Liability: Definition, Types, Example

Liability is a financial obligation or debt that a person or business owes to another party. It represents the amount of money or resources that need to be repaid or fulfilled in the future. In simple terms, liability is a legal responsibility to settle a debt or obligation.

There are several types of liabilities that individuals and businesses can have:

- Current Liabilities: These are short-term obligations that are expected to be settled within one year or the operating cycle of a business. Examples include accounts payable, accrued expenses, and short-term loans.

- Long-term Liabilities: These are obligations that are not expected to be settled within one year or the operating cycle of a business. Examples include long-term loans, mortgages, and bonds.

- Contingent Liabilities: These are potential liabilities that may or may not occur, depending on the outcome of a future event. Examples include pending lawsuits, warranties, and guarantees.

- Financial Liabilities: These are liabilities that arise from financial contracts or arrangements, such as loans, derivatives, and trade payables.

- Operating Liabilities: These are liabilities that arise from the day-to-day operations of a business, such as salaries payable, rent payable, and taxes payable.

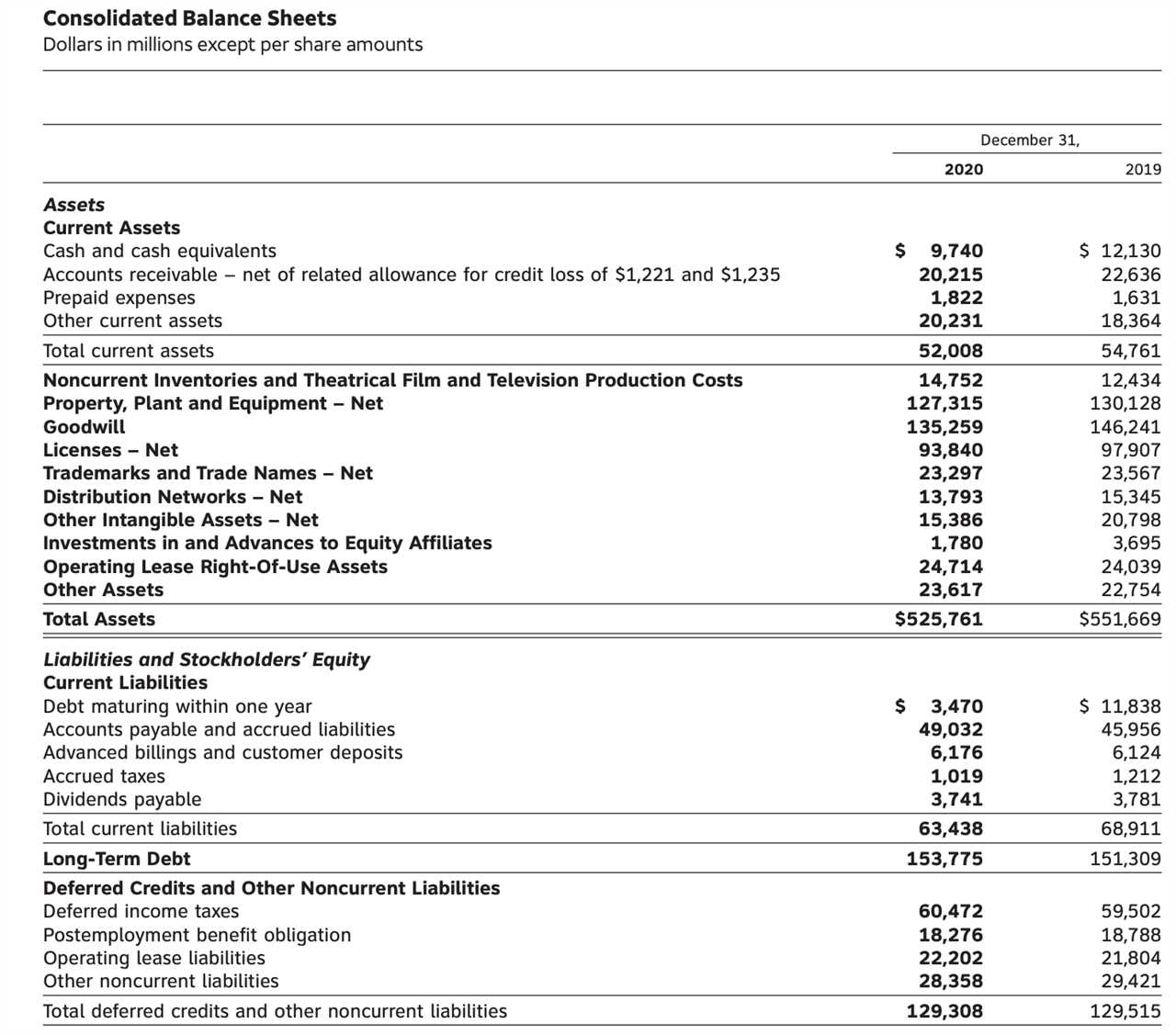

It is important to note that liabilities are recorded on a company’s balance sheet and are an essential component of financial reporting. They represent the claims of creditors against the company’s assets and can have a significant impact on the financial health and stability of an individual or business.

