What is Diluted EPS?

Diluted EPS, or Earnings Per Share, is a financial metric that measures the profitability of a company by dividing its earnings by the total number of outstanding shares. It is an important indicator for investors and analysts to assess the financial health and performance of a company.

Diluted EPS takes into account the potential impact of dilutive securities, such as stock options, convertible bonds, and preferred stock, which can potentially increase the number of outstanding shares and affect the earnings per share calculation.

Dilutive securities are financial instruments that have the potential to increase the number of outstanding shares of a company’s stock. These securities include stock options, convertible bonds, and preferred stock.

Stock options are contracts that give employees the right to buy a certain number of shares at a predetermined price. When these options are exercised, new shares are issued, which can dilute the earnings per share. Convertible bonds are debt instruments that can be converted into a certain number of shares. When these bonds are converted, the number of outstanding shares increases, potentially diluting the earnings per share. Preferred stock is a type of equity that has priority over common stock in terms of dividends and liquidation preference. If preferred stock is converted into common stock, it can dilute the earnings per share.

Calculation of Diluted EPS

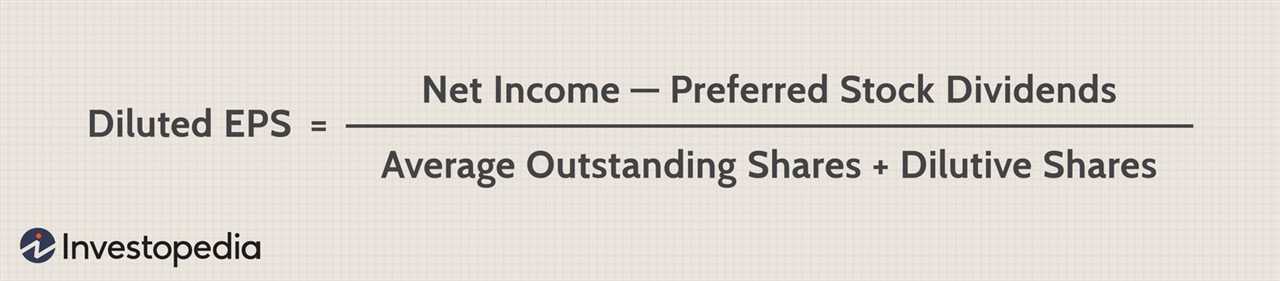

The calculation of diluted EPS involves adjusting the earnings and the number of outstanding shares to reflect the potential impact of dilutive securities. The formula for diluted EPS is:

The weighted average number of shares includes the number of outstanding shares and the potential additional shares that would be created if all dilutive securities were exercised or converted.

By calculating diluted EPS, investors and analysts can get a more accurate picture of a company’s earnings per share, taking into account the potential dilution from securities that could potentially increase the number of outstanding shares.

Importance of Diluted EPS

Diluted EPS is an important financial metric that provides valuable information about a company’s profitability and the potential impact of dilutive securities on its earnings per share. It is commonly used by investors, analysts, and financial institutions to assess a company’s financial health and make informed investment decisions.

Here are some key reasons why diluted EPS is important:

- Accurate representation of earnings: Diluted EPS takes into account the potential impact of dilutive securities, such as stock options, convertible bonds, and preferred stock, on a company’s earnings per share. By including these potential dilutions, diluted EPS provides a more accurate representation of a company’s true earnings potential.

- Comparison with industry peers: Diluted EPS allows investors to compare a company’s earnings performance with its industry peers on a more level playing field. Since different companies may have varying levels of dilutive securities, comparing only basic EPS may not provide an accurate picture of their relative profitability.

- Evaluation of stock-based compensation: Many companies offer stock-based compensation to their employees, such as stock options or restricted stock units. Diluted EPS helps investors assess the impact of these stock-based compensation plans on a company’s earnings per share. This information is crucial in evaluating the overall financial health and management practices of a company.

- Potential impact on stock price: Diluted EPS can have a significant impact on a company’s stock price. If a company’s diluted EPS is lower than its basic EPS, it may indicate that the company’s earnings are being diluted by the issuance of additional shares or convertible securities. This can negatively affect investor sentiment and lead to a decline in the stock price.

- Disclosure and transparency: Diluted EPS is a requirement for publicly traded companies to disclose in their financial statements. By providing this information, companies demonstrate transparency and accountability to their shareholders and the investing public.

