What is Adjusted Gross Income (AGI)?

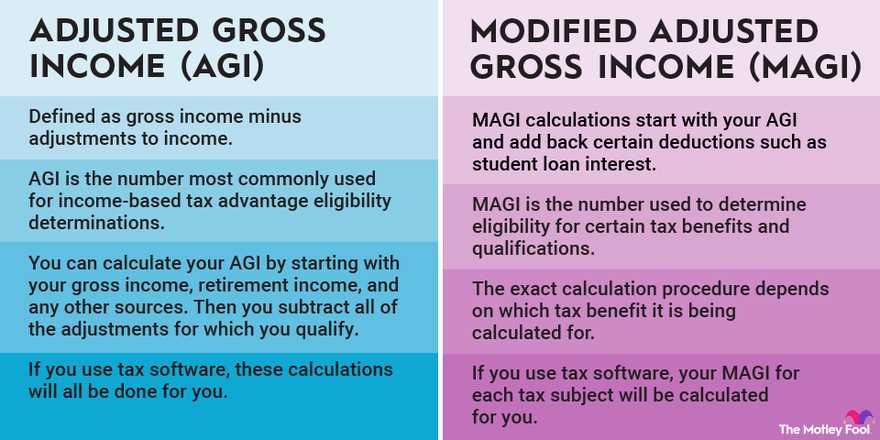

Adjusted Gross Income (AGI) is a term used in the United States tax system to determine an individual’s taxable income. It is an important concept that affects various aspects of a person’s tax obligations and eligibility for certain deductions and credits.

Definition

Adjusted Gross Income (AGI) is calculated by subtracting certain deductions from a person’s total income. These deductions include expenses such as student loan interest, alimony payments, and contributions to retirement accounts. AGI is an intermediate step in determining an individual’s taxable income.

Importance of AGI

Additionally, AGI is used to determine eligibility for certain government benefits and assistance programs. For example, when applying for financial aid for college, AGI is used to assess a student’s need for assistance.

