What is a Reverse Repurchase Agreement?

A reverse repurchase agreement (RRP) is a financial transaction in which one party sells a security to another party with the agreement to repurchase it at a later date. It is essentially the opposite of a repurchase agreement (repo), where the buyer purchases a security and agrees to sell it back to the seller at a specified price and date.

In a reverse repurchase agreement, the party selling the security is typically a financial institution, such as a bank or a money market fund, while the party buying the security is often the central bank or another financial institution with excess cash reserves.

How Does a Reverse Repurchase Agreement Work?

The process of a reverse repurchase agreement involves several steps:

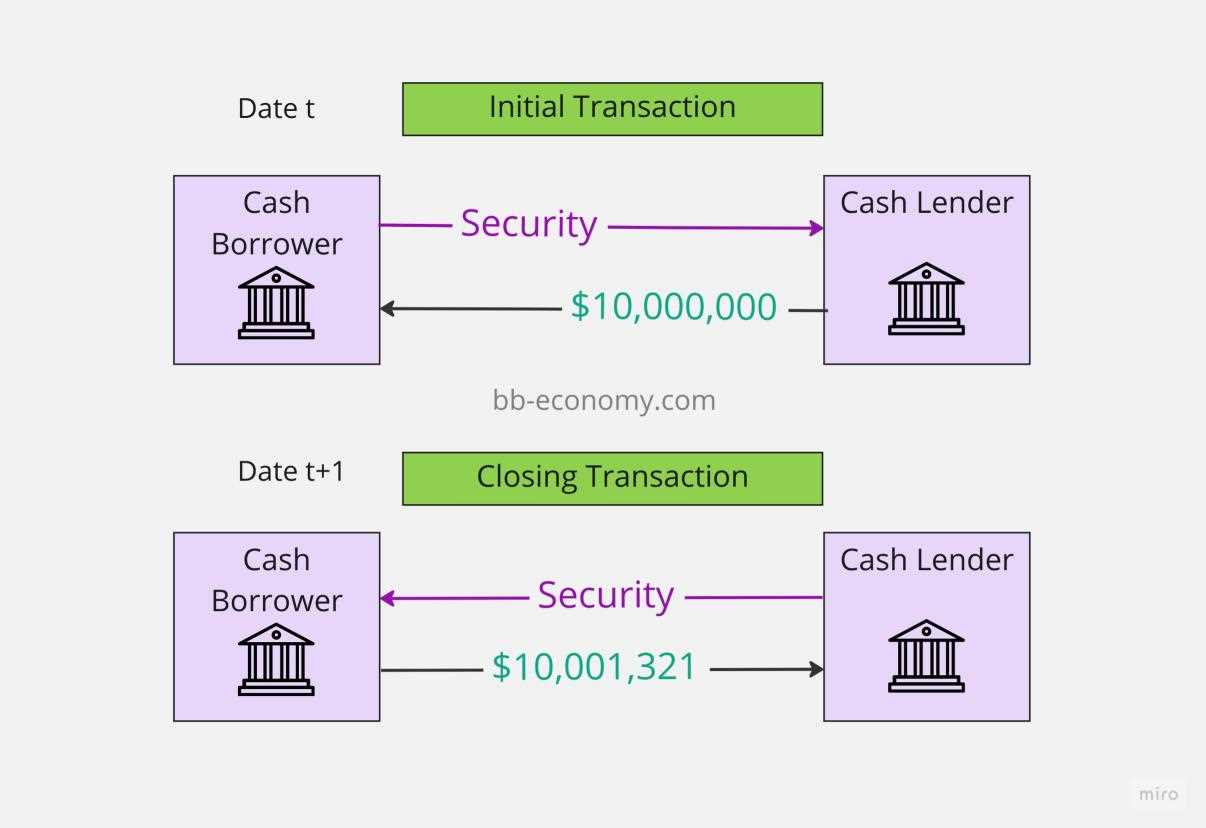

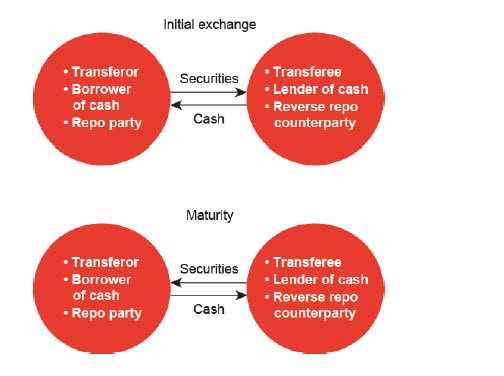

- The party selling the security (the borrower) approaches the party with excess cash (the lender) to enter into a reverse repurchase agreement.

