What is Form 1099-B?

Form 1099-B is a tax form used to report transactions involving the sale or exchange of certain financial assets. It is issued by brokers and barter exchanges to both the Internal Revenue Service (IRS) and the taxpayer. The purpose of this form is to provide the IRS with information about the proceeds from these transactions, which may be subject to capital gains tax.

Before delving into Form 1099-B, it is important to understand the basics of broker and barter exchange transactions. A broker is an individual or entity that facilitates the buying and selling of financial assets on behalf of others. Examples of financial assets include stocks, bonds, mutual funds, and options.

Who Needs to File Form 1099-B?

Brokers and barter exchanges are required to file Form 1099-B for each person who has engaged in transactions involving the sale or exchange of financial assets or barter exchange transactions. This includes individuals, corporations, partnerships, and other entities.

Additionally, taxpayers who receive Form 1099-B must report the information provided on the form on their tax returns. Failure to do so can result in penalties and interest.

Reporting Requirements for Form 1099-B

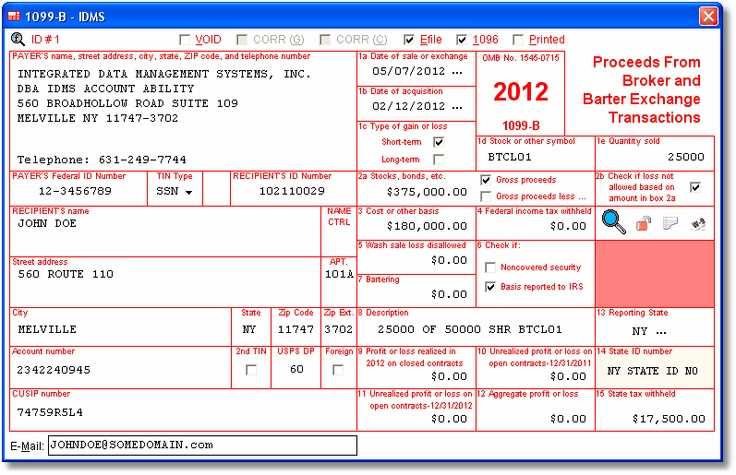

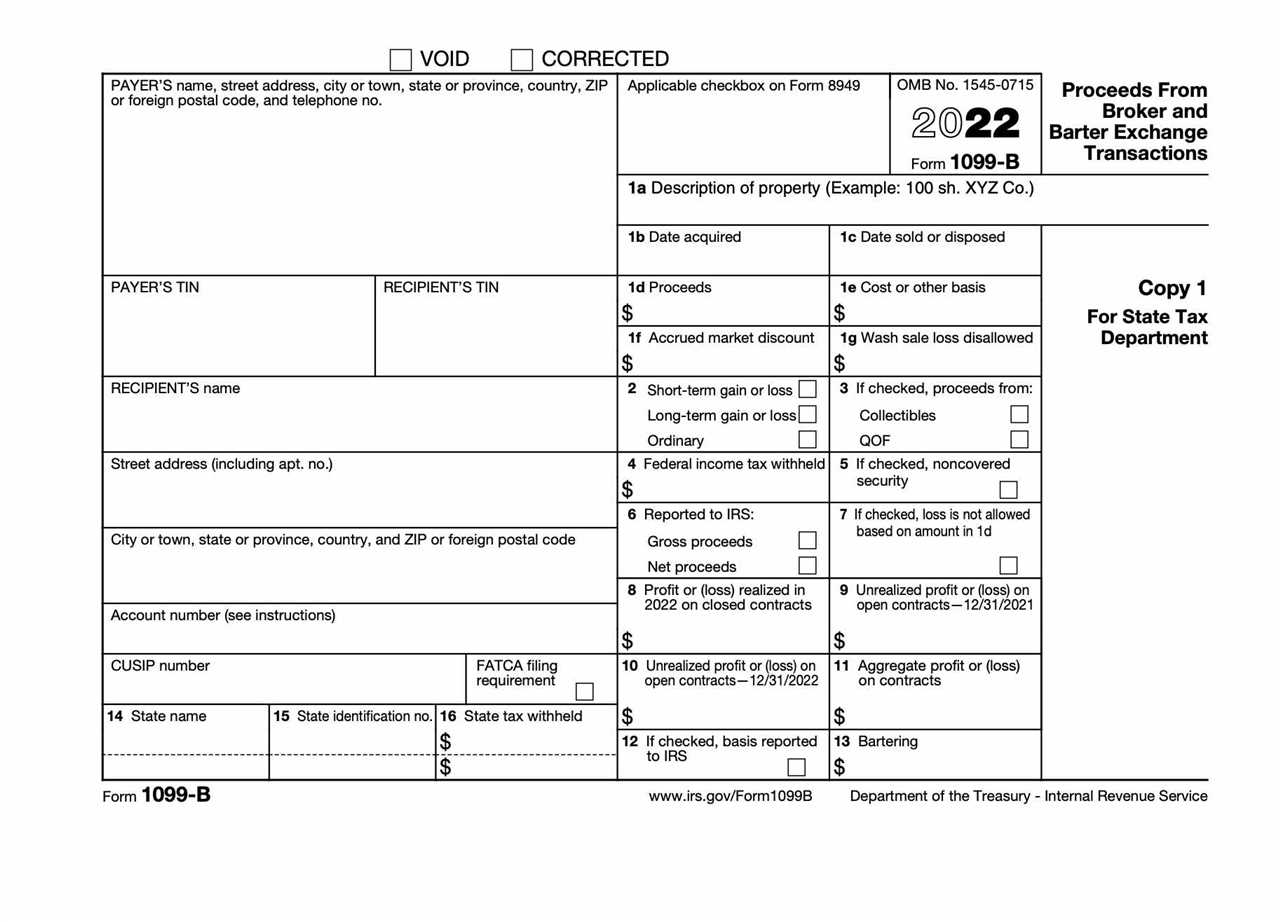

Form 1099-B requires the reporting of various information, including the taxpayer’s name, address, and taxpayer identification number (TIN), as well as a description of the asset sold or exchanged, the date of the transaction, the proceeds from the transaction, and any adjustments or basis information.

Brokers and barter exchanges must also provide a copy of Form 1099-B to the taxpayer by January 31st of the year following the transaction.

How to Fill Out Form 1099-B

Filling out Form 1099-B can be a complex process, as it requires accurate reporting of all relevant information. It is important to carefully review the instructions provided by the IRS and consult with a tax professional if needed.

Generally, brokers and barter exchanges will use their own software or online platforms to generate and file Form 1099-B. These platforms typically have built-in features that help ensure accurate reporting and compliance with IRS regulations.

Common Mistakes to Avoid When Filing Form 1099-B

When filing Form 1099-B, it is important to avoid common mistakes that can lead to penalties or delays in processing. Some common mistakes to avoid include:

- Incorrectly reporting the taxpayer’s name, address, or TIN

- Failing to report all relevant transactions

- Not providing a copy of Form 1099-B to the taxpayer

- Incorrectly calculating the proceeds from the transaction

- Not reporting adjustments or basis information

