Chapter 11 Bankruptcy: Exploring the Process, Benefits, and Drawbacks

Chapter 11 bankruptcy is a legal process that allows businesses to reorganize their debts and continue operating while repaying their creditors. This form of bankruptcy is often used by large corporations or businesses that have substantial assets and complex financial structures.

The process of filing for Chapter 11 bankruptcy involves several steps. First, the debtor must file a petition with the bankruptcy court, which includes a detailed disclosure statement outlining their financial situation and proposed reorganization plan. The court will then appoint a trustee to oversee the case and work with the debtor to develop a plan that is acceptable to both the creditors and the court.

One of the main benefits of Chapter 11 bankruptcy is that it allows the debtor to maintain control of their business operations while restructuring their debts. This means that the debtor can continue to operate their business and generate income, which can be used to repay their creditors over time. Additionally, Chapter 11 bankruptcy provides the debtor with the opportunity to renegotiate or terminate contracts and leases, which can help reduce their financial obligations.

However, Chapter 11 bankruptcy also has its drawbacks. The process can be time-consuming and expensive, as it requires the debtor to hire legal and financial professionals to assist with the restructuring process. Additionally, the debtor may face resistance from their creditors, who may challenge the proposed reorganization plan or seek to have the case converted to a Chapter 7 liquidation bankruptcy.

| Benefits of Chapter 11 Bankruptcy | Drawbacks of Chapter 11 Bankruptcy |

|---|---|

| – Allows businesses to continue operating | – Time-consuming and expensive process |

| – Ability to renegotiate contracts and leases | – Potential resistance from creditors |

| – Opportunity to restructure debts | – Possibility of case conversion to Chapter 7 |

Chapter 11 bankruptcy is a legal process that allows businesses to reorganize their debts and continue their operations. It is often referred to as “reorganization bankruptcy” and is available to both corporations and individuals, although it is primarily used by businesses.

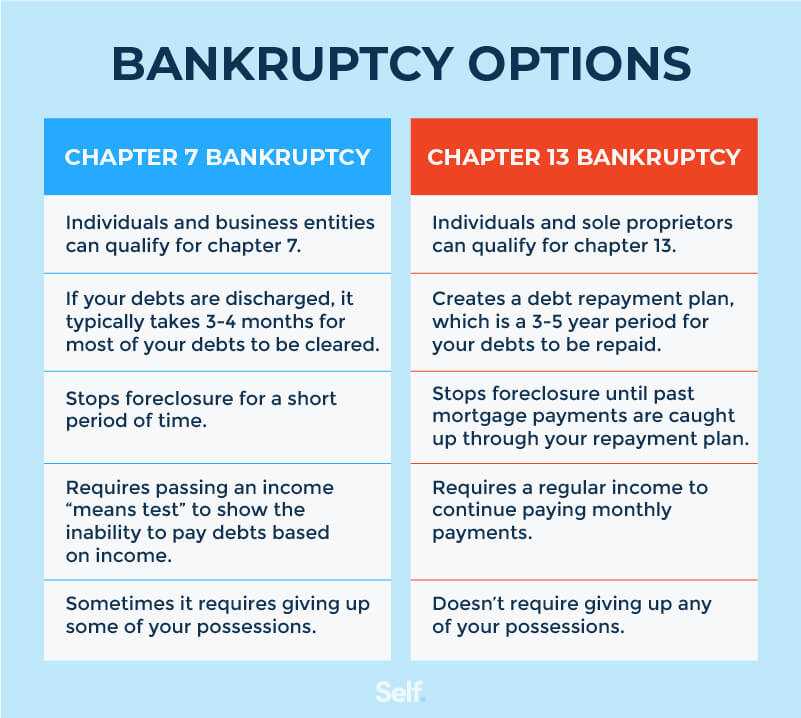

Unlike other forms of bankruptcy, such as Chapter 7 or Chapter 13, which involve liquidation or repayment plans, Chapter 11 bankruptcy focuses on restructuring the business’s debts and developing a plan to repay creditors over time. This allows the business to stay open and continue its operations while working towards financial stability.

During the Chapter 11 process, the business is given the opportunity to negotiate with its creditors and propose a plan of reorganization. This plan outlines how the business intends to repay its debts and may involve reducing the amount owed, extending the repayment period, or even converting debt into equity. The plan must be approved by the bankruptcy court and the majority of creditors before it can be implemented.