- The borrower transfers the security to the lender in exchange for cash.

- The lender holds the security as collateral and earns interest on the cash provided to the borrower.

- At the agreed-upon maturity date, the borrower repurchases the security from the lender at a slightly higher price, compensating the lender for the interest earned.

- The lender returns the security to the borrower, and the reverse repurchase agreement is complete.

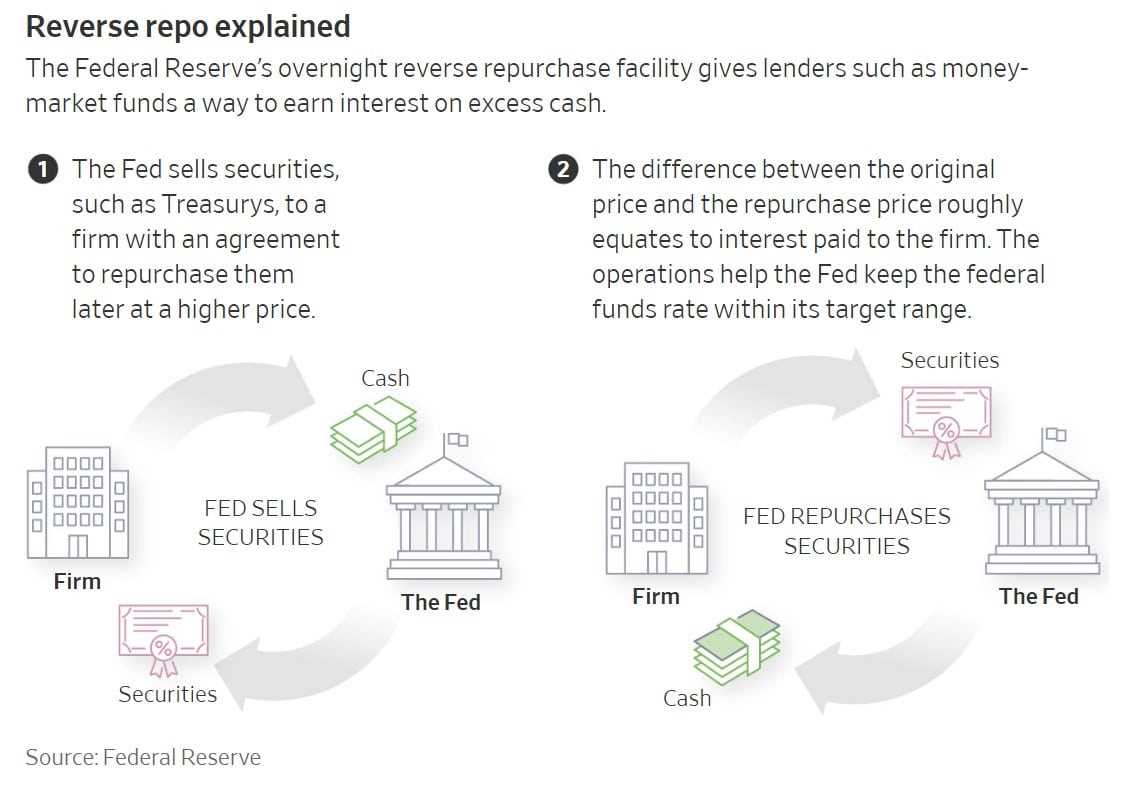

Reverse repurchase agreements are commonly used by central banks as a monetary policy tool to control the money supply in the economy. By entering into reverse repurchase agreements, central banks can temporarily remove excess cash from the financial system, reducing liquidity and potentially lowering inflationary pressures.

Example of a Reverse Repurchase Agreement

Let’s say Bank A has excess cash reserves and wants to earn some interest on it. Bank B, on the other hand, has a portfolio of government bonds but needs cash for short-term funding. Bank A enters into a reverse repurchase agreement with Bank B, agreeing to lend Bank B a specific amount of cash in exchange for the government bonds as collateral.

Bank B transfers the government bonds to Bank A and receives the cash. Bank A holds the government bonds as collateral and earns interest on the cash provided to Bank B. At the maturity date, Bank B repurchases the government bonds from Bank A at a slightly higher price, compensating Bank A for the interest earned.

By entering into this reverse repurchase agreement, Bank A earns interest on its excess cash, while Bank B obtains the necessary funds for its short-term needs. This transaction benefits both parties involved.

Benefits and Risks of Reverse Repurchase Agreements

Reverse repurchase agreements offer several benefits:

- They provide a way for financial institutions to earn interest on their excess cash reserves.

- They allow financial institutions to obtain short-term funding by using their securities as collateral.

- They provide liquidity to the financial system, helping to stabilize the markets.

