Rate of Change: Definition, Formula, and Importance

Definition

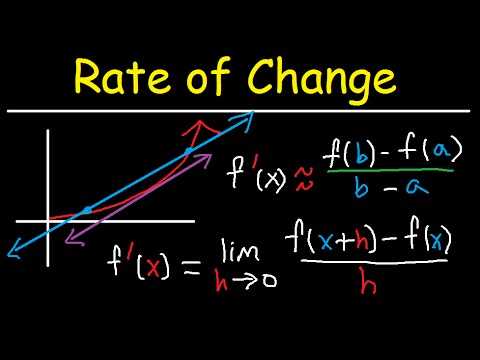

The formula for calculating the rate of change is:

Importance

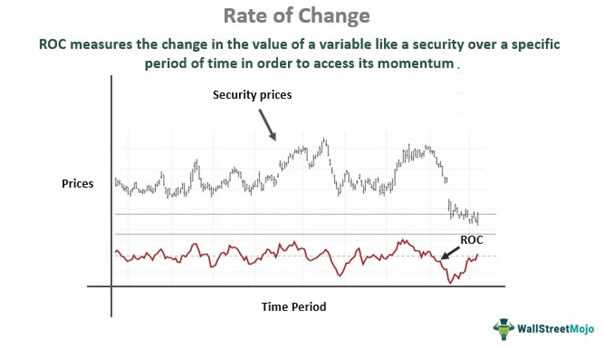

The rate of change is an important tool in technical analysis as it helps traders and investors identify trends and potential reversals in the market. By analyzing the rate of change, traders can determine whether a security is gaining or losing momentum and make informed decisions about buying or selling.

Additionally, the rate of change can be used to compare the performance of different securities or market indices. By calculating the rate of change for multiple variables, traders can identify which securities are outperforming or underperforming others.

Furthermore, the rate of change can be used in conjunction with other technical indicators to confirm or contradict signals. For example, if a security is showing a bullish signal based on a moving average crossover, but the rate of change is decreasing, it may indicate that the bullish trend is losing momentum and a reversal could be imminent.

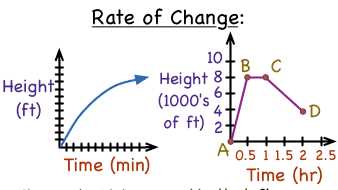

The rate of change is a fundamental concept in mathematics and is widely used in various fields, including finance, physics, and economics. It measures the speed at which a variable is changing over a specific period of time. In the context of advanced technical analysis concepts, the rate of change is particularly important in analyzing the momentum and trend of a financial instrument.

Definition

Where:

- ROC is the rate of change

- Current Value is the latest value of the variable

- Previous Value is the value of the variable at a previous point in time

Importance

The rate of change is an important tool in advanced technical analysis concepts because it provides valuable insights into the momentum and trend of a financial instrument. By calculating the rate of change, traders and analysts can identify periods of accelerating or decelerating price movements, which can help them make informed trading decisions.

Additionally, the rate of change can be used to compare the performance of different financial instruments or market indices. By calculating the rate of change for multiple variables, traders can identify which instruments are outperforming or underperforming others, allowing them to allocate their investments more effectively.

Furthermore, the rate of change can be used in conjunction with other technical indicators, such as moving averages or oscillators, to confirm or validate trading signals. For example, if the rate of change is indicating a strong upward momentum, and a moving average crossover signal is also indicating a bullish trend, it provides a stronger indication of a potential buying opportunity.

Calculating the Rate of Change

The rate of change is a key concept in technical analysis that helps traders and investors understand the momentum and direction of a particular asset’s price movement. It is calculated by comparing the current price of an asset to its price at a previous point in time. By analyzing the rate of change, traders can identify trends, determine the strength of a trend, and make informed decisions about buying or selling assets.

Formula for Calculating Rate of Change

The formula for calculating the rate of change is relatively simple:

For example, let’s say the current price of a stock is $50 and its price at the previous point in time was $40. To calculate the rate of change, we subtract the previous price from the current price and divide the result by the previous price:

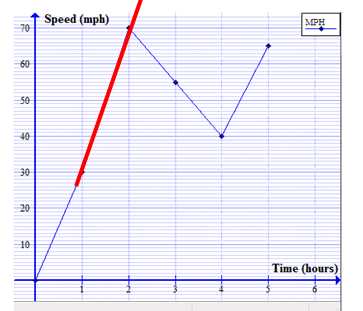

Interpreting the Rate of Change

The rate of change can be interpreted in different ways depending on the context. A positive rate of change indicates that the price of an asset is increasing, while a negative rate of change indicates that the price is decreasing. The magnitude of the rate of change can also provide valuable information. A higher rate of change suggests a stronger trend, while a lower rate of change suggests a weaker trend.

Traders and investors can use the rate of change to identify potential buying or selling opportunities. For example, a high positive rate of change may indicate that a stock is in an uptrend and could continue to rise, making it a good time to buy. Conversely, a high negative rate of change may indicate that a stock is in a downtrend and could continue to fall, making it a good time to sell.

Using Rate of Change in Technical Analysis

The rate of change is a valuable tool in technical analysis because it provides insight into the momentum and direction of price movements. Traders can use the rate of change in conjunction with other technical indicators, such as moving averages or oscillators, to confirm trends and make more accurate predictions about future price movements.

Additionally, the rate of change can be used to identify divergences, which occur when the rate of change and the price of an asset move in opposite directions. Divergences can signal a potential trend reversal and can be useful for traders looking to enter or exit positions.

| Advantages of Using the Rate of Change | Disadvantages of Using the Rate of Change |

|---|---|

| – Provides insight into momentum and direction | – Can be affected by outliers or extreme price movements |

| – Helps identify trends and confirm signals | – May lag behind price movements |

| – Can be used in conjunction with other indicators | – Requires interpretation and analysis |

The Importance of Rate of Change in Advanced Technical Analysis Concepts

One of the key benefits of using the rate of change is its ability to identify trends and reversals. By calculating the rate of change over a specific period, traders can determine whether the price is increasing or decreasing at an accelerating or decelerating rate. This information can help them identify potential trend changes and adjust their positions accordingly.

The rate of change can also be used to measure the strength of price movements. A higher rate of change indicates a stronger momentum, while a lower rate of change suggests a weaker momentum. This can be particularly useful for traders who want to gauge the strength of a trend or identify potential breakouts.

Furthermore, the rate of change can be used in conjunction with other technical indicators to confirm or validate trading signals. For example, if a moving average crossover occurs and is accompanied by a significant increase in the rate of change, it can provide a stronger signal for a potential trend reversal or continuation.

Additionally, the rate of change can be used to identify divergences between price and momentum. Divergences occur when the price and the rate of change move in opposite directions. This can indicate a potential trend reversal or a weakening of the current trend. Traders can use divergences as a signal to enter or exit trades.

Overall, the rate of change is a powerful tool in advanced technical analysis. It provides valuable insights into price momentum, trend strength, and potential reversals. By incorporating the rate of change into their analysis, traders and investors can enhance their decision-making process and improve their trading performance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.