What is Opening Price in Trading?

In trading, the opening price refers to the price at which a security or financial instrument starts trading at the beginning of a trading session. It is the first price at which buyers and sellers agree to transact.

The opening price is an important piece of information for traders and investors as it provides insight into the initial sentiment and demand for a particular security. It sets the tone for the rest of the trading session and can influence the overall market direction.

Definition and Explanation

The opening price is determined through a process called the opening auction or opening call auction. During this period, buyers and sellers submit their orders to buy or sell a security at a specific price. The opening price is then determined based on the supply and demand imbalance at that specific moment.

Example of Opening Price in Trading

Let’s say Company XYZ’s stock closed at $50 per share in the previous trading session. The next morning, when the market opens, buyers and sellers start submitting their orders. After the opening auction, the opening price for Company XYZ’s stock is determined to be $52 per share. This means that the first trade of the day for Company XYZ’s stock occurred at $52 per share.

This opening price of $52 per share provides valuable information to traders and investors. It indicates that there is strong demand for Company XYZ’s stock at the start of the trading session, which may suggest a positive market sentiment and potential upward movement in the stock price.

How Opening Price is Determined

The opening price is determined through a transparent and regulated process called the opening auction. During this period, buyers and sellers submit their orders to buy or sell a security at a specific price. These orders are then matched based on price priority and time priority.

The opening auction typically lasts for a short period of time, usually a few minutes, and the opening price is determined based on the supply and demand imbalance at that specific moment. The exchange or trading platform calculates the opening price based on the orders submitted and executes trades at that price.

It is important to note that the opening price can be influenced by various factors, including market news, economic data, and overall market sentiment. These factors can cause the opening price to deviate from the previous closing price and can result in significant price movements at the beginning of the trading session.

Trading Strategies Involving Opening Price

The opening price can be used as a basis for various trading strategies. Some traders may look for opportunities to buy or sell a security based on the opening price and its relationship to the previous closing price. For example, if the opening price is significantly higher than the previous closing price, it may indicate a bullish sentiment, and traders may consider buying the security.

Other traders may use the opening price as a reference point for setting stop-loss orders or profit targets. They may place these orders based on the opening price and the expected price movement after the opening auction. This can help manage risk and protect profits.

Overall, the opening price plays a crucial role in trading as it provides important information about the initial sentiment and demand for a security. Traders and investors can use this information to make informed decisions and develop trading strategies.

Definition and Explanation

The opening price in trading refers to the price at which a security or financial instrument starts trading at the beginning of a trading session. It is the first price at which buyers and sellers agree to transact and sets the tone for the rest of the trading day.

The opening price is an important data point for traders and investors as it provides valuable information about market sentiment and the initial supply and demand dynamics for a particular security. It is often used as a reference point for determining the overall trend and direction of the market.

Traders and investors analyze the opening price to gain insights into market behavior and make informed trading decisions. They look for patterns and trends in the opening price to identify potential opportunities for buying or selling securities.

For example, if the opening price is significantly higher than the previous closing price, it may indicate bullish sentiment and a potential uptrend. Conversely, if the opening price is lower than the previous closing price, it may suggest bearish sentiment and a potential downtrend.

Example of Opening Price in Trading

Let’s say you are a trader and you are interested in buying shares of a particular company. You decide to monitor the opening price of the stock to make an informed decision about when to buy.

On a particular trading day, the market opens at 9:30 am. The opening price of the stock is the first price at which the stock is traded when the market opens. This price is determined by the interaction of buyers and sellers in the market.

For example, let’s say the opening price of the stock you are interested in is $50. This means that the first trade of the day for that stock was executed at $50 per share.

How Opening Price is Determined

The opening price in trading is determined by a variety of factors, including supply and demand, market sentiment, and the actions of market participants. It is the price at which the first trade of a security or financial instrument occurs at the beginning of a trading session.

