Magic Formula Investing Definition

Magic Formula Investing is a strategy developed by Joel Greenblatt, an American investor and professor. It is a systematic approach to investing that aims to identify undervalued stocks with high earning yields and high returns on capital. The strategy is based on the idea that the market often misprices stocks, and by using a simple formula, investors can uncover opportunities for profitable investments.

How Does Magic Formula Investing Work?

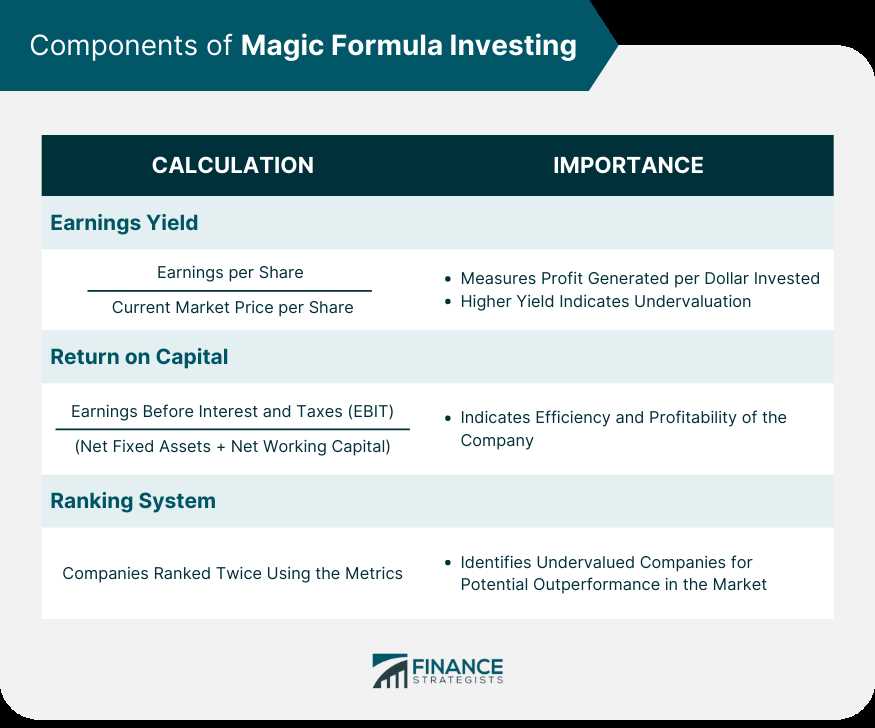

The Magic Formula Investing strategy involves two key financial ratios: earnings yield and return on capital. The formula ranks stocks based on these ratios and selects the top-ranked stocks for investment. The earnings yield is calculated by dividing the earnings per share by the stock price, while the return on capital is calculated by dividing the operating income by the net working capital plus net fixed assets.

Once the stocks are ranked, the investor creates a portfolio by investing an equal amount of money in each of the top-ranked stocks. The portfolio is then held for a predetermined period, typically one year, before being rebalanced. This approach aims to take advantage of the market’s tendency to correct mispricings over time.

What Can Magic Formula Investing Tell You?

Magic Formula Investing can provide investors with a list of potentially undervalued stocks that have a high earning yield and a high return on capital. These stocks may have been overlooked by the market and could present opportunities for long-term investment. However, it is important to note that the Magic Formula Investing strategy is not foolproof and does not guarantee positive returns. It is still subject to market risks and fluctuations.

Investors who follow the Magic Formula Investing strategy should also conduct their own research and analysis to ensure that the selected stocks align with their investment goals and risk tolerance. Additionally, it is important to regularly monitor the performance of the portfolio and make adjustments as necessary.

What Is Magic Formula Investing?

Magic Formula Investing is an investment strategy developed by Joel Greenblatt, a well-known investor and author. It is a systematic approach to value investing that aims to identify undervalued stocks with high earning yields.

The magic formula is based on two key financial ratios: return on capital (ROC) and earnings yield. Return on capital measures how efficiently a company generates profits from its invested capital, while earnings yield represents the earnings generated by a company relative to its market value.

How Does Magic Formula Investing Work?

The magic formula works by ranking stocks based on their return on capital and earnings yield. The formula assigns a score to each stock, with the highest scores indicating the most attractive investment opportunities.

