Petty Cash Management: A Comprehensive Guide with Examples

Petty cash management is an essential aspect of financial management for any organization. It involves the proper handling and tracking of small cash transactions that occur on a day-to-day basis. These transactions may include minor expenses such as office supplies, postage, or refreshments.

Effective petty cash management ensures that these small expenses are accounted for accurately and that there is a proper system in place to track and control the flow of cash. This helps to prevent misuse or theft of funds and allows for better financial control within the organization.

Once the vouchers are filled out, the custodian should review and approve them before reimbursing the individual. This ensures that all expenses are legitimate and within the approved budget. The custodian should also keep a record of all transactions and reconcile the petty cash fund on a regular basis.

Examples of petty cash management can vary depending on the organization. For example, a small business may have a petty cash fund of $100, while a larger organization may have a fund of $500 or more. The frequency of reimbursement may also vary, with some organizations reimbursing on a weekly basis and others on a monthly basis.

Petty cash is a small amount of cash that is kept on hand by a company or organization to cover small expenses. It is typically used for purchases that are too small to justify writing a check or using a credit card. The amount of petty cash varies depending on the needs of the company, but it is usually a fixed amount that is replenished regularly.

Managing petty cash effectively is important for several reasons. First, it allows for quick and convenient payment of small expenses without the need for formal approval or paperwork. This can help streamline the purchasing process and improve efficiency. Second, it provides a way to track and control small expenses, ensuring that they are properly recorded and accounted for. This can help prevent fraud or misuse of funds. Finally, it allows for flexibility in spending, as petty cash can be used for a wide range of small expenses that may arise.

Establishing a Petty Cash System

Before implementing a petty cash system, it is important to establish clear guidelines and procedures. This includes determining the amount of petty cash to be kept on hand, as well as who will be responsible for managing and replenishing it. It is also important to establish a process for documenting and approving petty cash transactions.

One common method for managing petty cash is to use a petty cash fund. This involves setting aside a specific amount of cash in a designated location, such as a locked drawer or cash box. The amount of cash in the fund should be sufficient to cover anticipated expenses, but not so much that it becomes a security risk. The fund should be replenished regularly, either by transferring funds from the company’s bank account or by reimbursing the petty cash custodian.

Managing Petty Cash Transactions

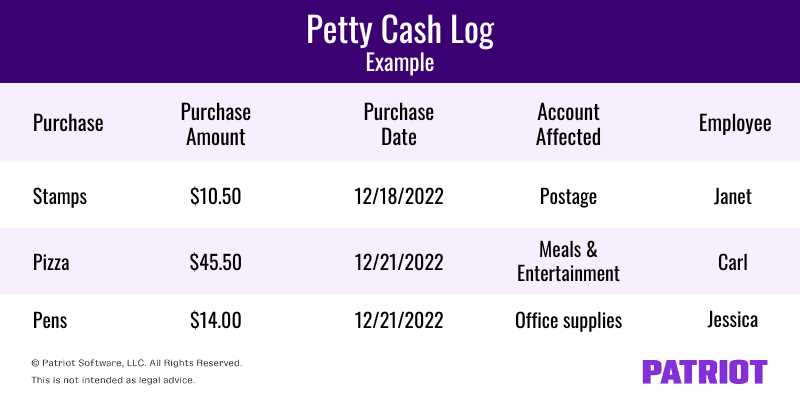

Once the petty cash system is established, it is important to properly manage and document all transactions. This includes keeping a record of all petty cash disbursements and receipts, as well as maintaining a log of the remaining cash balance. Each transaction should be supported by a receipt or other documentation, and should be approved by a designated individual.

A common method for managing petty cash transactions is to use a petty cash voucher system. This involves using pre-printed vouchers to document each transaction, including the date, amount, purpose, and recipient of the cash. The voucher should be signed by both the recipient and the approving individual, and a copy should be retained for record-keeping purposes.

