What Are Bridge Loans?

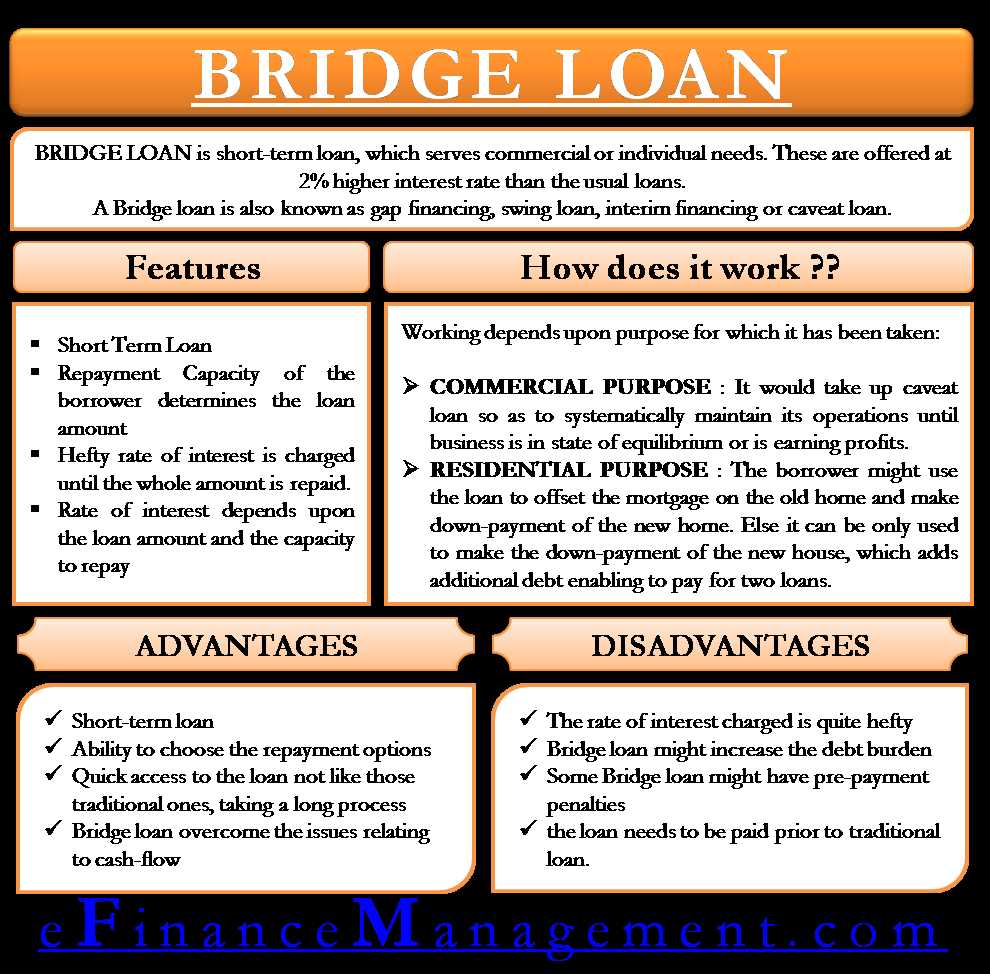

A bridge loan is a short-term loan that is used to bridge the gap between the purchase of a new property and the sale of an existing property. It is a temporary financing option that helps borrowers secure the funds they need to complete a real estate transaction.

Bridge loans are often used by homebuyers who are in the process of selling their current home and need funds to purchase a new one. They can also be used by real estate investors who need quick financing to acquire a property or make renovations before selling it for a profit.

How Do Bridge Loans Work?

Bridge loans work by providing borrowers with immediate access to funds that can be used for a down payment on a new property. The loan is typically secured by the borrower’s existing property, which serves as collateral. Once the borrower sells their current property, they use the proceeds to pay off the bridge loan.

Bridge loans are typically short-term loans with a repayment period of six months to one year. They often have higher interest rates and fees compared to traditional mortgage loans. However, they offer borrowers the flexibility and convenience of accessing funds quickly without having to wait for the sale of their existing property.

Benefits of Bridge Loans

Bridge loans offer several benefits to borrowers:

- Quick access to funds: Bridge loans provide borrowers with the funds they need to complete a real estate transaction quickly, allowing them to take advantage of investment opportunities or secure their dream home.