Calculation of Diluted EPS

Diluted earnings per share (EPS) is a measure that takes into account the potential dilution of outstanding shares, which can occur through the issuance of stock options, convertible securities, or other financial instruments. It provides investors with a more accurate picture of a company’s earnings per share.

The calculation of diluted EPS involves two steps:

Step 1: Determine the Dilutive Securities

The first step in calculating diluted EPS is to identify the dilutive securities that could potentially increase the number of outstanding shares. These securities include stock options, convertible preferred stock, convertible debt, and other similar instruments.

Step 2: Adjust the Earnings and Shares

Once the dilutive securities have been identified, the next step is to adjust the earnings and shares to reflect the potential dilution. This is done by adding the potential dilution to the numerator (earnings) and denominator (shares) of the basic EPS formula.

The formula for diluted EPS is:

Diluted EPS = (Net Income + Potential Dilution) / (Weighted Average Shares + Potential Dilution)

Where:

- Net Income is the company’s net income after taxes and preferred dividends.

- Potential Dilution is the sum of potential dilution from all dilutive securities.

- Weighted Average Shares is the average number of shares outstanding during the reporting period.

By including the potential dilution from dilutive securities, diluted EPS provides a more conservative measure of a company’s earnings per share. It reflects the potential impact of securities that could potentially increase the number of outstanding shares and reduce the EPS.

Investors and analysts use diluted EPS to assess a company’s financial performance and compare it to other companies in the industry. It helps them make informed investment decisions and evaluate the potential impact of dilutive securities on a company’s earnings per share.

Example of Diluted EPS Calculation

Let’s understand the concept of diluted earnings per share (EPS) with the help of an example.

Company XYZ

Company XYZ is a fictional company that manufactures and sells electronic devices. The company’s financial statements show the following information:

- Net Income: $1,000,000

- Weighted Average Number of Common Shares Outstanding: 1,000,000

- Convertible Preferred Stock: 100,000 shares

- Convertible Bonds: $500,000 face value

- Interest Expense on Convertible Bonds: $50,000

- Convertible Bonds Conversion Ratio: 10 shares per $1,000 bond

To calculate diluted EPS, we need to consider the potential dilution from convertible preferred stock and convertible bonds.

Dilution from Convertible Preferred Stock

The convertible preferred stock can be converted into common shares at a conversion ratio of 1:1. This means that each preferred stock can be converted into one common share.

To calculate the potential dilution from convertible preferred stock, we multiply the number of convertible preferred shares by the conversion ratio:

Convertible Preferred Stock Dilution = Convertible Preferred Stock * Conversion Ratio

Convertible Preferred Stock Dilution = 100,000 * 1

Convertible Preferred Stock Dilution = 100,000

Dilution from Convertible Bonds

To calculate the potential dilution from convertible bonds, we need to determine the number of common shares that can be obtained from the conversion of the bonds.

Number of Common Shares from Convertible Bonds = Convertible Bonds / Conversion Ratio

Number of Common Shares from Convertible Bonds = $500,000 / 10

Number of Common Shares from Convertible Bonds = 50,000

Now, we can calculate the dilution from convertible bonds:

Convertible Bonds Dilution = 0

Total Dilution

The total dilution is the sum of the dilution from convertible preferred stock and the dilution from convertible bonds:

Total Dilution = Convertible Preferred Stock Dilution + Convertible Bonds Dilution

Total Dilution = 100,000 + 0

Total Dilution = 100,000

Adjusted Weighted Average Number of Common Shares Outstanding

The adjusted weighted average number of common shares outstanding is calculated by adding the total dilution to the weighted average number of common shares outstanding:

Adjusted Weighted Average Number of Common Shares Outstanding = Weighted Average Number of Common Shares Outstanding + Total Dilution

Adjusted Weighted Average Number of Common Shares Outstanding = 1,000,000 + 100,000

Adjusted Weighted Average Number of Common Shares Outstanding = 1,100,000

Diluted EPS Calculation

Finally, we can calculate the diluted EPS by dividing the net income by the adjusted weighted average number of common shares outstanding:

Diluted EPS = Net Income / Adjusted Weighted Average Number of Common Shares Outstanding

Diluted EPS = $1,000,000 / 1,100,000

Diluted EPS = $0.91

Calculating diluted EPS is important for investors and analysts as it provides a more accurate measure of a company’s earnings per share, considering the potential dilution from convertible securities. It helps in evaluating the true value of a company’s stock and making informed investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.