Retail Investor: Definition, Activities, and Impact on the Market

A retail investor is an individual investor who buys and sells securities, such as stocks, bonds, and mutual funds, for their personal investment portfolio. Unlike institutional investors, such as banks, pension funds, and hedge funds, retail investors typically invest smaller amounts of money and do not have the same level of market influence.

Retail investors engage in various activities in the market, including researching investment opportunities, making investment decisions, and executing trades. They may rely on financial advisors, online platforms, or their own knowledge and experience to make investment choices.

Furthermore, retail investors play a crucial role in providing liquidity to the market. By actively participating in buying and selling securities, they ensure that there is a continuous flow of trades, which helps maintain market efficiency.

Additionally, retail investors contribute to market diversification. Their investment choices are often driven by personal preferences, beliefs, or interests, which can lead to the creation of niche markets and the discovery of new investment opportunities.

However, it is important to note that retail investors may also be more susceptible to market volatility and manipulation. Their limited resources and access to information can make them vulnerable to market fluctuations and fraudulent activities.

One of the key characteristics of retail investors is that they invest their own money, rather than managing funds on behalf of others. This means that they have a personal stake in the success or failure of their investments. Retail investors can be anyone from individual traders to small business owners or even retirees looking to grow their savings.

Activities of Retail Investors

Retail investors engage in a variety of activities in the stock market. They may buy and sell individual stocks, bonds, or other securities based on their own analysis or recommendations from financial advisors. Some retail investors also participate in initial public offerings (IPOs) or invest in mutual funds or exchange-traded funds (ETFs).

One of the key advantages of retail investors is their ability to make independent investment decisions. Unlike institutional investors who may have to follow certain investment mandates or restrictions, retail investors have the freedom to choose their own investment strategies. This flexibility allows them to take advantage of market opportunities and potentially earn higher returns.

The Importance of Retail Investors in the Market

Retail investors play a crucial role in the stock market ecosystem. Their collective actions can have a significant impact on the prices of individual stocks and overall market trends. When retail investors buy or sell securities, it can create buying or selling pressure, which can influence market prices.

Furthermore, retail investors contribute to market liquidity. By actively participating in buying and selling securities, they provide the necessary liquidity for other market participants, such as institutional investors or market makers. This liquidity helps to ensure that the market functions smoothly and efficiently.

Additionally, retail investors can bring diversity to the market. Their investment choices may differ from those of institutional investors, which can introduce new perspectives and investment strategies. This diversity can help to prevent market concentration and promote healthy competition.

Activities of Retail Investors

Retail investors engage in a wide range of activities in the market. Some of the key activities include:

1. Stock Trading: Retail investors actively participate in buying and selling stocks. They analyze market trends, company financials, and other relevant information to make informed investment decisions. They may trade stocks frequently or hold them for the long term.

2. Mutual Fund Investments: Retail investors often invest in mutual funds, which pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Mutual funds offer retail investors access to professional fund managers and diversification.

3. Bond Investments: Retail investors also invest in bonds issued by governments, municipalities, and corporations. Bonds provide fixed income and are considered less risky than stocks. Retail investors may buy individual bonds or invest in bond funds.

4. ETF Investments: Retail investors can invest in ETFs, which are similar to mutual funds but trade on stock exchanges like individual stocks. ETFs offer diversification and flexibility, allowing investors to gain exposure to specific sectors, asset classes, or investment strategies.

5. Options and Futures Trading: Some retail investors engage in options and futures trading, which involve contracts to buy or sell assets at a predetermined price in the future. These derivative instruments can be used for hedging or speculation purposes.

Retail investors also participate in initial public offerings (IPOs), crowdfunding platforms, real estate investments, and other alternative investment opportunities. They may seek advice from financial advisors or use online trading platforms to execute their investment strategies.

The activities of retail investors have a significant impact on the financial markets. Their buying and selling decisions can drive stock prices, affect market liquidity, and influence overall market sentiment. Retail investors’ collective actions can create market trends and contribute to market volatility.

It is important for retail investors to educate themselves about investment principles, risk management, and market dynamics. They should diversify their portfolios, set realistic investment goals, and stay informed about market developments. By actively participating in the market, retail investors can potentially generate wealth and contribute to economic growth.

