What is Minority Interest?

Minority interest refers to the ownership or equity stake in a company that is held by individuals or entities who do not have a controlling interest in the company. In other words, it represents the ownership share of the company that is held by minority shareholders.

Minority shareholders are typically individuals or institutional investors who own less than 50% of the company’s shares. They do not have the power to control the decision-making process or the operations of the company. Instead, they rely on the majority shareholders or the controlling party to make decisions on their behalf.

Minority interest is commonly found in companies that have a complex ownership structure, such as public companies with widely dispersed ownership or family-owned businesses where certain family members hold a controlling interest.

Minority interest can be acquired through various means, including purchasing shares on the open market or through private transactions. It can also be obtained through mergers and acquisitions, where the acquiring company may choose to allow the minority shareholders of the target company to retain their ownership stake.

While minority shareholders do not have control over the company, they still have certain rights and protections. These rights may include the right to receive dividends, the right to vote on certain matters, and the right to access company information.

Overall, minority interest plays a significant role in corporate governance and can have an impact on decision-making processes and the overall direction of a company. It is important for both minority shareholders and the controlling party to maintain a transparent and fair relationship to ensure the protection of minority interests.

| Advantages of Minority Interest | Disadvantages of Minority Interest |

|---|---|

| Access to potential financial gains through dividends and capital appreciation | Lack of control over decision-making and operations |

| Diversification of investment portfolio | Potential conflicts of interest with majority shareholders |

| Opportunity to participate in the growth and success of the company | Risk of limited liquidity and inability to sell shares easily |

Overall, minority interest is an important concept in the world of finance and corporate governance. It represents the ownership stake of minority shareholders in a company and can have both advantages and disadvantages. It is crucial for both minority shareholders and the controlling party to maintain open communication and ensure the protection of minority interests.

Definition and Explanation

When a company is owned by multiple shareholders, the majority shareholders have the power to make decisions and control the operations of the company. However, minority shareholders still have certain rights and protections under the law. These rights may include the right to receive dividends, the right to vote on certain matters, and the right to inspect the company’s books and records.

Minority interest can arise in various situations, such as when a company goes public and sells shares to the public, or when a company acquires another company and issues shares to the shareholders of the acquired company. It can also occur when a company is owned by a family or a group of individuals, and some members of the family or group hold a smaller ownership stake.

Types of Minority Interest

There are two main types of minority interest:

Examples of Minority Interest

Here are a few examples to illustrate the concept of minority interest:

| Example | Description |

|---|---|

| Publicly traded company | When a company goes public and sells shares to the public, the shareholders who purchase the shares become minority shareholders. |

| Mergers and acquisitions | When a company acquires another company, the shareholders of the acquired company may receive shares in the acquiring company, making them minority shareholders. |

| Family-owned business | In a family-owned business, some family members may hold a smaller ownership stake, making them minority shareholders. |

It is important to note that minority shareholders may have certain rights and protections under the law to ensure that their interests are not unfairly disregarded by the majority shareholders. These rights may vary depending on the jurisdiction and the specific circumstances of the company.

Types of Minority Interest

Minority interest refers to the ownership of a minority stake in a company. There are different types of minority interest depending on the level of ownership and control.

1. Non-controlling Interest: This type of minority interest occurs when an investor owns less than 50% of the voting shares of a company. The investor does not have control over the decision-making process and is subject to the decisions made by the majority shareholders.

4. Strategic Investments: Strategic investments occur when a company acquires a minority stake in another company to gain access to its resources, technology, or market presence. The investor may not have control over the company but can benefit from the synergies and strategic advantages of the partnership.

5. Passive Investments: Passive investments refer to minority stakes held by investors who do not have any active involvement in the company’s operations or decision-making process. They are purely financial investments made for the purpose of earning a return on investment.

6. Preferred Stock: Preferred stock is a type of equity security that gives the holder preferential treatment over common shareholders, including a fixed dividend payment and priority in the event of liquidation. Preferred stockholders often have a minority interest in the company.

| Type | Ownership Level | Control Level |

|---|---|---|

| Non-controlling Interest | Less than 50% | No control |

| Controlling Interest | Significant influence | |

| Joint Ventures | Shared ownership | No full control |

| Strategic Investments | Varies | No control |

| Passive Investments | Varies | No control |

| Preferred Stock | Varies | No control |

Examples of Minority Interest

Minority interest refers to the ownership or equity stake in a company that is less than 50%. It occurs when an investor or group of investors holds a minority share in a company, meaning they have less control and influence over the company’s operations and decision-making processes.

