What is SEC Form 10-Q Filing?

SEC Form 10-Q Filing is a financial report that publicly traded companies in the United States are required to submit to the Securities and Exchange Commission (SEC) on a quarterly basis. It provides important information about a company’s financial performance and operations during the quarter.

This filing is part of the SEC’s overall goal to protect investors and ensure transparency in the financial markets. By requiring companies to submit regular reports, the SEC aims to provide investors with accurate and timely information to make informed investment decisions.

The SEC Form 10-Q Filing contains a comprehensive set of financial statements, including the balance sheet, income statement, and cash flow statement. It also includes management’s discussion and analysis (MD&A) of the company’s financial condition and results of operations, as well as any significant events or changes that may have occurred during the quarter.

Investors and analysts rely on the information provided in the SEC Form 10-Q Filing to assess a company’s financial health and performance. It allows them to track trends, identify potential risks, and make comparisons with other companies in the same industry.

Overall, the SEC Form 10-Q Filing plays a crucial role in promoting transparency and accountability in the financial markets. It ensures that companies disclose relevant information to the public, allowing investors to make informed decisions and maintain confidence in the integrity of the market.

Definition and Purpose

The SEC Form 10-Q filing is a financial report that public companies are required to submit to the Securities and Exchange Commission (SEC) on a quarterly basis. It provides a comprehensive overview of a company’s financial performance and operations during the quarter. The purpose of the Form 10-Q filing is to ensure transparency and provide investors with up-to-date information about the company’s financial health.

This filing is an important tool for investors as it allows them to make informed decisions based on the company’s financial statements, management discussion and analysis, and other relevant information. It provides a snapshot of the company’s financial position, including its revenues, expenses, cash flows, and any significant events or risks that may impact its future performance.

The Form 10-Q filing is part of the SEC’s ongoing efforts to protect investors and maintain fair and efficient markets. It helps promote transparency, accountability, and trust in the financial markets by ensuring that companies disclose accurate and timely information to the public.

Companies must adhere to strict guidelines and regulations when preparing and filing the Form 10-Q. The filing must be accurate, complete, and in compliance with Generally Accepted Accounting Principles (GAAP) and SEC regulations. Any misrepresentation or omission of material information can result in severe penalties and legal consequences.

Overall, the SEC Form 10-Q filing plays a crucial role in providing investors with the necessary information to make informed investment decisions. It helps maintain the integrity of the financial markets and ensures that companies are held accountable for their financial reporting.

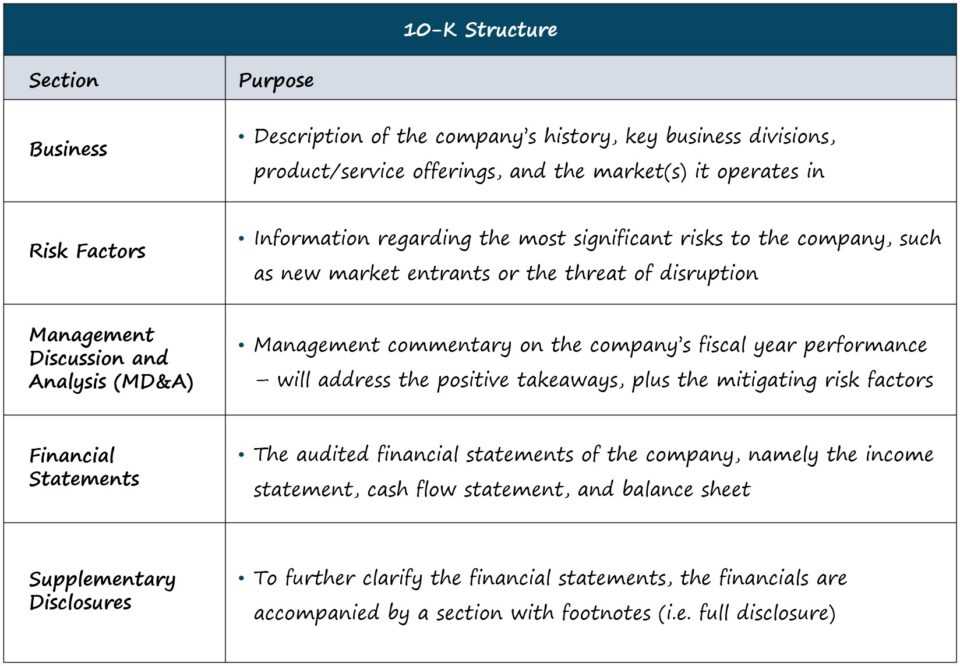

Components of SEC Form 10-Q Filing

SEC Form 10-Q is a comprehensive filing that provides detailed information about a company’s financial performance and operations. It consists of several components that help investors and regulators gain insights into the company’s current financial condition. The key components of SEC Form 10-Q filing include:

1. Financial Statements

The financial statements section is one of the most crucial components of SEC Form 10-Q. It includes the balance sheet, income statement, and cash flow statement. These statements provide a snapshot of the company’s financial position, profitability, and cash flow during the reporting period. Investors analyze these statements to assess the company’s financial health and make informed investment decisions.