To implement the magic formula, investors first compile a list of stocks based on certain criteria, such as market capitalization and liquidity. They then calculate the return on capital and earnings yield for each stock. The stocks are then ranked based on these ratios, with the top-ranked stocks considered the most attractive investment opportunities.

Once the stocks are ranked, investors can create a portfolio by selecting a certain number of top-ranked stocks. The portfolio is typically rebalanced periodically to ensure that it continues to reflect the most attractive investment opportunities.

What Can Magic Formula Investing Tell You?

Magic Formula Investing can provide investors with a systematic approach to value investing. By focusing on companies with high return on capital and earnings yield, the strategy aims to identify undervalued stocks that have the potential for long-term growth.

However, it is important to note that Magic Formula Investing is not a guarantee of success. Like any investment strategy, it carries risks and requires careful analysis and research. Investors should consider factors such as industry trends, competitive advantages, and management quality when evaluating potential investments.

How Does Magic Formula Investing Work?

Magic Formula Investing is a strategy developed by Joel Greenblatt, a well-known investor and author. The strategy aims to identify undervalued stocks by using a simple formula that combines two key financial ratios: return on capital and earnings yield.

The first step in the Magic Formula Investing process is to rank companies based on their return on capital. This ratio measures how efficiently a company is able to generate profits from its capital investments. Companies with a higher return on capital are considered to be more efficient and are given a higher ranking.

The second step is to rank companies based on their earnings yield. This ratio measures the earnings generated by a company relative to its market value. Companies with a higher earnings yield are considered to be undervalued and are given a higher ranking.

Once the companies are ranked based on return on capital and earnings yield, the Magic Formula Investing strategy selects the top-ranked companies and invests in them. The idea behind this strategy is that companies with a high return on capital and a high earnings yield are likely to be undervalued by the market and have the potential for future growth.

While the Magic Formula Investing strategy has been shown to outperform the market over the long term, it is not without its risks. Like any investment strategy, it is subject to market fluctuations and the performance of individual stocks. Therefore, it is important for investors to carefully research and monitor the companies in their portfolio to ensure they continue to meet the criteria of the Magic Formula Investing strategy.

What It Tells You

The earnings yield is calculated by dividing a company’s earnings per share (EPS) by its price per share. This ratio provides insight into how much return an investor can expect to earn on their investment. A high earnings yield suggests that the stock is undervalued, while a low earnings yield indicates that the stock may be overvalued.

The return on capital measures how efficiently a company is using its capital to generate profits. It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its total capital. A high return on capital indicates that the company is generating strong profits relative to the amount of capital invested, while a low return on capital suggests that the company may be less efficient in its use of capital.

By combining these two factors, the Magic Formula Investing strategy aims to identify companies that are both undervalued and have a strong track record of financial performance. The idea is that these companies have the potential to deliver above-average returns for investors.

Overall, the Magic Formula Investing strategy provides a systematic approach to value investing and can help investors make more informed investment decisions. However, it is important to conduct thorough research and analysis before making any investment decisions based on this strategy.

What Can Magic Formula Investing Tell You?

Magic Formula Investing is a strategy that can provide valuable insights for investors looking to identify undervalued stocks. By using a specific formula to rank stocks based on their earnings yield and return on capital, this approach aims to uncover companies that are trading at a discount to their intrinsic value.

When applying the Magic Formula Investing strategy, investors can gain several key insights:

1. Identifying Value Stocks

The Magic Formula Investing approach focuses on identifying value stocks, which are stocks that are trading at a lower price compared to their intrinsic value. By ranking stocks based on their earnings yield and return on capital, investors can identify companies that are potentially undervalued and may offer a favorable investment opportunity.

2. Evaluating Company Performance

Through the Magic Formula Investing strategy, investors can evaluate a company’s performance by analyzing its earnings yield and return on capital. These metrics provide insights into the company’s profitability and efficiency in generating returns. By comparing these metrics across different companies, investors can identify companies with strong financial performance.

3. Assessing Investment Potential

By combining the rankings based on earnings yield and return on capital, Magic Formula Investing provides a comprehensive assessment of a company’s investment potential. Companies with high rankings indicate that they have a combination of attractive valuation and strong financial performance, making them potential investment opportunities.

Overall, Magic Formula Investing can provide investors with a systematic approach to identify value stocks and assess their investment potential. By considering the rankings based on earnings yield and return on capital, investors can make informed decisions and potentially achieve favorable investment returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.