Level 3 Assets: Definition, Examples, Vs Level 1 and Level 2

- Level 1 assets are the most liquid and easily valued assets. They have quoted prices in active markets and require minimal judgment.

- Level 2 assets are less liquid than Level 1 assets but still have observable market inputs. These assets may have quoted prices in inactive markets or require some level of judgment.

- Level 3 assets are the least liquid and most difficult to value assets. They have unobservable inputs and require significant judgment and assumptions to determine their fair value.

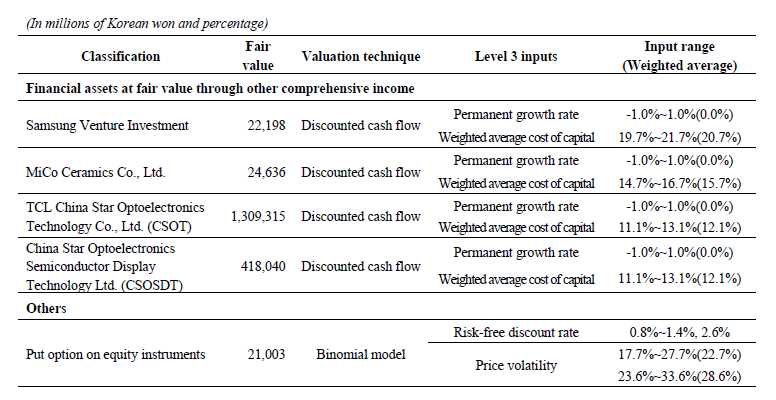

Examples of Level 3 assets include certain types of derivatives, complex structured products, private equity investments, and certain types of real estate investments. These assets often involve unique or specialized characteristics that make their valuation challenging. The lack of active markets for these assets makes it difficult to obtain reliable market prices, leading to the need for more subjective valuation methods.

When comparing Level 3 assets to Level 1 and Level 2 assets, the key difference lies in the availability of observable market inputs. Level 1 assets have readily available market prices, while Level 2 assets have observable inputs but may not have active markets. Level 3 assets, on the other hand, lack observable inputs and require significant judgment and assumptions to determine their fair value.

Overall, Level 3 assets pose higher risks and uncertainties compared to Level 1 and Level 2 assets due to their illiquid nature and subjective valuation methods. It is important for companies and investors to carefully assess the risks associated with Level 3 assets and consider the potential impact on financial statements and investment portfolios.

What are Level 3 Assets?

According to the Financial Accounting Standards Board (FASB), Level 3 assets are defined as assets for which there are no observable market prices or inputs, and therefore require significant judgment or estimation to determine their fair value.

Level 3 assets are often found in complex financial instruments such as derivatives, structured products, and certain types of private equity investments. These assets may include investments in private companies, distressed debt, and certain types of real estate.

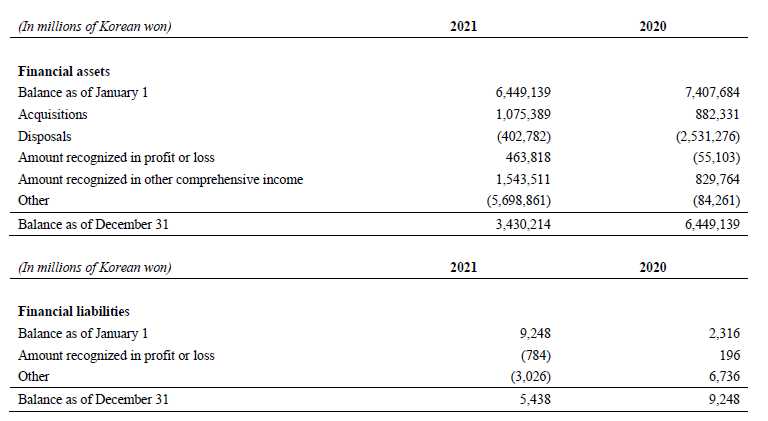

Given their illiquid nature and lack of market prices, Level 3 assets are typically disclosed in the footnotes of financial statements. Companies are required to provide detailed information about the valuation techniques and inputs used to determine the fair value of these assets.

Examples of Level 3 Assets

1. Complex Derivatives

Complex derivatives, such as exotic options or structured products, are often classified as Level 3 assets. These financial instruments have unique features and payoffs that make their valuation challenging. The fair value of these derivatives is typically estimated using complex mathematical models and assumptions.

2. Private Equity Investments

Private equity investments, including venture capital and buyout funds, are another example of Level 3 assets. These investments are typically held in private companies that are not publicly traded, making their fair value difficult to determine. Valuation methods for private equity investments often involve estimating the company’s future cash flows and applying a discount rate.

3. Distressed Debt

Distressed debt refers to debt securities issued by companies that are in financial distress or facing bankruptcy. These assets are considered Level 3 because their fair value depends on the likelihood of the issuer’s recovery and the timing of the repayment. Valuing distressed debt involves assessing the probability of default and estimating the recovery rate in case of default.

4. Real Estate Investments

Real estate investments, particularly those involving non-traded properties or development projects, are often classified as Level 3 assets. The fair value of these investments depends on various factors, such as market conditions, rental income, and property appraisals. Valuing real estate assets requires expertise in property valuation and market analysis.

Level 3 Assets Vs Level 1 and Level 2

Level 1 assets are the most liquid and easily valued assets. They include publicly traded securities such as stocks and bonds, which have readily available market prices. These prices are used to determine the fair value of Level 1 assets.

Level 2 assets are less liquid than Level 1 assets but still have observable market prices or inputs. These assets include certain derivatives and debt securities that are traded in less active markets. The fair value of Level 2 assets is determined using market prices or observable inputs, such as interest rates or yield curves.

Level 3 assets, on the other hand, have limited or no observable market prices or inputs. This lack of market data makes it difficult to determine their fair value. Valuing Level 3 assets requires the use of complex models and assumptions, often involving significant judgment by financial experts.

One key difference between Level 3 assets and Level 1 and Level 2 assets is the level of subjectivity involved in their valuation. Level 1 and Level 2 assets rely on objective market prices or observable inputs, which reduces the potential for bias or manipulation. In contrast, the valuation of Level 3 assets is more subjective and can be influenced by the assumptions and judgments made by the valuator.

Level 3 assets are typically reported at fair value on a company’s balance sheet, with any changes in value recorded in the income statement. The disclosure of Level 3 assets is also required in the footnotes of financial statements, providing additional information about the nature and valuation methods used.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.