2. Management’s Discussion and Analysis (MD&A)

The MD&A section is a narrative explanation provided by the company’s management. It offers insights into the company’s financial results, operations, and future prospects. Management discusses key financial trends, significant events, and risks that may impact the company’s performance. This section helps investors understand the company’s performance in the context of its business environment.

3. Risk Factors

The risk factors section outlines the potential risks and uncertainties that could affect the company’s future performance. It includes both internal and external factors that may impact the company’s operations, financial condition, and results. This section helps investors evaluate the potential risks associated with investing in the company.

4. Legal Proceedings

The legal proceedings section provides information about any ongoing or pending litigation, regulatory investigations, or other legal matters involving the company. It discloses the nature of the legal proceedings, potential liabilities, and the possible impact on the company’s financial condition. This section helps investors assess the potential legal risks and their potential impact on the company.

5. Exhibits

The exhibits section includes additional supporting documents and information that are filed along with SEC Form 10-Q. These may include contracts, agreements, auditor’s reports, and other relevant documents. Exhibits provide additional context and details that are not included in the main sections of the filing.

Overall, SEC Form 10-Q filing is a comprehensive document that provides a detailed overview of a company’s financial performance and operations. It helps investors make informed investment decisions and ensures transparency and accountability in the financial markets.

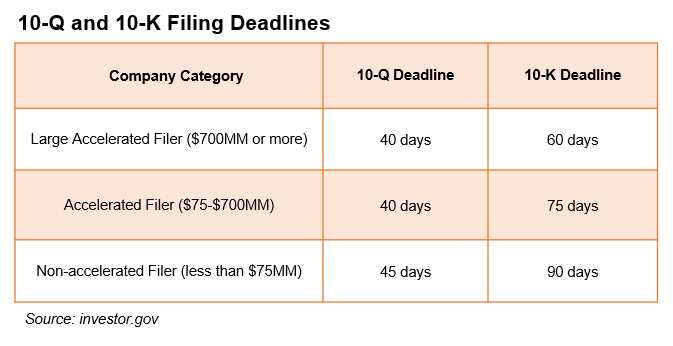

Deadlines for SEC Form 10-Q Filing

Quarterly Filing Deadline

The SEC Form 10-Q must be filed within 45 days after the end of each fiscal quarter. This means that companies have 45 days to compile and submit their financial statements, including the income statement, balance sheet, and cash flow statement, along with any other required disclosures.

Extension of Filing Deadline

Consequences of Late Filing

Failure to meet the deadlines for filing the SEC Form 10-Q can have serious consequences for companies. Late filings can result in penalties, fines, and even legal action by the SEC. Additionally, companies may face reputational damage and a loss of investor confidence if they consistently fail to meet their filing obligations.

It is important for companies to prioritize the timely and accurate filing of the SEC Form 10-Q to maintain transparency and accountability to their stakeholders. By meeting the filing deadlines, companies demonstrate their commitment to providing up-to-date financial information and complying with SEC regulations.

Importance of SEC Form 10-Q Filing

The SEC Form 10-Q filing is an essential requirement for publicly traded companies in the United States. It plays a crucial role in providing transparency and accountability to investors and the general public. This filing is a quarterly report that provides detailed information about a company’s financial performance and operations.

One of the main reasons why the SEC Form 10-Q filing is important is that it allows investors to make informed decisions about their investments. By reviewing the financial statements and disclosures provided in the filing, investors can assess the company’s current financial health and its ability to generate profits. This information is crucial for investors to determine whether to buy, sell, or hold onto their shares.

Furthermore, the SEC Form 10-Q filing helps to ensure fair and efficient markets. By requiring companies to disclose their financial information regularly, the SEC promotes transparency and prevents fraudulent activities. This filing also helps to maintain investor confidence in the market, as it provides a level playing field for all participants.

In addition, the SEC Form 10-Q filing is important for regulatory compliance. Publicly traded companies are required by law to submit this filing within a specific timeframe after the end of each quarter. Failure to comply with these deadlines can result in penalties and legal consequences for the company and its executives.

Moreover, the SEC Form 10-Q filing is an important tool for financial analysts, researchers, and other stakeholders. It provides them with valuable information about a company’s financial performance, risk factors, and future prospects. This information can be used to conduct industry analysis, compare companies, and make investment recommendations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.