Regulation U Bank Requirements

Under Regulation U, banks and other lenders are required to adhere to certain requirements when extending credit for the purchase of margin stock. These requirements include:

- Initial Margin: Regulation U requires borrowers to provide an initial margin of at least 50% of the purchase price of the margin stock. This means that borrowers must have at least 50% of the purchase price in their own funds, and can borrow the remaining 50% from the bank or lender.

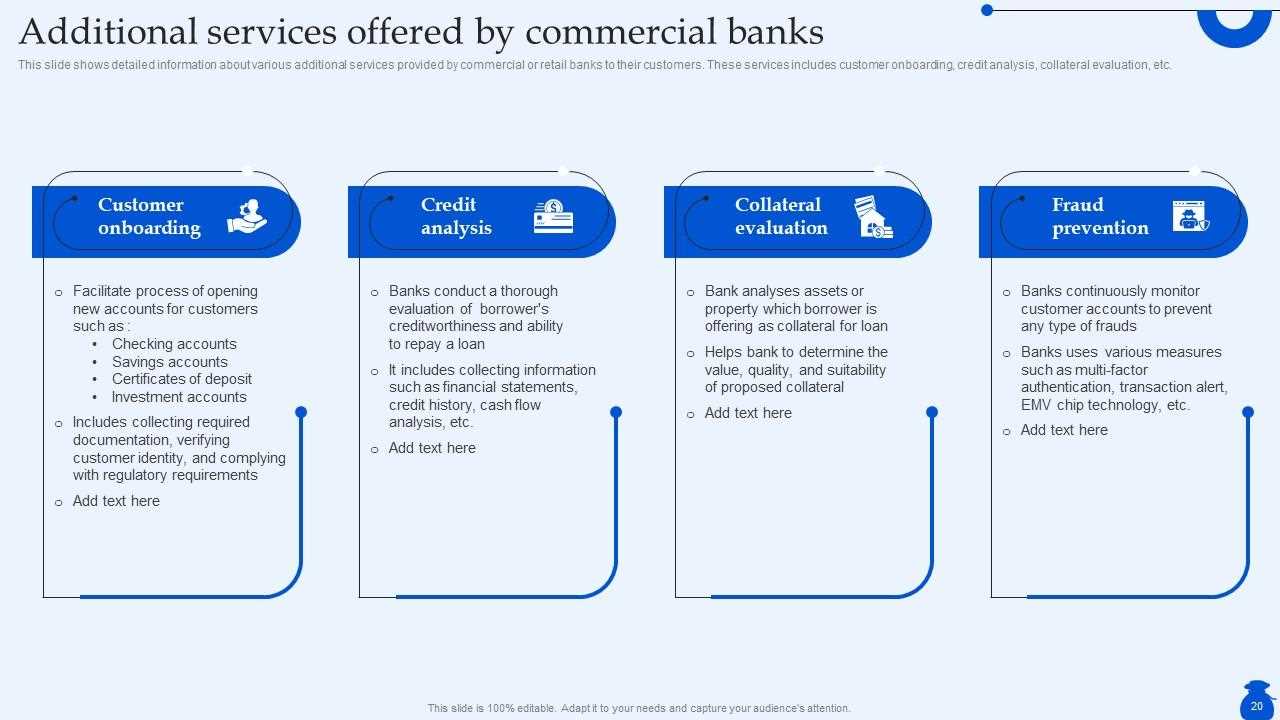

- Collateral: In addition to the initial margin, Regulation U also requires borrowers to provide collateral for the loan. The collateral can be in the form of cash, securities, or other assets that have a readily ascertainable market value.

- Loan-to-Value Ratio: Regulation U sets a maximum loan-to-value ratio of 50%. This means that the total amount of credit extended by the bank or lender cannot exceed 50% of the current market value of the margin stock.

- Record-Keeping: Regulation U also requires banks and lenders to keep detailed records of all transactions related to margin stock, including the amount of credit extended, the collateral provided, and the margin maintained by the borrower.

It is important for banks and lenders to comply with Regulation U to ensure the stability and integrity of the financial system. By setting these requirements, the Federal Reserve aims to prevent excessive speculation and promote responsible lending practices.

Overall, Regulation U plays a crucial role in regulating the extension of credit for the purchase of margin stock, and banks and lenders must carefully adhere to its requirements to avoid potential penalties or regulatory action.