- Flexibility: Bridge loans offer borrowers flexibility in terms of repayment. They can choose to repay the loan in full once their existing property is sold or refinance the loan into a traditional mortgage.

- No restrictions on use: Bridge loans can be used for a variety of purposes, including purchasing a new property, making renovations, or covering unexpected expenses.

Overall, bridge loans are a valuable financing option for borrowers who need short-term funds to bridge the gap between real estate transactions. They provide flexibility, convenience, and quick access to funds, making them an attractive choice for homebuyers and real estate investors.

How Do Bridge Loans Work?

A bridge loan is a short-term loan that is used to bridge the gap between the purchase of a new property and the sale of an existing property. It is often used by individuals or businesses who need immediate funds to complete a real estate transaction.

When a borrower applies for a bridge loan, the lender will evaluate the value of the borrower’s current property and the property they plan to purchase. The lender will then determine the loan amount based on the equity in the current property and the potential value of the new property.

Bridge loans are usually short-term loans, with terms ranging from a few months to a year. During this time, the borrower is responsible for making interest-only payments on the loan. Once the borrower sells their current property, they can use the proceeds to repay the bridge loan in full.

One important thing to note is that bridge loans often have higher interest rates and fees compared to traditional loans. This is because they are considered riskier for lenders due to the short-term nature of the loan and the potential uncertainties involved in the real estate market.

However, despite the higher costs, bridge loans can be a valuable financial tool for those who need immediate funds to complete a real estate transaction. They provide borrowers with the flexibility and liquidity they need to bridge the gap between buying a new property and selling their current one.

Benefits of Bridge Loans

Bridge loans offer several benefits to borrowers who are in need of short-term financing. These benefits include:

1. Quick access to funds

One of the main advantages of bridge loans is that they provide borrowers with quick access to funds. Unlike traditional loans that can take weeks or even months to be approved and funded, bridge loans can often be obtained within a matter of days. This makes them an ideal solution for borrowers who need immediate financing for time-sensitive projects or investments.

2. Flexibility

Bridge loans are also known for their flexibility. Unlike traditional loans that have strict eligibility criteria and require extensive documentation, bridge loans are typically more lenient. Borrowers with less-than-perfect credit scores or limited financial history may still be able to qualify for a bridge loan. Additionally, bridge loans can be used for a variety of purposes, including real estate purchases, renovations, or debt consolidation.

3. Bridge to long-term financing

Another benefit of bridge loans is that they can serve as a bridge to long-term financing. For example, if a borrower is in the process of selling their current home and purchasing a new one, a bridge loan can provide the necessary funds to make the down payment on the new home before the sale of the old home is finalized. Once the old home is sold, the borrower can use the proceeds to pay off the bridge loan and secure a long-term mortgage.

4. Avoiding contingency clauses

Examples of Bridge Loans

Bridge loans can be used in a variety of situations where there is a temporary need for financing. Here are a few examples of how bridge loans can be utilized:

Real Estate Transactions

One common use of bridge loans is in real estate transactions. For example, if a person is in the process of selling their current home and purchasing a new one, they may need bridge financing to cover the gap between the sale of their old home and the purchase of their new one. This allows them to buy the new home without having to wait for their old home to sell.

Business Expansion

Bridge loans can also be used by businesses to fund expansion projects. For instance, if a company wants to open a new location but needs additional capital to do so, they can take out a bridge loan to cover the costs until they can secure long-term financing. This allows the business to move forward with their expansion plans without delay.

Investment Opportunities

Bridge loans can be a useful tool for investors looking to take advantage of time-sensitive investment opportunities. For example, if an investor comes across a great deal on a property but doesn’t have the cash on hand to purchase it, they can use a bridge loan to secure the property quickly. Once they have acquired the property, they can then seek long-term financing or sell the property for a profit.

Construction Projects

Bridge loans are often used in construction projects to bridge the gap between the initial construction phase and the permanent financing. This allows builders and developers to begin construction without having to wait for traditional financing to be approved. Once the project is completed, they can then secure long-term financing to pay off the bridge loan.

These are just a few examples of how bridge loans can be utilized. In any situation where there is a temporary need for financing, a bridge loan can provide a solution. It is important to carefully consider the terms and conditions of the loan and ensure that it aligns with your financial goals and objectives.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.