What is Supply Chain Finance?

Supply Chain Finance is a financial strategy that focuses on optimizing the flow of funds within a supply chain. It involves the use of various financial instruments and techniques to improve cash flow, reduce risk, and enhance relationships between buyers and suppliers.

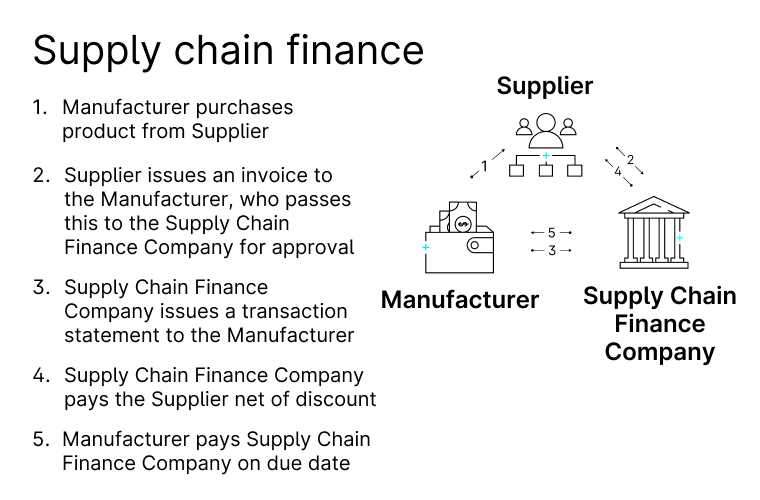

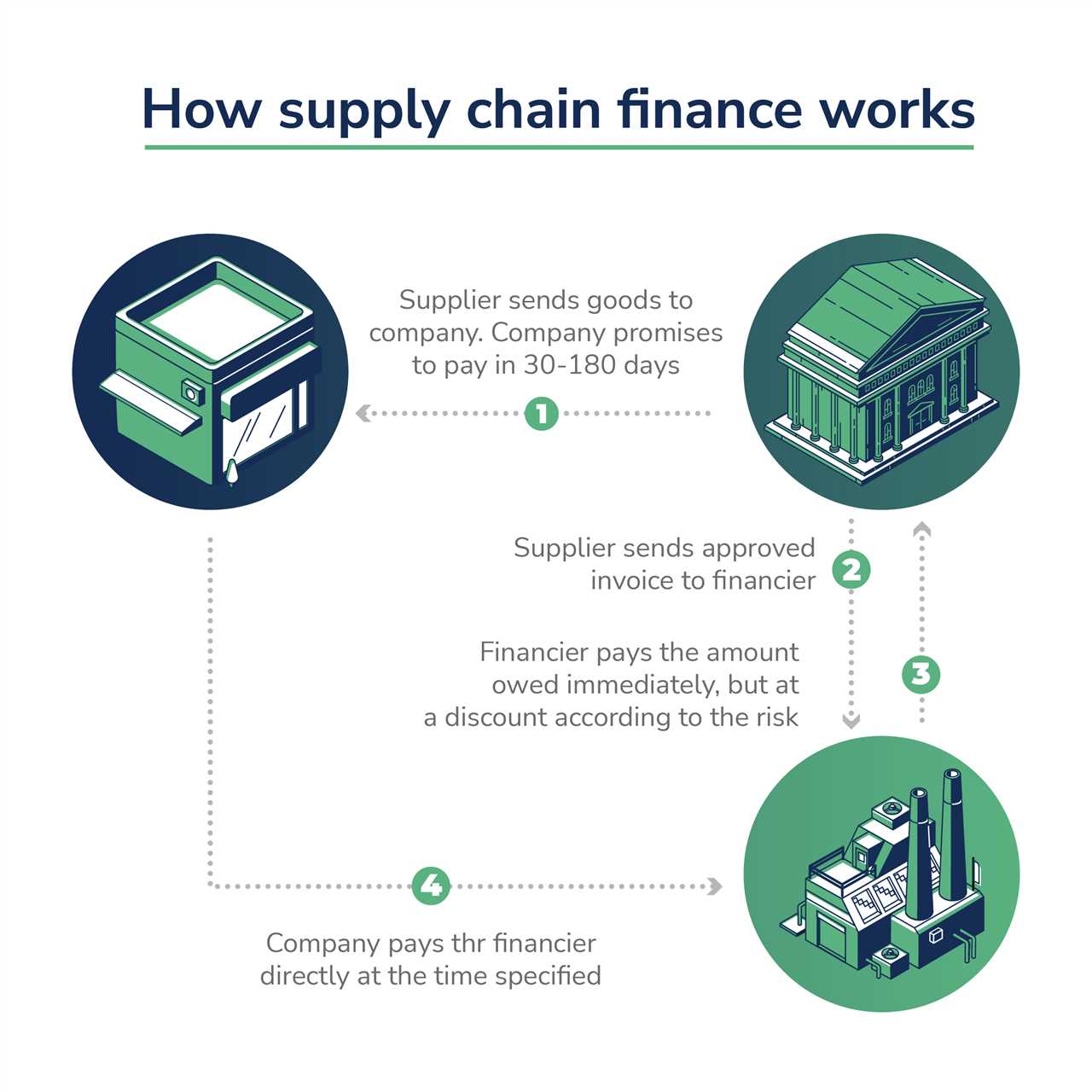

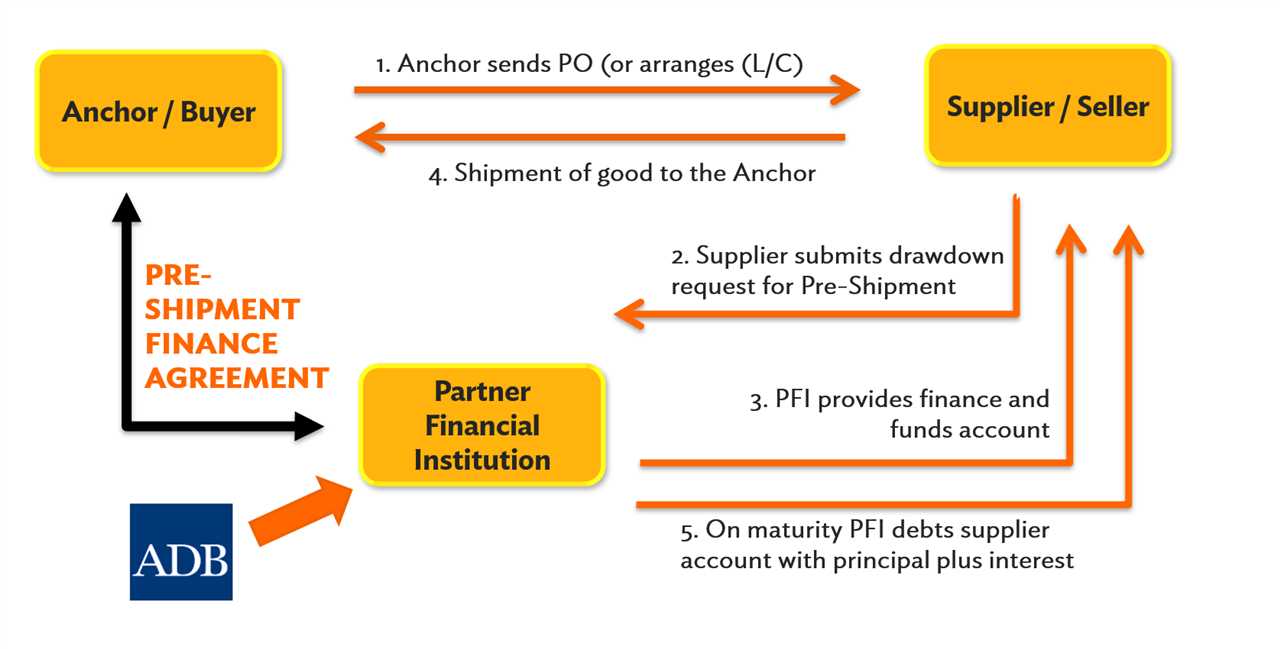

How does it work?

Supply Chain Finance works by leveraging the creditworthiness of the buyer to provide early payment to the supplier. This is achieved through a process called “reverse factoring” or “supplier financing”. The buyer’s financial institution pays the supplier on behalf of the buyer, and the buyer then repays the financial institution at a later date.

This arrangement benefits both the buyer and the supplier. The buyer can extend their payment terms, allowing them to preserve cash flow and improve working capital. The supplier, on the other hand, receives early payment, which helps them to reduce their own financing costs and improve their cash flow.

Key benefits of Supply Chain Finance

Improved Cash Flow: Supply Chain Finance allows buyers to extend their payment terms, which can help improve their cash flow and working capital. Suppliers also benefit from early payment, which improves their cash flow and reduces their financing costs.

Reduced Risk: By leveraging the creditworthiness of the buyer, Supply Chain Finance reduces the risk for the supplier. This can lead to lower financing costs and improved financial stability for the supplier.