Overview of Regulation U

The main objective of Regulation U is to prevent excessive speculation and maintain the stability of the financial system. It sets limits on the amount of credit that banks can extend for the purchase of margin stock, as well as establishes collateral and margin requirements.

Under Regulation U, banks are required to obtain collateral from borrowers to secure the credit extended for the purchase of margin stock. The collateral can be in the form of cash, securities, or other assets that have a readily ascertainable market value. This collateral provides a cushion for the bank in case the borrower defaults on the loan.

In addition to collateral requirements, Regulation U also sets loan-to-value ratio limits. The loan-to-value ratio is the ratio of the amount of credit extended to the value of the margin stock being purchased. The purpose of this ratio is to limit the amount of leverage that borrowers can use when purchasing margin stock.

Margin requirements are another important aspect of Regulation U. Banks are required to maintain a certain margin, or equity, in the margin stock purchased with borrowed funds. This margin acts as a buffer against potential losses and helps to ensure the stability of the financial system.

Overall, Regulation U plays a crucial role in regulating the extension of credit for the purchase of margin stock. By setting collateral, loan-to-value ratio, and margin requirements, it helps to prevent excessive speculation and maintain the stability of the financial system.

Collateral Requirements under Regulation U

Collateral requirements are an important aspect of Regulation U, which is a federal regulation implemented by the Federal Reserve. This regulation applies to banks and other financial institutions that extend credit for the purpose of purchasing or carrying securities.

Under Regulation U, banks are required to obtain collateral from borrowers to secure the loan. The collateral serves as a form of protection for the bank in case the borrower defaults on the loan. The value of the collateral must be sufficient to cover the loan amount, including interest and fees.

The types of collateral that are acceptable under Regulation U include cash, securities, and other assets that have a readily ascertainable market value. The value of the collateral is determined based on its market value at the time the loan is made.

In addition to the type of collateral, Regulation U also specifies the margin requirements that banks must adhere to. The margin requirement is the percentage of the loan amount that must be covered by collateral. For example, if the margin requirement is 50%, then the collateral must be worth at least 50% of the loan amount.

It is important to note that Regulation U sets different margin requirements depending on the type of security being purchased. For example, the margin requirement for non-exempted securities is generally 50%, while the margin requirement for exempted securities is 25%. Banks must ensure that they comply with these margin requirements when extending credit for the purchase of securities.

Furthermore, Regulation U also imposes restrictions on the use of certain types of collateral. For example, banks are prohibited from accepting certain types of securities as collateral, such as securities issued by affiliates of the borrower or securities that are subject to resale restrictions.

| Key Points |

|---|

| Collateral requirements are a key aspect of Regulation U. |

| Banks must obtain collateral to secure loans. |

| The collateral must be sufficient to cover the loan amount. |

| Acceptable collateral includes cash, securities, and other assets. |

| Margin requirements specify the percentage of the loan amount that must be covered by collateral. |

| Regulation U sets different margin requirements for different types of securities. |

| Restrictions are imposed on the use of certain types of collateral. |

Loan-to-Value Ratio under Regulation U

Under Regulation U, the loan-to-value (LTV) ratio is an important factor in determining the maximum amount of credit that a bank can extend for a margin loan. The LTV ratio is calculated by dividing the amount of the loan by the appraised value of the collateral.

The purpose of the LTV ratio is to assess the risk associated with the loan and ensure that the bank is not lending an excessive amount relative to the value of the collateral. This helps to protect the bank from potential losses in the event of default by the borrower.

Calculating the Loan-to-Value Ratio

To calculate the LTV ratio, the bank will need to obtain an appraisal of the collateral. The appraised value is an estimate of the fair market value of the collateral, which is typically determined by a qualified appraiser.

Once the appraised value is determined, the bank will divide the amount of the loan by the appraised value to calculate the LTV ratio. For example, if the loan amount is $100,000 and the appraised value of the collateral is $150,000, the LTV ratio would be 66.67% ($100,000 / $150,000).

Maximum Loan-to-Value Ratio

Regulation U sets a maximum LTV ratio that banks must adhere to when extending credit for margin loans. The specific maximum LTV ratio may vary depending on the type of collateral and the purpose of the loan.

