Lehman Formula: Definition and Calculation Examples

The Lehman Formula is a financial calculation used in the banking industry to determine the amount of capital that a bank should hold in order to cover potential losses. It is named after its creator, Robert Lehman, who developed the formula in the early 20th century.

The formula takes into account various factors such as a bank’s assets, liabilities, and risk profile to calculate the required capital. By doing so, it helps banks assess their financial stability and make informed decisions regarding their capital allocation.

To calculate the Lehman Formula, several steps need to be followed:

- Determine the bank’s total assets, including loans, investments, and other financial holdings.

- Identify the bank’s liabilities, which include deposits, borrowings, and other obligations.

- Calculate the bank’s risk-weighted assets by assigning a risk factor to each asset class. This factor reflects the likelihood of default or loss associated with that particular asset.

- Subtract the bank’s risk-weighted assets from its total assets to obtain the amount of capital required.

Here is an example calculation of the Lehman Formula:

- Total assets: $1,000,000

- Liabilities: $800,000

- Risk-weighted assets: $500,000

Using the formula, we can calculate the required capital:

Required capital = $500,000

The benefits of using the Lehman Formula include:

- Improved risk management: By calculating the required capital, banks can better assess and manage their exposure to potential losses.

- Enhanced financial stability: The formula helps banks maintain adequate capital levels, reducing the risk of insolvency.

- Regulatory compliance: Many regulatory authorities require banks to maintain a certain level of capital adequacy, and the Lehman Formula can assist in meeting these requirements.

What is the Lehman Formula?

The Lehman Formula is a mathematical formula used in the financial industry to calculate the compensation of investment bankers. It is named after its creator, Robert Lehman, who developed the formula to determine the commission earned by investment bankers for their services in underwriting securities offerings.

The formula takes into account several factors, including the size of the offering, the risk associated with the securities, and the efforts made by the investment banker in marketing and distributing the securities. By considering these factors, the Lehman Formula aims to provide a fair and objective method for determining the compensation of investment bankers.

One of the key features of the Lehman Formula is its flexibility. It allows for adjustments to be made based on the specific circumstances of each offering. This ensures that the compensation reflects the level of effort and risk undertaken by the investment banker.

Overall, the Lehman Formula plays a crucial role in the financial industry by providing a standardized method for calculating the compensation of investment bankers. It helps to ensure that investment bankers are fairly rewarded for their services and encourages them to work diligently in underwriting securities offerings.

How is the Lehman Formula Calculated?

The Lehman Formula is a mathematical formula used in finance to determine the amount of compensation owed to a broker for their services in facilitating a securities transaction. It takes into account several factors, including the size of the transaction, the type of security being traded, and the prevailing market conditions.

Components of the Lehman Formula

The Lehman Formula consists of three main components:

- Transaction Size: This refers to the total value of the securities being traded. It is usually expressed as a dollar amount.

- Multiplier: The multiplier is a percentage that is applied to the transaction size to determine the broker’s compensation. It is typically based on industry standards and can vary depending on the type of security and the prevailing market conditions.

