What is Mezzanine Financing?

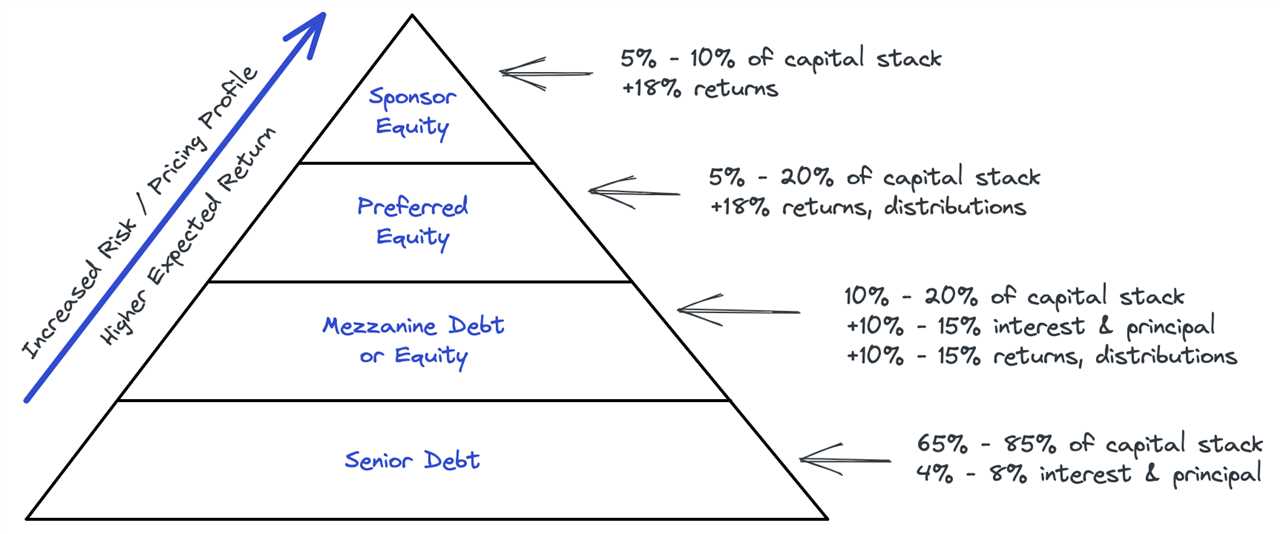

Mezzanine financing is a type of corporate debt that combines elements of debt and equity financing. It is often used by companies to fund growth, acquisitions, or other strategic initiatives. Mezzanine debt sits between senior debt and equity in the capital structure, providing a higher level of risk and potential return for investors.

Unlike traditional bank loans, mezzanine financing typically does not require collateral. Instead, it is backed by the company’s assets and future cash flows. This makes it an attractive option for companies that may not have sufficient collateral to secure a traditional loan.

Mezzanine financing can take various forms, including subordinated debt, preferred equity, or convertible debt. Subordinated debt ranks below senior debt in the event of bankruptcy, while preferred equity provides investors with a higher claim on the company’s assets and cash flows. Convertible debt, on the other hand, can be converted into equity at a later date.

One of the key features of mezzanine financing is its flexibility. It can be structured to meet the specific needs of the company and its investors. For example, the terms of the financing can include various covenants, such as restrictions on the company’s ability to take on additional debt or make certain investments.

Overall, mezzanine financing offers companies a way to access capital that may not be available through traditional sources. It provides investors with an opportunity to earn a higher return compared to senior debt, while still offering some level of security through the company’s assets and cash flows.

Definition and Explanation

Mezzanine financing is a type of corporate debt that sits between senior debt and equity in the capital structure of a company. It is often used to fund growth initiatives, acquisitions, and other strategic investments.

Mezzanine debt is typically unsecured and subordinate to senior debt, meaning that in the event of default or bankruptcy, senior debt holders have priority in receiving repayment. However, mezzanine debt holders have a higher claim on the company’s assets compared to equity holders.

Mezzanine financing is characterized by its hybrid nature, combining features of both debt and equity. While it is structured as a loan with regular interest payments, it also includes equity-like features such as warrants or options that give the lender the right to convert their debt into equity at a later date.

This type of financing is often attractive to companies that are looking to raise capital without diluting existing shareholders or giving up control of the company. It allows them to access additional funding while still maintaining ownership and operational control.