For example, Regulation U may require a maximum LTV ratio of 50% for certain types of securities, while allowing a higher maximum LTV ratio of 70% for other types of collateral. The purpose of the loan, such as whether it is for purchasing securities or for other purposes, may also impact the maximum LTV ratio.

Implications of the Loan-to-Value Ratio

The LTV ratio has implications for both the borrower and the lender. For the borrower, a lower LTV ratio means they will need to provide a larger amount of collateral to secure the loan. This can limit their borrowing capacity and may require them to provide additional assets as collateral.

For the lender, a lower LTV ratio reduces the risk of potential losses in the event of default by the borrower. By limiting the amount of credit extended relative to the value of the collateral, the lender can better protect themselves from market fluctuations and potential declines in the value of the collateral.

| Loan Amount | Appraised Value of Collateral | Loan-to-Value Ratio |

|---|---|---|

| $100,000 | $150,000 | 66.67% |

Margin Requirements under Regulation U

Margin requirements under Regulation U are rules set by the Federal Reserve to govern the amount of credit that can be extended by banks for the purpose of purchasing securities. These requirements are designed to prevent excessive borrowing and maintain stability in the financial system.

Under Regulation U, banks are required to maintain a margin of at least 50% on loans secured by margin stock. Margin stock refers to securities that are traded on a national securities exchange or designated as margin stock by the Federal Reserve. This means that banks can only lend up to 50% of the value of the margin stock, with the borrower providing the remaining 50% as collateral.

The margin requirement is calculated based on the loan-to-value ratio (LTV), which is the ratio of the loan amount to the value of the margin stock. For example, if the value of the margin stock is $100,000 and the LTV ratio is 50%, the maximum loan amount that can be extended by the bank is $50,000.

In addition to the initial margin requirement, Regulation U also sets forth maintenance margin requirements. Banks are required to monitor the value of the margin stock and ensure that the margin does not fall below a certain level. If the margin falls below the maintenance margin requirement, the borrower may be required to provide additional collateral or repay a portion of the loan.

It is important for banks to comply with the margin requirements under Regulation U to avoid penalties and maintain the stability of the financial system. Failure to comply with these requirements can result in regulatory action, including fines and restrictions on lending activities.

Frequently Asked Questions about Regulation U

1. What is the purpose of Regulation U?

The purpose of Regulation U is to prevent excessive speculation in the securities market and to protect the financial stability of banks and other financial institutions. It aims to ensure that borrowers have sufficient collateral to support their margin loans and to prevent the misuse of credit for speculative purposes.

2. Which institutions are subject to Regulation U?

Regulation U applies to banks, savings associations, and other financial institutions that are subject to the jurisdiction of the Federal Reserve. It also applies to nonbank lenders who extend credit for the purpose of purchasing or carrying margin stock.

3. What are the collateral requirements under Regulation U?

Under Regulation U, banks and other financial institutions are required to obtain collateral for margin loans. The collateral must have a market value equal to or greater than the loan amount, and it must be eligible for margin purposes as defined by the Federal Reserve. The specific collateral requirements may vary depending on the type of security being purchased or carried.

4. What is the loan-to-value ratio under Regulation U?

The loan-to-value ratio under Regulation U is the ratio of the loan amount to the market value of the collateral. The Federal Reserve sets the maximum loan-to-value ratio for different types of securities. Banks and other financial institutions must ensure that the loan-to-value ratio does not exceed the prescribed limits.

5. What are the margin requirements under Regulation U?

Margin requirements under Regulation U refer to the minimum amount of equity that borrowers must maintain in their margin accounts. The Federal Reserve sets the margin requirements based on the type of security and the loan-to-value ratio. Banks and other financial institutions must ensure that borrowers meet the minimum margin requirements at all times.

6. Are there any exemptions or exceptions to Regulation U?

Yes, there are certain exemptions and exceptions to Regulation U. For example, loans secured by government securities or certain exempted securities may be exempt from Regulation U. Additionally, certain transactions involving qualified lenders or borrowers may be exempt from certain provisions of Regulation U.

7. What are the penalties for non-compliance with Regulation U?

Non-compliance with Regulation U can result in various penalties, including fines, injunctions, and other enforcement actions by the Federal Reserve. Banks and other financial institutions that fail to comply with Regulation U may also face reputational and legal risks, which can have significant consequences for their business operations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.