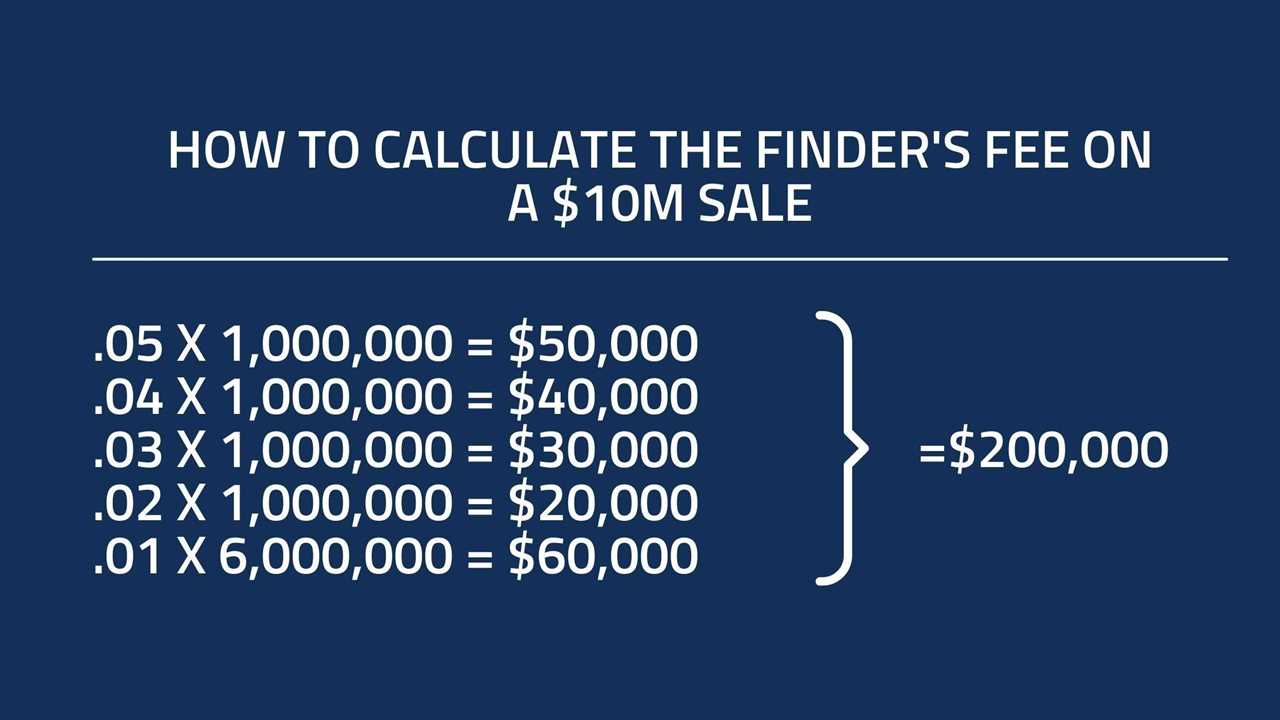

Calculation Example

Let’s say a broker facilitates a stock transaction with a transaction size of $1,000,000 and the multiplier is set at 1%. The calculation would be as follows:

Compensation = Transaction Size x Multiplier

Compensation = $1,000,000 x 1% = $10,000

It is important to note that the Lehman Formula is just one method used to calculate broker compensation and may not be applicable in all situations. Other factors, such as negotiated fees or commission structures, may also come into play.

Example Calculation of the Lehman Formula

Let’s walk through an example to understand how the Lehman Formula is calculated. Suppose a company has a net income of $1 million, total assets of $10 million, and total liabilities of $5 million.

Finally, we multiply the ROE by the equity to calculate the Lehman Formula. Using the example values, the Lehman Formula would be 20% * $5 million = $1 million.

The Lehman Formula provides a simple and effective way to measure the value of a company based on its return on equity. By considering both the company’s profitability (net income) and its financial strength (equity), the formula provides a comprehensive assessment of the company’s worth.

Benefits of Using the Lehman Formula

The Lehman Formula is a widely used method for calculating the value of a law firm. It provides a fair and objective way to determine the worth of a firm, taking into account its profitability and growth potential. There are several benefits to using the Lehman Formula:

1. Objectivity

The Lehman Formula provides an objective measure of a law firm’s value, based on its financial performance. This eliminates any biases or subjective opinions that may arise when valuing a firm. It ensures that the valuation is fair and accurate, providing a reliable basis for decision-making.

2. Consistency

The Lehman Formula follows a standardized approach to valuing law firms, making it easy to compare different firms and their performance. This consistency allows for meaningful benchmarking and analysis, enabling firms to identify areas for improvement and make informed decisions about their growth strategies.

3. Comprehensive Analysis

The Lehman Formula takes into account multiple financial factors, such as gross revenue, net income, and partner compensation, to provide a comprehensive analysis of a firm’s value. This holistic approach ensures that all relevant aspects of a firm’s financial performance are considered, giving a more accurate picture of its worth.

4. Transparency

The Lehman Formula is a transparent method for valuing law firms, as it uses publicly available financial data to calculate the firm’s value. This transparency promotes trust and confidence among stakeholders, such as partners, investors, and potential buyers, who can easily understand and verify the valuation process.

5. Flexibility

The Lehman Formula can be customized to suit the specific needs and characteristics of different law firms. It allows for adjustments and modifications to the formula based on factors such as firm size, practice area, and market conditions. This flexibility ensures that the valuation accurately reflects the unique aspects of each firm.

6. Strategic Decision-Making

By using the Lehman Formula, law firms can make more informed and strategic decisions about their future. The valuation provides insights into the firm’s financial health, growth potential, and profitability, helping partners and management to identify opportunities for expansion, investment, or restructuring.

| Benefits of Using the Lehman Formula |

|---|

| Objectivity |

| Consistency |

| Comprehensive Analysis |

| Transparency |

| Flexibility |

| Strategic Decision-Making |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.