Importance of Lipper Indexes in Mutual Funds

1. Performance Comparison

Lipper Indexes allow investors to compare the performance of different mutual funds. By analyzing the returns and risk metrics provided by these indexes, investors can assess the relative performance of various funds within the same category. This comparison helps investors identify top-performing funds and make investment decisions accordingly.

2. Benchmarking

Lipper Indexes serve as benchmarks for mutual funds. They provide a standard against which fund managers can measure their performance. By comparing their fund’s performance to the Lipper Indexes, fund managers can evaluate their success in achieving their investment objectives. Benchmarking helps fund managers identify areas of improvement and make necessary adjustments to enhance their fund’s performance.

3. Risk Assessment

Lipper Indexes also help investors assess the risk associated with different mutual funds. These indexes provide risk metrics such as standard deviation, beta, and Sharpe ratio, which help investors understand the volatility and potential downside of a fund. By considering these risk metrics, investors can align their investment goals and risk tolerance with the appropriate mutual funds.

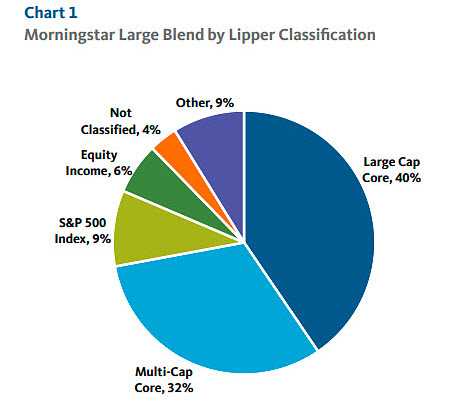

4. Diversification

Lipper Indexes provide information on the composition and diversification of mutual funds. Investors can analyze the asset allocation and sector exposure of various funds through these indexes. This information helps investors build a well-diversified portfolio by selecting funds that align with their investment objectives and risk appetite.

Overall, Lipper Indexes are essential tools for investors and fund managers in the mutual fund industry. They provide valuable insights into performance, benchmarking, risk assessment, and diversification. By utilizing these indexes, investors can make informed investment decisions and optimize their mutual fund portfolios.

How Lipper Indexes are Calculated

Lipper Indexes are widely used in the mutual fund industry to measure the performance of various investment funds. These indexes are calculated using a specific methodology that takes into account the returns of the funds over a given period of time.

The calculation of Lipper Indexes involves several steps. First, the returns of the individual funds in the index are collected and adjusted for any dividends or distributions. This ensures that the returns reflect the total return of the funds, including any income generated by the underlying investments.

Once the returns are collected, they are then weighted according to the assets under management (AUM) of each fund. This means that funds with larger AUM have a greater impact on the index than those with smaller AUM. This weighting ensures that the index represents the performance of the overall market, rather than being skewed by the performance of individual funds.

After the returns are weighted, they are then aggregated to calculate the overall index return. This is done by summing up the weighted returns of all the funds in the index. The resulting figure represents the average return of the funds in the index over the specified period.

Benefits of Using Lipper Indexes

Lipper Indexes are widely used in the mutual fund industry for various reasons. Here are some of the key benefits of using Lipper Indexes:

1. Performance Evaluation

Lipper Indexes provide a reliable benchmark for evaluating the performance of mutual funds. By comparing a fund’s performance against its relevant Lipper Index, investors can assess how well the fund has performed relative to its peers. This helps investors make informed decisions about which funds to invest in.

2. Risk Assessment

Lipper Indexes also help investors assess the risk associated with different mutual funds. The indexes provide information on the volatility and downside risk of funds, allowing investors to gauge the level of risk they are comfortable with. This is particularly important for investors who want to align their investment strategy with their risk tolerance.

3. Diversification Analysis

Another benefit of using Lipper Indexes is that they facilitate diversification analysis. Investors can use the indexes to identify funds that have low correlation with each other, helping them build a diversified portfolio. Diversification is important for reducing the overall risk of a portfolio and maximizing potential returns.

4. Investment Strategy Development

Lipper Indexes can also be used to develop investment strategies. By analyzing the historical performance and characteristics of different indexes, investors can identify trends and patterns that can inform their investment decisions. This can help investors optimize their portfolio allocation and enhance their overall investment strategy.

5. Market Insights

Lastly, Lipper Indexes provide valuable market insights. By tracking the performance of various sectors and asset classes, the indexes offer a snapshot of the overall market. This information can be used by investors to stay informed about market trends and make timely investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.