Importance of Retail Investors in the Market

Retail investors play a crucial role in the financial markets. They are individual investors who buy and sell securities for their personal investment portfolios, as opposed to institutional investors such as mutual funds, pension funds, or hedge funds. While institutional investors dominate the market in terms of volume and capital, retail investors have a significant impact on market dynamics and contribute to market liquidity.

Market Liquidity

Retail investors provide liquidity to the market by actively participating in buying and selling securities. Their constant presence ensures that there is a continuous flow of transactions, which facilitates smooth market operations. When retail investors buy securities, they increase demand, driving up prices. On the other hand, when they sell securities, they create supply, leading to price decreases. This buying and selling activity helps to establish fair market prices and prevents extreme price fluctuations.

Market Efficiency

Retail investors contribute to market efficiency by conducting thorough research and analysis before making investment decisions. They often rely on publicly available information and use their own judgment to evaluate the potential risks and rewards of different investment opportunities. This active involvement helps to uncover mispriced securities and correct market inefficiencies. Retail investors’ actions can also influence market sentiment and affect the behavior of other market participants, leading to more accurate pricing and improved market efficiency.

Diversification

Retail investors play a crucial role in diversifying the market. They invest in a wide range of securities across different sectors, industries, and geographic regions. This diversification helps to spread risk and reduce the impact of any individual security or sector on the overall market. By investing in various assets, retail investors contribute to a more balanced and stable market environment.

Long-Term Investment

Retail investors often have a long-term investment horizon and are less influenced by short-term market fluctuations. This long-term perspective helps to stabilize the market and reduce volatility. Retail investors’ commitment to their investment strategies can provide stability during periods of market turbulence and prevent panic selling or irrational buying behavior.

Democratic Participation

Retail investors represent the democratization of the financial markets. They provide an opportunity for individual investors to participate in the market and benefit from its potential returns. This democratization helps to distribute wealth and promote economic growth. Retail investors also bring diverse perspectives and investment strategies, which contribute to a more inclusive and robust market ecosystem.

| Benefits of Retail Investors | Impact on the Market |

|---|---|

| Provide liquidity | Smooth market operations |

| Contribute to market efficiency | Correct market inefficiencies |

| Spread risk through diversification | Reduce market volatility |

| Stabilize the market | Prevent panic selling or irrational buying |

| Promote economic growth | Distribute wealth |

Factors Influencing Retail Investors

Economic Conditions

Economic conditions, such as GDP growth, inflation rates, and interest rates, have a direct impact on retail investors’ decisions. During periods of economic expansion, retail investors are more likely to invest in riskier assets, such as stocks, in search of higher returns. On the other hand, during economic downturns, they may opt for safer investments, such as bonds or cash, to preserve capital.

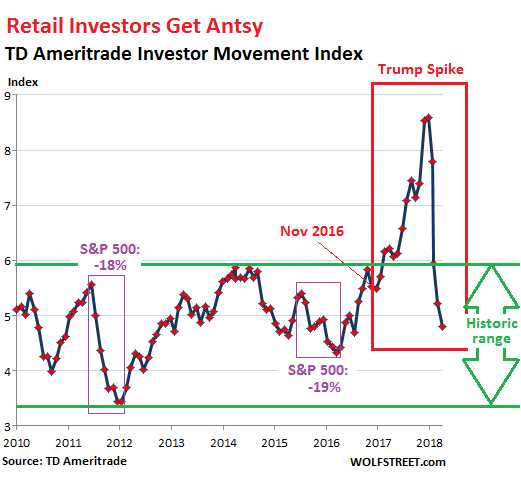

Market Sentiment

Market sentiment, which refers to the overall attitude of investors towards the market, can greatly influence retail investors. Positive market sentiment, characterized by optimism and confidence, often leads to increased buying activity among retail investors. Conversely, negative market sentiment, fueled by fear and uncertainty, may prompt them to sell their holdings or refrain from making new investments.

Media and News

The media plays a crucial role in shaping retail investors’ perceptions and decisions. News about companies, industries, or the overall market can significantly impact their investment choices. Positive news, such as strong earnings reports or favorable economic indicators, may attract retail investors to specific stocks or sectors. Conversely, negative news, such as corporate scandals or geopolitical tensions, can lead to a decrease in retail investor interest.

