Overview and History of KBW Bank Index

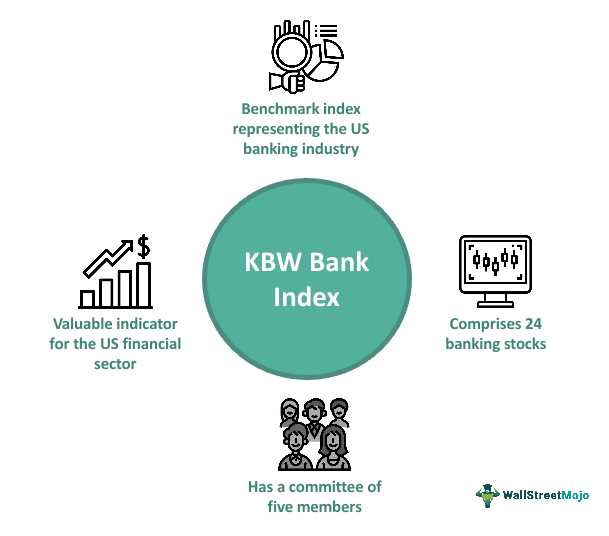

The KBW Bank Index is a financial index that tracks the performance of leading banking stocks in the United States. It was created by Keefe, Bruyette & Woods (KBW), an investment banking firm specializing in the financial services sector.

The index is composed of 24 large-cap U.S. banking stocks, representing both national and regional banks. These banks are selected based on their market capitalization, liquidity, and other factors that reflect their importance in the banking industry.

The KBW Bank Index was first introduced in 1991 and has since become a widely recognized benchmark for the performance of the banking sector. It provides investors and analysts with a comprehensive view of the health and trends in the banking industry.

The index is weighted based on market capitalization, meaning that larger banks have a greater impact on the index’s performance. This reflects the dominance of larger banks in the U.S. banking industry and their influence on the overall market.

Over the years, the KBW Bank Index has experienced significant fluctuations in response to various economic and market conditions. It has been affected by factors such as interest rate changes, regulatory developments, and economic cycles.

During periods of economic growth and stability, the index tends to perform well as banks benefit from increased lending activity and improved profitability. Conversely, during economic downturns or financial crises, the index may decline as banks face challenges such as loan defaults and reduced demand for their services.

Investors and analysts closely monitor the KBW Bank Index as a barometer of the overall health of the banking sector. Changes in the index can provide insights into the performance of individual banks and the broader economy.

Stock Trading Strategy and Education: KBW Bank Index

When developing a stock trading strategy based on the KBW Bank Index, it is important to consider both the overall market conditions and the specific factors affecting the banking industry. Here are some key points to consider:

| 1. Market Analysis: | Before making any trading decisions, it is crucial to analyze the overall market conditions. This includes assessing the current economic climate, interest rates, and regulatory environment. These factors can have a significant impact on the performance of banking stocks. |

| 2. Industry Analysis: | |

| 3. Technical Analysis: | Utilizing technical analysis tools and indicators can help identify potential entry and exit points for trading. This includes analyzing price patterns, moving averages, and volume trends. Technical analysis can provide valuable insights into the short-term price movements of banking stocks. |

| 4. Risk Management: | Implementing effective risk management strategies is crucial when trading the KBW Bank Index. This includes setting stop-loss orders to limit potential losses and diversifying your portfolio to reduce exposure to individual stocks. Additionally, staying updated on market news and events can help mitigate risks associated with unexpected market movements. |

| 5. Long-Term Investing: |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.