Residual Standard Deviation Definition

What are Residuals?

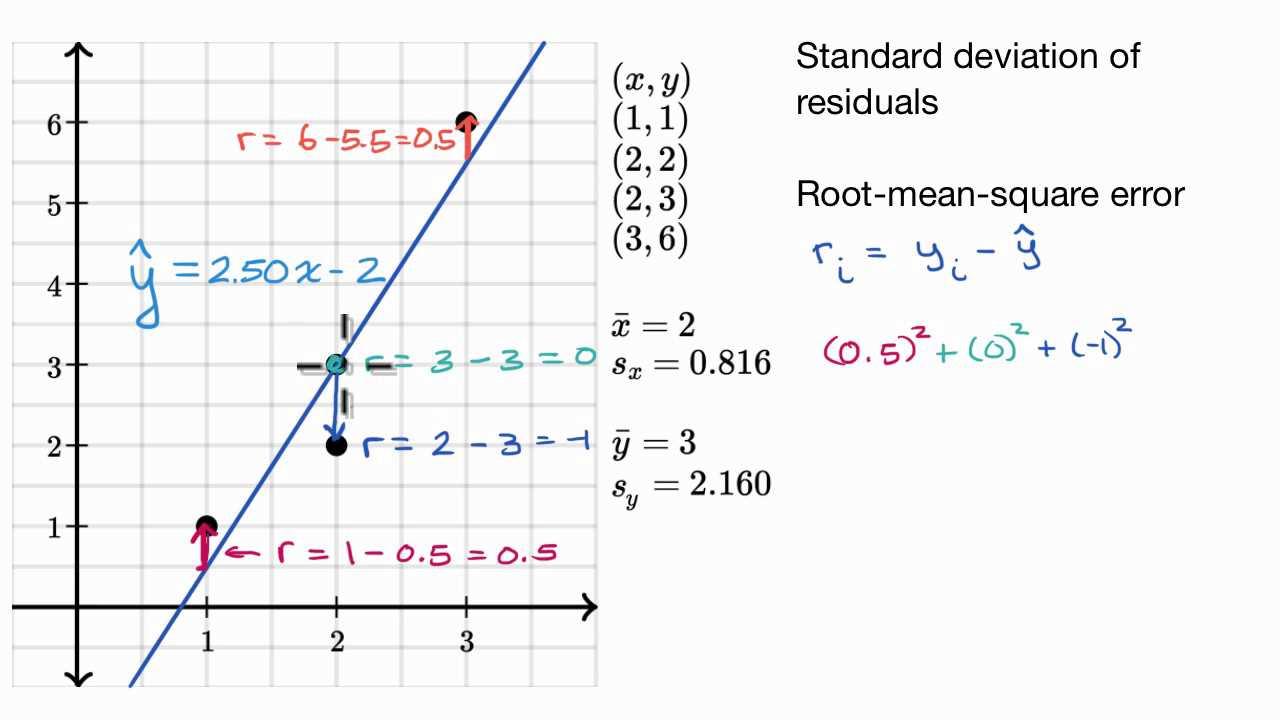

In regression analysis, residuals are the differences between the observed values and the predicted values of the dependent variable. They represent the unexplained variation in the data and are calculated by subtracting the predicted values from the actual values.

Why is Residual Standard Deviation Important?

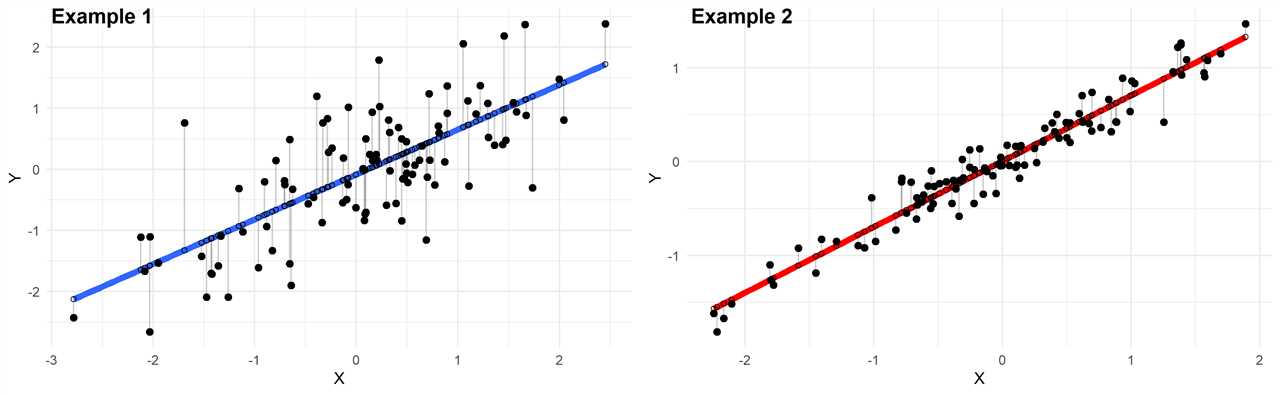

The residual standard deviation is an important measure in financial analysis because it provides an indication of how well the regression model fits the data. A lower residual standard deviation indicates a better fit, while a higher residual standard deviation suggests that the model may not accurately explain the relationship between the variables.