In addition to managing transactions, it is important to periodically reconcile the petty cash fund. This involves comparing the cash balance to the recorded transactions to ensure that they match. Any discrepancies should be investigated and resolved promptly.

| Advantages of Petty Cash Management | Disadvantages of Petty Cash Management |

|---|---|

| Allows for quick and convenient payment of small expenses | Can be susceptible to theft or fraud if not properly managed |

| Provides a way to track and control small expenses | Requires regular monitoring and reconciliation |

| Allows for flexibility in spending | May not be suitable for larger or more complex expenses |

Importance of Petty Cash Management

Petty cash management is a crucial aspect of financial management for any organization. It involves the proper handling and tracking of small cash transactions that occur on a day-to-day basis. While the amounts may seem insignificant, the efficient management of petty cash can have a significant impact on the overall financial health of a company.

1. Control and Accountability

One of the primary reasons why petty cash management is important is because it helps maintain control and accountability over small cash transactions. By establishing a clear system for managing petty cash, organizations can ensure that all expenses are properly recorded and accounted for. This helps prevent misuse or misappropriation of funds and promotes transparency within the organization.

2. Expense Tracking

Petty cash management also plays a vital role in expense tracking. By keeping a record of all petty cash transactions, organizations can easily track and analyze their expenses. This allows them to identify areas where costs can be reduced or optimized, leading to better financial decision-making.

Furthermore, accurate expense tracking enables organizations to comply with tax regulations and financial reporting requirements. It provides a clear audit trail and ensures that all expenses are properly documented, reducing the risk of non-compliance and potential legal issues.

3. Cash Flow Management

Effective petty cash management contributes to better cash flow management. By properly managing small cash transactions, organizations can avoid cash shortages or overages. This ensures that there is always enough cash on hand to cover immediate expenses without disrupting the overall cash flow of the organization.

Additionally, efficient petty cash management allows organizations to forecast and plan their cash flow more accurately. By analyzing past petty cash transactions, they can identify patterns and trends, enabling them to make informed decisions regarding cash flow management.

4. Employee Empowerment

Implementing a well-structured petty cash management system empowers employees by giving them the responsibility to handle small cash transactions. This not only streamlines the process but also promotes a sense of ownership and accountability among employees.

When employees are entrusted with petty cash management, they become more aware of their spending habits and are more likely to make responsible financial decisions. This can lead to cost savings and improved financial discipline within the organization.

Establishing a Petty Cash System

Establishing a petty cash system is an essential part of effective cash management for businesses. A petty cash system allows for the efficient handling of small, day-to-day expenses that occur in the course of business operations. It provides a convenient way to handle expenses such as office supplies, postage, and minor repairs without the need for writing checks or using company credit cards.

When establishing a petty cash system, there are several key steps to follow:

1. Determine the Petty Cash Float:

2. Designate a Custodian:

Next, designate a trusted employee to be the custodian of the petty cash fund. This person will be responsible for managing the cash, making disbursements, and maintaining accurate records. It is important to choose someone who is reliable and detail-oriented.

3. Establish Procedures:

4. Set Limits and Controls:

Set limits on the amount of cash that can be disbursed from the petty cash fund without additional approval. This helps to prevent abuse and ensures that expenses are properly authorized. Implementing controls such as requiring receipts for all expenses and conducting regular audits can also help to maintain accountability.

5. Replenish the Fund:

Regularly replenish the petty cash fund to maintain the established float. This can be done by reimbursing the custodian for approved expenses and adding additional cash as needed. Keeping accurate records of disbursements and replenishments is crucial for tracking expenses and ensuring that the fund remains balanced.

By following these steps, businesses can establish a well-functioning petty cash system that streamlines the management of small expenses. This not only saves time and resources but also promotes financial transparency and accountability within the organization.

Managing Petty Cash Transactions

Managing petty cash transactions is an essential part of maintaining an organized and efficient accounting system. It involves the proper recording, tracking, and reconciliation of small cash expenses that occur within a business. By implementing effective procedures for managing petty cash, businesses can ensure transparency, accuracy, and accountability in their financial operations.

1. Establishing a Petty Cash Fund

The first step in managing petty cash transactions is to establish a petty cash fund. This involves setting aside a specific amount of cash that will be used for small, day-to-day expenses. The amount of the petty cash fund will vary depending on the needs and size of the business.