Enhanced Supplier Relationships: Supply Chain Finance can help strengthen relationships between buyers and suppliers. By providing early payment, buyers can demonstrate their commitment to their suppliers and foster a more collaborative and mutually beneficial partnership.

Overall, Supply Chain Finance is a powerful financial strategy that can help optimize the flow of funds within a supply chain, improve cash flow, reduce risk, and enhance relationships between buyers and suppliers.

Benefits of Supply Chain Finance

Supply Chain Finance offers several benefits to businesses, helping them optimize their financial operations and improve overall efficiency. Here are some key advantages:

1. Improved Cash Flow: Supply Chain Finance allows businesses to access early payments from their buyers or financial institutions, ensuring a steady cash flow. This helps companies meet their working capital needs, pay suppliers on time, and invest in growth opportunities.

2. Reduced Risk: By leveraging Supply Chain Finance, businesses can mitigate the risk of late payments or non-payment from buyers. The financial institution assumes the credit risk, providing assurance to suppliers and enabling them to focus on their core operations without worrying about cash flow disruptions.

3. Enhanced Supplier Relationships: Supply Chain Finance strengthens the relationship between buyers and suppliers. By offering early payments, buyers can negotiate better terms with suppliers, such as discounts or extended payment periods. This fosters trust and collaboration between the parties, leading to long-term partnerships.

4. Streamlined Processes: Implementing Supply Chain Finance streamlines the payment process, reducing administrative burden and manual tasks. It enables automated invoice processing, payment reconciliation, and real-time visibility into cash flows. This efficiency improves operational efficiency and reduces costs.

5. Competitive Advantage: Adopting Supply Chain Finance can give businesses a competitive edge by offering attractive payment terms to suppliers. This can help attract high-quality suppliers, secure better pricing, and differentiate from competitors who may not offer such financing options.

Improved Cash Flow

One of the key benefits of supply chain finance is the improvement it brings to cash flow management. By implementing supply chain finance solutions, companies can optimize their working capital and ensure a steady flow of cash throughout the supply chain.

Traditionally, companies have faced challenges in managing their cash flow due to delays in payments from customers or extended payment terms with suppliers. This can create a cash crunch and hinder the smooth operation of the business.

With supply chain finance, companies can access early payment options for their invoices, allowing them to receive payment sooner than the agreed-upon payment terms. This provides a significant boost to their cash flow, enabling them to meet their financial obligations and invest in growth opportunities.

Additionally, supply chain finance allows companies to extend their payment terms with suppliers without negatively impacting their relationships. By offering suppliers the option to receive early payment through supply chain finance, companies can negotiate longer payment terms, improving their working capital position and strengthening their supplier relationships.

Improved cash flow through supply chain finance also enables companies to take advantage of early payment discounts offered by suppliers. By paying suppliers early, companies can often secure discounts on their purchases, resulting in cost savings and improved profitability.

Reduced Risk

Supply chain finance offers a range of benefits to businesses, and one of the most significant advantages is the reduced risk it provides. By implementing supply chain finance solutions, companies can mitigate various risks associated with their supply chain operations.

One of the primary risks in supply chain management is the risk of non-payment or late payment by customers. This can have a significant impact on a company’s cash flow and overall financial health. However, with supply chain finance, businesses can access early payment options, allowing them to receive payment for their invoices sooner and reducing the risk of non-payment.

Additionally, supply chain finance can help companies reduce the risk of supplier default. By providing suppliers with access to financing options, businesses can help ensure that their suppliers have the necessary funds to fulfill their obligations. This reduces the risk of supplier bankruptcy or failure, which can disrupt the supply chain and impact the company’s operations.

Supply Chain Finance and Risk Mitigation

Supply chain finance also enables companies to better manage the risk of supply chain disruptions. By improving cash flow and strengthening supplier relationships, businesses can enhance their ability to respond to unexpected events or changes in the market.

For example, if a company experiences a sudden increase in demand for its products, it may need to increase its production capacity or secure additional raw materials. With supply chain finance, the company can quickly access financing options to fund these activities, reducing the risk of supply chain disruptions and ensuring that it can meet customer demand.

In summary, supply chain finance offers businesses a range of benefits, including reduced risk. By implementing supply chain finance solutions, companies can mitigate the risks associated with non-payment, supplier default, and supply chain disruptions. This not only improves the company’s financial health but also enhances its overall operational resilience.

Enhanced Supplier Relationships

Supply Chain Finance not only benefits the buyer, but also enhances the relationships with suppliers. By implementing supply chain finance solutions, companies can offer their suppliers early payment options, which can help improve their cash flow and reduce their financial stress. This can lead to stronger and more collaborative relationships between the buyer and supplier.

