What is Deferred Tax Liability?

A deferred tax liability is a tax obligation that a company will have to pay in the future due to temporary differences between the accounting treatment of certain transactions and their tax treatment. It represents the amount of income tax that will be payable in future periods when these temporary differences reverse.

When these temporary differences result in taxable amounts in the future, a deferred tax liability is recognized on the balance sheet. This liability represents the company’s future tax obligation and is recorded as a liability because it is an amount that the company will have to pay to the tax authorities in the future.

It is important to note that a deferred tax liability does not represent an actual cash outflow at the time it is recognized. It is a non-cash item that reflects the future tax consequences of certain transactions. However, when the temporary differences reverse and the tax liability becomes due, the company will need to make a cash payment to settle the tax obligation.

Deferred tax liabilities are an important aspect of financial reporting and tax planning for companies. They need to be properly accounted for and disclosed in the financial statements to provide a clear picture of a company’s tax obligations and potential future cash outflows. Failure to accurately account for deferred tax liabilities can result in misrepresentation of a company’s financial position and potential tax liabilities.

Importance of Deferred Tax Liability

1. Financial Reporting

Deferred tax liability is a key component of a company’s financial statements. It is reported on the balance sheet as a liability and affects the company’s overall financial position. By accurately accounting for deferred tax liability, companies can provide a clear and transparent picture of their financial health to investors, creditors, and other stakeholders.

Additionally, deferred tax liability can impact a company’s income statement. Changes in the deferred tax liability account can result in deferred tax expense or benefit, which is recorded as a line item in the income statement. This expense or benefit reflects the impact of temporary differences on the company’s taxable income and can have a significant effect on the company’s reported earnings.

2. Tax Planning

Furthermore, deferred tax liability can affect a company’s ability to utilize tax credits and carryforward losses. Companies with significant deferred tax liabilities may face limitations on their ability to offset future taxable income with these tax attributes. Therefore, proper management of deferred tax liability is essential for maximizing tax benefits and minimizing tax costs.

Examples of Deferred Tax Liability

Deferred tax liability is a concept in accounting that arises due to temporary differences between the tax basis of an asset or liability and its carrying amount in the financial statements. These temporary differences can result in future tax obligations, leading to the recognition of deferred tax liability.

Here are some examples of situations that can give rise to deferred tax liability:

