Recovery Rate Calculation: Definition and Step-by-Step Guide

The recovery rate is an important metric used in the financial industry to assess the potential losses that creditors may face in the event of a default by a borrower. It represents the percentage of the outstanding debt that can be recovered through the liquidation or restructuring of the borrower’s assets.

Calculating the recovery rate involves several steps:

- Identify the total outstanding debt: This includes the principal amount borrowed plus any accrued interest or fees.

- Determine the value of the borrower’s assets: This can be done through a valuation process, which may involve appraisals or market assessments.

- Assess the priority of claims: Different creditors may have different levels of priority in the event of liquidation or restructuring. This step involves determining the order in which creditors will be paid.

- Estimate the potential recovery amount: Based on the value of the assets and the priority of claims, an estimate can be made of the amount that can be recovered.

- Calculate the recovery rate: The recovery rate is calculated by dividing the potential recovery amount by the total outstanding debt and multiplying by 100 to get a percentage.

The recovery rate is an important tool for investors and creditors as it helps them assess the risk associated with lending or investing in a particular borrower. A higher recovery rate indicates a lower risk of loss, while a lower recovery rate suggests a higher risk.

Factors that can affect the recovery rate include the type of collateral securing the debt, the economic conditions at the time of default, the legal framework governing the recovery process, and the efficiency of the liquidation or restructuring process.

By following the step-by-step guide outlined above, creditors and investors can calculate the recovery rate for a particular borrower and make more informed decisions about lending or investing.

The recovery rate is a key concept in finance and investing, particularly in the field of corporate debt. It refers to the percentage of a loan or investment that is recovered in the event of a default or bankruptcy. In other words, it measures the amount of money that creditors can expect to receive back from a borrower who is unable to fulfill their financial obligations.

The recovery rate is an important metric for investors and lenders because it helps them assess the potential risk and return of a particular investment or loan. A higher recovery rate indicates a lower level of risk, as creditors are more likely to recoup a larger portion of their investment. On the other hand, a lower recovery rate suggests a higher level of risk, as creditors may only recover a small fraction of their initial investment.

Factors Affecting Recovery Rate

There are several factors that can influence the recovery rate of a loan or investment. These include:

- Collateral: The presence of collateral, such as real estate or equipment, can increase the recovery rate as it provides a tangible asset that can be sold to repay the debt.

- Seniority: The priority level of a creditor’s claim can impact the recovery rate. Creditors with higher seniority, such as secured lenders, are usually paid first and have a higher chance of recovering their investment.

- Legal and regulatory environment: The legal and regulatory framework can impact the recovery rate. For example, bankruptcy laws and court procedures can determine how assets are distributed among creditors.

