Electronic Filing: Definition, Options, Advantages

There are several options available for electronic filing, depending on the country and the specific requirements of the tax authorities. Some common methods include:

| Option | Description |

|---|---|

| Online Filing | This method allows taxpayers to file their returns directly through the tax authority’s website. It typically involves filling out an online form and submitting it electronically. |

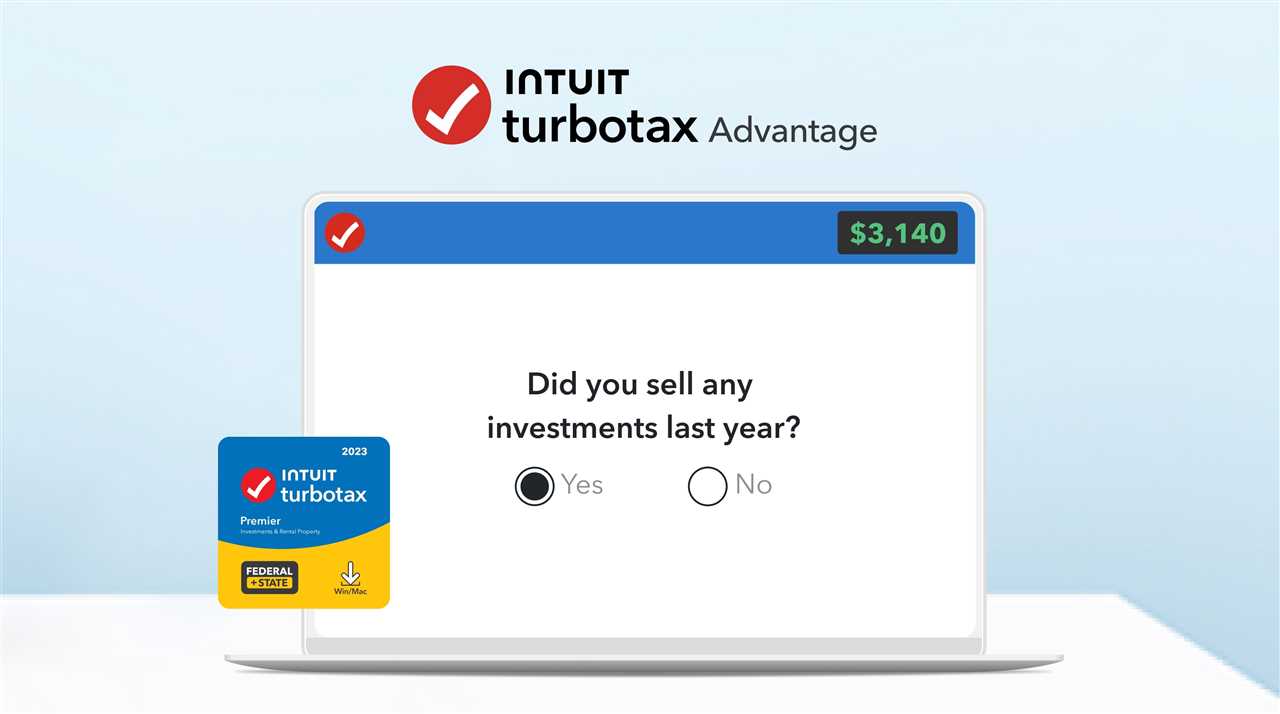

| Software Filing | Taxpayers can use specialized tax software to prepare and file their returns. The software often includes features such as automatic calculations and error checking, making the process easier and more accurate. |

| Third-Party Filing | Some individuals and businesses choose to hire a tax professional or a third-party service provider to handle their tax filings electronically. This option can be beneficial for those who prefer to outsource the task or require expert assistance. |

Electronic filing offers several advantages over traditional paper filing. Firstly, it is much faster and more efficient. Taxpayers can submit their returns instantly and receive confirmation of receipt from the tax authority. This eliminates the need for mailing documents and waiting for them to be processed.

Additionally, e-filing reduces the risk of errors and inaccuracies. The software and online forms often have built-in validation checks, which can help catch mistakes before the return is submitted. This can prevent delays and potential penalties resulting from incorrect information.

Furthermore, electronic filing is more environmentally friendly. It eliminates the need for paper forms, envelopes, and postage, reducing the amount of paper waste and carbon emissions associated with traditional filing methods.

TAX FILINGS

Electronic filing offers many advantages over traditional paper filing. First and foremost, it is much faster. Instead of waiting for your paper forms to be processed and mailed, electronic filing allows for instant submission and confirmation. This means that you can receive your tax refund much quicker.

In addition to speed, electronic filing also offers increased accuracy. When you file electronically, the software automatically checks for errors and omissions, reducing the likelihood of mistakes on your tax return. This can help to prevent delays and potential penalties from the IRS.

Furthermore, electronic filing is more secure than paper filing. Your personal information is encrypted and transmitted securely, protecting it from potential identity theft or fraud. Additionally, electronic filing provides a digital record of your tax return, making it easier to access and reference in the future.

There are several options available for electronic filing. One option is to use commercial tax preparation software, which guides you through the process and ensures that all necessary information is included. Another option is to use the IRS Free File program, which provides free online tax preparation and filing services for eligible taxpayers.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.