Qualified Distribution Definition

A qualified distribution refers to a withdrawal made from a retirement plan that meets certain requirements set by the Internal Revenue Service (IRS). These requirements are designed to ensure that the funds are used for retirement purposes and not for other non-retirement expenses.

How Plans Work

Retirement plans, such as 401(k)s and individual retirement accounts (IRAs), are established to help individuals save for their retirement. These plans offer tax advantages, such as tax-deferred growth and potential tax deductions for contributions.

When an individual contributes to a retirement plan, the funds are typically invested in a variety of assets, such as stocks, bonds, and mutual funds. Over time, these investments can grow in value, allowing the individual to accumulate a substantial retirement nest egg.

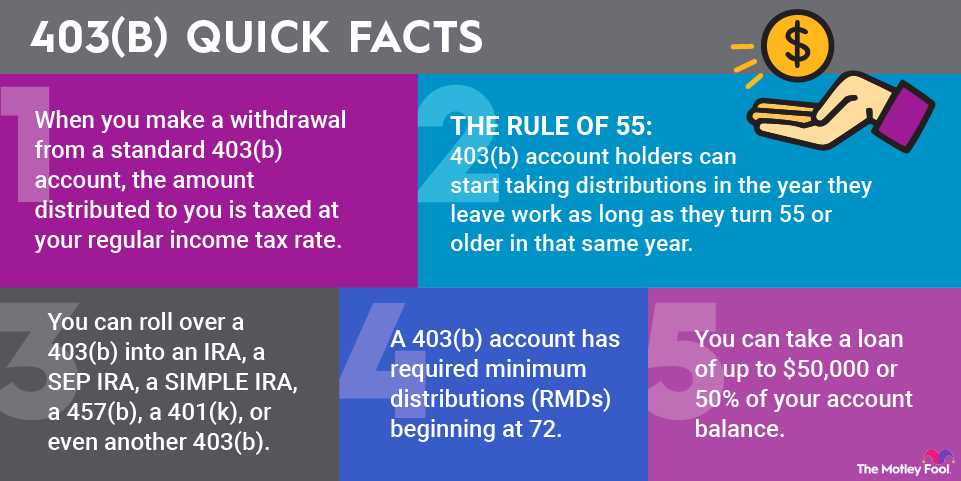

However, there are restrictions on when and how the funds can be withdrawn from a retirement plan. The IRS imposes penalties and taxes on early withdrawals to discourage individuals from using their retirement savings for non-retirement purposes.

Taxation in Retirement Planning

One of the key benefits of qualified distributions is the favorable tax treatment. When a qualified distribution is made from a retirement plan, the funds are generally taxed as ordinary income. However, if the distribution is made from a Roth IRA, the funds may be tax-free if certain conditions are met.

On the other hand, non-qualified distributions, which do not meet the IRS requirements, may be subject to additional taxes and penalties. For example, if an individual withdraws funds from a retirement plan before reaching the age of 59 ½, they may be subject to a 10% early withdrawal penalty in addition to regular income taxes.

It is important for individuals to understand the rules and regulations surrounding qualified distributions to ensure they make informed decisions about their retirement savings. Consulting with a financial advisor or tax professional can provide valuable guidance in navigating the complexities of retirement planning and taxation.

Once the money is contributed to the retirement plan, it is typically invested in a variety of assets, such as stocks, bonds, and mutual funds. The goal of these investments is to grow the value of the retirement account over time, so that individuals have a substantial nest egg when they retire.

Additionally, individuals should also understand the concept of vesting. Vesting refers to the amount of time an individual must work for an employer before they are entitled to the full value of their employer’s contributions to their retirement plan. This is an important consideration for individuals who may change jobs frequently.

Taxation in Retirement Planning

Retirement accounts, such as 401(k)s and IRAs, offer individuals the opportunity to save for their future while enjoying certain tax advantages. Contributions to these accounts are typically made on a pre-tax basis, meaning that individuals can deduct the amount they contribute from their taxable income. This reduces their overall tax liability in the year of contribution.

However, when it comes time to withdraw funds from these accounts during retirement, individuals must pay taxes on the distributions. The tax treatment of these distributions depends on the type of retirement account and the individual’s tax bracket at the time of withdrawal.

Traditional retirement accounts, such as traditional IRAs and 401(k)s, are taxed as ordinary income when funds are withdrawn. This means that the distributions are subject to the individual’s marginal tax rate, which is based on their overall income and tax bracket. For example, if an individual is in the 25% tax bracket and withdraws $10,000 from their traditional IRA, they would owe $2,500 in taxes on that distribution.

Roth retirement accounts, on the other hand, offer tax-free withdrawals in retirement. Contributions to Roth accounts are made on an after-tax basis, meaning that individuals do not receive a tax deduction for their contributions. However, when funds are withdrawn during retirement, both the contributions and any earnings are tax-free. This can be a significant advantage for individuals who anticipate being in a higher tax bracket during retirement.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.