While Chapter 11 bankruptcy offers businesses the opportunity to restructure their debts and continue operating, it is a complex and expensive process. The business must work with attorneys, accountants, and other professionals to navigate the bankruptcy proceedings, which can be time-consuming and costly. Additionally, the business may face scrutiny from creditors and the bankruptcy court, and may be required to make significant changes to its operations and management.

Process of Filing for Chapter 11 Bankruptcy

Filing for Chapter 11 bankruptcy is a complex legal process that involves several steps. Here is an overview of the process:

- Pre-Filing: Before filing for Chapter 11 bankruptcy, the debtor must gather all necessary financial documents and information. This includes a list of assets, liabilities, income, expenses, and any pending lawsuits or claims.

- Initial Filing: The debtor must file a petition for Chapter 11 bankruptcy with the bankruptcy court. This petition includes a detailed disclosure statement and a proposed reorganization plan.

- Automatic Stay: Once the petition is filed, an automatic stay goes into effect. This means that creditors are prohibited from taking any further action to collect debts from the debtor, including lawsuits, foreclosure, or repossession.

- Disclosure Statement and Plan Approval: The debtor must prepare a disclosure statement that provides all relevant information about the debtor’s financial situation and proposed reorganization plan. This statement must be approved by the bankruptcy court before the plan can be considered.

- Creditor Voting: Once the disclosure statement is approved, the debtor must send the plan and disclosure statement to all creditors. Creditors then have the opportunity to vote on whether to accept or reject the plan.

- Confirmation Hearing: If the plan is approved by the majority of creditors, a confirmation hearing is scheduled. At the hearing, the bankruptcy court will review the plan and determine if it meets the requirements of Chapter 11 bankruptcy.

- Plan Implementation: If the plan is confirmed by the bankruptcy court, the debtor must begin implementing the plan. This may involve selling assets, renegotiating contracts, and restructuring debt payments.

- Post-Confirmation Monitoring: After the plan is implemented, the bankruptcy court will continue to monitor the debtor’s progress and ensure compliance with the plan. The court may also appoint a trustee to oversee the reorganization process.

- Plan Completion: Once the debtor has successfully completed all requirements of the reorganization plan, the bankruptcy court will issue a final order of discharge, officially ending the Chapter 11 bankruptcy case.

Filing for Chapter 11 bankruptcy can be a lengthy and complex process, requiring careful planning and execution. It is important for debtors to consult with an experienced bankruptcy attorney to navigate through the process and maximize the chances of a successful reorganization.

Benefits of Chapter 11 Bankruptcy

Filing for Chapter 11 bankruptcy can provide several benefits for businesses and individuals facing financial difficulties. Here are some of the key advantages:

1. Reorganization and Restructuring:

Chapter 11 bankruptcy allows businesses to reorganize their debts and develop a plan to repay creditors over time. This gives the company an opportunity to continue operations and potentially regain profitability. Individuals can also use Chapter 11 bankruptcy to restructure their debts and create a manageable repayment plan.

2. Protection from Creditors:

Once a Chapter 11 bankruptcy petition is filed, an automatic stay goes into effect, which prevents creditors from taking any further collection actions. This gives the debtor a temporary reprieve from harassing phone calls, lawsuits, and other collection efforts, allowing them to focus on developing a plan to repay their debts.

3. Flexibility in Negotiating with Creditors:

Chapter 11 bankruptcy provides debtors with the opportunity to negotiate with their creditors to modify the terms of their debts. This can include reducing interest rates, extending repayment periods, or even reducing the overall amount owed. This flexibility can help debtors create a more manageable repayment plan that aligns with their current financial situation.

4. Ability to Reject or Modify Contracts:

Under Chapter 11 bankruptcy, debtors have the power to reject or modify existing contracts, leases, or other agreements that are burdensome or no longer beneficial. This can help businesses shed unprofitable contracts or renegotiate lease terms to reduce expenses and improve their financial position.

5. Preservation of Assets:

Chapter 11 bankruptcy allows businesses and individuals to retain control over their assets while developing a plan to repay their debts. This can be particularly beneficial for businesses, as it allows them to continue operating and potentially preserve the value of their assets. It also provides individuals with the opportunity to protect certain assets from being liquidated to satisfy their debts.

