What is Excess Cash Flow?

Excess cash flow refers to the amount of cash generated by a business that exceeds its operating and financing needs. It is the surplus cash that remains after all the necessary expenses and debt obligations have been met. This excess cash flow can be used for various purposes, such as reinvesting in the business, paying dividends to shareholders, or reducing debt.

Excess cash flow is an important financial metric that indicates the financial health and profitability of a company. It reflects the ability of a business to generate cash beyond its immediate needs, which can be a sign of strong financial management and operational efficiency.

Importance of Excess Cash Flow

Having excess cash flow provides a company with financial flexibility and stability. It allows the business to weather unexpected expenses or economic downturns without having to rely on external financing or accumulating additional debt. Excess cash flow can also be used to fund growth initiatives, such as expanding operations, acquiring new assets, or investing in research and development.

Furthermore, excess cash flow can enhance the value of a company and attract investors. A business that consistently generates excess cash flow demonstrates its ability to generate profits and create value for its shareholders. This can lead to higher stock prices and a positive perception in the investment community.

Factors Affecting Excess Cash Flow

Several factors can influence the amount of excess cash flow generated by a company. These include:

- Revenue growth: Higher sales can result in increased cash flow, allowing for more excess cash.

- Profit margin: A higher profit margin means more cash is generated from each sale, contributing to excess cash flow.

- Operating expenses: Controlling and reducing operating expenses can increase excess cash flow.

- Debt obligations: High debt payments can reduce the amount of excess cash flow available to the business.

- Capital expenditures: Large investments in assets or infrastructure can decrease excess cash flow.

Definition of Excess Cash Flow

Excess cash flow refers to the surplus cash generated by a business after meeting all its financial obligations, including debt service payments and capital expenditures. It is an important financial metric used by investors and lenders to assess the financial health and stability of a company.

Excess cash flow is calculated by subtracting the required cash flow from the actual cash flow. The required cash flow includes all the necessary expenses and payments that a company must make to maintain its operations and meet its financial obligations. These expenses may include interest payments on debt, taxes, and capital expenditures.

The excess cash flow is an indication of the company’s ability to generate additional cash that can be used for various purposes, such as paying dividends to shareholders, investing in new projects, or reducing debt. A higher excess cash flow is generally seen as a positive sign, as it indicates that the company has a strong financial position and is capable of generating surplus cash.

Investors and lenders often use excess cash flow as a key measure of a company’s financial performance and stability. It helps them assess the company’s ability to generate cash and meet its financial obligations in the long term. A company with a consistent and positive excess cash flow is generally considered more financially stable and less risky.

Overall, excess cash flow is an important financial metric that provides insights into a company’s financial health and stability. It helps investors and lenders make informed decisions about investing in or lending to a company, and it can also be used by the company itself to plan for future growth and financial stability.

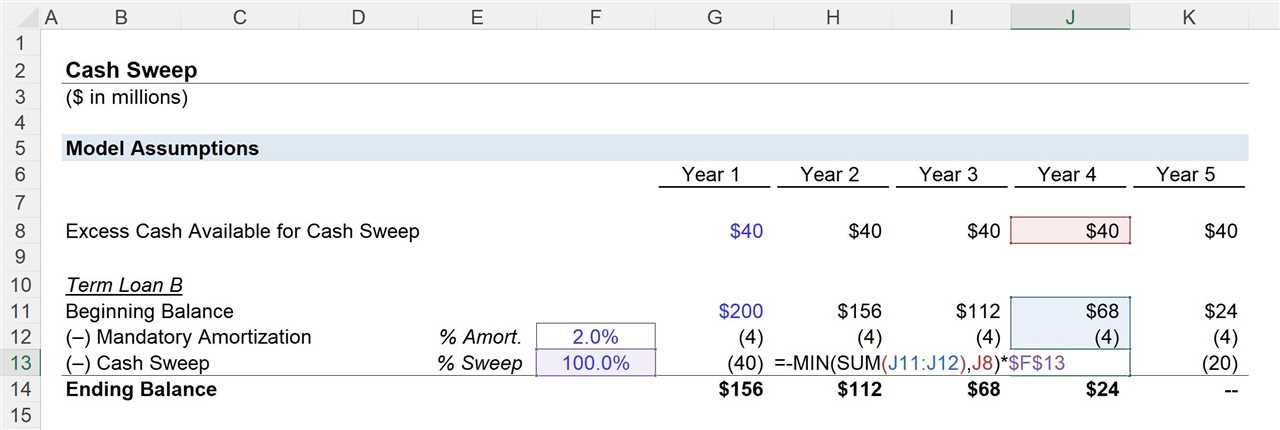

Calculation of Excess Cash Flow

Excess Cash Flow is a financial metric used to determine the amount of cash generated by a company’s operations that is available to service debt obligations. It is calculated by subtracting the company’s mandatory debt payments from its operating cash flow.

To calculate Excess Cash Flow, follow these steps:

- Start by determining the company’s operating cash flow. This can be found in the company’s financial statements, specifically the statement of cash flows.

- Next, identify the company’s mandatory debt payments. These include principal and interest payments on outstanding debt.

- Subtract the mandatory debt payments from the operating cash flow to calculate the Excess Cash Flow.

The formula for calculating Excess Cash Flow is:

For example, let’s say a company has an operating cash flow of $1 million and mandatory debt payments of $500,000. The Excess Cash Flow would be calculated as:

Calculating Excess Cash Flow is important for both investors and lenders. It provides insight into a company’s ability to generate cash and meet its debt obligations. A positive Excess Cash Flow indicates that a company has sufficient cash flow to cover its debt payments, while a negative Excess Cash Flow may signal financial distress.

By analyzing a company’s Excess Cash Flow, investors and lenders can make informed decisions about the company’s creditworthiness and financial health.

Formulas and Example of Excess Cash Flow

The calculation of excess cash flow involves several formulas and can vary depending on the specific financial situation. Here are some common formulas used to calculate excess cash flow:

1. Operating Cash Flow: This is the cash generated from the regular operations of a company. It is calculated by subtracting the operating expenses from the total revenue. The formula for operating cash flow is:

2. Debt Service Coverage Ratio: This ratio measures the ability of a company to meet its debt obligations. It is calculated by dividing the operating income by the total debt service. The formula for debt service coverage ratio is:

Debt Service Coverage Ratio = Operating Income / Total Debt Service

3. Excess Cash Flow: This is the amount of cash flow that exceeds the company’s debt service requirements. It is calculated by subtracting the required debt service from the operating cash flow. The formula for excess cash flow is:

Here is an example to illustrate the calculation of excess cash flow:

A company has a total revenue of $1,000,000 and operating expenses of $800,000. The operating income is $200,000. The total debt service is $150,000. The required debt service is $100,000.

Using the formulas mentioned above, we can calculate the excess cash flow as follows:

Debt Service Coverage Ratio = $200,000 / $150,000 = 1.33

Calculating and analyzing excess cash flow is important for investors, creditors, and financial analysts as it provides insights into a company’s financial health and its ability to meet its debt obligations. It helps in assessing the company’s cash flow management and its capacity for future investments or expansion.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.