Formula for Residual Standard Deviation

The formula for calculating the residual standard deviation is:

Where:

- observed value is the actual value of the dependent variable

- predicted value is the value predicted by the regression model

- n is the number of observations

- p is the number of predictors or independent variables

Examples of Residual Standard Deviation in Financial Analysis

Let’s consider an example to understand how the residual standard deviation is used in financial analysis. Suppose we have a regression model that predicts the stock prices based on various financial indicators. The residual standard deviation can help us assess the accuracy of the model’s predictions and identify any outliers or unusual observations.

By calculating the residual standard deviation, we can determine the average amount by which the actual stock prices deviate from the predicted values. This information can be valuable for investors and analysts in evaluating the reliability of the regression model and making informed decisions.

What is Residual Standard Deviation?

The residuals are the differences between the observed values and the predicted values from the regression model. The residual standard deviation provides a measure of how much the observed values deviate from the predicted values on average.

The residual standard deviation is an important metric in financial analysis as it helps to evaluate the performance and reliability of regression models used in predicting financial outcomes. It is particularly useful in assessing the accuracy of financial forecasting models, such as those used to predict stock prices or market returns.

The lower the residual standard deviation, the better the regression model fits the data, indicating a higher level of accuracy. Conversely, a higher residual standard deviation suggests that the model has more errors and may not be a good fit for the data.

The formula for calculating the residual standard deviation is:

Where:

- Sum of squared residuals is the sum of the squared differences between the observed values and the predicted values.

- n is the number of observations.

- k is the number of independent variables in the regression model.

By calculating the residual standard deviation, analysts can determine the accuracy of their regression models and make informed decisions based on the reliability of the predictions. It is an essential tool in financial analysis for assessing the quality of regression models and improving forecasting accuracy.

Formula for Residual Standard Deviation

Where:

- y is the observed value

- ŷ is the predicted value

- n is the number of observations

- k is the number of independent variables

The residual standard deviation is used to evaluate the accuracy of a regression model. It measures the average distance between the observed values and the predicted values. A lower residual standard deviation indicates a better fit of the model to the data.

Example:

Let’s consider a simple example to understand the calculation of the residual standard deviation. Suppose we have a dataset with 10 observations and one independent variable. The predicted values for these observations are as follows:

| Observation | Observed Value (y) | Predicted Value (ŷ) | |

|---|---|---|---|

| 1 | 10 | 12 | 4 |

| 2 | 15 | 14 | 1 |

| 3 | 12 | 10 | 4 |

| 4 | 8 | 9 | 1 |

| 5 | 9 | 8 | 1 |

| 6 | 11 | 12 | 1 |

| 7 | 14 | 13 | 1 |

| 8 | 13 | 15 | 4 |

| 9 | 10 | 11 | 1 |

| 10 | 12 | 10 | 4 |

Using the formula, we can calculate the residual standard deviation as follows:

Therefore, the residual standard deviation for this dataset is approximately 1.66.

The residual standard deviation is a useful measure in financial analysis as it helps assess the accuracy of regression models and the variability of data points around the predicted values. It is commonly used in risk management, portfolio analysis, and forecasting.

Examples of Residual Standard Deviation in Financial Analysis

Residual standard deviation is a statistical measure used in financial analysis to assess the variability of the residuals, or errors, in a regression model. It provides valuable insights into the accuracy and reliability of the model’s predictions.

Example 1: Stock Returns

Let’s consider a hypothetical example of analyzing stock returns using a regression model. The model aims to predict the returns of a particular stock based on various factors such as market conditions, industry performance, and company-specific data.

After running the regression analysis, we obtain a residual standard deviation of 0.05. This means that, on average, the actual stock returns deviate from the predicted returns by 5%.

By examining the residual standard deviation, we can assess the effectiveness of the regression model in accurately predicting stock returns. A lower residual standard deviation indicates a more precise and reliable model.

Example 2: Loan Default Rates

Another application of residual standard deviation in financial analysis is assessing the risk associated with loan default rates. A regression model can be used to predict the likelihood of borrowers defaulting on their loans based on various factors such as credit score, income level, and loan amount.

Suppose we have a regression model that predicts loan default rates with a residual standard deviation of 0.1. This indicates that, on average, the actual default rates deviate from the predicted rates by 10%.

By analyzing the residual standard deviation, financial analysts can evaluate the accuracy of the model in predicting loan default rates. A higher residual standard deviation suggests a higher level of uncertainty and risk associated with the predictions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.