To establish the petty cash fund, a designated custodian should be appointed. The custodian is responsible for safeguarding the cash and ensuring that it is used for legitimate business expenses only. The custodian should also keep a record of all transactions and receipts related to the petty cash fund.

2. Recording Petty Cash Transactions

It is important to ensure that all petty cash transactions are supported by valid receipts or invoices. These documents should be attached to the petty cash log as proof of the expense. This documentation is crucial for auditing purposes and to maintain accurate financial records.

3. Replenishing the Petty Cash Fund

As petty cash expenses are incurred, the cash in the petty cash fund will gradually decrease. To ensure that the fund remains at the designated amount, it must be replenished regularly. This can be done by submitting a petty cash reimbursement request to the accounting department.

The reimbursement request should include a summary of all petty cash expenses incurred since the last replenishment, along with the supporting receipts or invoices. The accounting department will review the request, verify the expenses, and issue a reimbursement to the custodian. The custodian will then use the reimbursement to replenish the petty cash fund.

4. Reconciling Petty Cash

Periodically, the petty cash fund should be reconciled to ensure that the recorded transactions match the actual cash on hand. This involves counting the cash in the fund, comparing it to the recorded transactions, and identifying any discrepancies.

If there are discrepancies, the custodian should investigate and resolve them. This may involve reviewing the supporting documentation, verifying the accuracy of the recorded transactions, or conducting further investigations if necessary. Any discrepancies should be documented and reported to the appropriate personnel.

Reconciling petty cash on a regular basis helps to identify any potential issues or irregularities in the management of petty cash. It also ensures that the petty cash fund remains accurate and reliable for future transactions.

| Date | Amount | Purpose | Recipient | Receipt |

|---|---|---|---|---|

| 01/01/2022 | $10.00 | Office supplies | John Smith | View |

| 01/05/2022 | $5.00 | Postage | Jane Doe | View |

| 01/10/2022 | $20.00 | Refreshments | Marketing Team | View |

By following these procedures for managing petty cash transactions, businesses can maintain control over their cash expenses and ensure accurate financial reporting. It is important to regularly review and update the petty cash procedures to adapt to changing business needs and to address any issues that may arise.

Examples of Petty Cash Management

Petty cash management is an essential aspect of any business’s financial operations. It involves the proper handling and tracking of small cash transactions that occur on a day-to-day basis. To illustrate how petty cash management works in practice, let’s take a look at a few examples:

Example 1: Office Supplies

Suppose a company regularly purchases office supplies such as pens, paper, and printer ink. To streamline the process, they allocate a petty cash fund of $200. The office manager is responsible for managing this fund and making small purchases as needed.

When the office manager needs to buy more pens, for example, they would withdraw $10 from the petty cash fund and keep a record of the transaction. They would then purchase the pens and obtain a receipt as proof of the expense.

At the end of the week or month, the office manager would reconcile the petty cash fund by comparing the remaining cash balance to the total value of receipts. If there is a discrepancy, they would investigate and make the necessary adjustments.

Example 2: Employee Reimbursements

Another common use of petty cash is for employee reimbursements. Let’s say an employee uses their own money to purchase office snacks for a team meeting. They can submit a reimbursement request along with the receipt to the petty cash custodian.

The petty cash custodian would then review the request, verify the receipt, and reimburse the employee for the amount spent. This transaction would be recorded in the petty cash log, ensuring that all expenses are properly accounted for.

Example 3: Travel Expenses

In some cases, petty cash may be used to cover small travel expenses. For instance, an employee attending a conference may need to pay for parking or grab a quick meal while on the road. Instead of going through the lengthy process of requesting reimbursement, they can use the petty cash fund to cover these expenses.

Similar to other petty cash transactions, the employee would provide a receipt for the expenses incurred. The petty cash custodian would then deduct the amount from the fund and record the transaction accordingly.

| Date | Expense Description | Amount |

|---|---|---|

| 10/15/2022 | $10 | |

| 10/18/2022 | $20 | |

| 10/20/2022 | $5 |

These examples demonstrate how petty cash management can be implemented in various scenarios. By establishing a clear system for handling small cash transactions and maintaining accurate records, businesses can effectively manage their petty cash and ensure proper financial control.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.