Financial Education

The level of financial education and knowledge among retail investors also influences their investment decisions. Investors with a higher level of financial literacy are more likely to make informed choices and understand the risks involved. On the other hand, those with limited financial knowledge may rely on recommendations from friends, family, or financial advisors, which can sometimes lead to suboptimal investment outcomes.

Regulatory Environment

The Future of Retail Investing

The retail investing landscape is constantly evolving, and it is important to understand the future trends and developments that will shape the industry. Here are some key factors that will influence the future of retail investing:

- Technological advancements: Technology has already had a significant impact on retail investing, with the rise of online trading platforms and robo-advisors. In the future, we can expect further advancements in artificial intelligence, machine learning, and automation, which will make investing more accessible and efficient for retail investors.

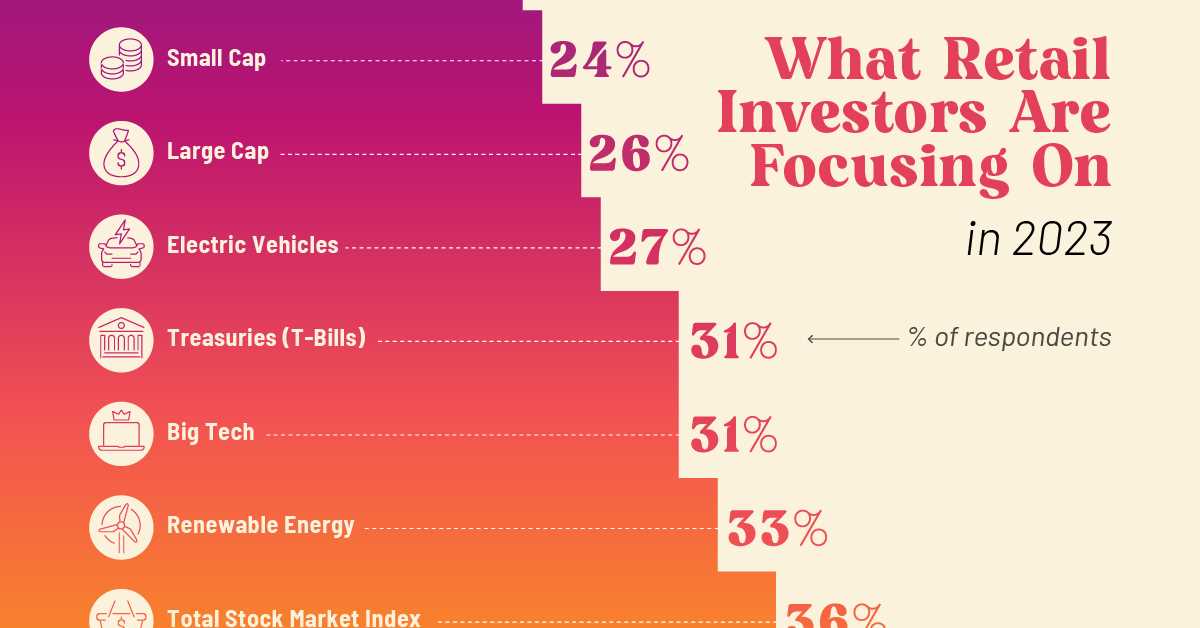

- Demographic shifts: As younger generations enter the workforce and start investing, their preferences and behaviors will shape the future of retail investing. Millennials and Gen Z investors are more likely to prioritize sustainable and socially responsible investments, and they are also more comfortable using technology for investing.

- Regulatory changes: Regulatory changes can have a significant impact on the retail investing landscape. Governments and regulatory bodies are increasingly focused on investor protection and transparency. Changes in regulations can affect the types of investment products available to retail investors and the level of oversight and disclosure required.

- Education and financial literacy: Improving financial literacy among retail investors will be crucial for the future of retail investing. As investing becomes more accessible, it is important for investors to have the knowledge and skills to make informed decisions. Efforts to improve financial education and provide accessible resources will play a key role in shaping the future of retail investing.

- Market volatility and economic conditions: Market volatility and economic conditions will always be factors that influence retail investing. Retail investors need to be aware of market trends and economic indicators to make informed investment decisions. The future of retail investing will depend on how investors navigate and adapt to changing market conditions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.