By carefully reviewing the instructions and double-checking all information before submitting Form 1099-B, brokers and barter exchanges can ensure compliance with IRS regulations and avoid costly mistakes.

Broker Transactions

A broker transaction refers to the buying or selling of securities, such as stocks, bonds, or mutual funds, through a brokerage firm. The brokerage firm acts as an intermediary between the buyer and the seller, facilitating the transaction and charging a commission or fee for their services.

Barter Exchange Transactions

Barter exchange transactions involve the exchange of goods or services without the use of money. Instead, individuals or businesses trade their goods or services directly with each other. Barter exchanges can be facilitated through online platforms or organized networks.

Who Needs to File Form 1099-B?

Form 1099-B is a tax form that is used to report certain types of transactions to the Internal Revenue Service (IRS). It is typically filed by brokers and barter exchanges to report the sale or exchange of securities or other property. However, not everyone is required to file Form 1099-B. Here are some key points to understand:

1. Brokers:

If you are a broker and you have sold or exchanged securities or other property on behalf of your clients, you are generally required to file Form 1099-B. This includes transactions such as stock sales, bond sales, and mutual fund sales. You must also report any proceeds from the sale of real estate or other property.

2. Barter Exchanges:

If you are a barter exchange and you facilitate the exchange of goods or services between members of your exchange, you are also required to file Form 1099-B. This includes transactions where goods or services are exchanged for other goods or services, as well as transactions where goods or services are exchanged for cash.

3. Thresholds:

There are certain thresholds that determine whether or not you need to file Form 1099-B. If you are a broker, you must file the form if you have sold or exchanged securities or other property for a customer and the total amount of proceeds from those transactions is $20 or more. If you are a barter exchange, you must file the form if you have facilitated barter transactions for a member and the total amount of barter sales proceeds is $1 or more.

It is important to note that even if you are not required to file Form 1099-B, you may still choose to do so voluntarily. This can help ensure that you are accurately reporting your income and can also provide documentation for tax purposes.

Conclusion:

If you are a broker or a barter exchange, it is important to understand the requirements for filing Form 1099-B. By filing the form correctly and on time, you can ensure that you are in compliance with IRS regulations and avoid any potential penalties or fines.