There are several methods used to determine the opening price:

1. Auction Method:

In some markets, such as stock exchanges, the opening price is determined through an auction process. During this auction, buyers and sellers submit their orders, and the opening price is set based on the highest bid and the lowest ask price that can be matched.

2. Previous Closing Price:

In other cases, the opening price is simply set at the previous closing price. This is common in markets where trading is continuous, and there is no specific opening or closing auction.

3. Pre-Market Trading:

In certain markets, there is a pre-market trading session where trades can occur before the official opening. The opening price is then determined based on the prices at which trades took place during this pre-market session.

Traders and investors often analyze the opening price and its relationship to other factors, such as news events or technical indicators, to make trading decisions. They may look for patterns or trends in the opening price to identify potential opportunities or risks in the market.

Trading Strategies Involving Opening Price

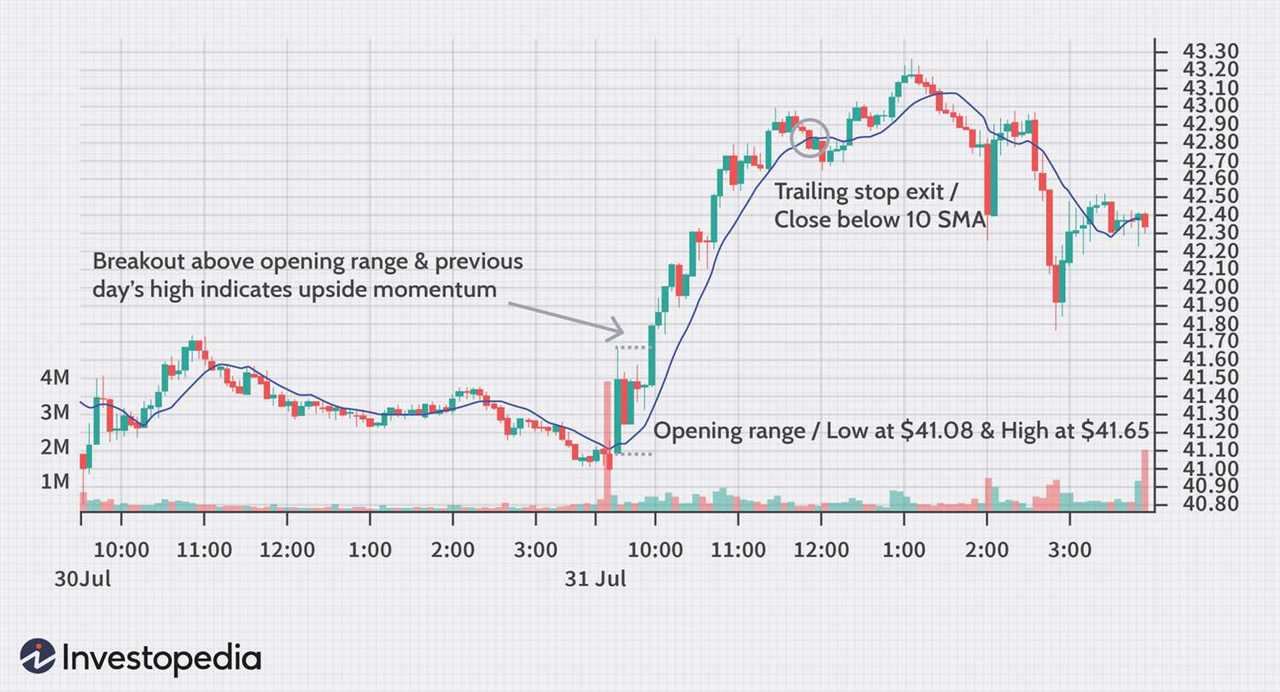

One popular trading strategy involving the opening price is the “Opening Range Breakout” strategy. This strategy involves identifying the high and low price range of a security during the first few minutes of trading after the market opens. Traders then wait for the price to break out of this range, either above the high or below the low, before entering a trade.