Calculating Recovery Rate

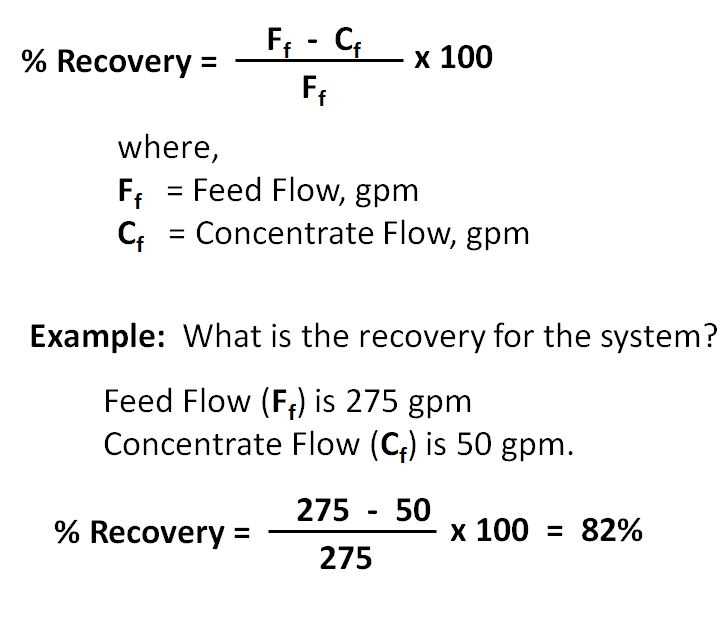

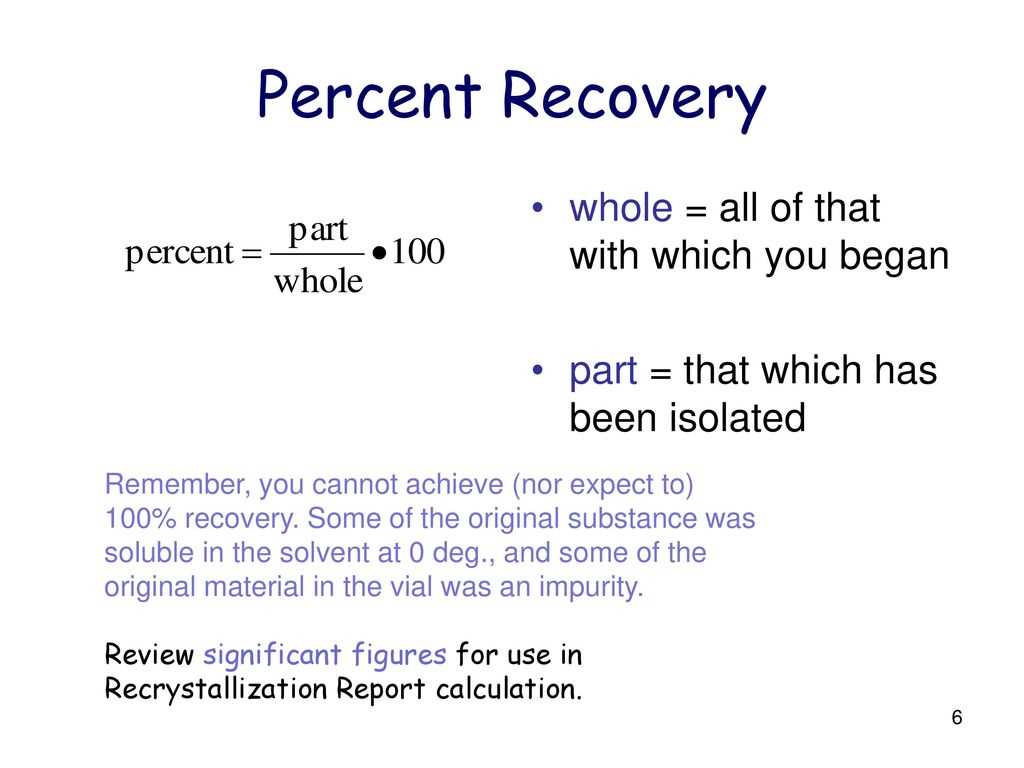

Calculating the recovery rate involves determining the percentage of the initial investment or loan that is recovered. This can be done by dividing the amount recovered by the total amount of the investment or loan and multiplying by 100.

Recovery Rate = (Amount Recovered / Total Amount) * 100

For example, if a lender recovers $80,000 from a $100,000 loan, the recovery rate would be:

Recovery Rate = ($80,000 / $100,000) * 100 = 80%

It is important to note that the recovery rate is an estimate and can vary depending on various factors and circumstances. It is also worth mentioning that recovery rates can differ significantly between different types of loans and investments, as well as across industries and economic cycles.

Factors Affecting Recovery Rate

1. Collateral

One of the primary factors affecting the recovery rate is the presence of collateral. Collateral refers to assets or property that a borrower pledges to secure a loan. In the event of default, creditors can seize and sell the collateral to recover their losses. The value and quality of the collateral play a significant role in determining the recovery rate. High-quality collateral, such as real estate or valuable assets, increases the chances of recovering a larger portion of the outstanding debt.

2. Seniority of Debt

The seniority of debt refers to the priority of repayment in the event of default. Senior debt holders have a higher claim on the borrower’s assets compared to junior debt holders. In case of bankruptcy, senior debt holders are paid first before junior debt holders receive any payment. The seniority of debt affects the recovery rate as higher-ranking creditors have a better chance of recovering their debts fully or partially, resulting in a higher recovery rate.

3. Industry and Economic Conditions

The recovery rate can also be influenced by the industry and economic conditions. Different industries have varying levels of recovery rates due to their specific characteristics and market dynamics. Economic conditions, such as recessions or economic downturns, can impact the recovery rate by affecting the value of collateral and the ability of borrowers to repay their debts. A strong economy and favorable industry conditions generally lead to higher recovery rates, while a weak economy and unfavorable industry conditions may result in lower recovery rates.

4. Legal and Regulatory Environment

5. Market Liquidity

Market liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. The availability of buyers and sellers in the market can impact the recovery rate. In illiquid markets, where there are fewer buyers and sellers, creditors may face challenges in selling the seized collateral, resulting in a lower recovery rate. On the other hand, in highly liquid markets, creditors can quickly sell the collateral, increasing the chances of recovering a higher portion of the outstanding debt.

Step-by-Step Guide to Calculating Recovery Rate

Calculating the recovery rate is an essential step in assessing the creditworthiness of a borrower or the potential losses for a lender in the event of default. The recovery rate represents the percentage of a loan or debt that can be recovered after default.

Step 1: Define the Recovery Rate

The first step in calculating the recovery rate is to define what it represents. The recovery rate is typically expressed as a percentage and can vary depending on the type of debt or loan being analyzed. For example, recovery rates for corporate debt may differ from recovery rates for consumer loans.

Step 2: Gather Data

Next, gather the necessary data to calculate the recovery rate. This includes information on the total amount of debt or loan, the amount recovered after default, and any associated costs or expenses incurred during the recovery process.

Step 3: Calculate the Recovery Rate

To calculate the recovery rate, divide the amount recovered after default by the total amount of debt or loan. Multiply the result by 100 to express the recovery rate as a percentage. The formula can be represented as follows:

Recovery Rate = (Amount Recovered / Total Debt) * 100

Step 4: Consider Additional Factors

While the basic formula for calculating the recovery rate is straightforward, it is important to consider additional factors that may affect the accuracy of the calculation. These factors may include the timing of the recovery, the nature of the collateral or security associated with the debt, and any legal or regulatory constraints that may impact the recovery process.

Step 5: Interpret the Results

Once the recovery rate has been calculated, it is important to interpret the results in the context of the specific debt or loan being analyzed. A higher recovery rate indicates a lower risk of loss for the lender, while a lower recovery rate suggests a higher risk of loss.

By following these step-by-step instructions, you can accurately calculate the recovery rate for a given debt or loan. This information can be invaluable in making informed decisions regarding credit risk and potential losses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.