Here are some examples of minority interest:

| Company | Majority Owner | Minority Owner |

|---|---|---|

| XYZ Corporation | ABC Holdings (75%) | DEF Investments (25%) |

| Acme Inc. | Smith Enterprises (60%) | Jones Holdings (40%) |

| Global Industries | Mega Corporation (80%) | Small Investments (20%) |

Minority interest can arise in various situations, such as when a company goes public and sells shares to the public, or when a company acquires another company but allows the acquired company’s existing shareholders to retain a minority stake.

Overall, minority interest plays a significant role in corporate governance and M&A transactions, as it represents the ownership rights and interests of individuals or entities who do not have majority control over a company.

Importance of Minority Interest in M&A

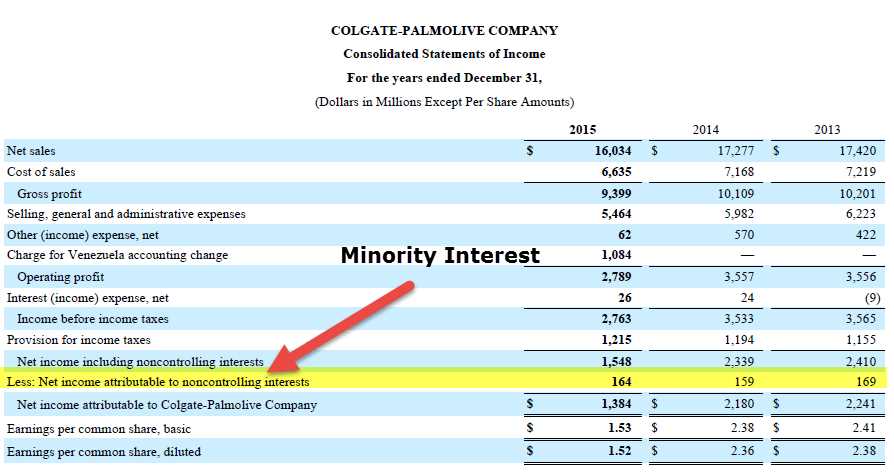

The concept of minority interest plays a crucial role in the field of mergers and acquisitions (M&A). It refers to the ownership stake in a company that is held by individuals or entities who do not have control over the company’s operations or decision-making process. While minority shareholders may not have the power to influence the company’s strategic direction, their interests are still significant and need to be considered in M&A transactions.

Protecting Minority Shareholders’ Rights

One of the key reasons why minority interest is important in M&A is to ensure the protection of minority shareholders’ rights. In many cases, minority shareholders may be at a disadvantage compared to majority shareholders who have control over the company. M&A transactions can potentially impact the value of minority shareholders’ investments, and it is crucial to have mechanisms in place to safeguard their interests.

Through legal frameworks and regulations, minority shareholders are provided with certain rights and protections. These may include the right to receive information about the company, the right to vote on certain matters, and the right to receive a fair price for their shares in the event of a sale or merger. By considering the interests of minority shareholders, M&A transactions can be conducted in a fair and transparent manner.

Enhancing Corporate Governance

Another reason why minority interest is important in M&A is its role in enhancing corporate governance. Minority shareholders can act as a check and balance on the actions of the company’s management and majority shareholders. Their presence can help prevent potential abuses of power and ensure that decisions are made in the best interest of all shareholders.

By having minority shareholders actively involved in the decision-making process, companies can benefit from diverse perspectives and expertise. This can lead to better decision-making, improved corporate performance, and ultimately, increased shareholder value. M&A transactions provide an opportunity to reassess and strengthen corporate governance structures, ensuring that the interests of all shareholders are taken into account.

Unlocking Value and Opportunities

Minority interest can also play a role in unlocking value and opportunities in M&A transactions. In some cases, minority shareholders may hold valuable assets or intellectual property that can complement the acquiring company’s operations. By acquiring the minority interest, the acquiring company can gain access to these assets and leverage them to create synergies and drive growth.

Furthermore, minority shareholders may have unique market insights or relationships that can be beneficial to the acquiring company. By integrating these insights and relationships into the post-merger or acquisition strategy, the acquiring company can tap into new markets, expand its customer base, or improve its competitive position.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.