Reporting Requirements for Form 1099-B

1. Identifying Information: The first requirement is to provide the identifying information of the filer and the recipient. This includes the name, address, and taxpayer identification number (TIN) of both parties involved in the transaction.

3. Date of Acquisition and Sale: It is crucial to report the date of acquisition and the date of sale for each transaction. This information helps the IRS determine the holding period and calculate the capital gains or losses associated with the transaction.

4. Proceeds from the Sale: You need to report the total proceeds from the sale of the property or securities. This includes any cash, property, or other consideration received as a result of the transaction.

5. Cost Basis: The cost basis is the original value of the property or securities. It is important to accurately report the cost basis to determine the capital gains or losses. If the cost basis is not provided, the IRS may assume a cost basis of zero, resulting in a higher tax liability.

6. Wash Sales: If you engaged in any wash sales, where you sold a security at a loss and repurchased it within a certain timeframe, you must report these transactions separately. The IRS has specific rules for reporting wash sales, so it is important to understand and comply with these rules.

7. Foreign Transactions: If you engaged in any foreign transactions, you may have additional reporting requirements. It is important to consult the IRS guidelines or seek professional advice to ensure compliance with these requirements.

9. Submission Deadline: The deadline for filing Form 1099-B is typically January 31st of the year following the calendar year in which the transaction occurred. It is important to file the form on time to avoid penalties or fines.

10. Copy Distribution: After filing Form 1099-B with the IRS, you are also required to provide a copy to the recipient of the form. This allows them to report the transaction on their own tax return.

How to Fill Out Form 1099-B

Filling out Form 1099-B is an important step in reporting broker and barter exchange transactions to the Internal Revenue Service (IRS). This form is used to report the proceeds from the sale of stocks, bonds, mutual funds, and other securities, as well as certain barter exchange transactions.

1. Gather the necessary information

2. Obtain the correct version of Form 1099-B

There are different versions of Form 1099-B, so make sure you are using the correct one for the tax year you are reporting. The form can be downloaded from the IRS website or obtained from your broker or barter exchange.

3. Complete the payer and recipient information

4. Fill in the transaction details

Next, provide a description of the securities or property involved in the transaction. This should include the name of the security or property, the quantity, and any other relevant details. If there were multiple transactions, you may need to attach additional sheets.

5. Calculate the cost basis and proceeds

You will need to calculate the cost basis and proceeds for each transaction. The cost basis is the original purchase price of the securities or property, while the proceeds are the amount received from the sale or exchange. If you are unsure about the cost basis, consult your broker or tax advisor.

6. Report any adjustments

If there are any adjustments to the cost basis or proceeds, you will need to report them on Form 1099-B. This could include adjustments for wash sales, corporate actions, or other events that affect the cost basis or proceeds of the transaction.

7. Sign and submit the form

Once you have completed Form 1099-B, sign it and submit it to the IRS. Keep a copy for your records. If you are filing electronically, follow the instructions provided by the IRS for electronic filing.

It is important to accurately fill out Form 1099-B to ensure compliance with IRS regulations. If you have any questions or need assistance, consult a tax professional or refer to the instructions provided by the IRS.

Common Mistakes to Avoid When Filing Form 1099-B

Filing Form 1099-B is an important task for brokers and barter exchanges to accurately report transactions to the IRS. However, there are several common mistakes that can occur during the filing process. Here are some key mistakes to avoid:

2. Failure to Report All Transactions: Another mistake to avoid is failing to report all the transactions that require Form 1099-B. It is important to carefully review all the transactions and ensure that any reportable transactions are included in the form. Failure to report all transactions can result in penalties and additional scrutiny from the IRS.

3. Not Providing Correct Cost Basis Information: The cost basis is the original value of an asset for tax purposes. It is essential to provide the correct cost basis information on Form 1099-B to ensure accurate reporting. Failing to provide the correct cost basis can lead to discrepancies and potential tax issues for the recipient.

4. Late or Incorrect Filing: Filing Form 1099-B late or with incorrect information can result in penalties and fines. It is important to adhere to the IRS deadlines for filing and ensure that all the information provided is accurate. Double-checking the form before submission can help avoid these costly mistakes.

5. Failure to Provide Correct Backup Withholding: If a recipient fails to provide a correct TIN or if the IRS notifies the payer that the TIN provided is incorrect, backup withholding may be required. It is important to understand the backup withholding requirements and ensure compliance to avoid penalties.

7. Not Retaining Copies for Recordkeeping: It is crucial to retain copies of all filed Form 1099-B for recordkeeping purposes. These forms serve as documentation of the transactions and can be helpful in case of any future inquiries or audits. Keeping organized records can save time and effort in the long run.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.