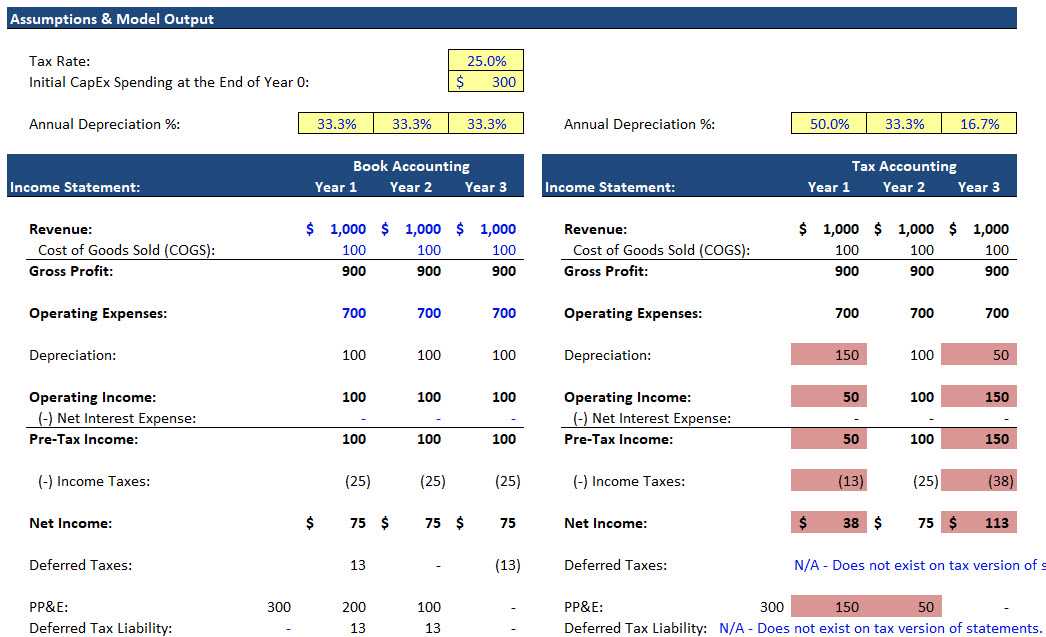

1. Depreciation

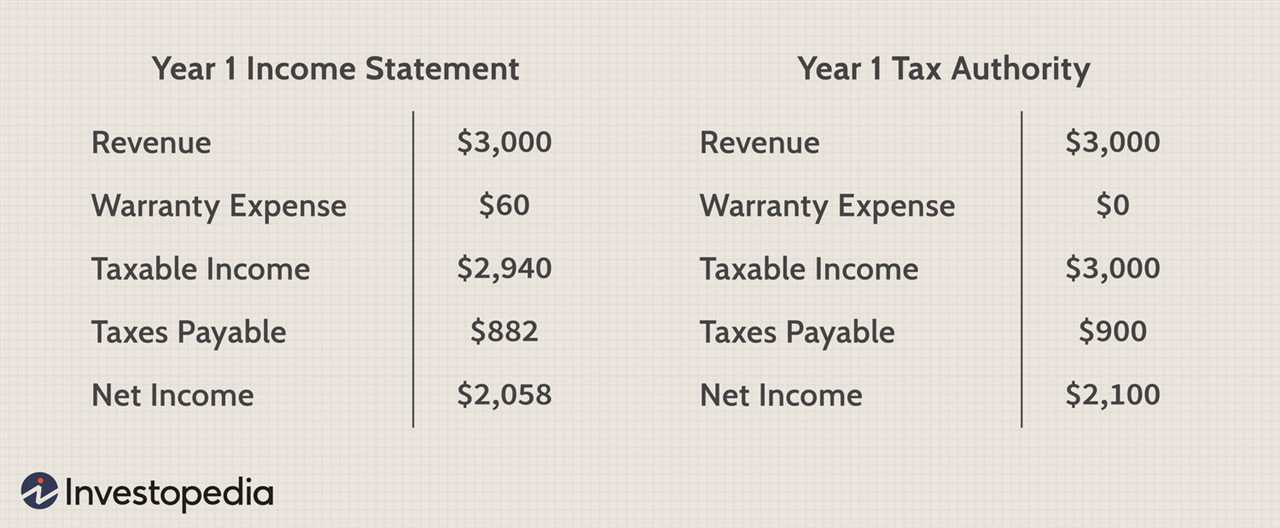

2. Revenue Recognition

3. Inventory Valuation

4. Pension Obligations

| Example | Temporary Difference | Deferred Tax Liability |

|---|---|---|

| Depreciation | Different depreciation methods | Higher taxes in the future |

| Revenue Recognition | Different timing of revenue recognition | Taxes on recognized revenue in the future |

| Inventory Valuation | Different inventory valuation methods | Higher taxes in the future |

| Pension Obligations | Differences in recognizing pension expense | Taxes on pension expense in the future |

Accounting for Deferred Tax Liability

Accounting for deferred tax liability is an important aspect of financial reporting for businesses. It involves recognizing and recording the tax consequences of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and their tax bases.

When there is a temporary difference, which means that the tax base of an asset or liability is different from its carrying amount, a deferred tax liability is created. This liability represents the amount of additional taxes that will be payable in the future when the temporary difference reverses.

The accounting for deferred tax liability follows the principles of accrual accounting. The liability is recognized and measured based on the tax rates that are expected to apply when the temporary difference reverses. The tax rates used are those that have been enacted or substantively enacted by the end of the reporting period.

Deferred tax liabilities are classified as non-current liabilities on the balance sheet because they are expected to be settled more than 12 months after the reporting period. They are also disclosed in the notes to the financial statements to provide transparency and information to users of the financial statements.

Changes in deferred tax liabilities are recognized in the income statement as part of the income tax expense or benefit. If the liability increases, it results in a higher income tax expense, reducing the net income. Conversely, if the liability decreases, it results in a lower income tax expense, increasing the net income.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.