What is Disposition in Trading?

Disposition in trading refers to the act of selling or closing a position in a financial instrument, such as stocks, bonds, or options. It is an essential part of the investing process and involves making decisions based on various factors, including market conditions, risk tolerance, and investment goals.

When an investor decides to dispose of a position, they are essentially ending their ownership or interest in that particular asset. This can be done for a variety of reasons, such as taking profits, cutting losses, or reallocating capital to other investments.

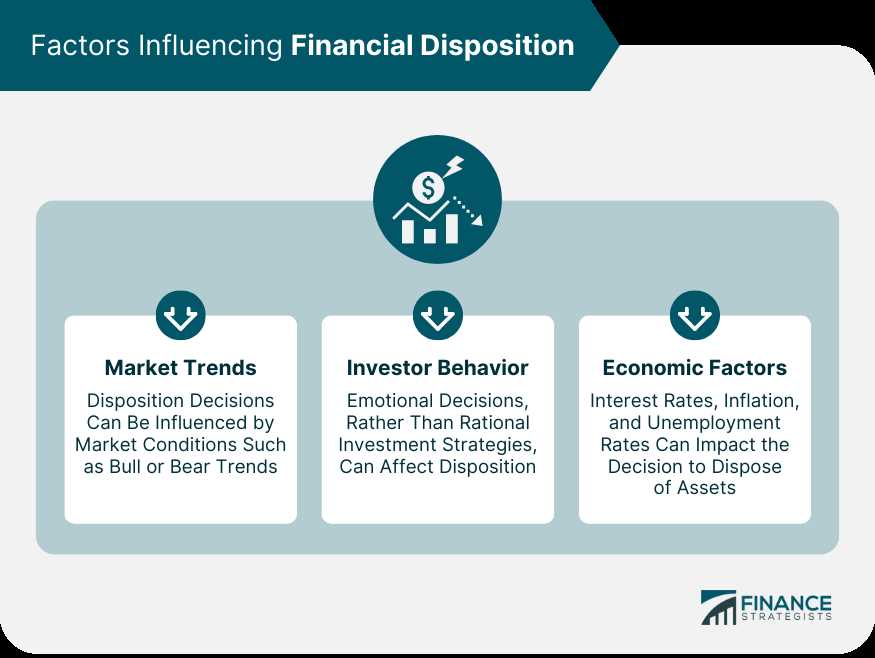

There are several factors that traders consider when determining the appropriate time to dispose of a position. These include technical indicators, fundamental analysis, market trends, and personal risk tolerance. By carefully analyzing these factors, traders can make informed decisions about when to sell their investments.

Additionally, traders may employ various strategies to optimize their disposition process. This can include setting profit targets, using stop-loss orders to limit potential losses, and regularly reviewing and adjusting their portfolio based on market conditions.

Definition and Explanation

Disposition in trading refers to the act of selling or liquidating an investment position. It is the process of closing out a trade and realizing the gains or losses associated with it. Disposition can be a crucial step in the investing process as it allows traders to lock in profits or cut losses.

When traders decide to dispose of an investment, they are essentially making a decision to exit the market and take their profits or losses. This decision is often based on various factors such as market conditions, investment goals, and risk tolerance.

Disposition can be done in various ways, depending on the type of investment and the trader’s preferences. It can involve selling shares of a stock, closing out a futures contract, or liquidating a position in a mutual fund or exchange-traded fund (ETF).

Importance of Disposition

Disposition plays a crucial role in trading as it allows traders to manage their investment portfolios effectively. By disposing of investments at the right time, traders can maximize their profits and minimize their losses.

One of the key aspects of successful trading is knowing when to exit a trade. This requires careful analysis of market trends, fundamental factors, and technical indicators. Traders need to be able to identify signs of a potential reversal or a change in market sentiment.

By having a clear disposition strategy, traders can avoid holding onto losing positions for too long and prevent further losses. It also allows them to take advantage of market opportunities and lock in profits when the market is favorable.

Overall, disposition is an essential part of the trading process that allows traders to effectively manage their investments and make informed decisions about when to exit a trade.

Investing Process in Disposition

1. Research and Analysis

The first step in the investing process is to conduct thorough research and analysis. Traders need to gather relevant information about the asset they are considering investing in, such as its historical performance, market trends, and any news or events that may impact its price. This research helps traders make informed decisions and identify potential opportunities for profitable trades.

2. Setting Investment Goals

Once the research is complete, traders need to set clear investment goals. These goals can be short-term or long-term, depending on the trader’s risk tolerance and investment strategy. Setting goals helps traders stay focused and disciplined, and it provides a benchmark for measuring success.

3. Developing a Trading Plan

4. Risk Management

Risk management is a crucial aspect of the investing process in disposition. Traders need to identify and assess the risks associated with their trades and develop strategies to mitigate these risks. This can include setting stop-loss orders, diversifying the portfolio, and using proper position sizing techniques.

5. Execution of Trades

Once the trading plan is in place and the risks are managed, traders can execute their trades. This involves placing buy or sell orders based on the predetermined entry and exit points. Traders should closely monitor the market and make adjustments to their trades if necessary.

6. Monitoring and Evaluation

After executing trades, it is important to continuously monitor and evaluate their performance. Traders should track the progress of their investments, review their trading plan, and make any necessary adjustments. This ongoing monitoring and evaluation help traders identify strengths and weaknesses in their strategies and make improvements for future trades.

By following these steps and strategies in the investing process, traders can increase their chances of success in disposition. It is important to note that investing in the financial markets involves risks, and traders should always conduct their own research and seek professional advice before making any investment decisions.

Steps and Strategies

1. Identify the Market Trend:

2. Set Clear Entry and Exit Points:

Once the market trend is identified, it is crucial to set clear entry and exit points for the trade. Entry points are the price levels at which a trader enters a trade, while exit points are the price levels at which a trader exits a trade. These points can be determined based on technical analysis, support and resistance levels, or other trading strategies.

3. Implement Risk Management Techniques:

Risk management is an essential aspect of trading. It involves setting stop-loss orders to limit potential losses and take-profit orders to secure profits. Traders should also consider the size of their position relative to their account balance and risk tolerance.

4. Monitor the Trade:

Once a trade is executed, it is important to monitor its progress. This includes regularly checking the market conditions, adjusting stop-loss and take-profit levels if necessary, and staying updated with relevant news and events that may impact the trade.

5. Evaluate and Learn:

After the trade is closed, it is crucial to evaluate its outcome and learn from the experience. This involves analyzing the reasons for the trade’s success or failure, identifying any mistakes or areas for improvement, and adjusting trading strategies accordingly.

By following these steps and strategies, traders can effectively implement a disposition in their trading approach. It is important to note that trading involves risks, and no strategy can guarantee profits. Therefore, it is advisable to practice risk management and continuously educate oneself to improve trading skills.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.