Calculating AGI

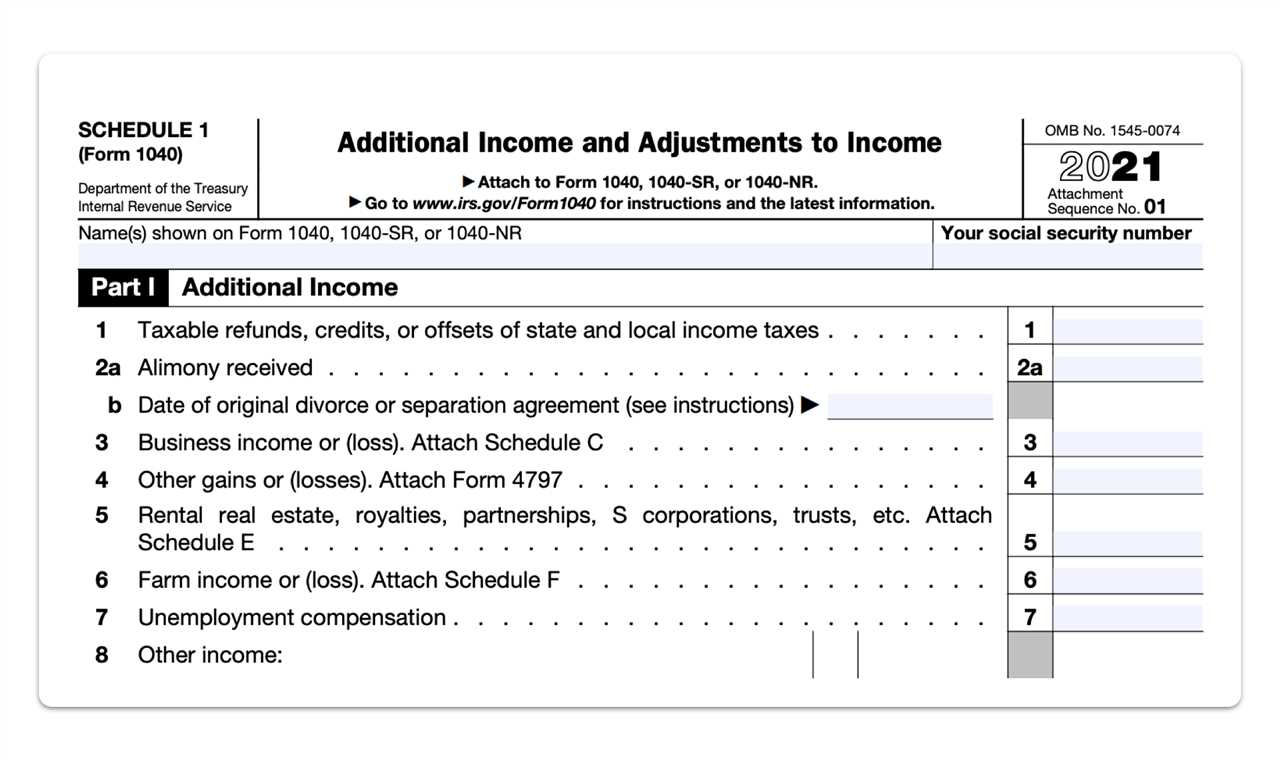

Calculating AGI involves several steps. First, an individual must determine their total income, which includes wages, self-employment income, rental income, and other sources of income. Then, they subtract certain deductions to arrive at their AGI.

Some common deductions that are subtracted from total income to calculate AGI include:

- Student loan interest

- Alimony payments

- Contributions to retirement accounts

- Self-employment taxes

- Health insurance premiums

Once these deductions are subtracted, the resulting amount is the individual’s AGI.

It is important to note that AGI is different from taxable income. After calculating AGI, an individual may still be eligible for additional deductions and credits, which can further reduce their taxable income.

Calculating Adjusted Gross Income (AGI)

Calculating your Adjusted Gross Income (AGI) is an important step in determining your overall tax liability. AGI is a key figure used by the Internal Revenue Service (IRS) to determine your eligibility for certain tax deductions, credits, and benefits.

To calculate your AGI, you need to start with your total income and make certain adjustments. Here is a step-by-step guide to help you calculate your AGI:

- Start with your total income: This includes all the money you earned throughout the year, such as wages, salaries, tips, self-employment income, rental income, and any other taxable income.

- Subtract any above-the-line deductions: Above-the-line deductions are deductions that you can claim before calculating your AGI. These deductions include expenses such as student loan interest, self-employment taxes, contributions to retirement accounts, and health savings account contributions.

- Add back any income adjustments: Income adjustments are certain deductions that are subtracted from your total income but then added back to calculate your AGI. These adjustments include items such as alimony received, business losses, and rental losses.

- Calculate your AGI: Once you have made all the necessary adjustments, subtract the total above-the-line deductions and add back the income adjustments to arrive at your AGI.

Calculating your AGI accurately is crucial for ensuring that you pay the correct amount of taxes and take advantage of any applicable tax benefits. It’s recommended to consult a tax professional or use tax software to calculate your AGI to ensure accuracy and compliance with IRS regulations.

Importance of Adjusted Gross Income (AGI)

In addition to its role in taxation, AGI is also important for other financial matters. Many lenders and financial institutions use AGI as a measure of an individual’s financial stability and ability to repay loans. When applying for a mortgage, for example, lenders may consider an individual’s AGI to determine their loan eligibility and interest rate. By maintaining a healthy AGI, individuals can improve their chances of securing favorable loan terms.

Income Categories and Adjusted Gross Income (AGI)

1. Earned Income

Earned income refers to the money you receive from working, such as wages, salaries, and tips. This category also includes income from self-employment, freelance work, and business profits. It is essential to report all your earned income accurately to calculate your AGI correctly.

2. Investment Income

Investment income includes earnings from investments, such as interest, dividends, capital gains, and rental income. This category also covers income from real estate properties, stocks, bonds, and mutual funds. It is important to report all your investment income to ensure an accurate calculation of your AGI.

3. Retirement Income

Retirement income includes distributions from retirement accounts, such as 401(k)s, IRAs, and pensions. This category also covers Social Security benefits and annuity payments. It is crucial to report all your retirement income accurately to determine your AGI correctly.

4. Other Income

Other income refers to any additional income sources that do not fall into the above categories. This can include alimony, rental income from a property you do not actively manage, and any other miscellaneous income. It is important to report all your other income to ensure an accurate calculation of your AGI.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.