Key Features of Mezzanine Financing:

1. Subordinate to senior debt: Mezzanine debt ranks below senior debt in terms of repayment priority.

2. Unsecured: Mezzanine debt is typically not backed by specific collateral.

3. Hybrid structure: It combines debt-like features, such as regular interest payments, with equity-like features, such as conversion rights.

4. Higher risk, higher return: Mezzanine financing carries higher interest rates compared to senior debt to compensate for the increased risk.

Applications of Mezzanine Debt

Mezzanine debt is a versatile financial tool that can be used in various applications. Here are some common uses of mezzanine financing:

1. Real Estate Development:

Mezzanine debt is often used in real estate development projects to bridge the gap between the senior debt and the equity investment. It provides developers with additional capital to fund construction costs, acquisition expenses, and other project-related expenses. Mezzanine financing allows developers to leverage their investments and maximize their returns.

2. Acquisitions and Mergers:

Mezzanine debt is frequently utilized in acquisitions and mergers to finance the purchase of a target company. It can be used to fund a portion of the acquisition price or to provide additional working capital for the merged entity. Mezzanine financing allows buyers to enhance their purchasing power and complete transactions that may not be feasible with traditional debt alone.

3. Expansion and Growth:

Mezzanine debt can be used by companies looking to expand their operations or pursue growth opportunities. It can provide the necessary capital to invest in new markets, launch new products, or acquire complementary businesses. Mezzanine financing allows companies to fuel their growth without diluting existing shareholders’ ownership.

4. Recapitalizations:

Mezzanine debt is often used in recapitalization transactions, where a company restructures its capital structure to optimize its financial position. It can be used to refinance existing debt, provide liquidity to shareholders, or fund a special dividend. Mezzanine financing allows companies to improve their balance sheets and enhance their financial flexibility.

5. Management Buyouts:

Mezzanine debt is commonly employed in management buyout transactions, where the existing management team acquires a controlling stake in the company. It can be used to finance the purchase of shares from the current owners and provide working capital for the newly acquired entity. Mezzanine financing allows management teams to take ownership and control of the businesses they operate.

6. Restructuring and Turnarounds:

Mezzanine debt can be used in restructuring and turnaround situations to provide the necessary capital to stabilize and reposition a struggling company. It can be used to fund operational improvements, debt repayment, or working capital needs. Mezzanine financing allows companies to navigate through challenging times and emerge stronger.

Overall, mezzanine debt offers flexibility and creative financing solutions for various corporate needs. It can be a valuable tool for companies and investors looking to optimize their capital structures and achieve their financial objectives.

Real Estate Development

Mezzanine financing plays a crucial role in the real estate development industry. It provides developers with the necessary capital to fund their projects and bridge the gap between traditional debt and equity financing.

Real estate development projects often require a significant amount of capital to acquire land, obtain permits, and construct buildings. Mezzanine financing can be used to cover these costs, allowing developers to move forward with their projects.

One of the key advantages of mezzanine financing in real estate development is its flexibility. Unlike traditional bank loans, mezzanine debt can be structured in a way that aligns with the specific needs of the project. This flexibility allows developers to customize the terms of the financing to fit their unique circumstances.

Additionally, mezzanine financing can be used to leverage existing equity in a project. By securing mezzanine debt, developers can increase their overall borrowing capacity and maximize their return on investment. This can be particularly beneficial in high-growth markets where property values are rapidly appreciating.

Furthermore, mezzanine financing can provide developers with a source of capital that is subordinate to senior debt. This means that in the event of a default or foreclosure, the mezzanine lender would have a claim on the assets of the project after the senior lender has been repaid. This added security can make mezzanine financing an attractive option for both developers and investors.

Acquisitions and Mergers

In addition to real estate development, mezzanine financing is also commonly used in acquisitions and mergers. When a company is looking to acquire another company or merge with another company, they may need additional funding to complete the transaction. This is where mezzanine debt can come into play.

Mezzanine financing can be used to bridge the gap between the equity provided by the acquiring company and the total purchase price of the target company. This allows the acquiring company to leverage their existing capital and secure the necessary funds to complete the acquisition or merger.

One of the key advantages of using mezzanine financing in acquisitions and mergers is that it allows the acquiring company to maintain a higher level of control and ownership. Unlike traditional debt financing, mezzanine debt does not require the acquiring company to pledge specific assets as collateral. This means that the acquiring company can maintain control over their assets and operations, while still securing the necessary funding.

Additionally, mezzanine financing can provide flexibility in the repayment terms. The terms of mezzanine debt can be structured to align with the cash flow and profitability of the acquiring company, making it a more attractive option for companies looking to finance acquisitions and mergers.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.