6. Potential for Business Recovery:

For struggling businesses, Chapter 11 bankruptcy offers the potential for recovery and long-term viability. By reorganizing debts, reducing expenses, and developing a sustainable business plan, companies can emerge from bankruptcy stronger and more financially stable. This can give them a fresh start and the opportunity to rebuild their reputation and relationships with customers, suppliers, and investors.

Drawbacks of Chapter 11 Bankruptcy

While Chapter 11 bankruptcy offers several benefits, it is important to consider the drawbacks before deciding to pursue this option. Here are some of the main drawbacks:

- Complex and Expensive Process: Filing for Chapter 11 bankruptcy can be a complex and expensive process. It requires extensive documentation, financial disclosures, and legal fees. The process can be time-consuming and may require the assistance of professionals such as attorneys and accountants, which can add to the overall cost.

- Lack of Privacy: Chapter 11 bankruptcy is a public process, meaning that the details of the bankruptcy filing and financial information become a matter of public record. This lack of privacy can be a concern for individuals or businesses who value their confidentiality.

- Loss of Control: When a company files for Chapter 11 bankruptcy, it typically loses control over its operations. The bankruptcy court appoints a trustee who takes over the management of the company’s affairs. This loss of control can be challenging for business owners who are accustomed to making decisions independently.

- Restrictions on Business Operations: Chapter 11 bankruptcy imposes certain restrictions on the debtor’s business operations. These restrictions may include limitations on entering into contracts, acquiring or selling assets, or making major financial decisions without court approval. These limitations can hinder the debtor’s ability to operate and grow their business.

- Potential for Liquidation: While Chapter 11 bankruptcy is primarily focused on reorganizing the debtor’s finances and allowing them to continue operating, there is always the risk that the bankruptcy court may convert the case to a Chapter 7 bankruptcy, which involves liquidation of assets. This can result in the closure of the business and the sale of its assets to repay creditors.

- Credit and Reputation Impact: Filing for Chapter 11 bankruptcy can have a negative impact on the debtor’s creditworthiness and reputation. It may become more difficult to obtain credit or secure favorable terms in the future. Additionally, the bankruptcy filing may be publicly reported and can damage the debtor’s reputation among customers, suppliers, and business partners.

It is important to carefully weigh the benefits and drawbacks of Chapter 11 bankruptcy and consider alternative debt management strategies before making a decision. Consulting with a qualified bankruptcy attorney can provide valuable guidance and help determine the best course of action.

Debt Management Strategies for Chapter 11 Bankruptcy

When a business is facing financial difficulties and considering filing for Chapter 11 bankruptcy, it is crucial to have a well-thought-out debt management strategy in place. This strategy will help guide the business through the bankruptcy process and maximize the chances of a successful reorganization.

1. Assessing the Debt

2. Negotiating with Creditors

Once the debt has been assessed, the next step is to negotiate with creditors. This involves reaching out to each creditor individually to discuss potential debt restructuring options. The goal is to come to an agreement that is beneficial for both the business and the creditors. This may include reducing interest rates, extending repayment terms, or even forgiving a portion of the debt.

It is important to approach these negotiations with a well-prepared proposal that demonstrates the business’s commitment to repaying the debt and its ability to generate future revenue. This will help build trust with the creditors and increase the likelihood of reaching a favorable agreement.

3. Developing a Reorganization Plan

Once negotiations with creditors have been completed, the next step is to develop a reorganization plan. This plan outlines how the business intends to restructure its operations, reduce expenses, and generate sufficient revenue to repay the debt. It may involve downsizing, selling assets, or implementing cost-cutting measures.

The reorganization plan should be realistic and achievable, taking into account the current market conditions and the business’s competitive position. It should also address any potential challenges or risks that may arise during the implementation process.

4. Seeking Professional Guidance

Navigating the Chapter 11 bankruptcy process can be complex and overwhelming, especially for businesses without prior experience. Therefore, it is highly recommended to seek professional guidance from bankruptcy attorneys and financial advisors who specialize in Chapter 11 cases.

These professionals can provide valuable insights and expertise throughout the debt management process. They can help analyze the business’s financial situation, negotiate with creditors, and develop a comprehensive reorganization plan. Their guidance can significantly increase the chances of a successful bankruptcy reorganization.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.