Macroeconomics: Definition and Importance

Macroeconomics is a branch of economics that focuses on the study of the overall economy, including factors such as inflation, unemployment, economic growth, and government policies. It examines the behavior and performance of the economy as a whole, rather than individual markets or industries.

One of the key concepts in macroeconomics is the aggregate demand and aggregate supply. Aggregate demand refers to the total amount of goods and services that consumers, businesses, and the government are willing and able to purchase at a given price level. Aggregate supply, on the other hand, represents the total amount of goods and services that producers are willing and able to supply at a given price level.

Secondly, macroeconomics provides insights into the overall health of the economy. By analyzing indicators such as GDP (Gross Domestic Product), inflation rate, and unemployment rate, economists can assess the performance of the economy and identify potential risks or imbalances. This information is crucial for businesses and investors in making strategic decisions.

Furthermore, macroeconomics helps us understand the impact of global events and policies on the domestic economy. Changes in international trade, exchange rates, and financial markets can have significant effects on a country’s economy. By studying macroeconomics, we can better comprehend the interconnections between different economies and anticipate the potential consequences of global events.

What is Macroeconomics?

Macroeconomics is a branch of economics that focuses on the study of the economy as a whole. It examines aggregate economic phenomena, such as inflation, unemployment, economic growth, and the overall level of national income. Unlike microeconomics, which looks at individual economic agents and their interactions, macroeconomics takes a broader perspective and analyzes the behavior of the entire economy.

One of the key concepts in macroeconomics is the aggregate demand and aggregate supply framework. Aggregate demand represents the total demand for goods and services in the economy, while aggregate supply represents the total supply of goods and services. The interaction between aggregate demand and aggregate supply determines the overall level of economic activity, as measured by gross domestic product (GDP).

Macroeconomics also examines the role of monetary and fiscal policy in influencing the economy. Monetary policy refers to the actions taken by the central bank to control the money supply and interest rates, while fiscal policy refers to the use of government spending and taxation to influence the economy. These policy tools can be used to stabilize the economy during periods of recession or inflation.

The Significance of Macroeconomics

Macroeconomics is a branch of economics that focuses on the study of the economy as a whole. It examines the aggregate behavior of various economic variables such as national income, employment, inflation, and economic growth. The significance of macroeconomics lies in its ability to provide policymakers with valuable insights into the functioning of the economy and guide them in formulating effective economic policies.

Policy Formulation

Macroeconomics provides policymakers with the tools and frameworks necessary to formulate effective economic policies. By studying the relationships between various economic variables, economists can identify the factors that influence economic growth, inflation, and unemployment. This knowledge enables policymakers to design policies that promote stable economic growth, control inflation, and reduce unemployment rates.

For example, during periods of economic recession, macroeconomists can recommend expansionary fiscal policies, such as increased government spending or tax cuts, to stimulate economic activity and create jobs. On the other hand, during periods of high inflation, they may suggest contractionary monetary policies, such as raising interest rates, to reduce aggregate demand and curb inflationary pressures.

Forecasting and Risk Assessment

Macroeconomics also plays a crucial role in forecasting future economic trends and assessing potential risks. By analyzing historical data and current economic indicators, economists can make predictions about future economic performance. This information is valuable for businesses, investors, and policymakers, as it allows them to make informed decisions and manage risks effectively.

For example, macroeconomists can forecast future economic growth rates, inflation levels, and interest rates, which can help businesses plan their production and investment strategies. They can also assess the risks associated with economic imbalances, such as high levels of government debt or trade deficits, and provide recommendations on how to mitigate these risks.

International Economics

History of Macroeconomics

One of the earliest contributions to the development of macroeconomics was made by John Maynard Keynes, a British economist who is widely regarded as one of the most influential figures in the field. Keynes challenged the prevailing economic theories of his time, which focused primarily on the behavior of individual markets, and argued that government intervention and fiscal policy could be used to stabilize the economy and promote full employment.

In the post-World War II period, macroeconomics became increasingly focused on issues of economic growth and development. Economists such as Robert Solow and Paul Romer made significant contributions to the study of long-term economic growth, highlighting the importance of technological progress and innovation in driving economic prosperity.

Over the years, macroeconomics has continued to evolve and adapt to new challenges and developments in the global economy. The field has expanded to include topics such as inflation, unemployment, exchange rates, and international trade, among others.

Early Development of Macroeconomics

The early development of macroeconomics can be traced back to the 1930s, during the Great Depression. This period of economic downturn led to a reevaluation of traditional economic theories and the emergence of new ideas.

One of the key figures in the early development of macroeconomics was John Maynard Keynes. Keynes challenged the prevailing view that markets would automatically adjust to restore equilibrium in the economy. Instead, he argued that government intervention was necessary to stimulate demand and promote economic growth.

