One-Time Item Overview

One-time items are unique occurrences or events that impact a company’s financial statements. These items are not expected to recur in future periods and are typically excluded from the company’s regular operating activities. One-time items can have both positive and negative effects on a company’s financial performance.

One-time items can include various types of transactions, such as gains or losses from the sale of assets, restructuring charges, legal settlements, or write-offs of impaired assets. These items are often non-recurring and not directly related to the company’s core operations.

Companies may report one-time items separately in their financial statements to provide a clearer picture of their ongoing business performance. By isolating these items, investors and analysts can better assess the company’s underlying profitability and financial health.

One-time items can have significant impacts on a company’s financial statements. For example, a one-time gain from the sale of a subsidiary can boost a company’s net income for a particular period. On the other hand, a one-time charge for a legal settlement can reduce a company’s net income. These items can distort the overall financial performance and should be carefully analyzed and understood.

| Benefits of One-Time Items | Examples of One-Time Items |

|---|---|

|

|

By analyzing one-time items and their impact on a company’s financial statements, investors and analysts can gain valuable insights into the company’s overall financial performance and make more informed decisions.

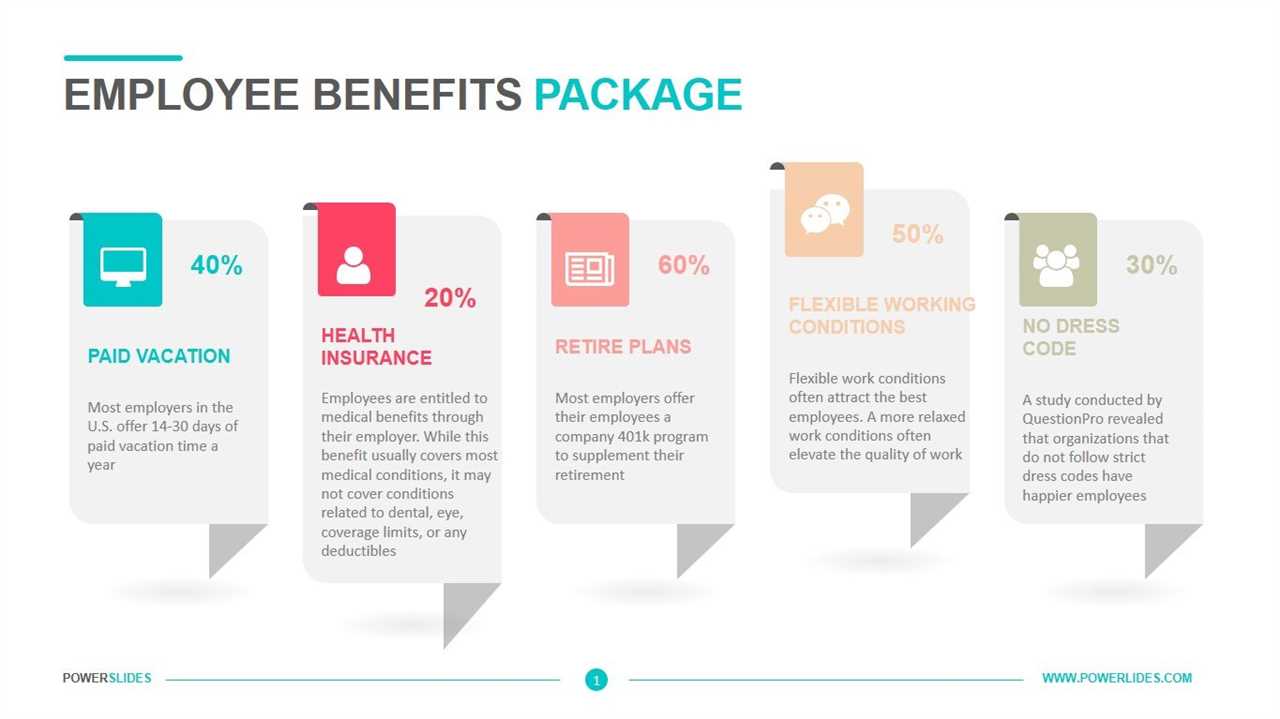

Benefits of One-Time Items

One-time items can provide several benefits for a company’s financial statements. These benefits include:

- Improved Accuracy: By identifying and separating one-time items from recurring items, financial statements can provide a more accurate representation of a company’s ongoing operations. This allows investors and stakeholders to make more informed decisions based on the company’s true financial performance.

- Enhanced Transparency: One-time items can help enhance the transparency of a company’s financial statements. By clearly identifying and explaining these items, companies can provide a clearer picture of their financial position and performance to investors and stakeholders.

- Increased Comparability: One-time items can also improve the comparability of financial statements across different periods and companies. By separating these items, it becomes easier to compare the ongoing operations and financial performance of a company over time or against industry peers.

Examples of One-Time Items

One-time items are unique and non-recurring events or transactions that can significantly impact a company’s financial statements. These items are usually not part of the company’s regular operations and can distort the overall financial performance and position of the company. Here are some examples of one-time items:

1. Restructuring Costs

2. Litigation Settlements

3. Mergers and Acquisitions

4. Natural Disasters

5. Asset Impairments

Companies may need to write down the value of their assets if they become impaired, meaning their carrying value exceeds their recoverable amount. This impairment charge is considered a one-time item as it reflects an unusual and non-recurring event.

These examples illustrate the diverse nature of one-time items and their potential impact on a company’s financial statements. It is important for investors and analysts to identify and understand these items to accurately assess a company’s financial performance and make informed decisions.

| Example | Amount | Impact on Financial Statements |

|---|---|---|

| Restructuring Costs | $10 million | Decrease in net income |

| Litigation Settlements | $5 million | Decrease in cash and increase in liabilities |

| Mergers and Acquisitions | $20 million | Decrease in cash and increase in intangible assets |

| Natural Disasters | $15 million | Decrease in property, plant, and equipment |

| Asset Impairments | $8 million | Decrease in asset value and net income |

Financial Statements and One-Time Items

Financial statements are important tools used by companies to communicate their financial performance and position to stakeholders, such as investors, creditors, and regulators. These statements provide a snapshot of a company’s financial health and help stakeholders make informed decisions.

One-time items can appear in various sections of the financial statements, including the income statement, balance sheet, and cash flow statement. They are typically disclosed separately from recurring items to ensure transparency and clarity. One-time items can have both positive and negative effects on the financial statements.

For example, a company may have a one-time gain from the sale of a non-core asset. This gain would be reported separately on the income statement and can significantly boost the company’s net income for the period. On the other hand, a company may incur a one-time expense, such as a legal settlement or restructuring costs. This expense would also be reported separately and can negatively impact the company’s net income.

It is important for stakeholders to carefully analyze the financial statements and consider the impact of one-time items when making investment or lending decisions. One-time items can distort the true financial performance of a company, especially if they are not properly disclosed or explained. Therefore, it is crucial for companies to provide clear and detailed explanations of one-time items in their financial statements.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.