Another strategy that traders employ is the “Opening Gap” strategy. This strategy involves identifying significant gaps between the previous day’s closing price and the current day’s opening price. Traders interpret these gaps as potential indicators of market sentiment and use them to make trading decisions. For example, if a stock opens with a significant gap up, traders may interpret it as a bullish signal and consider buying the stock.

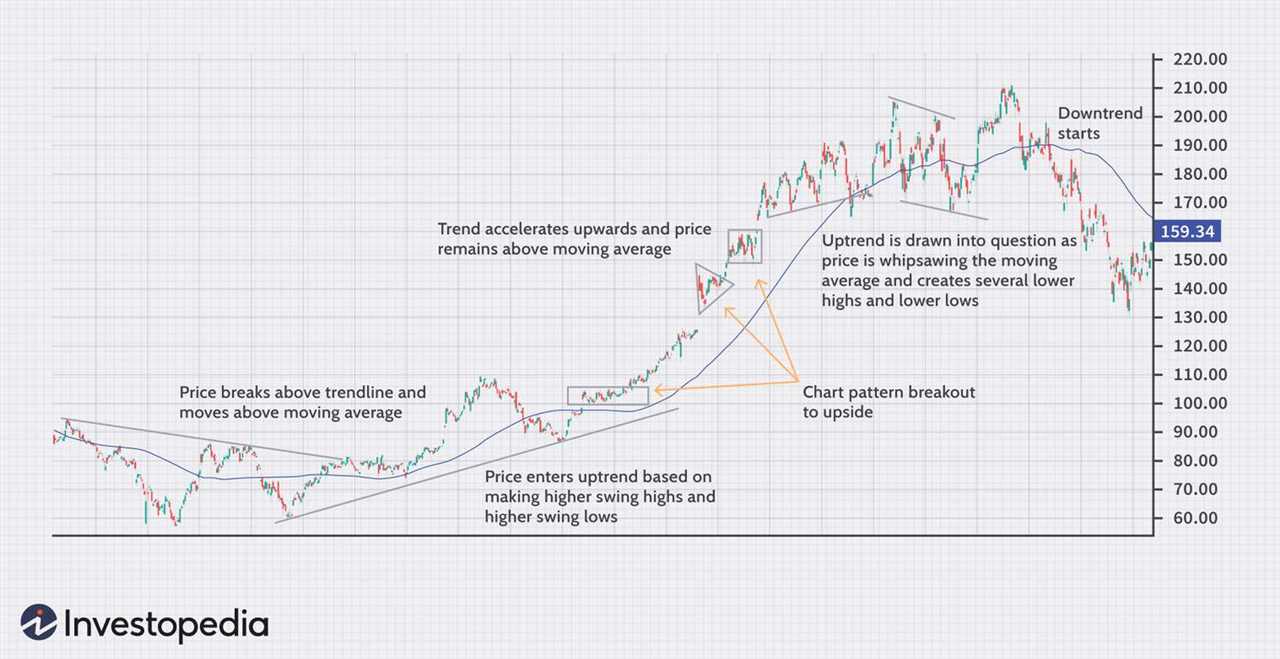

Furthermore, the opening price can also be used in conjunction with technical indicators to develop trading strategies. For instance, traders may use moving averages or trend lines to identify potential support or resistance levels near the opening price. They can then use these levels to determine entry or exit points for their trades.

Additionally, some traders pay close attention to the opening price in relation to the previous day’s closing price. If a security opens above its previous day’s close, it may be seen as a bullish signal, indicating potential upward momentum. Conversely, if a security opens below its previous day’s close, it may be seen as a bearish signal, indicating potential downward momentum.

It is important to note that trading strategies involving the opening price should not be solely relied upon. Traders should conduct thorough analysis, consider other factors such as market trends and news events, and use risk management techniques to mitigate potential losses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.