With supply chain finance, buyers can negotiate better payment terms with their suppliers, such as extended payment terms or discounts for early payment. This can help suppliers manage their working capital more effectively and reduce their reliance on expensive financing options, such as bank loans or factoring. As a result, suppliers are more likely to prioritize the buyer’s orders and provide better pricing and service.

In addition, supply chain finance can help improve transparency and trust between the buyer and supplier. By providing suppliers with real-time visibility into the status of their invoices and payments, supply chain finance solutions enable open and transparent communication. This can help resolve any payment disputes or discrepancies quickly and efficiently, fostering a more collaborative and mutually beneficial relationship.

Furthermore, supply chain finance can also help suppliers access financing at more favorable rates. By leveraging the buyer’s creditworthiness, suppliers can obtain financing at lower interest rates or with less stringent requirements. This can help suppliers invest in their operations, improve their production capabilities, and ultimately deliver higher quality products or services to the buyer.

In summary, supply chain finance not only provides benefits to the buyer, such as improved cash flow and reduced risk, but also enhances the relationships with suppliers. By offering early payment options, negotiating better payment terms, improving transparency, and facilitating access to financing, supply chain finance can foster stronger and more collaborative relationships between buyers and suppliers, leading to mutual growth and success.

Real-Life Examples of Supply Chain Finance

Supply chain finance has become increasingly popular among businesses of all sizes and industries. Here are some real-life examples of companies that have successfully implemented supply chain finance strategies:

1. Company A: Streamlining Payments

Company A, a global manufacturing company, was facing challenges with their payment processes. They had a complex supply chain with multiple suppliers, and managing payments was time-consuming and prone to errors. By implementing a supply chain finance program, Company A was able to streamline their payment processes.

With supply chain finance, Company A was able to negotiate extended payment terms with their suppliers. This allowed them to improve their cash flow by delaying payment while still ensuring their suppliers were paid on time. The program also provided visibility into the payment status of each invoice, reducing the risk of duplicate payments or late fees.

Additionally, supply chain finance helped Company A strengthen their relationships with their suppliers. By offering early payment options, Company A was able to provide their suppliers with access to working capital, improving their cash flow as well.

2. Company B: Mitigating Supply Chain Risks

Company B, a retail company, faced significant risks in their supply chain due to their reliance on overseas suppliers. They were concerned about the potential impact of political instability, natural disasters, and other unforeseen events on their supply chain.

To mitigate these risks, Company B implemented a supply chain finance program that allowed them to diversify their supplier base. By offering early payment options to new suppliers, Company B was able to attract and onboard suppliers from different regions, reducing their dependence on a single geographic area.

Supply chain finance also helped Company B improve their risk management processes. By gaining visibility into their supplier’s financial health, Company B was able to identify and address potential risks before they became major issues. This allowed them to proactively manage disruptions in their supply chain and ensure continuity of operations.

Overall, these real-life examples demonstrate the benefits and effectiveness of supply chain finance in improving cash flow, reducing risk, and enhancing supplier relationships. By implementing supply chain finance strategies, businesses can optimize their supply chain operations and gain a competitive advantage in the market.

Company A: Streamlining Payments

Company A is a leading global manufacturer and distributor of consumer electronics. With a complex supply chain that spans across multiple countries and involves numerous suppliers, managing payments has always been a challenge.

However, by implementing supply chain finance solutions, Company A has been able to streamline its payment processes and improve efficiency. Here are some key ways in which they have achieved this:

1. Automated Invoicing

Company A has implemented an automated invoicing system that allows suppliers to submit their invoices electronically. This eliminates the need for manual data entry and reduces the risk of errors. The system also provides real-time visibility into the status of invoices, allowing for better tracking and reconciliation.

2. Early Payment Discounts

By offering early payment discounts to suppliers, Company A is able to incentivize them to submit their invoices early. This not only improves cash flow for the suppliers but also allows Company A to take advantage of discounts and reduce costs.

3. Supply Chain Financing Program

Company A has partnered with financial institutions to offer a supply chain financing program to its suppliers. This program allows suppliers to receive early payment for their invoices, while Company A extends its payment terms. This win-win arrangement helps improve cash flow for both parties and reduces the risk of late payments.

Overall, by streamlining its payment processes through supply chain finance, Company A has been able to improve efficiency, reduce costs, and strengthen its relationships with suppliers. This has ultimately contributed to the company’s success in the highly competitive consumer electronics industry.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.