An example of a liability is a business loan taken out by a company to finance its operations. The loan amount represents the liability, and the company is obligated to repay the loan according to the terms and conditions agreed upon with the lender.

What is Liability?

Liability refers to the legal obligation or responsibility of an individual or entity to pay debts, fulfill contracts, or compensate for damages or losses. It represents a financial obligation that arises from past transactions or events and requires the transfer of economic resources. In simple terms, liability is a claim against an individual or entity’s assets.

Types of Liability

There are various types of liabilities that individuals and businesses may encounter:

| Type of Liability | Description | Example |

|---|---|---|

| 1. Financial Liability | Refers to debts or obligations arising from financial transactions, such as loans, mortgages, or credit card debts. | An individual taking out a mortgage to purchase a house. |

| 2. Legal Liability | Arises from legal obligations or responsibilities, such as lawsuits, fines, or penalties. | A company being sued for product liability due to a defective product. |

| 3. Contractual Liability | Occurs when an individual or entity fails to fulfill the terms and conditions of a contract. | A business breaching a contract with a supplier by not delivering goods as agreed. |

| 4. Tax Liability | Refers to the amount of taxes owed to the government based on income, property, or other taxable factors. | An individual owing income tax to the government. |

| 5. Environmental Liability | Relates to the responsibility for environmental damage or pollution caused by an individual or entity. | A company being held liable for contaminating a nearby river with toxic waste. |

These are just a few examples of the different types of liabilities that can exist. It is important for individuals and businesses to understand their liabilities and manage them effectively to ensure financial stability and legal compliance.

Types of Liability

1. Contractual Liability

Contractual liability is the most common type of liability that arises from a contractual agreement between two or more parties. When parties enter into a contract, they agree to certain terms and conditions, which create legal obligations. If one party fails to fulfill their obligations as stated in the contract, they can be held liable for breach of contract.

2. Tort Liability

Tort liability refers to the legal responsibility for wrongful acts or omissions that cause harm to another person or their property. This type of liability is based on the concept of negligence, where an individual or entity fails to exercise reasonable care, resulting in injury or damage. Examples of tort liability include personal injury claims, product liability claims, and premises liability claims.

3. Vicarious Liability

Vicarious liability is a type of liability that arises when one person or entity is held responsible for the actions or omissions of another person or entity. This type of liability is often seen in employer-employee relationships, where an employer can be held liable for the actions of their employees that occur within the scope of their employment.

4. Strict Liability

Strict liability is a legal concept that holds individuals or entities responsible for certain actions or products, regardless of fault or intent. This type of liability is often applied in cases involving dangerous activities or defective products. For example, if a person is injured by a defective product, they can hold the manufacturer strictly liable for their injuries, even if the manufacturer was not negligent.

5. Criminal Liability

Criminal liability refers to the legal responsibility for committing a crime. When an individual or entity engages in illegal activities, they can be held criminally liable and face penalties, such as fines or imprisonment. Criminal liability requires proof beyond a reasonable doubt, and the burden of proof lies with the prosecution.

Assets vs Liabilities

What are Assets?

Assets are resources that have economic value and can be owned or controlled by an individual, organization, or entity. They are what you own and can include both tangible and intangible items. Tangible assets are physical items that you can touch and see, such as cash, real estate, and vehicles. Intangible assets, on the other hand, are non-physical items that still hold value, such as patents, trademarks, and copyrights.

What are Liabilities?

Liabilities are important because they represent the claims that others have on your assets. They can impact your financial health and determine your ability to meet your financial obligations. It is essential to manage your liabilities effectively to maintain a healthy financial position.

Assets vs Liabilities

The main difference between assets and liabilities is that assets represent what you own, while liabilities represent what you owe. Assets are resources that can generate income or provide value, while liabilities are financial obligations that need to be fulfilled. The goal is to have more assets than liabilities, as this indicates a positive net worth and financial stability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.