The early development of macroeconomics was not without controversy. There were debates and disagreements among economists about the best way to analyze and manage the economy. Some economists argued for a more hands-off approach, while others advocated for active government intervention.

Despite these disagreements, the early development of macroeconomics laid the groundwork for the modern study of the economy as a whole. It provided a new perspective on economic issues and paved the way for further advancements in the field.

Key Figures in Macroeconomics

1. John Maynard Keynes

John Maynard Keynes is widely regarded as one of the most influential economists in history. His work during the Great Depression revolutionized macroeconomic theory and policy. Keynes argued that government intervention, through fiscal and monetary policies, could help stabilize the economy during periods of recession or depression. His ideas laid the foundation for modern macroeconomic thinking and the development of Keynesian economics.

2. Milton Friedman

3. Robert Lucas

Robert Lucas is a Nobel laureate who made groundbreaking contributions to macroeconomics. He is known for his work on rational expectations, which suggests that individuals form expectations about future economic conditions based on all available information. Lucas’ research challenged traditional Keynesian theories and highlighted the importance of incorporating rational expectations into macroeconomic models.

4. Paul Romer

5. Janet Yellen

| Key Figure | Contributions |

|---|---|

| John Maynard Keynes | Revolutionized macroeconomic theory and policy during the Great Depression |

| Milton Friedman | Advocated for free markets and emphasized the importance of monetary policy |

| Robert Lucas | Challenged traditional Keynesian theories and introduced rational expectations |

| Paul Romer | Developed the theory of endogenous growth and its implications for economic growth |

| Janet Yellen | Played a crucial role in shaping macroeconomic policy as Chair of the Federal Reserve |

Schools of Thought in Macroeconomics

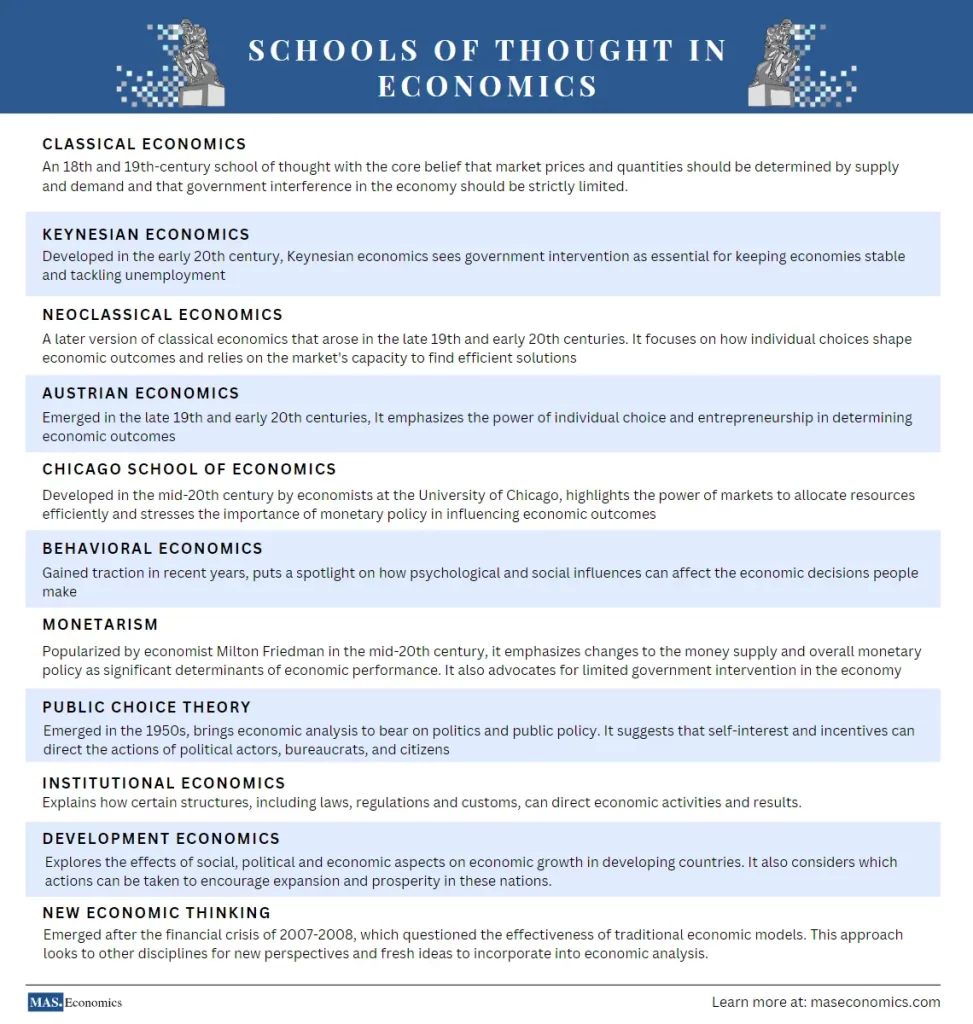

Macroeconomics is a field of study that examines the behavior and performance of an economy as a whole. Within the field of macroeconomics, there are several different schools of thought that offer different perspectives on how the economy functions and how it should be managed. These schools of thought have evolved over time and continue to shape the way economists analyze and understand macroeconomic phenomena.

