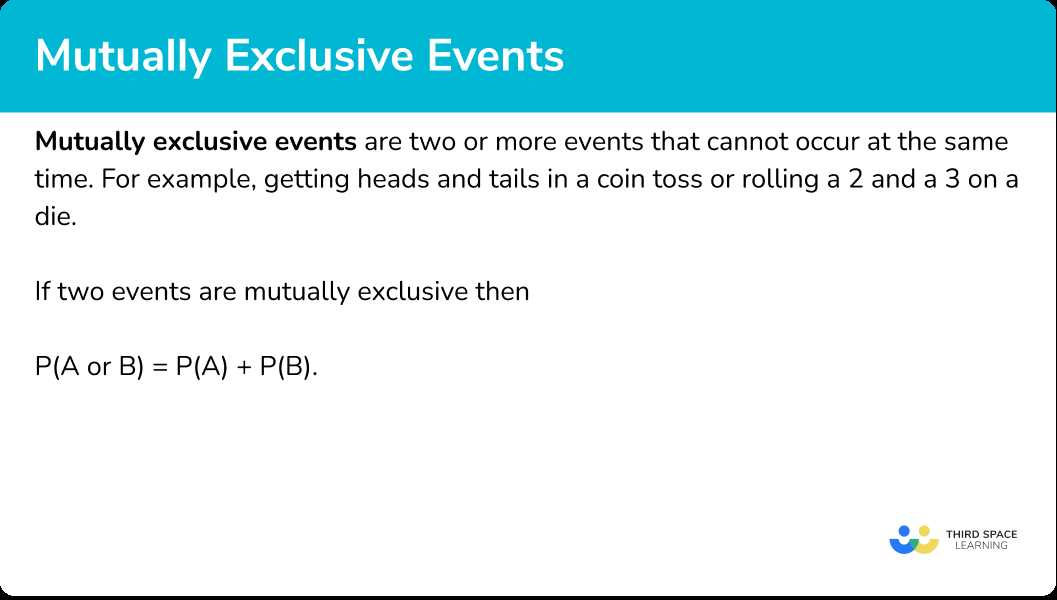

In the field of financial analysis, the term “catname” refers to a category or classification of financial data. It is used to group similar types of data together, allowing for easier analysis and comparison. Mutually exclusive examples are specific instances or cases within a catname that do not overlap or share any common characteristics.

For example, in the catname of “revenue sources,” mutually exclusive examples could include revenue from product sales, revenue from service fees, and revenue from licensing agreements. Each of these examples represents a distinct source of revenue that is separate and independent from the others.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.