Raw Materials: Definition

In the field of economics, raw materials refer to the basic materials or substances that are used in the production of goods or services. These materials are typically obtained from nature and undergo various processes to be transformed into finished products.

Raw materials can be categorized into two types: primary raw materials and secondary raw materials. Primary raw materials are those that are directly extracted from nature, such as minerals, metals, agricultural products, and natural resources like oil and gas. Secondary raw materials, on the other hand, are materials that have already undergone some level of processing and are used as inputs in the production of other goods or services.

Importance of Raw Materials

Accounting for Raw Materials

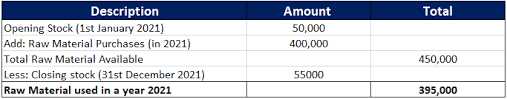

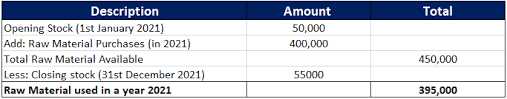

Proper accounting for raw materials is important for businesses to accurately assess their inventory levels, monitor costs, and make informed decisions regarding production and procurement.

Accounting for Raw Materials

The accounting process for raw materials involves tracking and recording the acquisition, usage, and disposal of these materials. This is important for several reasons:

- Cost Control: By accurately accounting for raw materials, businesses can monitor and control their costs. This includes tracking the cost of acquiring materials, as well as any additional costs associated with storage, transportation, or waste disposal.

- Inventory Management: Accounting for raw materials allows businesses to keep track of their inventory levels. This helps ensure that they have enough materials on hand to meet production demands, while also avoiding excess inventory that can tie up capital.

- Financial Reporting: Proper accounting for raw materials is necessary for accurate financial reporting. This includes recording the value of raw materials on the balance sheet as assets, as well as any changes in value due to fluctuations in market prices or obsolescence.

- Compliance: Many industries have regulations or standards that require businesses to maintain accurate records of their raw materials. This is particularly important for industries that deal with hazardous materials or have strict environmental regulations.

To effectively account for raw materials, businesses typically use inventory management systems or software. These systems help automate the tracking and recording process, making it easier to monitor inventory levels, track usage, and generate reports.

Importance and Methods of Accounting for Raw Materials

Accounting for raw materials is essential for businesses in order to accurately track and manage their inventory. Raw materials are the basic substances or components used in the production of goods. They can include items such as wood, metal, chemicals, or fabric, depending on the industry.

Importance of Accounting for Raw Materials

Accurate accounting for raw materials is crucial for several reasons:

- Cost Control: By properly accounting for raw materials, businesses can monitor and control their costs more effectively. This allows them to identify any inefficiencies or areas where cost savings can be made.

- Inventory Management: Accounting for raw materials helps businesses keep track of their inventory levels. This ensures that they have enough materials on hand to meet production demands, while also avoiding excess stock that ties up capital.

- Financial Reporting: Proper accounting for raw materials is necessary for accurate financial reporting. It allows businesses to calculate the cost of goods sold (COGS) and determine their gross profit margins.

- Decision Making: Accurate accounting for raw materials provides businesses with the necessary data to make informed decisions. This includes decisions related to pricing, production planning, and resource allocation.

Methods of Accounting for Raw Materials

There are several methods that businesses can use to account for raw materials:

- First-In, First-Out (FIFO): This method assumes that the first raw materials purchased are the first ones used in production. It is commonly used when the cost of raw materials tends to increase over time.

- Last-In, First-Out (LIFO): This method assumes that the last raw materials purchased are the first ones used in production. It is commonly used when the cost of raw materials tends to decrease over time.

- Weighted Average: This method calculates the average cost of all raw materials in inventory. It is useful when the cost of raw materials fluctuates frequently.

- Specific Identification: This method individually tracks the cost of each unit of raw material. It is used when the raw materials are unique or have significantly different costs.

Choosing the appropriate method of accounting for raw materials depends on various factors, such as industry norms, cost fluctuations, and the nature of the raw materials themselves.

Direct vs Indirect Raw Materials

Direct Raw Materials

Direct raw materials are those that are directly used in the production process to create the final product. These materials can be easily traced and allocated to a specific product or production order. Examples of direct raw materials include wood for furniture manufacturing, fabric for clothing production, or steel for construction projects.

Direct raw materials play a critical role in determining the cost of production. The cost of these materials is directly proportional to the quantity used in the manufacturing process. Therefore, any fluctuations in the price or availability of direct raw materials can significantly impact the overall cost of production.

Indirect Raw Materials

Indirect raw materials, on the other hand, are not directly incorporated into the final product but are still necessary for the production process. These materials are not easily traceable to a specific product or production order. Examples of indirect raw materials include lubricants, cleaning agents, or packaging materials.

Indirect raw materials are essential for maintaining the production process and ensuring smooth operations. While they may not directly impact the cost of production, they still contribute to the overall efficiency and effectiveness of the manufacturing process.

Differentiating Direct and Indirect Raw Materials

Direct Raw Materials

Direct raw materials are the primary inputs used in the production process. These materials can be easily identified and measured, and their costs can be directly allocated to the final product. Examples of direct raw materials include wood for furniture manufacturing, steel for construction, or fabric for clothing production.

Direct raw materials play a crucial role in determining the quality and characteristics of the final product. They directly contribute to the value and functionality of the end product.

Indirect Raw Materials

Examples of indirect raw materials include:

- Office supplies such as pens, paper, and printer ink

- Cleaning supplies and maintenance tools

- Utilities like electricity, water, and internet services

- Protective gear and safety equipment

Indirect raw materials are necessary for the day-to-day operations of a business and ensure that the production process runs efficiently and safely.

Economics of Raw Materials

- Supply and Demand: The availability and demand for raw materials directly influence their prices. Factors such as global market trends, geopolitical events, and natural disasters can affect the supply and demand dynamics. Businesses need to closely monitor these factors to anticipate price fluctuations and make informed decisions.

- Price Volatility: Raw material prices can be highly volatile, which poses risks and challenges for businesses. Sudden price increases can lead to higher production costs, reduced profit margins, and potential supply chain disruptions. Companies must develop strategies to manage price volatility, such as hedging, diversifying suppliers, or exploring alternative materials.

- Global Trade: Raw materials are often traded on a global scale, and international trade policies can significantly impact their availability and prices. Tariffs, trade agreements, and political tensions between countries can disrupt supply chains and create uncertainties for businesses. Staying informed about trade regulations and diversifying sourcing strategies can help mitigate these risks.

- Sustainability and Environmental Impact: The extraction and processing of raw materials can have significant environmental consequences, including deforestation, pollution, and habitat destruction. Businesses are increasingly under pressure to adopt sustainable practices and reduce their environmental footprint. This includes sourcing raw materials from responsible suppliers, promoting recycling and circular economy initiatives, and investing in eco-friendly technologies.

- Technological Advances: Technological advancements can have a profound impact on the economics of raw materials. Innovations in extraction, processing, and recycling technologies can improve efficiency, reduce costs, and minimize environmental impact. Businesses that embrace these advancements can gain a competitive edge and enhance their long-term sustainability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.