Liquidating Definition and Process as Part of Bankruptcy

The liquidation process involves assessing the value of the debtor’s assets and selling them off to generate funds. These assets can include physical property, inventory, equipment, and even intellectual property. The proceeds from the sale are then distributed among the creditors based on their priority and the amount owed.

One of the main goals of liquidation in bankruptcy is to ensure a fair and equitable distribution of assets to creditors. The trustee is responsible for conducting the sale of assets in a transparent manner, following the rules and regulations set forth by the bankruptcy court.

Liquidation is a crucial aspect of the bankruptcy process. It involves the sale of a debtor’s assets to repay creditors. When a company or individual files for bankruptcy, their assets are evaluated and sold off to generate funds for debt repayment. This process is overseen by a court-appointed trustee.

During liquidation, the debtor’s assets are categorized as either exempt or non-exempt. Exempt assets are protected from being sold, while non-exempt assets can be liquidated. Exempt assets typically include necessities such as a primary residence, personal belongings, and certain retirement accounts.

The non-exempt assets are sold off in a systematic manner to maximize the recovery for creditors. The proceeds from the sale are distributed among the creditors according to a predetermined priority system. Secured creditors, such as those with liens on specific assets, are typically the first to be paid. Unsecured creditors, such as credit card companies and suppliers, are usually paid last and may only receive a fraction of what they are owed.

The liquidation process can vary depending on the type of bankruptcy filed. Chapter 7 bankruptcy involves the liquidation of assets for individuals and businesses, while Chapter 11 bankruptcy allows businesses to reorganize and continue operations while repaying creditors. Chapter 13 bankruptcy is designed for individuals with regular income and involves a repayment plan over a specified period of time.

It is important for investors to understand the implications of liquidation in bankruptcy. If an investor holds debt or equity in a company that is going through liquidation, they may only receive a fraction of their investment back, if anything at all. It is crucial to carefully evaluate the financial health of a company before investing to minimize the risk of bankruptcy and liquidation.

| Key Points |

|---|

| – Liquidation involves the sale of a debtor’s assets to repay creditors in bankruptcy. |

| – Assets are categorized as exempt or non-exempt, with exempt assets being protected from sale. |

| – The proceeds from the sale of non-exempt assets are distributed among creditors according to a priority system. |

| – Different types of bankruptcy have varying processes for liquidation. |

| – Investors should be aware of the risks of bankruptcy and liquidation when investing in a company. |

Types of Liquidation

| Type | Description |

|---|---|

| Chapter 7 Liquidation | This is the most common type of liquidation in bankruptcy. It involves the sale of a debtor’s non-exempt assets to repay creditors. The proceeds from the sale are distributed among the creditors according to a priority system. |

| Chapter 11 Liquidation | This type of liquidation is specific to businesses. It allows a company to reorganize its debts and assets while still remaining in operation. The company may sell off certain assets to generate funds to repay creditors. |

| Chapter 13 Liquidation |

Each type of liquidation has its own specific rules and requirements, and the process can vary depending on the jurisdiction and the individual circumstances of the bankruptcy case. It is important for individuals and businesses considering bankruptcy to consult with a qualified bankruptcy attorney to understand their options and navigate the liquidation process effectively.

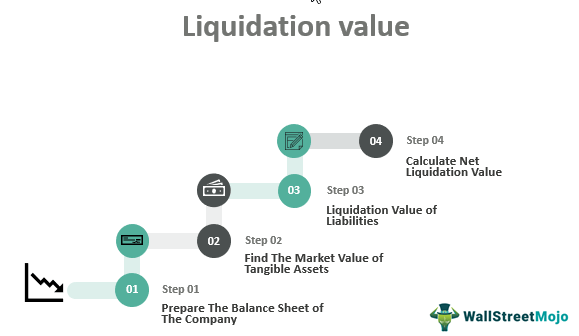

The Liquidation Process

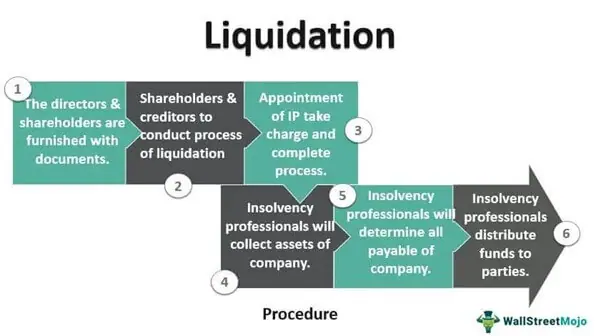

1. Appointment of a liquidator

The first step in the liquidation process is the appointment of a liquidator. This is typically done by the court or by the company’s creditors. The liquidator is responsible for overseeing the entire liquidation process and ensuring that it is carried out in accordance with the law.

2. Identification and valuation of assets

Once a liquidator is appointed, they will begin the process of identifying and valuing the company’s assets. This includes everything from physical assets such as property and equipment to intangible assets such as intellectual property and trademarks. The liquidator will work with appraisers and other professionals to determine the value of these assets.

3. Sale of assets

After the assets have been identified and valued, the liquidator will proceed with selling them off. This can be done through various methods, such as public auctions, private sales, or through the use of specialized asset sales companies. The proceeds from the sale of assets will be used to pay off the company’s debts.

4. Distribution of funds

Once the assets have been sold and the funds have been collected, the liquidator will distribute the funds to the company’s creditors. The funds will be distributed in accordance with the priority of the creditors’ claims, with secured creditors being paid first, followed by unsecured creditors.

5. Dissolution of the company

Once all the assets have been sold and the funds have been distributed, the liquidator will proceed with the dissolution of the company. This involves formally winding up the affairs of the company and removing it from the register of companies. The company will cease to exist as a legal entity.

The liquidation process can be complex and time-consuming, often taking several months or even years to complete. It is important for investors to understand this process and its implications, as it can have a significant impact on their investment in the company.

Implications for Investors

When a company goes through liquidation as part of bankruptcy proceedings, it can have significant implications for investors. Here are some key points to consider:

- Loss of Investment: Investors who hold shares or bonds in the bankrupt company may face a complete loss of their investment. In liquidation, the company’s assets are sold off to repay creditors, and there may not be enough funds left to distribute to shareholders or bondholders.

- Prioritization of Creditors: In liquidation, creditors are typically given priority over shareholders. This means that bondholders and other secured creditors will be paid first from the proceeds of the asset sales. Shareholders are usually the last to receive any remaining funds, if there are any.

- Market Reaction: The announcement of a company’s liquidation can have a significant impact on its stock price. Investors may rush to sell their shares, causing the price to plummet. On the other hand, some investors may see an opportunity to buy shares at a discounted price, hoping for a potential recovery in the future.

- Opportunities for Distressed Investing: Some investors specialize in distressed investing, which involves buying assets or securities of companies in financial distress, including those going through liquidation. These investors may see an opportunity to acquire assets at a discounted price, with the potential for future profitability if the company is able to turn around.

- Legal Proceedings: In some cases, investors may choose to take legal action against the company or its management if they believe their rights as shareholders or bondholders have been violated. This can add further complexity and uncertainty to the liquidation process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.