However, reverse repurchase agreements also come with risks:

- If the borrower defaults on repurchasing the security, the lender may suffer losses.

- Changes in interest rates can affect the profitability of the transaction for both parties.

- There is a risk of market volatility and fluctuations in the value of the securities used as collateral.

Overall, reverse repurchase agreements play an important role in the financial markets and are widely used by financial institutions and central banks to manage liquidity and control the money supply.

How Does a Reverse Repurchase Agreement Work?

In a reverse repurchase agreement, the party selling the securities is the borrower, while the party buying the securities is the lender. The borrower agrees to repurchase the securities at a higher price, which includes interest, within a specified time frame.

The reverse repurchase agreement is a short-term borrowing tool used by financial institutions, such as banks and investment firms, to raise funds quickly. It provides them with liquidity and allows them to meet their short-term cash needs.

The interest rate on a reverse repurchase agreement is determined by the lender and is usually based on prevailing market rates. The borrower pays interest on the borrowed funds for the duration of the agreement.

Reverse repurchase agreements are commonly used in the bond market, where government securities, such as Treasury bonds, are often used as collateral. The borrower pledges these securities to the lender to secure the loan.

One of the main benefits of a reverse repurchase agreement is that it allows financial institutions to manage their short-term liquidity needs efficiently. They can quickly raise funds by selling securities and repurchase them when needed.

However, reverse repurchase agreements also come with risks. If the borrower fails to repurchase the securities at the agreed-upon price, the lender may suffer losses. Additionally, changes in market conditions can affect the value of the securities, leading to potential losses for both parties.

Example of a Reverse Repurchase Agreement

A reverse repurchase agreement (RRP) is a financial transaction that involves the sale of securities by one party to another, with a promise to repurchase them at a later date. This type of agreement is commonly used by central banks and other financial institutions to manage liquidity in the market.

Here’s an example to help illustrate how a reverse repurchase agreement works:

Scenario:

Let’s say that Bank A has a large amount of government bonds that it wants to temporarily sell to Bank B in exchange for cash. Bank A agrees to repurchase the bonds from Bank B at a later date, typically within a short period of time.

Terms of the Agreement:

The terms of the reverse repurchase agreement are as follows:

- Bank A sells $1 million worth of government bonds to Bank B.

- Bank B provides $1 million in cash to Bank A.

- The agreement has a maturity period of 7 days.

- At the end of the 7-day period, Bank A repurchases the government bonds from Bank B for $1 million plus interest.

Benefits:

Reverse repurchase agreements offer several benefits to both parties involved:

- Bank A gains access to immediate cash by temporarily selling its securities.

- Bank B earns interest on the cash it provides to Bank A.

- Both parties can use reverse repurchase agreements to manage their short-term liquidity needs.

Risks:

While reverse repurchase agreements can be beneficial, they also come with certain risks:

- There is a risk that the value of the securities being sold may decrease during the term of the agreement, resulting in a loss for Bank A.

- If Bank B fails to return the securities to Bank A at the end of the agreement, Bank A may face difficulties in recovering its assets.

- Changes in interest rates can affect the profitability of the reverse repurchase agreement for both parties.

Benefits and Risks of Reverse Repurchase Agreements

A reverse repurchase agreement (RRP) can provide several benefits for both parties involved. Firstly, it allows the party selling the security to raise short-term funds quickly. This can be beneficial for financial institutions or corporations that need immediate liquidity for various purposes, such as meeting short-term obligations or funding new projects.

On the other hand, the party purchasing the security through the RRP gains the opportunity to earn interest income on their excess cash. This can be particularly attractive for entities with excess funds that they do not need for immediate use. By investing in reverse repurchase agreements, they can earn a return on their idle cash while maintaining a high level of liquidity.

Another benefit of reverse repurchase agreements is that they can serve as a tool for monetary policy implementation by central banks. By conducting RRPs, central banks can absorb excess liquidity from the financial system, which can help manage inflationary pressures and stabilize interest rates.

However, reverse repurchase agreements also carry certain risks that participants should be aware of. One risk is the potential for counterparty default. If the party selling the security fails to repurchase it at the agreed-upon price and time, the purchasing party may face losses. To mitigate this risk, participants often conduct due diligence on the counterparty’s financial health and creditworthiness before entering into an RRP.

Another risk is the possibility of market fluctuations affecting the value of the underlying security. If the value of the security decreases significantly during the term of the RRP, the purchasing party may incur losses if they decide to sell the security before maturity.

Furthermore, reverse repurchase agreements may be subject to regulatory and accounting considerations. Participants must comply with relevant regulations and accounting standards, which can add complexity and administrative burden to the transaction.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.