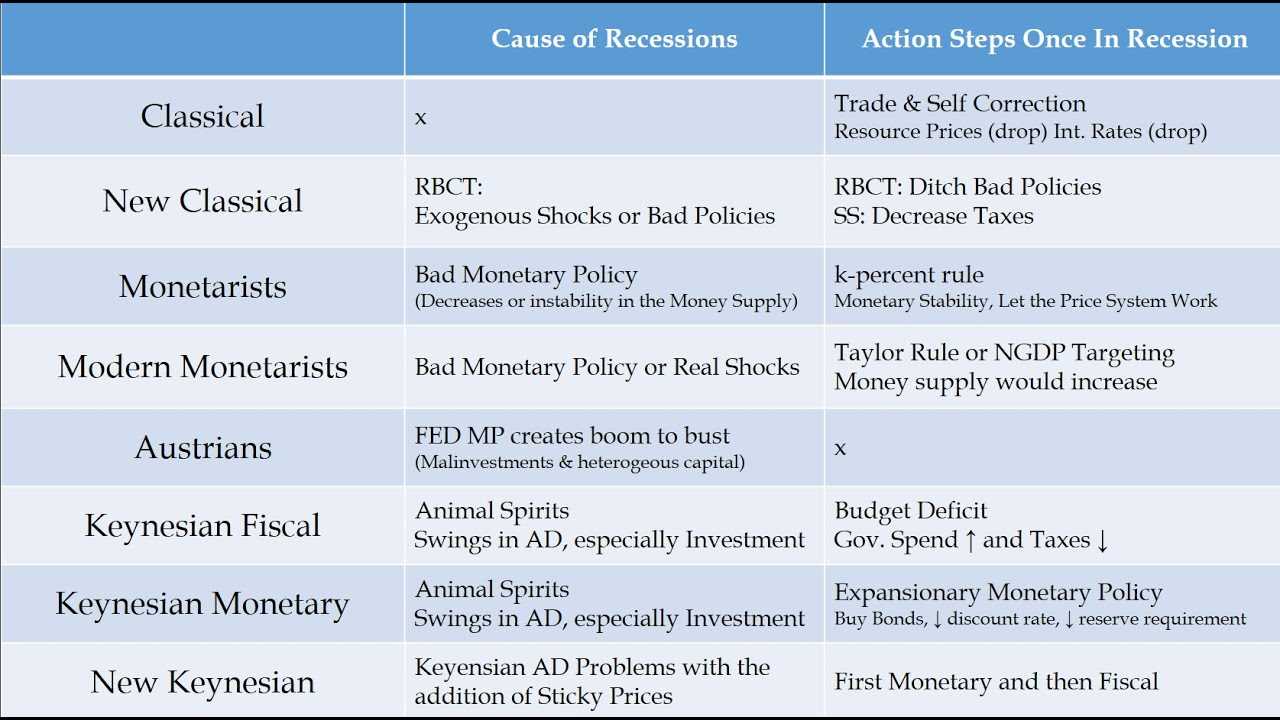

One of the most influential schools of thought in macroeconomics is Keynesian economics. Developed by British economist John Maynard Keynes during the Great Depression, Keynesian economics emphasizes the role of government intervention in stabilizing the economy. Keynesians believe that fluctuations in aggregate demand can lead to periods of high unemployment and low output, and that government policies, such as fiscal stimulus and monetary easing, can help to mitigate these fluctuations and promote economic growth.

Another important school of thought in macroeconomics is monetarism. Developed by economists such as Milton Friedman, monetarism emphasizes the role of money supply in determining economic outcomes. Monetarists believe that changes in the money supply can have a significant impact on inflation and economic growth, and that central banks should focus on controlling the money supply to achieve stable and predictable economic outcomes.

Neoclassical economics is another prominent school of thought in macroeconomics. Neoclassical economists emphasize the role of individual decision-making and market forces in determining economic outcomes. They believe that markets are efficient and that government intervention can often lead to unintended consequences. Neoclassical economists also emphasize the importance of long-run economic growth and productivity.

Other schools of thought in macroeconomics include the Austrian school, which emphasizes the role of entrepreneurship and market processes in driving economic growth, and the New Keynesian school, which combines elements of Keynesian economics with neoclassical economics. These different schools of thought offer different perspectives on how the economy works and how it should be managed, and economists continue to debate and refine these theories in order to better understand and predict macroeconomic phenomena.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.